Investing in the AI Energy Gap

Today, I’m going to explore the theme of growing AI power needs.

Concern around energy consumption has become the standard refrain for those afraid of AI's growth.

Headlines like these don’t help anyone feel like we are moving in the right direction:

Let’s explore these claims and see if this is a crisis or an opportunity for investors.

But before we get to that, let’s head back in time.

In 1894, The Times of London declared a crisis.

Cities worldwide were drowning in a particularly nasty problem, and no one saw a solution.

What was it?

Horse manure.

Back then, society still relied on horses for all manner of transportation and industry.

In cities like New York and London, around 100,000+ horses worked, ate, and did their business on the streets.

Diseases like typhoid and cholera were rife as manure, flies, and smells overwhelmed city streets.

Worry peaked as The Times front page declared London was ‘drowning in horse manure’ and forecasted that:

‘In 50 years, every street in London will be buried under nine feet of manure.’

The crisis remained hotly debated, prompting the world's first international urban planning conference in 1898.

However, the conference had no solutions…

But as the saying goes, ‘necessity is the mother of invention.’

Henry Ford was just around the corner. By 1912, horses were on the way out as cars and trucks came into use.

Oh well, crisis averted… until those cars began to smog up our cities.

This was neither the first nor the last time we fixed an environmental crisis, only for the solution to create its own set of problems.

As American Historian Melvin Kranzberg said when he laid out his ‘Six Laws of Technology.’

‘First law: Technology is neither good nor bad; nor is it neutral.’

AI power boom

Simple AI has been around for some time, but everything changed when Open AI’s ChatGPT burst onto the scene a year and a half ago.

Their AI reached an estimated 100 million users in two months, setting off our current AI cycle.

Now, with the huge demand for AI by large companies, we’ve seen a market-defining run by Nvidia [NASDAQ:NVDA] for its AI chips.

Closer to home, Macquarie Technology Group [ASX:MAQ] and NextDC [ASX:NXT] have invested heavily. Both fighting to be the next major AI data centre operator.

It makes sense, capital flows to capture this new uptick in demand.

But the speed of this buildout has raised concerns that AI will use more power than we generate.

So, I thought I should investigate these mainstream articles’ AI-power estimates and their accuracy.

Because If you know anything about this space, you'll know that AI hyperscalers are very cagey about their costs and figures.

Then, you have to consider the huge variance between AI models, chips and data centre locations.

While my search was far from exhaustive, it did reveal that many of the figures emerged from silly assumptions and lazy press.

OK, so what are some of the alarmist estimates?

Interestingly, if you follow the breadcrumbs, many come from two sources.

The first is from a PhD candidate, Alex de Vries, who sparked the first discussions and many of these scary headlines.

Using Nvidia’s (now two generations older) A100 chips’ power usage and sales growth, he put AI power growth at 29.2 TWh a year.

That’s a figure on par with Ireland’s annual power consumption.

The Scientific American, The BBC, The New York Times, and many others took this and ran with headlines like:

‘Things could, and probably will, get much worse in time,’ wrote the New Scientist.

It sounds a lot like our horse problem to me.

The first glaring issue is the use of the much older chips.

The latest Nvidia chips claim up to '25x less energy consumption than its predecessor.'

We can ignore most of that as marketing for now.

They could run that efficiently in the future, but not with the current AI models.

My own estimates for this generation's models put the power costs at around 3.75x less than their last chip — still a good improvement.

The next source was from a 2024 report by the International Energy Agency.

Their back-of-the-envelope estimates made some pretty bold assumptions. The biggest one being that AI will replace every Google search.

These 9 billion daily Google searches, which typically use 0.3Wh, would be replaced by AI, each using 2.9Wh per request.

I don’t know about you, but this seems like dubious speculation when making power assumptions.

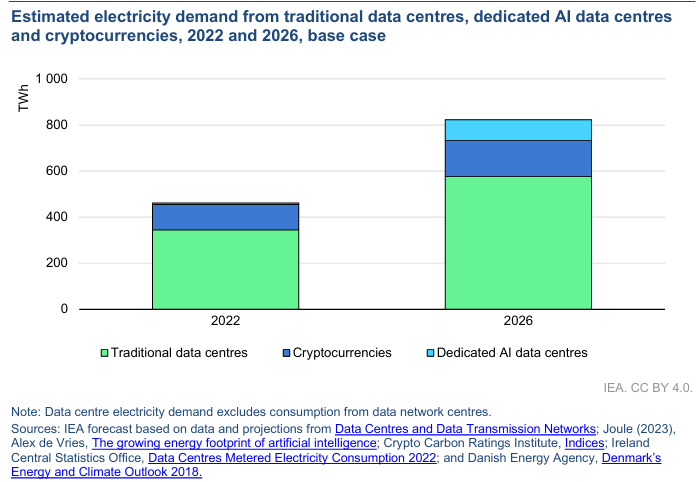

Even then, this is what those (base case only one graphed) figures will look like by 2026.

Just look at how big those traditional data centres are in comparison.

These ‘traditional’ data centres account for about 1–1.5% of global electricity use, so why aren’t we concerned about that?

What if we compare that energy use to steel’s 7% of world electricity use, or aluminium’s 3%.

Doesn’t seem to raise an eyebrow.

It's worth remembering that traditional data centres have been on a decades-long shift towards energy-optimized ones in the cloud.

This has brought their energy intensity down 20% annually since 2010.

Shouldn't we also assume that AI efficiencies will also emerge?

‘Hardware works best when it matters the least.’

— Norman Ralph Augustine

While I’m not denying that these new AI data centres will use more power, this is not some new scale of use.

These estimates also fail to consider rapid progress in energy generation and efficiencies that will likely come thanks to AI.

It's like trying to imagine what a laptop would look like if we used the first computers.

As Intel Executive Vice President Stacy Smith put it:

‘If there were a Moore’s Law in the car industry, you could drive to the sun on a gallon of gas.’

A lot of great work goes into energy-efficient chips and AI models. I wouldn’t bet against human progress here.

Still, even without the hyperbole, we obviously need investment to meet the growing electricity demand.

And this is where you should look next.

Fear for them, opportunity for you!

The utilities sector looks poised for a boom in capital investment and expenditures.

This includes investments in power plants, transmission lines, and other critical infrastructure.

The ripple effects of these investments will be felt across a wide range of industries, from steel and concrete to power management technology.

As a result, many ‘old economy’ industries may also benefit from the rise of AI.

The uranium sector's recent performance provides valuable insight into what could happen in oil, gas, and coal.

After a decade of underinvestment, the spot price of uranium began to rise sharply in March 2023, benefiting developers and advanced explorers like Boss Energy [ASX:BOE] and Paladin Energy [ASX:PDN].

A similar scenario could play out in other energy subsectors if demand rebounds.

In the US, for example, gas pipeline stocks were the best-performing energy industry segments in May.

A major reason appears to be the rising demand for natural gas to power these data centres.

Pipeline companies like Kinder Morgan [NYSE:KMI] and Williams Cos [NYSE:WMB] both mentioned ‘rising data centre electricity demand’ in recent earnings calls, a phrase that would have been alien just months before.

For Australia, we can see clear gaps in transmission, storage, and generation, so invest where you know the most.

On the more speculative side, I would point to our microcap energy sector with stocks like Alligator Energy [ASX:AGE].

Or adjacent infrastructure companies like MMA Offshore [ASX:MRM].

These areas have underperformed in recent years, but signs of a turnaround may be on the horizon.

A surge in mergers and acquisitions (M&A) activity is one potential catalyst for a rebound here.

Cash-rich large-cap companies may begin to cherry-pick undervalued microcap firms.

Or the microcaps themselves may merge to create a new tier of development companies.

Brookfield’s recent $10 billion dollar bid for Neoen shows that they think renewables are the answer for Australia.

For our own bets, our resident geologist, James Cooper, believes that Oil could see its final boom before energy systems change, and is exploring breakout stocks here.

For me, I'm looking towards battery storage solutions of all shapes and sizes to balance this complex mix of energy inputs on the grid.

Wherever you look, remember it’s an opportunity, not a crisis.

Curious about other potential ASX small-cap gems in energy? Every Thursday, Fat Tail Daily explores market movements to uncover promising opportunities in commodities. Don't miss out on exponential gainers. Subscribe for free here.

2 topics

%20cropped.png)

%20cropped.png)