Is China the sugar daddy our miners no longer need?

Australia’s been known as the “lucky country” ever since Donald Horne penned a book by the same name back in 1964. According to Horne, Australia would’ve been a global backwater if not for its abundant natural resources.

Although we will never know for certain how Australia would’ve fared absent its natural resources, the health of our economy over the past three decades (28 years without a recession) has borne out the importance of these exports - and China’s insatiable appetite for them.

For a while, it looked like the music would never stop. And it plays still. But recently it’s taken a melancholy turn as China’s growth slows.

At first take, this spells bad news for our miners. It’s never good when your number one customer loses their appetite for your stuff. Yet, as it turns out, they might be just fine without China.

Trouble in the Middle Kingdom

China’s demand for Aussie commodities has largely been a function of its property construction. But that golden goose has stalled.

“The mighty property engine that has been the bedrock of Chinese growth appears to be in disarray with sales and starts down almost 50% year on year,” says Nick Pashias, Head of Equities at Antares Equities.

“At this stage it's not clear if this is the result of temporary covid lockdowns or something longer-dated and more damaging.”

In response, the People’s Bank of China (PBOC) lowered the five-year loan prime rate (LPR) by 15 basis points, to 4.45%.

“Reduction to the five-year Loan Prime Rate (LPR) should help drive a revival in housing sales, which have gone from bad to worse recently,” notes Julian Evans-Pritchard from Capital Economics.

“But the lack of any reduction to the one-year LPR suggests that the PBOC is trying to keep easing targeted and that we shouldn’t expect large-scale stimulus of the kind that we saw in 2020."

A well-timed bull market

Ironically, Australia’s miners mightn’t be all that miffed about China’s slowdown thanks to the current commodities bull market.

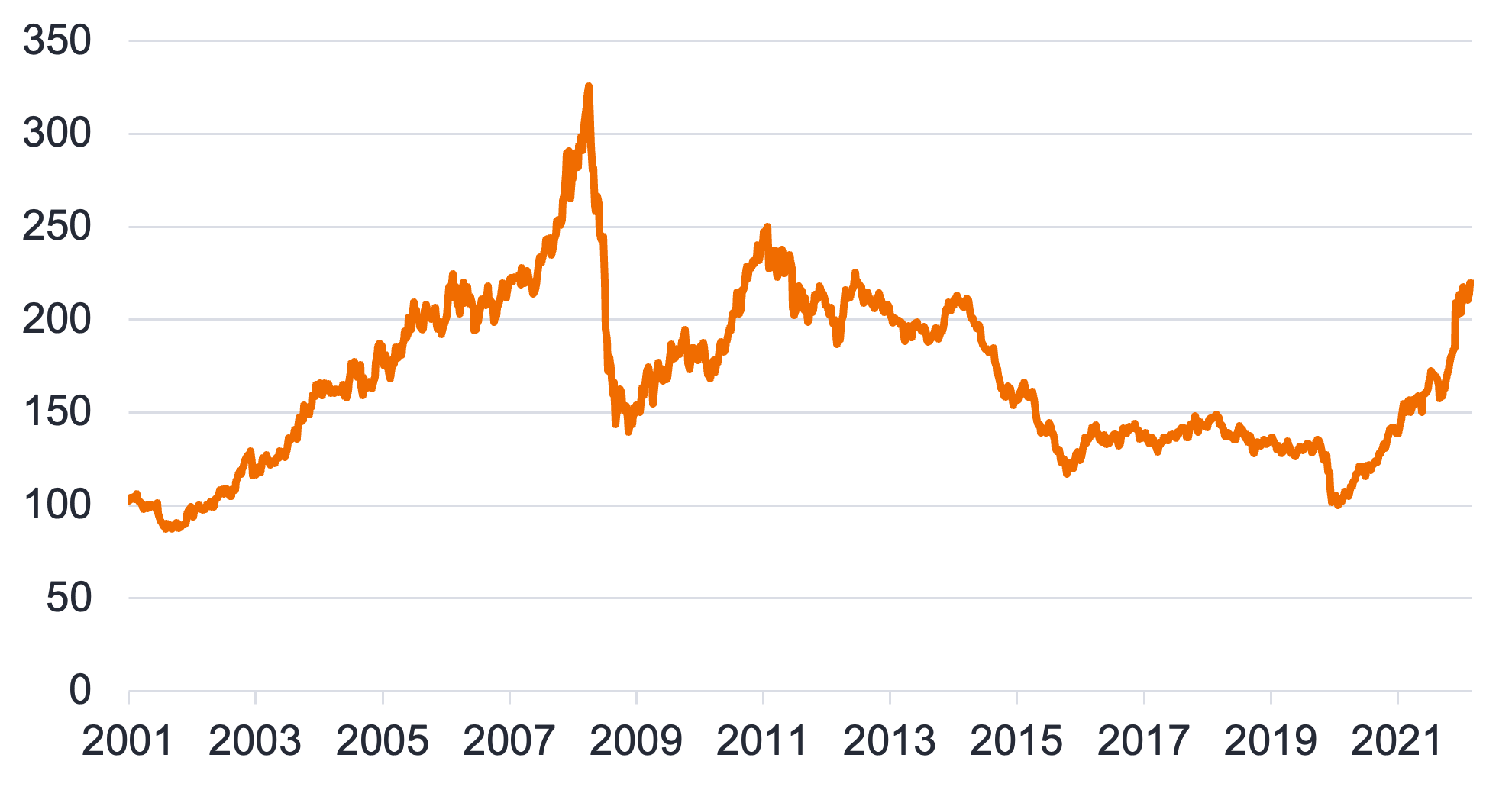

The Bloomberg Commodity Total Return Index (in AUD) up over 100% over the past two years. Here at home, the S&P/ASX 200 Resources Index (XJR) is up 12.06% this year, and 21.63% over the past six months alone.

“While COVID-19 restrictions in China have caused iron ore and base metal prices to correct on the downside in the short-term, we actually believe there will be an extended period of high prices for the broad basket of commodities required to drive the electrification of the global economy,” say Tim Gerrard and Daniel Sullivan from Janus Henderson Investors.

The commodities bull market is really a supply-side story, as the war in Ukraine and supply chain bottlenecks throttle down supply.

There’s a strong thematic tailwind helping them along, too.

“Helping the bull case in resources is the ex-China story and specifically the (low carbon) electrification of the global economy,” says Pashias.

“This thematic, supported by governments, industry and consumers supports commodity demand and therefore prices. Again Australia, the lucky country, finds itself right in the middle of a new demand wave that we feel is still in its early stages.”

Attractive valuations

Australia’s miners are in a strong position, despite the slowdown in China.

“In spite of slowing Chinese steel production, stocks are reasonable and steel volumes remain at levels unforeseen three or four years ago,” say Gerrard and Sullivan.

“At the big end of town, BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG), strong profits mean strong cash flows.”

Macquarie agree.

“BHP is our preferred large-cap exposure, and we remain positive on RIO. Mineral Resources (ASX: MIN) and Champion Iron (ASX: CIA) are our key mid-cap picks and offer unique leverage to both the iron- ore price and CAPEX cycle.”

According to Macquarie, at spot prices FY22e free cash flow yields are 10% for BHP (ASX: BHP), 13% for RIO (ASX: RIO) and 6% for Fortescue (ASX: FMG).

Pashias believes valuations are currently attractive with multiples at modest levels, even assuming much lower commodity prices, but notes that some headwinds remain.

“Balance sheets are as strong as I can remember,” says Pashias.

“And there are the structural drivers around electrification.”

Meanwhile, the electrification thematic noted above is good news for the suppliers of the raw materials that go into batteries.

“This encompasses a broad basket of commodities, including copper, lithium, cobalt, steel, aluminium and rare earths, just to name a few,” notes Gerrard and Sullivan.

“These are the building blocks of a net zero world, enabling the production of batteries, wind turbines, solar panels and the infrastructure required to harness and distribute the power they generate.”

Antares point to IGO (ASX:IGO) as a company that’s well placed here.

Still, the sector isn’t headwind free.

“One element that is lacking however is growth, or specifically a lack of production growth across many of the major producers,” according to Pashias.

“Ironically this seeming deficiency can be viewed as a positive, as lack of growth is really a lack of supply in an already tight market.”

Key takeaways

- China's economy is slowing

- Commodities are up over 100% in the last two years

- Macquarie is bullish on BHP and RIO in the large cap space, MIN and CIA among mid caps

- Electrification thematic will be a tailwind for metals and rare earths, with IGO well-placed to benefit

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

6 stocks mentioned

2 contributors mentioned