Is high-yield debt the path to stability and income?

Assets under management for the global private debt market topped US$2.1 trillion (A$3.15 trillion) in 2023. According to the IMF, private credit has grown rapidly since the global financial crisis (GFC), taking market share from bank lending and bond markets following the long period of low interest rates which has driven a huge expansion of alternative investment strategies.

Most demand globally has come from institutional investors such as pension funds, a trend that is being replicated in Australia. The private debt market has enjoyed active participation from industry Australian superannuation funds which have readily diversified into this asset class.

Demand comes from superannuation funds keen to diversify

Several Australian industry superannuation funds such as CBUS and Aware Super are directly investing in private credit, while other funds are choosing to invest through specialist private credit fund managers to gain exposure to the asset class. Australian Super is one of the largest investors and has allocated over A$7 billion in private credit globally, having stated it wants to triple its exposure to private credit in the coming years.

CBUS also plans to triple its global allocation to private credit over the next 18 months given the opportunity “to earn low double-digit returns” while Hostplus wants to add to its record 7% allocation to private credit in its default balance fund.

Separately, the biggest investment allocations UniSuper has made into any asset class over the past 18 months has been in the debt, not equity markets. While the fund is holding back on allocating any more to investment-grade bonds, UniSuper’s chief investment officer John Pearce told The Wall Street Journal earlier this year that he is still actively investing in private credit given attractive returns.

As noted in a Bloomberg report, direct lending yielded an average 11.5% in the second quarter of 2023, according to an analysis by JPMorgan Chase & Co. In comparison, global investment-grade bonds yielded an average of below 5% in the same period.

Private credit’s low volatility

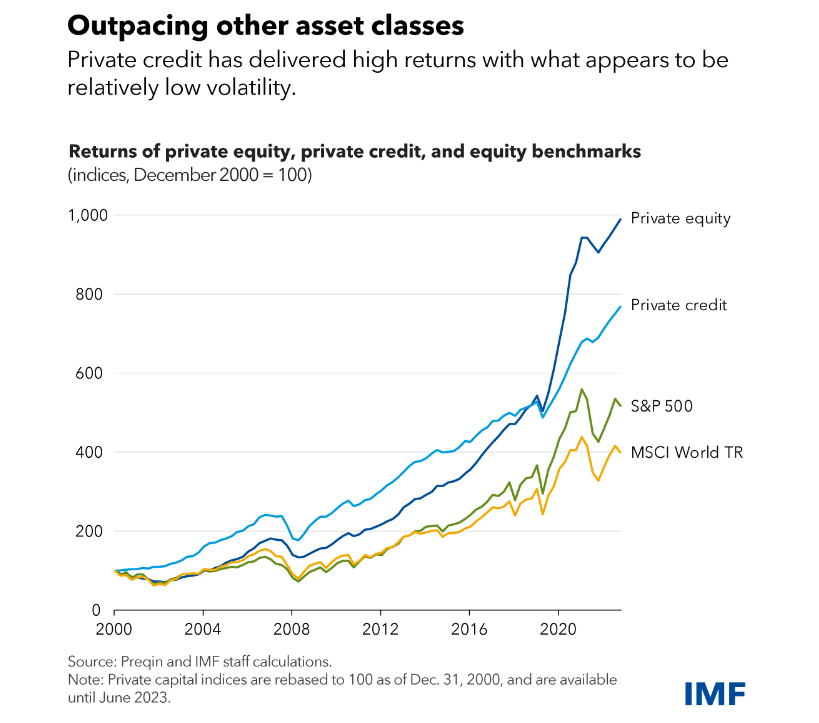

The IMF recently said in a report, The Rise and Risks of Private Credit in its Global Financial Stability Report, “In this context, private credit has appeared attractive, with some of the highest historical returns across debt markets and appears to be relatively low volatility,”

The IMF chart below displays the relatively higher returns of private credit compared to equities since 2000.

Smaller investors may follow institutional lead

Retail investors and self-managed superannuation funds (SMSFs) have not embraced the private credit asset class to the same extent as institutional investors.

Data from the ATO reveals SMSFs have almost a $150 billion exposure to Australian property investments alone, with residential and non-residential property investments totalling a record $141.8 billion in the March 2024 quarter. That represented 15% of their total net assets.

SMSFs also invested a near record of $145.1 billion in cash and deposits (15% of their total

assets). An aggregate of $287.1 billion was invested in Australian and overseas shares (31% of total assets). In contrast, SMSFs invested just $9.5 billion directly in debt securities and $6.5 billion in loans, less than 2% of total SMSF assets.

With significant exposure and weighting to Australian property, shares and cash, SMSFs, and other investors would benefit from greater allocations to private credit investments.

Diversification role in portfolios

Since returns from private credit are not closely correlated with either bond or share markets, they offer a powerful source of portfolio diversification and stability.

An investment in private debt offers a predicable income stream secured against residential, commercial, retail and industrial real estate with geographic diversity. Security is further enhanced with guarantees provided by individuals and companies.

Investments in private credit can be used to diversify private equity or traditional portfolio allocations such as fixed income or even replace equities allocations given the regular income returns.

While institutional investors have capitalised on this asset class, retail investors and SMSFs have yet to fully embrace it. The appropriate allocation to private debt markets can vary depending on an investor's risk tolerance, investment goals, and overall portfolio composition.

Investors should explore increasing their allocations to private debt through specialist managers, who can navigate the complexities of this market and deliver consistent returns, helping to bolster portfolio stability and long-term growth.

(VIEW LINK)

4 topics