Is Goodman Group the best of a bad bunch?

Listed real estate has been one of the ASX's worst-performing sectors over the past few years.

Since the beginning of 2022, the sector has fallen 24%. And while it may have recovered from its lows in September last year, the sector is still down nearly 10% year to date. The ASX 200, in comparison, is back in the black in 2023 (albeit only just).

It's pretty easy to see why. COVID lockdowns have created a societal shift towards working from home and "hybrid" working, while rising interest rates have taken their toll on everything linked to yields (read: property). Cap rates, which are calculated by dividing a property's net operating income by its asset value, are also rising - putting further pressure on valuations in the sector.

And yet, Goodman Group has seen its share price rise more than 13% in 2023. So could this company be the best of a bad bunch?

In this wire, Medallion Financial's Michael Wayne analyses the company's latest FY23 result, shares why he would be avoiding the rest of the REIT sector, and outlines why he would still be buying Goodman Group on the back of its result today.

Note: This interview took place on Thursday 17 August 2023. Goodman Group is held in Medallion's managed fund and client portfolios.

Goodman Group (ASX: GMG) Key Results

- Operating profit $1.78B, up 17% on last year’s $1.53B

- Statutory NPAT $1.56B, down 54% on last year’s $3.41B

- EPS $0.94, up 16% y/y and ahead of guidance of +15%

- AUM $81.0B, up 11% y/y

- NTA per security $9.12 vs year-ago $8.37

- FY Guidance (Jun 2024):

- EPS +9% vs prior year's $0.94, implying $1.02

- On track to achieve key Group sustainability targets including 306MW of solar PV installed or committed in FY23, taking us to 75% of our 400MW 2025 target

- Forecast distribution for FY24 remains at 30.0 cps

Market Meter Ranking

Goodman Group ranked #7 for the effectiveness of its board; #2 for credibility, the effectiveness of its CFO, leadership depth, and operational management; and #3 for the effectiveness of its CEO. You can learn more about Market Meters rankings here.

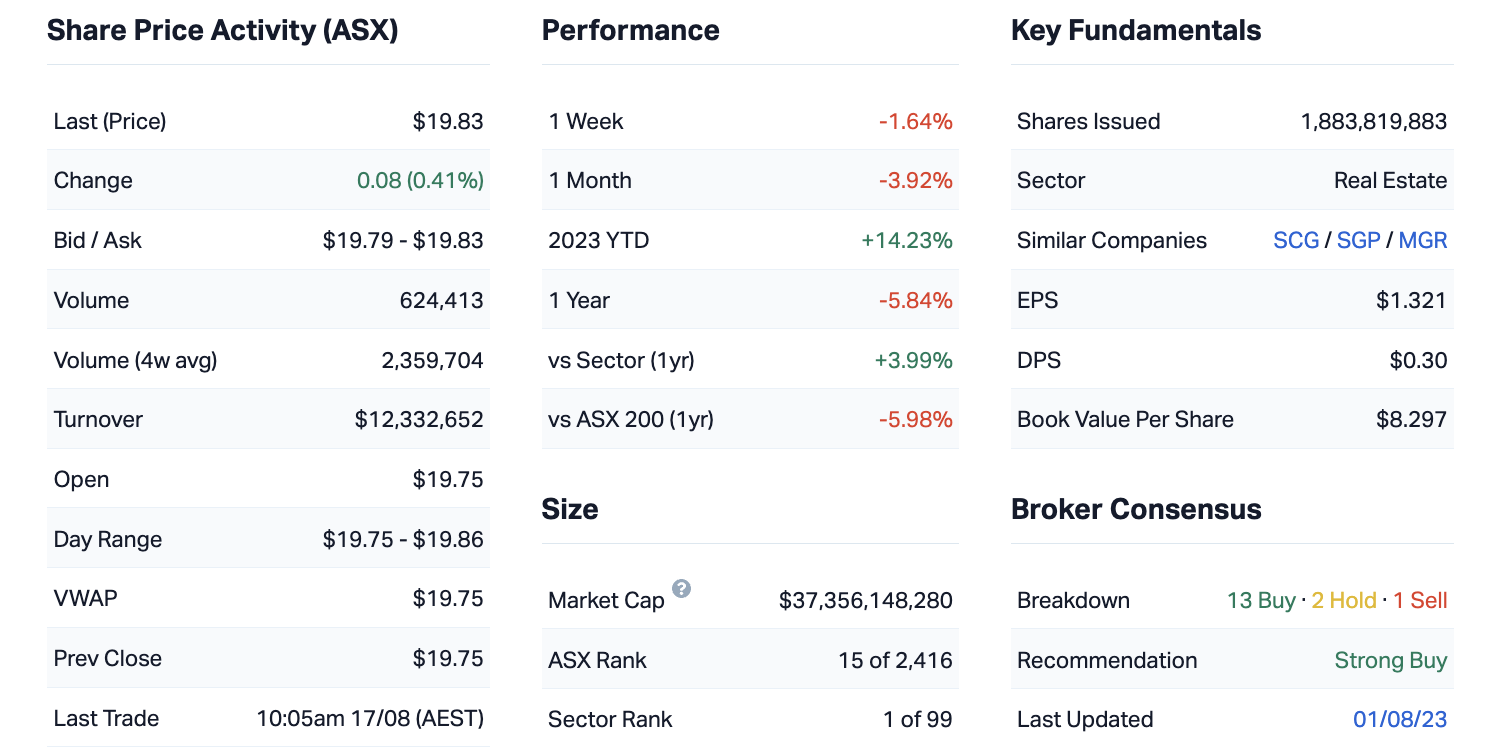

Key company data

Net revaluations across Goodman Group's property portfolio for FY23 were higher and that goes against the grain of what we've been seeing across other real estate businesses that have reported so far this earnings season.

2. What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

It will probably be a muted reaction given there weren't many surprises in the result.

The reaction looks appropriate given the result exceeded expectations despite updating the market as recently as May.

3. Were there any major surprises in this result that you think investors should be aware of?

When it released its update in May, it actually put out a forecast of earnings growth of about 15% for EPS (earnings per share). And the result came in 16% higher on that EPS number. That is a beat on not only the company's forecast but also on consensus expectations. So that was a positive surprise in that respect.

4. Would you buy, hold or sell GMG on the back of these results?

Rating: BUY

We hold Goodman Group for a lot of our clients, and we actually hold Goodman Group in our managed fund as well. What we were looking for in the results were work-in-progress numbers - which were very strong and along the lines of what they were suggesting would play out in May. We were also looking out for their current development completion run-rate of about $7 billion, which was reiterated in this number.

Off the back of today’s result, we would be comfortable buying Goodman Group. It never really screams cheap relative to its peers either domestically or overseas. But it's constantly delivered high rates of return, lower levels of leverage and a pretty decent price-to-book ratio relative to its peers.

So taking that all into account, we're happy to have Goodman Group as a buy on a long-term view.

5. What’s your outlook on GMG and the REIT sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

Obviously, real estate has a lot of sensitivity to interest rates, and with rates going higher, it's a challenge. We prefer active real estate managers, those who can grow their assets under management and can also add value by buying and building different assets and managing the strategy once those assets are complete. Goodman Group ticks the boxes in that regard. They're operating in a sweet spot when it comes to the real estate industry, being focused on logistics, warehouses and also an increasing amount of exposure to data centres.

Upon completion, 99% of their projects are leased and 50% of commencements are pre-leased. They've got a very good business model where they'll essentially set up the transaction before anything is built. They’ll find an investor like a super fund who would be happy to buy an asset yielding 5-7%. And then on the other side of the fence, they’ll have a tenant ready to go who's looking to lease that space straight off the bat. So that de-risks their projects significantly.

We also quite like Goodman Groups because they're seeing a pretty decent rental uplift. This is termed “under renting”. Around 27% of their book is classified as under-rented, so you'll see a lot of the rents increase across their book over the years. You'll also see cap rates go up, which collectively puts downward pressure on valuations. So you need those rental increases to offset higher cap rates.

We're less optimistic about the rest of the sector because we are conscious of the fact that gearing levels are fairly high more often than not for most real estate companies. That's not necessarily the case for Goodman Group.

We're starting to see debt servicing costs across the industry flow through and that's putting downward pressure on valuations. You've also got a situation where cap rates - which are the market's expectations or the required yield that these investments need to achieve - are actually going up. So that's putting downward pressure on valuations as well. So we're less optimistic about the rest of the sector.

It's definitely come back a long way. It is starting to look more attractive and there are certain pockets of the market that are getting excited about REITs. However, we think it's a little bit premature to invest in the sector.

6. From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

Rating: 3

We think the ASX is fairly valued at the moment. You've always got to factor in the different components of the ASX. Earnings are expected to fall 10% in FY24. A lot of that is driven by falls in the earnings of mining and energy companies, for instance, which are fairly big constituents of the ASX. But there are definitely pockets of the market that we think look better than others. So at the moment, we would give the market a rating of three out of five in terms of valuation.

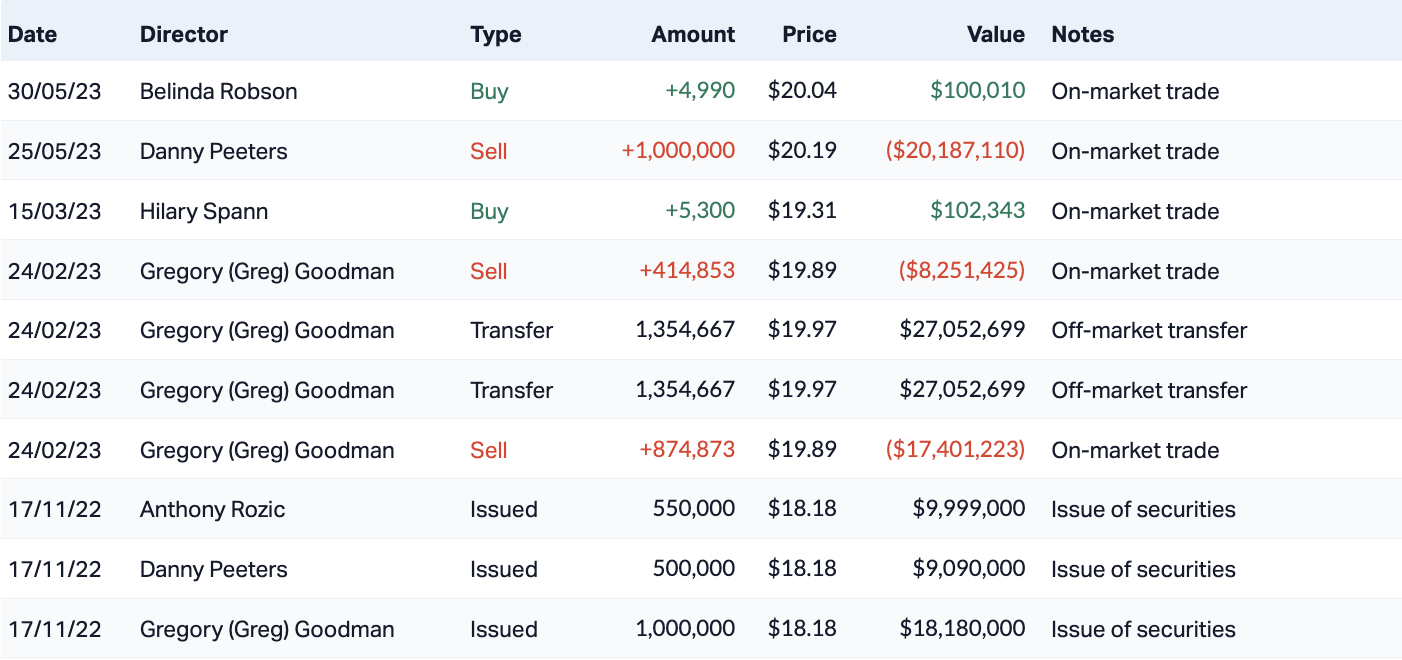

The 10 most recent director transactions in Goodman Group

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

1 stock mentioned

1 contributor mentioned