Introducing fund profiles and Livewire’s Top-Rated Funds Series

In another milestone for Livewire Markets, we’ve now launched new website features: Fund Profiles and the 100 Top-Rated Funds Series.

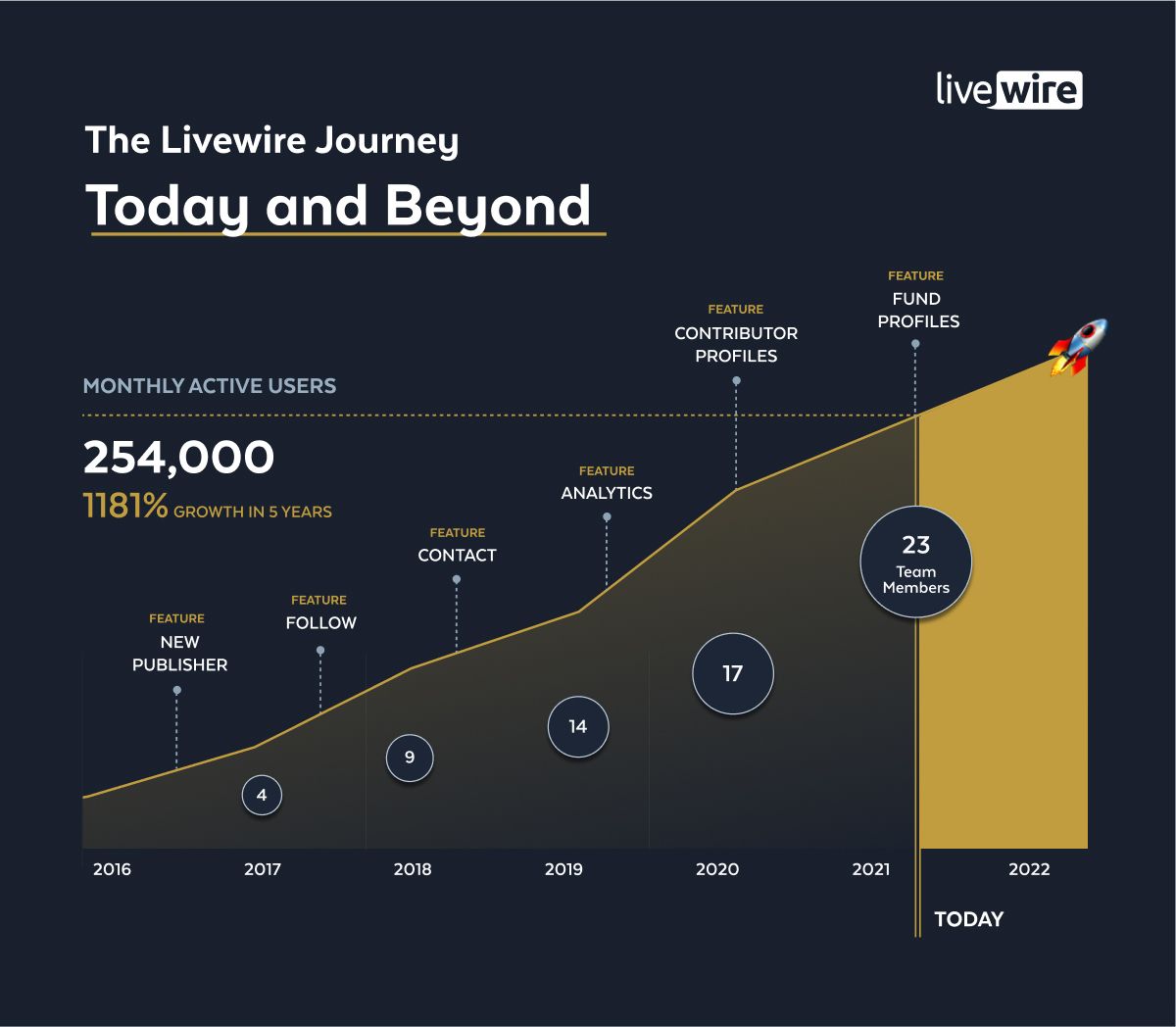

Over the course of the past five years, we have consistently invested in the Livewire website and expanded the team to ensure readers and contributors have the best experience possible. This ongoing investment has been fundamental to growing Livewire and ensuring it remains a valuable resource for investors like you. And we’re just getting started.

In this wire, I'll give you a brief overview of Fund Profiles, the 100 Top-Rated Funds Series and how you can stay up to date with the latest insights.

Image: A growing platform, audience and team to help Livewire readers make more informed investment decisions.

What are Fund Profiles?

We know that for many investors the process of discovering, comparing, and evaluating the universe of investment products is time-consuming and costly. Following a period of extensive research and development, we’re excited to be launching fund profiles on Livewire.

Fund profiles provide quantitative and qualitative information to help you make more informed investment decisions. For example, you’ll be able to see fund performance figures, fees and minimum investment information, with data provided by Morningstar.

You'll also be able to access key information via Livewire's exclusive Q&A section. This feature has been designed to help you understand the manager’s investment philosophy and process, the return objective of the fund, how they manage risk and importantly how the investment team is incentivised and aligned.

Fund profiles will also contain important documents such as the PDS, latest performance reports and links on how to invest.

To help you stay up to date, the team has developed functionality allowing you to follow a fund, so you can receive notifications when new content about the fund becomes available.

Livewire's 100 Top-Rated Funds Series

The 100 Top-Rated Funds series is exclusive to Livewire, allowing you to discover and evaluate Australia’s top-rated funds in each asset class and understand their fee structures, performance and philosophies.

The 100 Top-Rated Funds series will run throughout June. Fresh content will be published on a regular basis, so make sure you keep an eye on the morning email and the Top-Rated Funds website.

This is what you can expect.

A list of 100 top-rated funds: Find out Australia's top-rated fund managers, as assessed by Lonsec, Zenith and Morningstar.

Fund Profile pages: Click on a fund listing to access a more detailed Fund Profile including performance information, fees and minimum investment amounts*.

Investing insights: Access exclusive interviews that take you inside the heads of Australia's leading Fund Managers.

Tips for evaluating funds: Experienced fund researchers from Lonsec, Morningstar and Zenith will share their tips and myths about picking good managers.

*Fund data provided by Morningstar

Image: David Wright, Zenith Investment Partners

How the 100 Top-Rated Funds list was compiled

Livewire created an initial list of funds by aggregating all funds that currently have a “top-level rating” from at least one of three major funds research providers, being Lonsec, Morningstar and Zenith. This resulted in a list of 190 funds, which was reduced to 100 using the following steps.

- All Listed Funds and Exchange Traded Funds (ETFs) were removed. From a ratings perspective, the majority of funds are unlisted and the majority of Livewire contributors have unlisted funds.

- Where two versions of a fund existed (Hedged & Unhedged) - the hedged fund was removed, and the unhedged version was kept.

- Where two versions of a fund existed with Share Class or Performance Aligned variants - only one of the funds was kept.

Finally, the remaining funds were cut back to a list of 100 with the following considerations in mind:

- Asset Class mix - we tried to ensure that each asset class had a fair representation of funds, allowing for a greater number of total funds in more popular assets classes (e.g. Australian Equities) and keeping most funds in the less popular asset classes (e.g. Alternatives and Multi-Asset).

- Each of the 100 funds included on the list has agreed to be part of this series, however, the list is not exhaustive.

We hope the series helps you to discover some high-quality funds and better understand how they invest.

Stay up to date with the series and send us your feedback

The best way to stay up to date on the 100 Top-Rated Funds Series is to pre-register by visiting this website. You should also keep an eye out for updates via the Trending on Livewire morning email and the Livewire homepage.

If you have feedback feel free to send an email to team@livewiremarkets.com

1 topic