Investing in India - Convenience or Return?

The Cost of Convenience..

Global investors are increasingly gravitating towards country-specific investments, with India drawing significant attention due to its economic momentum and favourable structural-demographic trends. Australian investors can access the India growth story directly by investing in India specific unit trusts or via ASX/NYSE listed ETF's. Those looking for a tactical trade or a "bet" on India based on an asset allocation view usually choose the most convenient path to access India's "beta" rather than looking for "alpha" given its a niche investment in a portfolio.

ETF's are a convenient way to access India’s growth story. However, it is important to understand the "cost" of convenience.....

| ETF vs benchmark performance | 1y | 3y (p.a.) | 5y (p.a.) |

| Average India ETF returns (AUD) | 23.4% | 14.5% | 10.4% |

| Average benchmark returns (AUD) | 29.1% | 17.4% | 13.3% |

| Average tracking difference | -5.6% | -3.0% | -2.9% |

Across almost all time periods, India focused ETFs have significantly underperformed their own benchmarks/indices. Across longer-term periods (3-5 years), India ETFs produce a slippage of roughly 3% p.a. outside of fees. This is a hefty differential in return to be giving up each year, underscoring the price tag that comes with convenience.

| 5-year returns (p.a.) | India | Aust. | US |

| Average ETF returns (AUD) | 10.4% | 7.6% | 14.9% |

| Average benchmark returns (AUD) | 13.3% | 7.7% | 15.0% |

| Average tracking difference | -2.9% | -0.1% | -0.1% |

Source: ETFs are both domestic and international domiciled in AUD. Performance is calculated on a post-fee return basis. Returns as at 30/04/2024.

This compares with 0.1% slippage for both Australian and US stock ETFs relative to their indices/benchmark (e.g. ASX 200 or S&P500), which highlights the difficulty of capturing index returns in the Indian market and the need to maintain active positioning, especially in a more inefficient market like India.

There are several factors for this slippage in India, which we outline below.

Impact of taxation on both India-focused Fund's/ETFs on performance

In India, the capital gains tax of 10% is charged for investments held longer than one year (15% for those held less than a year). This impacts the investment returns of India Fund's/ETFs that pay those taxes. NAVs/unit prices are calculated after taxes are paid in India.

However, due to a bilateral tax agreement between Australia and India, investors receive a partial to full refund of capital gains taxes paid in India by the Fund's/ETFs they invest in at the point when they lodge their tax refund.

This however has an impact on the returns of investment vehicles relative to their indices/benchmarks when it comes to investing in India (for India-focused vehicles as well as EM/Asia/Global funds investing in Indian stocks). This can lead to a slippage of approximately 50bps per annum (assuming yearly returns of 15% and 30% turnover). This cost is inevitable for a foreign investor in India. It highlights the slippage against a benchmark like the MSCI India (which does not have any inherent CGT embedded in its calculation). This can be much higher than 50bps in a higher returning year.

Sizeable implementation cost

India is a relatively costly market for transacting in financial securities. The implementation costs of trading Indian securities encompass both transaction costs and global custody expenses. For foreign investors, such as Australian/Global ETF providers, utilising a global custodian for transactions in Indian securities can incur costs of up to $50-70 per trade, in contrast to using a local custodian, based in India.

Management costs

India ETFs are not cheap and low cost to implement, with the largest India ETF in the world at US$ 10bn AUM charging approximately 60bps per annum. India-focused ETFs have a Management Expense Ratio (MER) of 60-80bps in general. It is not the same cost as implementing an ASX 200 or S&P 500 view with ETFs.

High turnover

As previously noted, India is a relatively expensive market for security transactions. This expense is further magnified when implementation is via a model and rebalancing structure (as practised by most passive/ETF structures). To replicate the index, these ETFs undergo quarterly rebalancing, resulting in frequent transactions of the underlying securities. On average, India ETFs experience an annual turnover of 25-30% whilst generating a substantial number of transactions due to this rebalancing mechanism. This can lead to significant slippage in implementation.

Other factors

Several other factors contribute to the significant tracking differences between India ETFs and their benchmarks:

1) Disparity in trading time zones (basis risk of using Nifty 50 futures for exposure).

2) Currency conversion impact cost (global custody rates in regions where AUD-INR is not heavily traded. Timing differences can also result in slippages in the currency conversion process.

3) Given ETF valuations are determined on a mark-to-market basis, traders are required to execute transactions on the same day. With only a 1.5-2.5 hour overlap between Australia and India's trading house, the buy-sell spread can widen considerably, leading to slippage.

What is the alternative?

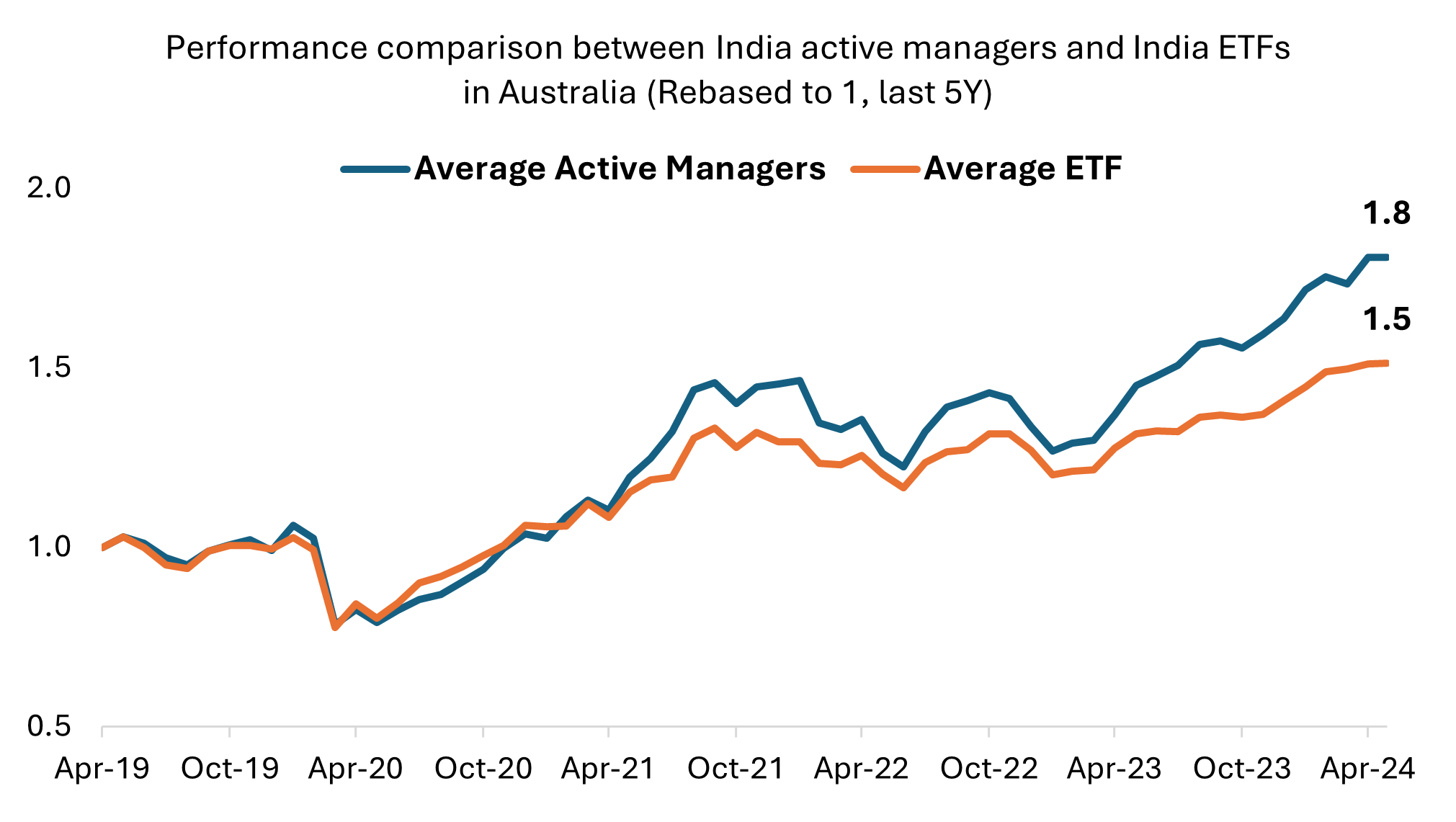

To gain exposure to India’s growth story without incurring substantial slippage/costs, active management utilising local infrastructure and cost frameworks is likely to provide a more effective approach. When we aggregate the performance of active managers to compare with India ETFs, we find that on average the active managers perform significantly better than ETFs.

While some of the aforementioned factors are also relevant to actively managed funds, active managers can operate more efficiently, enhancing long-term success prospects. Employing active managers with a long-term horizon using actively managed allocations results in lower transaction costs and more effective tax management.

A strategy that leverages localised knowledge for stock picking and portfolio construction, as well as local custodians via a unit trust structure, can significantly reduce the cost base and narrow buy/sell spreads and currency slippage, owing to operating within local time zones in India.

For 20 mins less convenience, the potential of greater returns through active management and "smarter" structuring are at the fingertips of Australian investors.

5 topics