Is gold set to be institutionalised?

Even though gold prices rallied in the first two weeks of July, there is no denying it was a tough first half of the year for the precious metal, which fell toward USD 1,760 per troy ounce by the end of June, down almost 15% from the all-time highs seen in August 2020.

A huge stock market rally combined with almost unprecedented inflows into risk assets, a stabilisation in real yields, the attention that Bitcoin has generated, and an improving economic outlook, have all driven the correction, with sentiment toward gold also falling.

Despite the pullback, a look at gold over a longer timeframe demonstrates that it is becoming more popular with investors, best evidenced by the almost 900 tonnes and USD 48 billion worth of gold purchased through gold ETFs globally in 2020. Demand for bars and coins in Western markets has picked up over the last couple of years, with gold prices rising approximately 50% in USD terms since bottoming out below USD 1,200 per troy ounce in Q3 2018.

This increase in demand has come from a range of investors, including SMSF trustees, HNWs and Family Offices. Institutional portfolio managers, many of whom are looking to allocate to gold for the first time, are also paying more attention to the precious metal.

This was made clear in a recent report produced by The World Gold Council and Greenwhich Associates titled: “Rethink, Rebalance, Reset: Institutional Portfolio Strategies for the Post-Pandemic Period” the report found that over the next three years, institutional investor allocations to alternative and other assets were expected to increase by 3%, from 29% to 32% of total portfolios.

Gold is likely to be a beneficiary of this trend, evidenced by the following findings from the same report:

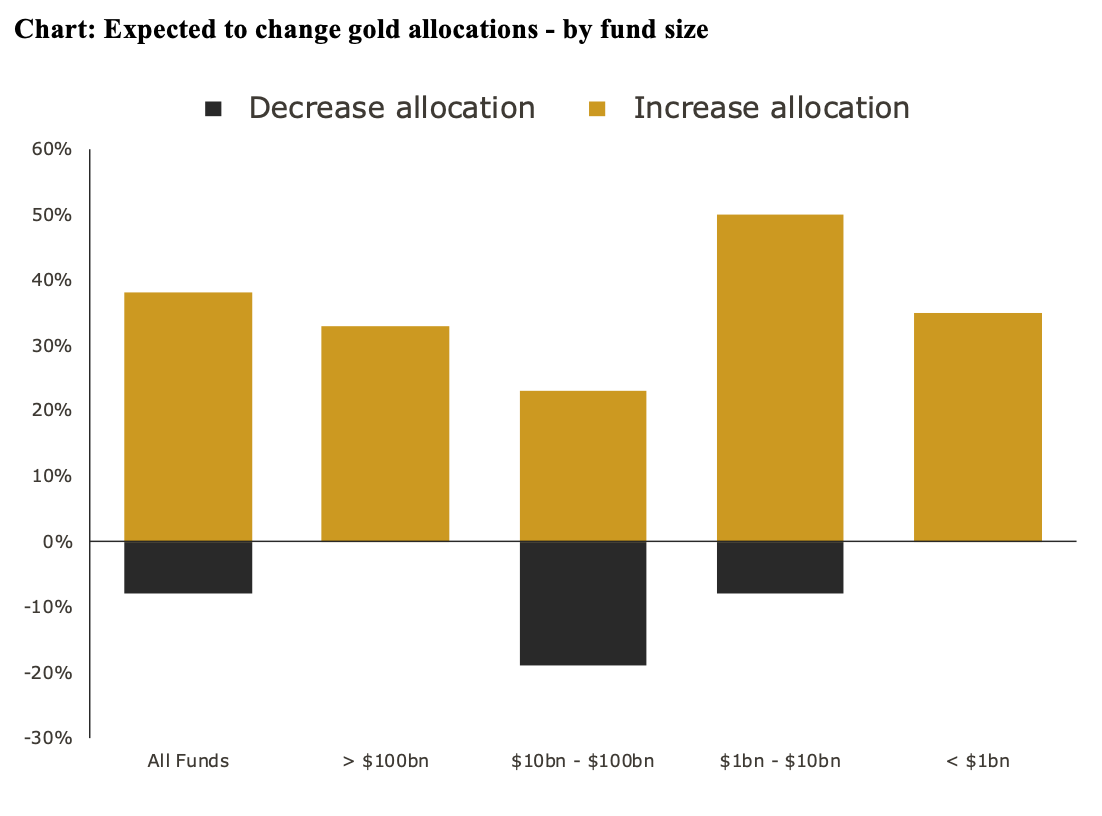

- 38% of investors with an existing gold allocation are expected to increase their holding in the next 3 years vs. 8% who think their exposure will decline. The expected change in exposure by fund size is highlighted in the chart below.

- 40% of investors with no allocation expect to adopt one in the coming three years, with 4% of portfolio assets being the anticipated allocation amount.

Source: World Gold Council, Greenwhich Associates

The reasons institutional investors are looking at gold are multifaceted. They include its potential to provide valuable portfolio diversification, improve risk adjusted returns, hedge potentially higher rates of inflation and be a reliable source of liquidity.

Australian superannuation funds to join the gold rush?

The findings from the World Gold Council and Greenwhich Associates report are highly relevant to Australian institutional investors, given the role gold could play in these funds.

This is made clear in the latest report from The Perth Mint, The case for gold: A special report for institutionally managed superannuation funds, which highlights the multiple reasons Australian superannuation funds may wish to incorporate a modest allocation to the precious metal in their portfolios.

How far back does the study go?

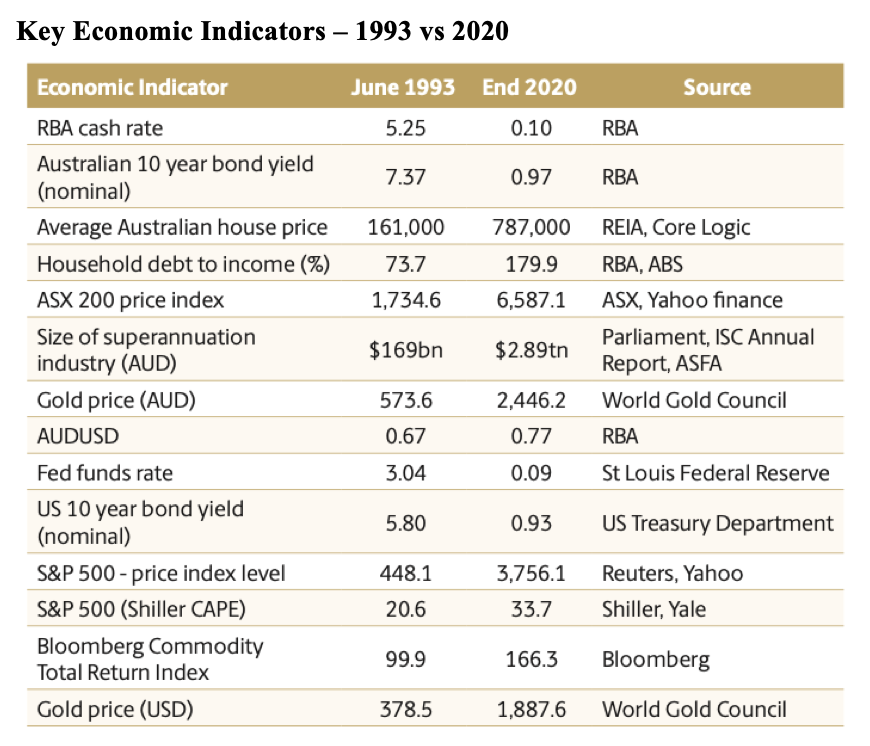

The Perth Mint report covers the time period from June 1993 through to the end of December 2020 for growth strategies, essentially capturing the entire compulsory superannuation guarantee era. The table below highlights some of the key economic indicators and how they have changed in the last 27 years.

What do the numbers say?

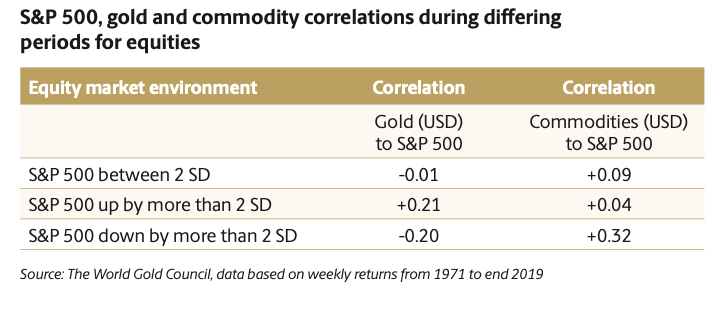

The data suggests that strategic allocations to gold would have improved risk adjusted returns (RARs) for diversified investment strategies, from conservative through to all growth portfolios. This is primarily due to the fact gold has historically had a positive correlation to rising risk assets, and a negative correlation to falling risk assets.

This can be seen in the table below, which highlights the correlation of gold, and of commodities, to the S&P 500 in environments

- Where S&P 500 performance sits within 2 standard deviations of mean performance

- When S&P 500 performance is more than two standard deviations above the mean

- When S&P 500 performance is more than two standard deviations below the mean

Gold has worked to protect downside risk. Commodities as a general rule have not.

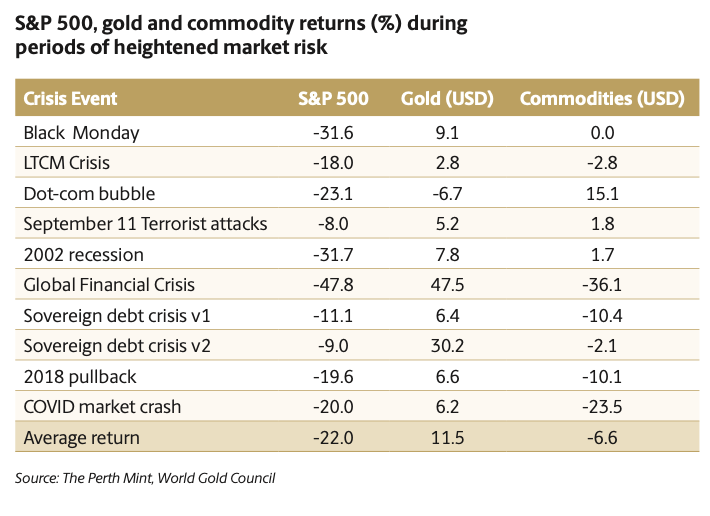

This is further illustrated in the next table, which demonstrates the performance of the S&P500, gold, and a basket of commodities in some of the major risk off events that have afflicted markets in the past 30 plus years.

Given this relationship, and how important equity market returns are in terms of driving risk within superannuation portfolios, it’s no surprise that modest allocations to gold would have reduced the volatility of diversified portfolios, and improved risk-adjusted returns.

As gold is seen by some investors as a growth asset (it’s a commodity by nature after all), and by others as a defensive asset, our report looks at the impact of making 1% to 5% allocations to fixed income assets and a basket of commodities, including gold.

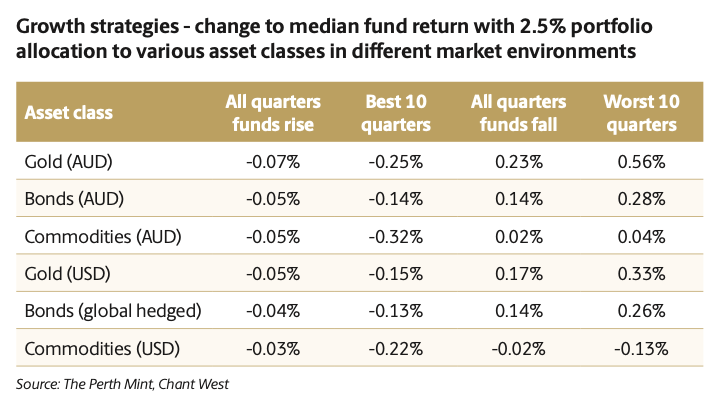

The table below shows the impact that a 2.5% allocation to these three asset classes would have had on the median return for growth superannuation funds.

The data in the table indicates that in the quarters funds increased in value, an allocation to gold, bonds or commodities would have cost a fund performance, relative to the actual returns generated.

However, when growth funds decline in value, and especially when they decline rapidly, nothing would help improve returns like an allocation to gold.

It’s not all about performance

While improved risk adjusted returns alone could justify a gold allocation in a portfolio, they arguably do not fully capture the benefits of holding the precious metal, given they only look at performance and volatility, rather than the full range of risk investors need to factor in when allocating capital.

All other things being equal, an allocation to gold will also likely improve the liquidity, as well as lower the investment costs and credit risk of an institutionally managed portfolio.

With institutional investors increasingly focused on alternative assets, it’s also worth noting that gold would also likely lower dispersion risk, with this article published on Livewire noting: “BlackRock research shows that manager return dispersion within alternative asset classes is three to five times higher than for traditional asset classes.”

Considering all of these factors, a strategic gold holding could also allow portfolio managers to be more aggressive with the other allocations in their portfolios.

But isn’t gold expensive now?

With gold hitting all-time highs last year, one could question whether now is the right time to look at incorporating an allocation to the precious metal in a diversified portfolio.

The first observation is that when one reviews markets as a whole today, few if any seem cheap on an absolute basis. Investing and comparing asset classes against each other looks like it will almost exclusively be a relative game going forward.

Looking at gold specifically, and while no longer as cheap as it was twenty years ago, a variety of metrics from measuring the real gold price relative to inflation, to gold’s share of global financial assets, to its price relative to equity market indexes, all suggest it is still inexpensive relative to history.

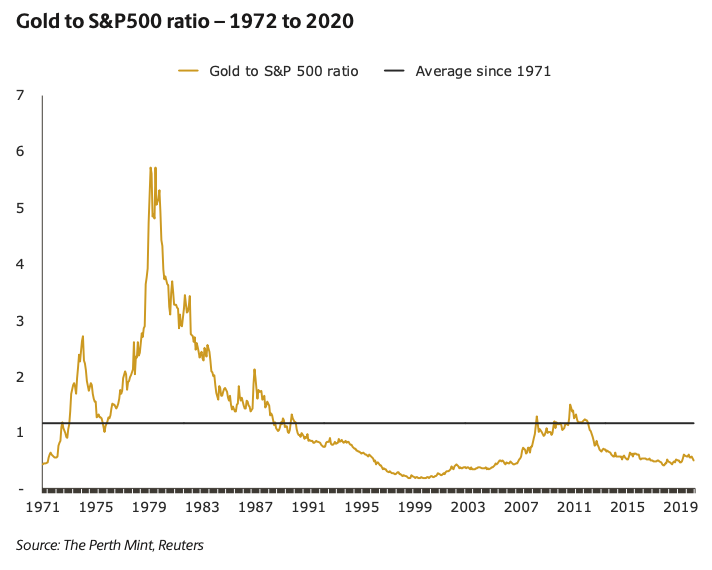

As an example, the chart below illustrates the ratio between the USD spot price of gold, and the S&P 500 from 1972 to end 2020. It suggests gold is far from expensive relative to equities today.

As we stated in our report, gold would need to more than double the price performance of the equity market in the coming years for the ratio to return to its historical average, while a return to the highs seen in 1980 would require the precious metal to outperform by a factor of ten.

What about self-directed investors?

A good argument can be made that the findings from our latest research report are just as, if not more, relevant for self-directed investors, including SMSF trustees.

After all, not only do SMSF trustees face the same challenge of low to negative real rates, which impact cash and term deposit holdings, but (and I say this as a trustee myself) they also tend to lack the scale to allocate to many alternative assets, from private equity, to unlisted infrastructure, to hedge funds.

Gold on the other hand is highly liquid and efficient to allocate money to. This means it could be particularly useful to the SMSF community and the intermediaries who advise them on their portfolios.

Outlook

The environment investors will need to navigate in the decade ahead is likely to support continued allocations to gold.

In the short-term, while the global economy should continue to improve from its COVID-19 induced malaise, it’s worth remembering that global GDP growth had been trending down for years before the pandemic hit. Moving forward there remain a number of headwinds, from ageing demographics, to high private and public debt levels, plus the likelihood of a continued pushback against globalisation.

On the monetary front, policy makers continue to stress we will remain in a low to negative real interest rate environment for years to come. Central bank balance sheets will also continue to expand, even if the speed at which they are increasing moderates.

Happy hour might be over, but everyone is still stuck at the bar.

Finally, from a market perspective, current valuations and real yields suggest traditional diversified investment strategies are set to deliver much lower returns in the decade ahead, relative to what investors have enjoyed in the past.

Combined these factors continue to provide a favourable backdrop for gold. The fact that the precious metal is highly liquid, has zero credit risk, is easy to trade and store, and is a low-cost investment to incorporate into a diversified, institutionally managed or SMSF portfolio, should only add to its appeal.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

1 stock mentioned

.jpg)

.jpg)