Is Australia's limited dry powder good news for SMEs?

At a Glance:

- The U.S. market's abundant dry powder creates a highly competitive environment, with investors and General Partners (GPs) targeting larger, established companies, often leaving smaller, viable businesses underfunded.

- Despite lower levels of 'dry powder' than other markets, Australia benefits from a more stable investment environment focused on long-term growth, lower-risk businesses and access to international capital.

- Australia's prudent investment culture and rigorous approach to private debt are key to managing risks and opportunities, ensuring the long-term success of SMEs in years to come.

In the 1950s, Australia rode on the back of sheep. Today, it's the small business sector that drives the economy forward. Recent stats from the RBA show that there are around 2.6 million businesses in Australia and 97% of them are small enterprises.

SMEs play a vital role in the national economy, driving employment and growth across all industries. However, since the Global Financial Crisis, Australian banks have increasingly retreated from mid-market lending, influenced by Basel III capital adequacy ratios and heightened risk aversion. The aftermath of the Royal Commission further intensified this trend, leading to a more cautious lending approach towards SMEs.

Recently, these challenges have been compounded by high inflation and labour shortages, further dampening small business confidence and conditions. Adding high interest rates and sluggish economic activity to the mix has created the perfect conditions for non-bank lenders to step in and fill the gap left by traditional banking systems.

Following a global trend, many companies have turned to private debt to secure funding. But while the U.S. and Europe dispose of large amounts of dry powder, the situation is quite different on Australian shores. Here, the surge in demand for private debt is met with a relatively subdued supply, highlighting the necessity for Australian firms to explore additional sources of capital offshore to adequately cater to this growing demand.

The availability of dry powder affects SMEs’ ability to secure funding in many ways.

When there's a large amount of dry powder in the market, generally there's more capital available for investment. For SMEs, this can translate into better access to funding as investors are actively looking to deploy their capital.

In this environment, investors might compete for attractive deals, potentially leading to higher valuations and more favourable terms for SMEs. Conversely, in markets with limited dry powder, investors may offer lower valuations and more stringent terms.

The level of dry powder can also affect the corporate investment focus. With an abundance of dry powder, investors may opt for higher leverage in speculative sectors or favour borrower-friendly terms such as covenant-lite arrangements, deviating from traditional lender-friendly practices.

Overall, the level of dry powder can influence investor confidence in the market. High levels might make investors optimistic about future opportunities, while low levels might instil caution or pessimism, influencing the overall financing conditions for SMEs.

So limited dry powder may seem to be bad news for SMEs. But a deeper analysis shows that it’s not always the case.

Comparing the US vs Australia

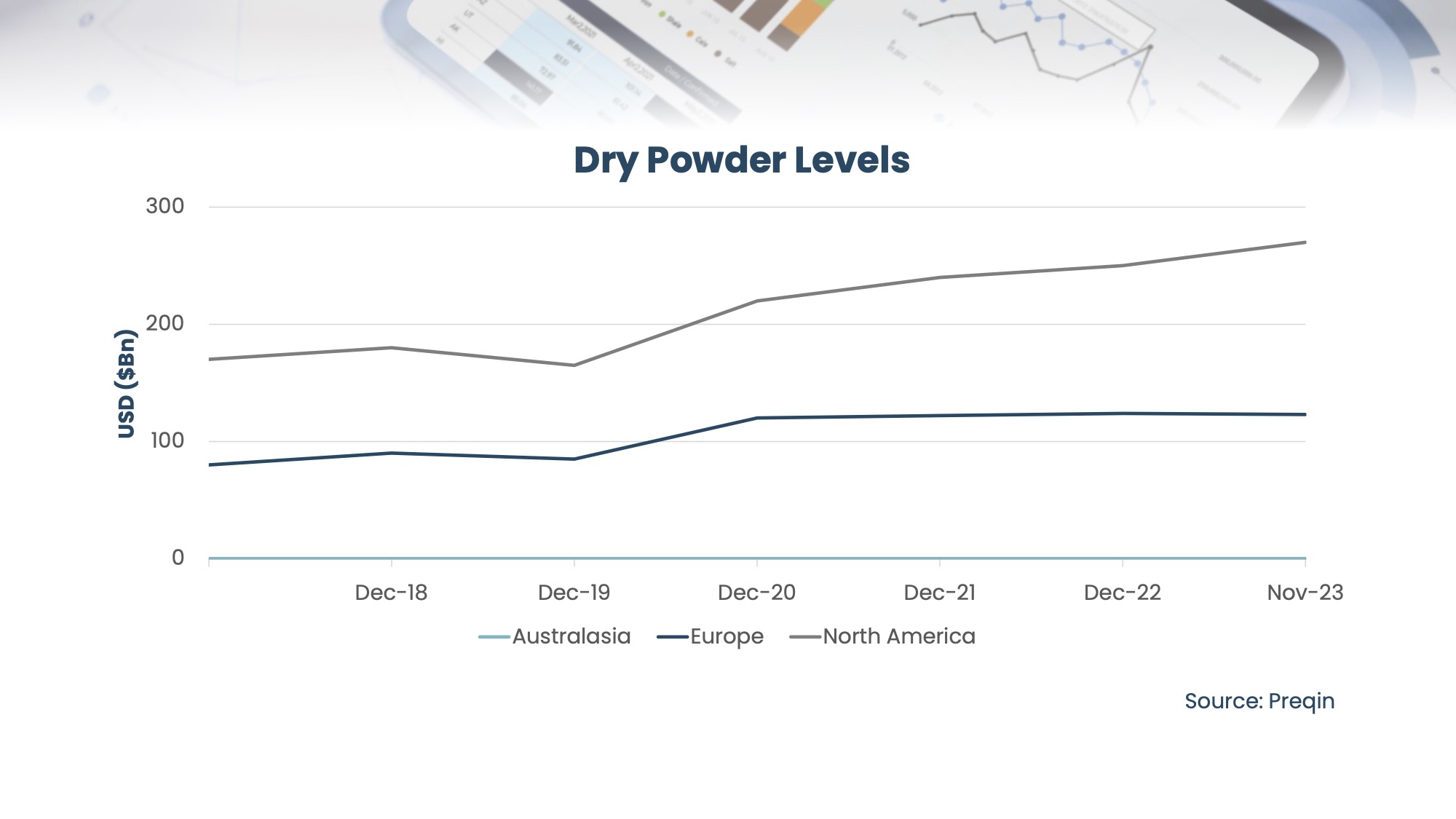

As of November 2023, private equity firms in North America have accumulated around US$265 billion in dry powder, while in the same period, their Australasia counterparts had US$600 million[1] ready to deploy for new investments.

While these figures need to be considered in conjunction with the scale of the two economies, what is certain is that in Australia the number of investment opportunities outstrips the available investment capital.

Limited available funds mean that SMEs often spend substantial time exploring various options, whether it be for working capital, asset purchases, or growth funding. In this environment, securing financing becomes increasingly challenging, especially for companies in early stages or less lucrative sectors.

However, that’s only one part of the big picture.

US - Bigger doesn’t always mean better

The US market is characterised by a significant amount of dry powder, driven by a large investor base, including institutional investors like pension funds. This creates a highly competitive environment where investors are continuously searching for lucrative investment options.

In the pursuit of higher returns, investors, including General Partners (GPs), are focusing more on larger, established companies. This is heightening competition and leaving smaller enterprises struggling to find funding.

As investors chase larger, more high-profile deals, smaller enterprises, particularly those requiring smaller investments or operating in less trendy sectors, might struggle to attract funding. This focus on 'blockbuster' investments can leave a funding gap for small but viable businesses.

The other challenge is posed by the attractive yields that are fuelling the current enthusiasm for private credit. High interest rates can translate into elevated stress levels for borrowers, particularly those with few other capital sources.

Australia - Dear Prudence, greet the brand new day

In contrast, Australia's market operates on a more measured scale. The amount of dry powder available is limited, partly due to a smaller investor base and a more conservative investment culture. With a stronger focus on due diligence and risk assessment, the Australian market tends to prioritise stable, long-term growth over high-risk, high-return companies.

In Australia, investors are more likely to support businesses with solid fundamentals, realistic growth plans, and lower risk profiles.

This cautious investment approach ensures that Australian SMEs that receive funding are well-vetted and have a higher likelihood of success — often resulting in lower default rates.

Last, Australian small businesses can also benefit from supportive government policies such as the recent Treasury Laws Amendment Bill (Support for Small Business and Charities and Other Measures). Part of the 2022-23 Budget, this measure includes a $20,000 instant asset write-off for businesses with turnover under $10 million.

The growing SME appetite for Private Debt

Recently, an increasing number of Australian SMEs have started considering private debt as a viable financing avenue. The ground was prepared by the tighter bank lending conditions post-GFC, as small businesses found it challenging to secure working capital from traditional banks. More recently, the end of pandemic stimulus programs and the scaling back of bank lending to SMEs have fuelled the growth of the category.

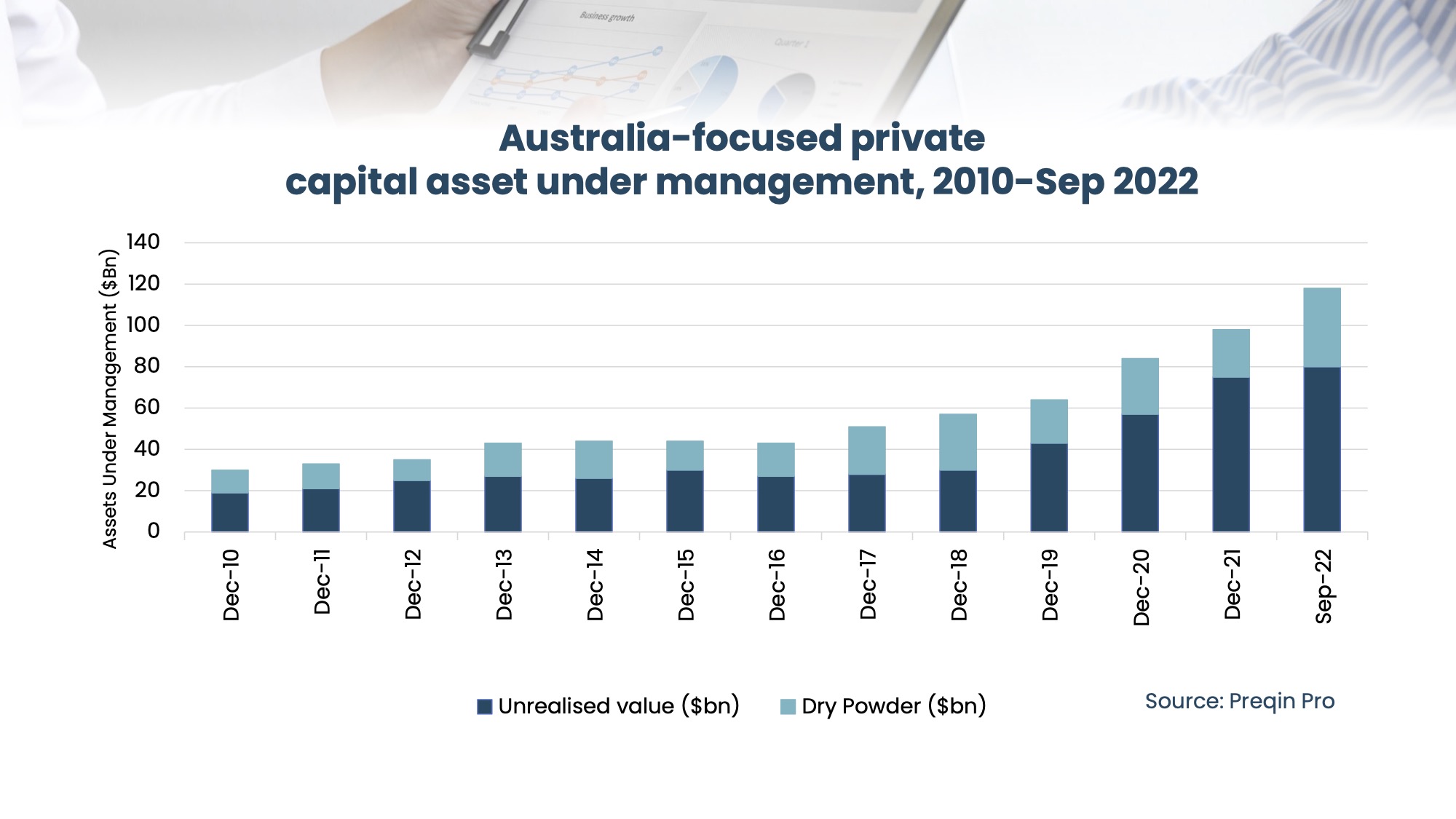

Australian private debt Assets Under Management (AUM) more than tripled between 2020 and 2021 and reached $2.1 billion by September 2022.

There are many reasons why private debt is getting traction amongst Australian SMEs, including increased access to capital from a variety of alternative providers, greater funding flexibility, and the ability to access funds for immediate needs or opportunities.

Private credit instruments also offer protection against inflation as they operate floating rate facilities and shorter loan periods.

Australian super funds are waking up to the benefits of private debt, too. According to Preqin Pro, they have nearly doubled their exposure from 2.0% in April 2018 to 3.9% in April 2023.

Last year, AustralianSuper formed a partnership with Churchill Asset Management to target traditional senior and unitranche loans for mid-market companies in the U.S. backed by private equity. Hostplus, another superannuation fund, teamed up with Apollo, an alternative asset manager listed in New York. Together, they initiated an Asia Pacific Credit Strategy valued at $1.25 billion, concentrating on a broader regional scope that includes Australia, India, Singapore, South Korea, and Hong Kong.

So if the appetite for private debt is growing, why are Australian private debt managers actively seeking capital from overseas markets? The answer is that dry powder in the country is still not enough to meet the needs of Australian investors.

By tapping into international capital, GPs can secure the necessary funds for direct lending projects, addressing the funding gaps and forging beneficial collaborations with global investors. This strategic move sustains the momentum of the sector and opens up new opportunities for Australian SMEs to thrive in a global landscape.

Looking ahead

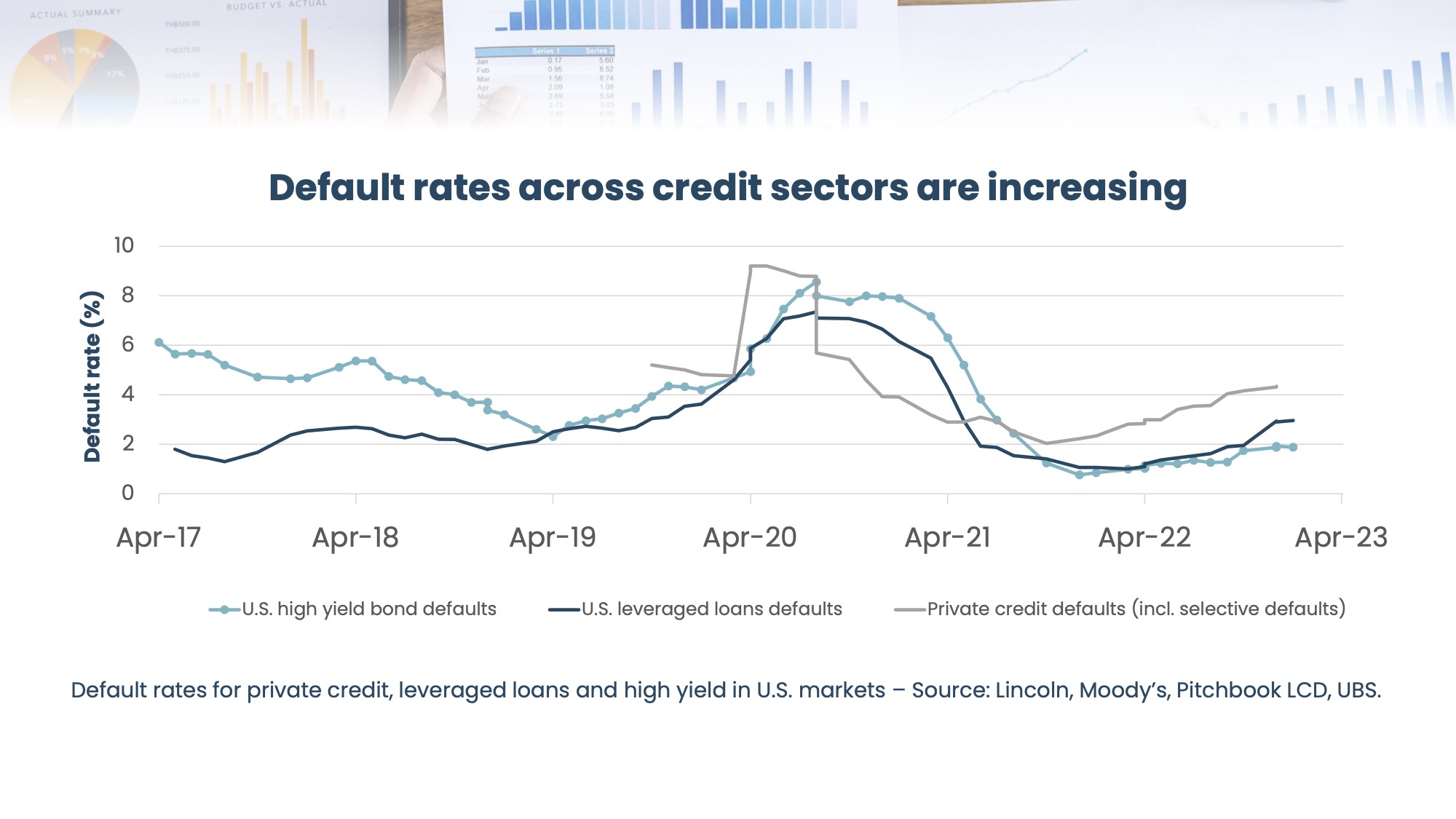

The initial stages of private credit development, characterised by strong returns and low risk, may become more challenging to sustain in years to come.

The current surge in investment can test the capability of alternative asset managers to allocate capital effectively. The increasing borrower stress due to higher rates, especially in high-risk markets like the U.S., could create the perfect storm for a turn in the credit cycle and rising defaults.

This environment requires a more nuanced approach to credit investment. The defensive benefits of mezzanine debt and the opportunistic advantages of special situations and secondaries should assume more prominent roles.

Managers with experience across past default cycles and the discipline to maintain underwriting standards will be indispensable. Soon, it won’t be just about making the deal – but who makes the deal.

In this context, a prudent approach that manages both risks and opportunities will be key to guaranteeing the long-term success of both borrowers and investors. Adopting this very approach is how Australia is future-proofing the category.

In conclusion, dry powder might be harder to find on Australian shores. But it’s proving to be the catalyst for the resilience and sustainable growth of local SMEs.

FC Capital’s investment strategy includes credit investments in markets not well served by traditional sources of capital which encompasses corporate capital solutions, special situations, and property.

5 topics