Is it time to invest in biotech now that it is cheap?

Global X ETFs

After coronavirus vaccines made biotech the standout performer in 2020, the sector has faced a major reckoning this year.

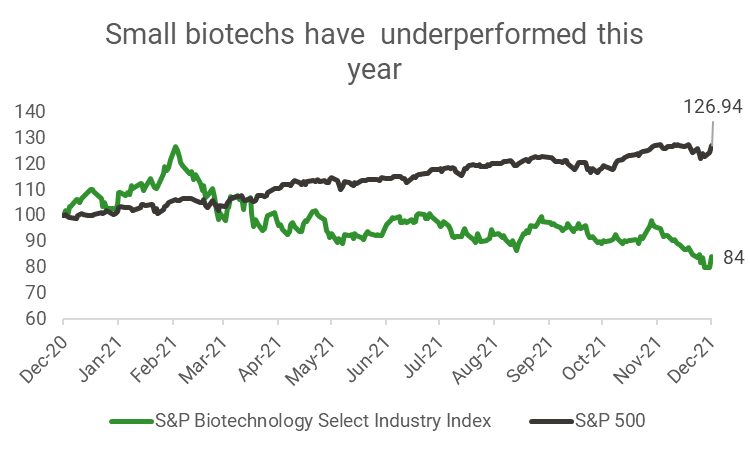

Source: S&P Global, ETF Securities. Data as of 7 December 2021.

Over the past year, the S&P 500 has delivered a return of 26%. Yet over the same period, the S&P Biotechnology Select Industry Index, which measures the US biotech sector on an equal weighted basis, is down 16%.

The underperformance has left many wondering what’s going on.

Underperformance owes to politics

Since Joe Biden won the presidential election, he has tried to make drugs more affordable. While these changes are forecast to have only a modest impact on biotech companies’ fundamentals, they have nonetheless affected the market.

Politics has been the primary driver of biotech underperformance.

What are Biden’s changes?

- Government to negotiate Medicare drug prices

- Tougher M&A oversight

- FDA commissioner absence

As part of the US$2 trillion infrastructure and climate bill Biden pushed through by Congress in November, the government will negotiate down the prices of older drugs purchased by Medicare. While these types of negotiation are common in other parts of the world, including Australia, the US has been unusual in the free hand it has given drug companies to set the prices it charges the government.

With the government negotiating some drug prices, biotech companies’ revenues are likely to be lower. However, they are unlikely to be significantly lower. Analysts cited by the Wall St Journal estimate that the bill will have a “very modest,” impact on the drug industry, with a total reduction in industry revenue of just 3% to 5%--which amounts to surrendering under one year’s growth.

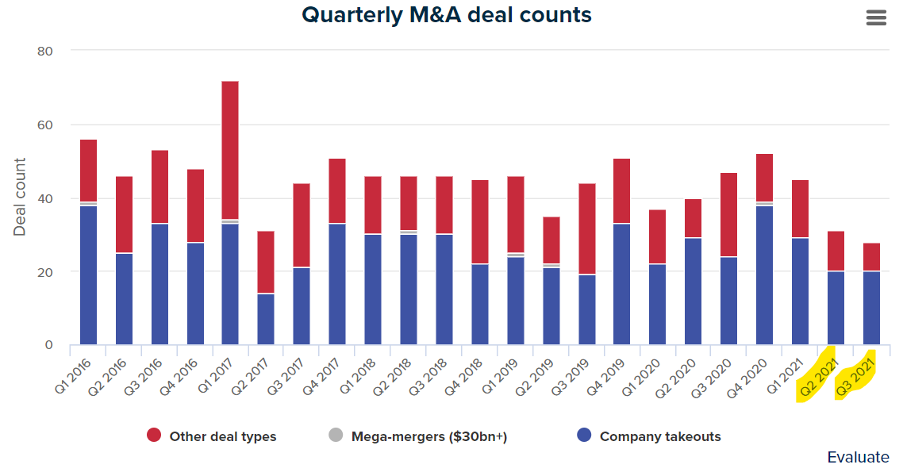

Another reason for the selloff is the restrictions on mergers and acquisitions that Biden is placing across the healthcare sector. In a bid to increase competition, Biden is set to review hospital and pharmaceutical mergers a lot more closely. On this score, we have already seen a slowdown in M&A activity this year.

Source: Evaluate. Data as of 1 August 2021

Tougher M&A oversight dampens the valuations of smaller biotech companies. This is because M&A activity – such as around patent cliffs – is a primary driver of their value. It may be this that most readily explains small cap biotech’s underperformance.

The final cause has been the power vacuum at the top of the Food and Drug Administration, the key industry regulator. The FDA has burned through eight commissioners since 2015. And from January to November 2021, there was no permanent commissioner (a new commissioner was only appointed in November, after several months without one). The vacuum at the top has created delayed drug reviews and, in some cases, confusing regulatory decisions.

Why we remain optimistic

Despite the political headwinds we remain optimistic about the prospects for biotech. Why are we optimistic?

Three reasons:

- Drawdowns greater than 30% have been common

- The sector is currently cheap

- Resemblance to the 2015-2016 crash

The first is simple history. Among biotech investors there has always been an understanding that “volatility is the price of admission”. Volatility can go both ways—up and down.

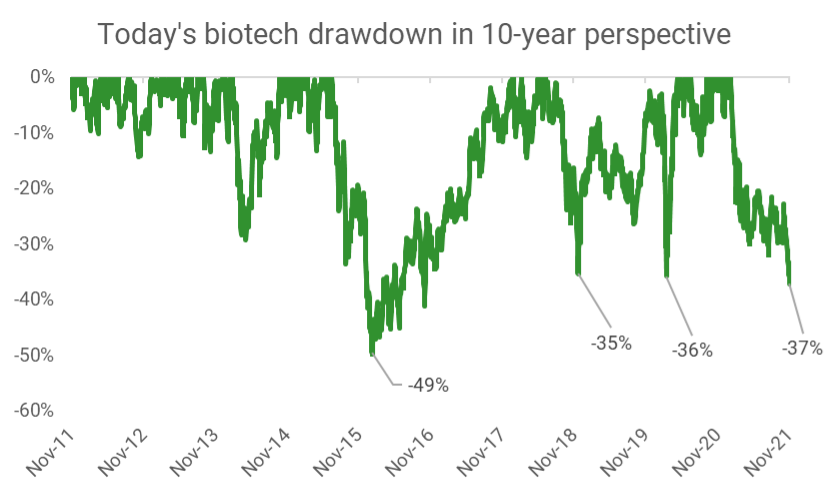

A look at the index history shows this. Looking at the 10-year history of the S&P Biotechnology Index, drawdowns greater than 30% have been common (graph below). In each previous instance, the index has recovered and in some instances, the large drawdowns were followed by periods of outperformance. However past performance is no guide to future returns.

Source: S&P Global, ETF Securities. S&P Biotechnology Select Industry Index price returns over 10 years as of 7 December 2021.

Another reason for our optimism is that the sector now looks cheap.

The S&P Biotech index is currently trading on a one year forward price-to-earnings ratio of just 11.6 as of 8 December 2021. This is roughly half the forward PE of the S&P 500 index, which is on a forward PE of 21.7 on the same date.

We should note that these low PE ratios owe not to biotech companies being cigar butts, with their best days behind them. Many of these cheap biotechs are at the bleeding edge of modern medicine. Some are inventing the cure to cancer (literally). While others are building out mRNA technology, the miracles of which we’ve seen with covid-19 vaccines.

A final reason for our optimism is that today’s drawdown bears a resemblance to the biotech crash in 2015-2016.

After presidential candidates Hilary Clinton and Donald Trump criticised biotechs “price-gouging”, the index fell almost 50%. Yet in the five years that followed the index gained 284.2%.

Simple access to biotech investing?

Would you like to get exposure to biotechnology? Click here to find out more about ETFS S&P Biotech ETF (ASX:CURE).

4 topics

1 stock mentioned

1 fund mentioned

Expertise