Investor lesson: How interest rate duration can "insure" your portfolio

One of the key uses of interest rate duration as an exposure is to help manage risk within a portfolio. Unfortunately, as recent events have shown, there are times at which bond yields are so low that the level of protection they can provide is questionable. In turn, this may have impacts on how duration is utilised as insurance within a portfolio. The following sets out a simplified framework for determining the extent to which interest rates may provide insurance within a portfolio.

There are many approaches that can be used for undertaking the proactive management of duration as a risk management tool[1]. What follows is one potential approach which is consistent with the earlier article’s framework, recognising that:

“…whilst a strategic bias to being long duration can offset credit risk, such an exposure is best managed proactively by taking into account (a) the outlook for credit risk, i.e. the amount of protection desired, and (b) the level of interest rates, i.e. the amount of protection provided per unit of duration.”

In establishing any framework, the starting point is to set out the objective, which will be stated as:

“Utilisation of duration to provide an appropriate level of return protection against adverse moves in risk assets.”

Formulation of such an objective is important as it recognises that (a) the purpose of duration is hedging and not the generation of outperformance on a ‘standalone’ basis, and (b) specific directional forecasts for interest rates are less important for achieving the desired objective.

The key to the duration bias providing an appropriate level of return protection is therefore (a) the outlook for risk assets, and (b) the amount of protection provided per unit of duration. The outlook for risk assets will be assumed to be an exogenous factor.

This means that the key factor driving the scaling of duration exposures is the amount of protection provided per unit of duration; where the amount of protection provided per unit of duration is defined as the downside potential of interest rates.

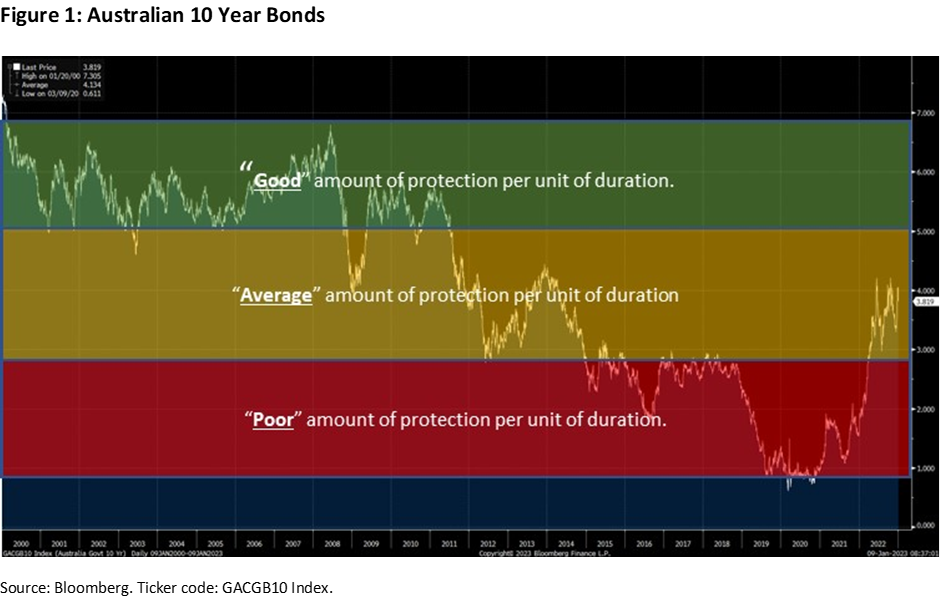

Assessing this becomes a subjective factor and depends on an explicit view regarding the potential range for interest rates. Such an assessment can be relatively simple or highly complicated. For illustrative purposes, a relatively simple framework will be adopted while recognising the limitations associated with such simplicity. Taking the history of 10 year government bond yields since 2000, the broad range has been between 1.00% and 6.00%. Based on one’s assessment of fundamentals over the next 12 to 18 months, and associated risks, these broad range limits would appear reasonable and consistent. Accordingly, such a range can be utilised to assess the expected future range for interest rates.

The expected interest rate range can now be decomposed into zones based on the amount of protection provided per unit of duration. An example of this is provided in Figure 1 below.

Based on which zone interest rates are in, the investor would scale the size of the duration hedge to reflect the amount of protection provided per unit of duration, i.e. the size of duration hedge and amount of protection per unit of duration are positively correlated.

Some may argue that the size of the duration exposure and amount of protection per unit of duration should be negatively correlated. Under this framework, the less protection provided per unit of duration, the more duration you need to create an appropriate level of return protection. Though there is logic behind such an approach, there are also some potential flaws; namely that such an approach implicitly assumes the ability of duration to act as a hedge is (a) independent of the level of rates in terms of directionality, and (b) that hedging is costless. It is debatable whether these assumptions necessarily hold. For this reason, it is assumed that the sizing of duration should decline as the amount of protection per unit of duration declines, reflecting the dual characteristics that duration is now less likely to provide a directional hedge and the act of hedging, in general, is not costless.

Coming back to Figure 1, the benefit of the approach is that it can be easily modified to reflect (a) different assumptions regarding the range of interest rates, and (b) different levels of granularity to accommodate higher or lower levels for proactively managing the level of duration hedging.

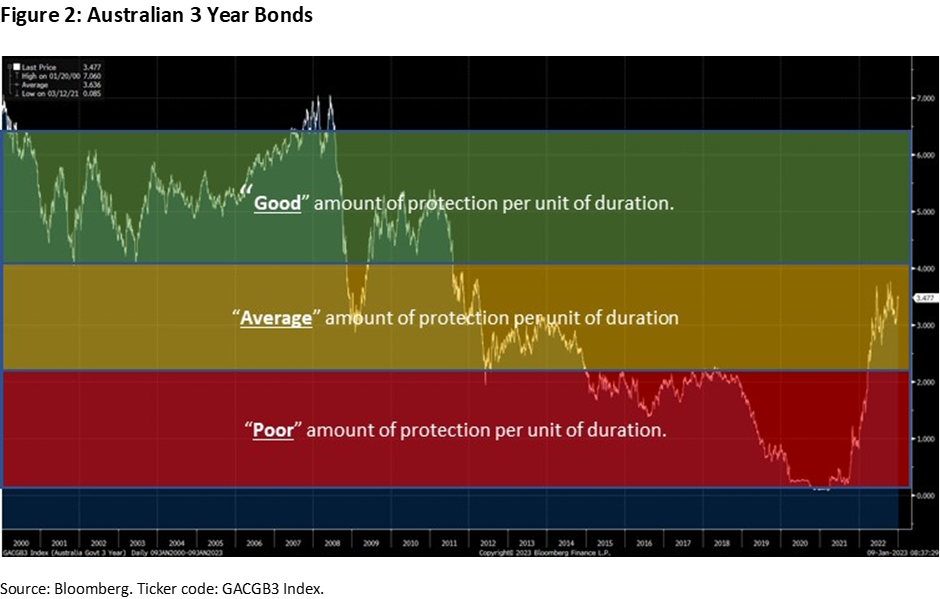

This framework can obviously be extended to consider other interest rates as risk management tools. While the analysis considers the 10 year government bond yield, this approach can also be applied to other parts of the yield curve to identify the most attractive part of the curve to take the duration hedge. In Figure 2 below, the same approach is applied to the 3 year government bonds which generates similar results.

Both 10 year and 3 year government bond rates would appear to provide “Average” amount of protection per unit of duration. Based on this, there is no clear bias for implementing the duration hedge via one contract over the other.

The consideration of multiple interest rates at different points of the yield curve highlights the potential for a further extension involving consideration of the asymmetry of potential outcomes.

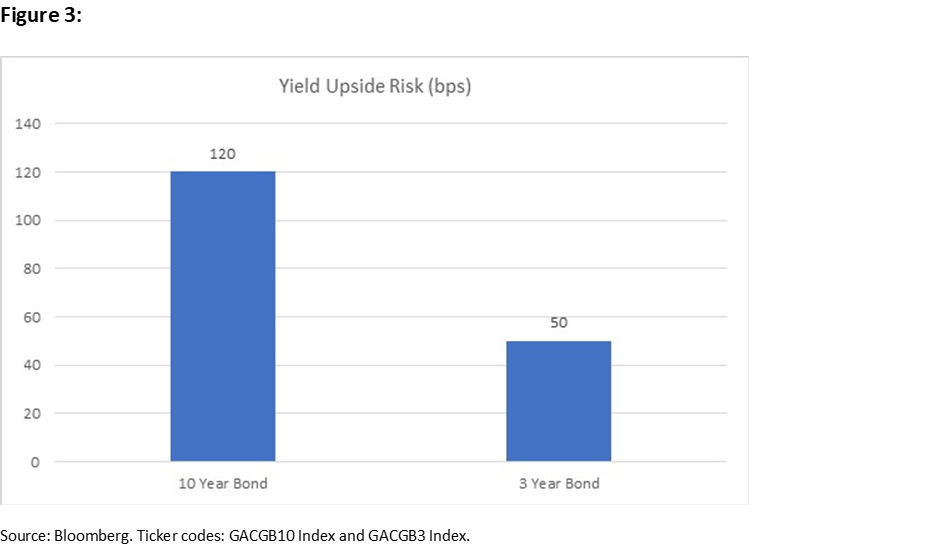

To date, the focus has been on the level of downside protection available from interest rates. Yet it is also relevant for an investor to consider the ‘opportunity cost’ from a hedge should the event one is hedging against not eventuate. This opportunity cost can be quantified by the difference between the current yield and the potential upside based on an investor’s expectations. Though the methodology utilised will vary from investor to investor, based on some reasonable assumptions one view of the potential upside for 10 and 3 year bond yields is set out in Figure 3. The investor using duration as a hedge can now compare the potential outcomes based on whether the outcome being hedged against does or does not eventuate.

Figure 3 illustrates the greater potential upside risk for the 10 year government bond yield versus the 3 year government bond yield at this point in the cycle. Such a difference in upside risks could tilt the investor to consider the three-year government bond as a more appropriate tenor for hedging risk assets. Which asset is ultimately preferred will depend on the level of conviction and sensitivity regarding the event being hedged, as this will impact the potential investor trade-off between downside risk and opportunity cost when hedging.

Duration can be utilised within a portfolio as a useful risk management tool. Though a static overweight to duration can assist in offsetting credit risk, the proactive management of such duration exposures over the cycle can potentially generate superior outcomes. When setting out a framework for proactive management, both the level of protection provided by duration and the asymmetry in potential outcomes become potential inputs to the decision-making process. Though the framework set out is purely illustrative and simplistic, it nonetheless seeks to highlight how a structured approach to proactive management can not only provide greater transparency but also focus investor attention on the key variables relevant for decision-making based on the investment objectives.

(1) Using duration as a counterweight to credit can improve investor outcomes, Clive Smith – 2 November 2020.

[1] For brevity, the term ‘hedge’ will be utilised; though in practice, duration is only acting as a risk management tool or risk offset.

2 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...