Is obesity finally in decline? The 'miracle' drugs and stocks to watch

A little over a year ago, I took the stage at Livewire Live and made a 'shocking prediction' for 2024: we would witness “the end of obesity,” driven by the emergence of GLP-1 drugs from pharmaceutical giants Novo Nordisk and Eli Lilly.

The response? An outpouring of scepticism. One commenter scoffed, “End of obesity?? LOL!”

Another quipped, “So, we’re done with fast food, sugary drinks, and couch surfing too? Sure, it’s the end of the world as we know it!”

Now, twelve months later, it’s time to revisit the data.

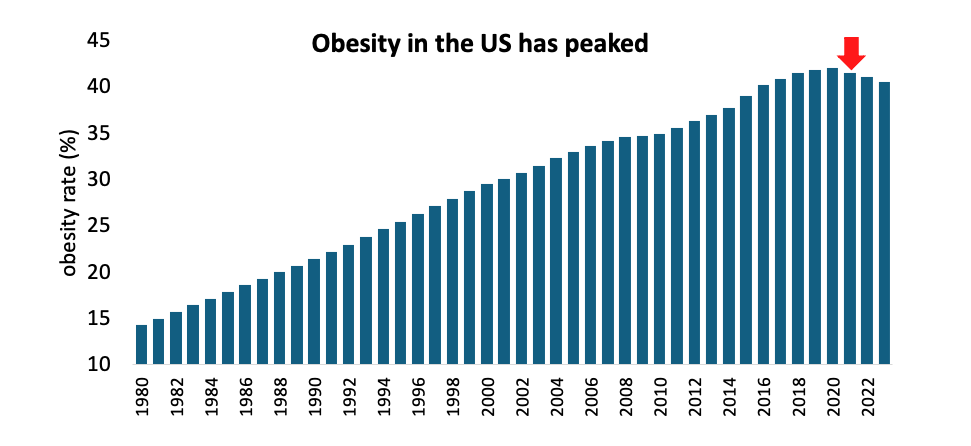

Today, one in eight US adults has tried these drugs, which are on course to become the best-selling pharmaceuticals of all time. Obesity rates, once on a seemingly endless upward trajectory, have peaked and are now showing a decline, dropping approximately two percentage points.

Source: Age-adjusted obesity rate among adults aged 20 and older (%). US National Health and Nutrition Examination Survey

Frankly, even as someone deeply immersed in drug R&D, the speed of this turnaround has surpassed my expectations. The anticipated introduction of oral GLP-1s (most current versions are injectable) will only accelerate this trend.

GLP-1 drugs are proving to be remarkably versatile, with the potential to mitigate a range of serious health issues, from diabetes, cardiovascular disease, dementia, fertility, arthritis and even addiction. No wonder researchers have dubbed them the “Swiss Army knife” of modern medicine.

For decades, it has seemed that nothing could stop the relentless climb in obesity levels. Yet, here we are, seeing real results from a once-weekly injectable pen, succeeding where billions spent on public health campaigns and government interventions have failed.

The GLP-1 drugs primarily work by reducing caloric intake, but that is not the whole story.

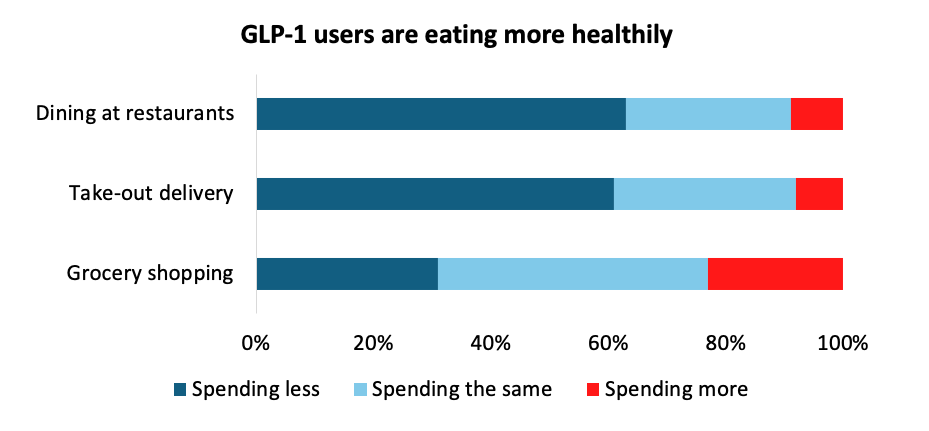

Studies have shown that the drugs also reduced cravings for high-fat and high-sugar foods due to their impact on dopamine pathways in the brain.

Source: Morgan Stanley Research AlphaWise Survey

Estimates based on responses collected in February 2024 from 300 U.S. participants taking GLP-1 drugs

Big implications

The implications of this shift are profound, not just for healthcare, but also for markets and industries ranging from pharmaceuticals to wellness and beyond.

A close friend who works as a designer at a large US fashion label now tells me that there is no longer an emphasis on catering for plus-size body shapes. Only last year, catering for larger sizes was seen as the key growth area, serving a historically neglected segment. Instead, the apparel industry is seeing a rare growth tailwind as newly trim customers refresh their wardrobes.

GLP-1 drugs are not just altering waistlines - they’re reshaping the entire landscape of medicine (none of this is to say that these drugs are free from side effects or moral hazard).

Take my tennis buddy for instance. He started Ozempic 3-4 months back. At 6’1’, and a little over 100kg, you would not have thought of him as overweight. Before he started, he had a full medical. His blood pressure, blood sugar, liver function and cholesterol were all well above the normal range. Fast forward to now, he is 88kg, all his markers are perfectly in line, and he is now beating me in straight sets.

In the Plato Global Alpha portfolio, we have held GLP-1 makers Novo Nordisk (CPH: NOVO-B) (+145%) and Eli Lilly (NYSE: LLY) (+280%) for over three years.

Eli Lilly’s drug Mounjaro is the most effective, resulting in a staggering 22.5% loss in body weight. If I continue to lose in straight sets, I may have to get a script myself.

Learn about the Plato Global Alpha Fund

Dr David Allen is the portfolio manager of the Plato Global Alpha Fund. A long/short global equities strategy that aims to generate all-weather alpha for investors.

To 31 August 2024, the Plato Global Alpha Fund has returned 19.8% p.a. after fees since inception (1 September 2021), outperforming its benchmark (MSCI World Net Returns Unhedged Index) by 10.1% p.a. after fees.

Visit the Plato Global Alpha website

2 topics

2 stocks mentioned

1 fund mentioned