Is it time to buy the healthcare sector?

Yesterday the Healthcare Sector rallied +2.6%, only beaten on the day by the IT stocks, its been a while since this previously loved group has caught my eye in the outperformance enclosure. In our opinion there are 3 standout reasons that the likes of CSL Ltd (CSL) have struggled over the last 6-months (e.g. over this period CSL has fallen -9% while even the embattled CBA has rallied over +10%).

1 – After being a huge outperformer post the GFC investors and momentum traders were complacently long the likes of CSL Ltd (CSL), ResMed (RMD) and Cochlear (COH), history tells us this was an accident waiting to happen.

2 – As COVID hit the world the sector significantly outperformed the market for obvious reasons, it had all the characteristics of a blow-off top.

3 – Most of the Healthcare Sector have significant offshore earnings which has been a massive tailwind over the last decade but since March this has reversed and again we believe investors were significantly overweight “$US earners” which in our opinion both is and was wrong. MM has been bullish the $A all year.

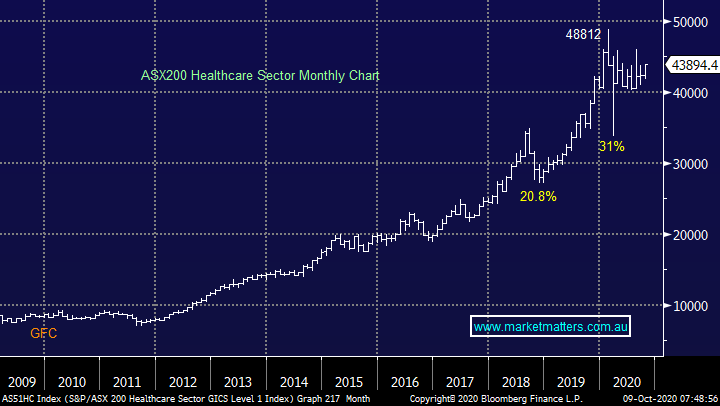

MM feels the Healthcare Sector is now due for a period of market performance after struggling over the last 6-months.

Australian Dollar ($A) Chart

Hence if we assume that the sector will basically perform in-line with the ASX moving forward and MM is bullish equities then the subsequent read through is there will be some opportunities within the sector into 2021.

MM is bullish the ASX and Healthcare Sector into 2021.

ASX200 Healthcare Sector Chart

Today I have briefly looked at 5 major members of the sector to evaluate if / when we may consider increasing our exposure to Healthcare.

1 Ramsay Healthcare (RHC) $69.49

Private hospital operator RHC like many companies has experienced a tough 2020 due to COVID and the subsequent decrease in elective surgeries while costs went up. However, as the world looks forward to a vaccine in 2021 we believe the stocks perfectly positioned to test its all-time high ~$80.

MM remains bullish and long RHC in our Growth Portfolio.

Ramsay Healthcare (RHC) Chart

2 CSL Ltd (CSL) $298.94

Heavyweight CSL is undoubtedly a great company but it was suffering from all 3 of the points raised earlier plus its valuation simply became way too stretched. However, we do believe the stocks now bracing for a 10-15% rally, this is arguably the conservative play in the sector but we would be more comfortable leaving some room to average into another dip lower towards $250.

MM likes CSL but would leave room to average under $260.

CSL Ltd (CSL) Chart

3 Cochlear (COH) $208.85

Hearing implant business COH reported a 6% drop in sales over the last financial year which included the savage COVID quarter, not too bad in our opinion. With a kick up in elective surgeries the stock should be able to rally 10-15% in a firm market but its vulnerable if a vaccine is not forthcoming.

MM is neutral to bullish COH.

Cochlear (COH) Chart

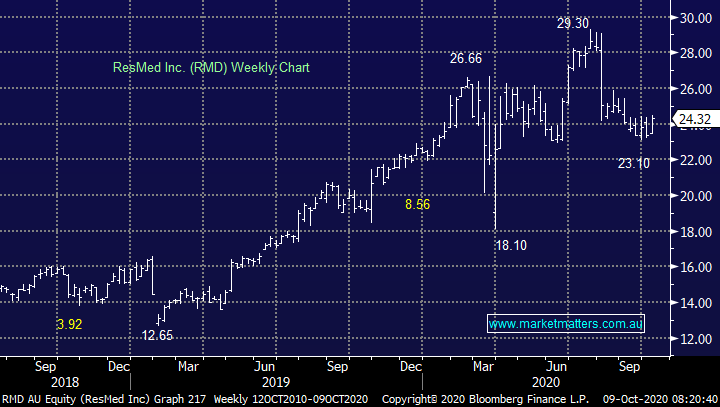

4 ResMed (RMD) $24.32

Sleep disorder business RMD delivered solid 4th quarter and full year results in August but cautious comments from the company didn’t excite investors who had the business priced for ongoing strong growth. Short-term the stock looks set to test $26 but it’s definitely not on our shopping list.

MM is mildly bullish RMD short-term.

ResMed (RMD) Chart

5 Ansell (ANN) $38.81

We hopefully are approaching a post COVID world but 2020 will not be forgotten in a hurry and we believe health and safety business ANN is well positioned for this new look future – ANN looks set to rally a minimum of 10% short-term.

MM is bullish ANN targeting fresh all-time highs.

Ansell (ANN) Chart

Conclusion

MM likes the Healthcare Sector into 2021 with our order of preference of stocks looked at today : RHC, ANN, CSL, COH and RMD, at this stage only the first 3 are on our watch list and we already own RHC.

Get regular market updates

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

2 topics

5 stocks mentioned