Is Pepper Money a rare structural growth stock?

Pepper Money is clearly a deep value opportunity. For readers who missed our initial article outlining the value case you can read it via the link below. But, in our view, it may also be an emerging structural growth opportunity.

Anecdotally, there are some factors that indicate strong management, culture and operational excellence. The company for example has won the award for best specialist lender for the past 9 years consecutively. They have also been awarded best non-bank lender in 2017, 2019 and again in 2021 - out of a field of several hundred. So clearly they are doing the single most important thing in business, which is creating a great customer experience.

On the distribution side, the PPM brand is well known and respected by mortgage brokers who have more than 20 years of distributing their products. Channel checks confirm that PPM is known for fast turnaround times (see below), consistency and great end-customer service. This has led to more than 20,000 brokers distributing their product - and growing by the month. In addition, Pepper has close to 40 white label partnerships with third parties (and also increasing). This captive market now accounts for 45% of originations.

On the financing side, PPM has syndicated more funds than any other non-bank lender. Wholesale lenders know how Pepper mortgage securities perform through their lifecycle and are ready and willing to fund their growth. Many have dealings dating back more than 15 years. PPM currently has access to more than 100+ institutional financiers, and this number also continues to grow.

But the area that has us most interested, is that we see PPM as being firmly in the sweet spot in terms of their development and deployment of technology. PPM has 2 proprietary platforms that enable them to service brokers (arguably) better than any of their competitors. Their many years of toil and innovation have enabled them to develop a class leading process that integrates human oversight with technological insight. The clearest example of this is their ability to turn around applications. On average, PPM is able to respond to mortgages in less than 7 hours. 27% of auto finance is approved within 2 second, and with the new platform capability, that is expected to grow to 60% by the end of CY22. To provide some context, the larger banks are requiring in the order of several weeks to process mortgage applications. To finance brokers and their white label partners, this is the single most critical aspect that they seek in a lender. A fast, consistent response.

There are of course a host of fintech’s nipping at their heels. But PPM is in that sweet spot where it is large enough that it is able to devote more resources to developing and deploying technology than the host of non-bank start-ups. And on the flipside, it is sufficiently nimble and flexible to be able to act with more speed and effect than the banks themselves. Additionally, only a handful of fintech’s actually do the financing piece – and this is where the real margin is to be had.

In our recent meeting with management, the comment was made that

‘we feel we are at a very exciting stage; the foundations have been laid with our people and technology.’

Some may see this as an unusual statement, given the company has been operating for 21 years. However, we see this as a reflection of how much growth management see on the horizon.

The awards, brand, technology and people have enabled PPM to become one of the largest non-bank lenders in Australia. This economy of scale creates in and of itself a further competitive advantage.

Does the Track Record Confirm Structural Growth?

Clearly the surest measure is the actual operating track record. The quantifiable, definable history of the business.

And this is where the light bulb may turn on for (some) investors.

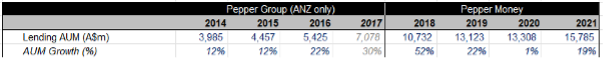

Over the past 8 years, PPM has averaged AUM growth of 21.3%. And considerably more at the bottom line, due to the operating leverage in the business. This is a top tier rate of growth over a long period of time in a particularly low growth market.

And there are 2 even more compelling points to observe. Firstly, this rate of growth has accelerated from the early years where for example growth averaged 12% per annum in 2014 and 2015. Secondly, it should be appreciated that in 2020, management made the prudent but ‘costly’ decision to turn off the taps and hold a 12-month financing buffer. This saw AUM grow at the lowest rate in its history at just 1%. If we remove the Covid impacted 2020 data, we see that average growth in AUM has actually been 24.1% per annum.

To date all the evidence is pointing to a record start to the new year, despite supposed headwinds. PPM has a track record of growth and surpassing expectations. Many ASX debutants fail to meet their prospectus forecasts. PPM not only hit their targets but surpassed the pro-format NPAT by nearly 18% ($21m).

Model Forecasts

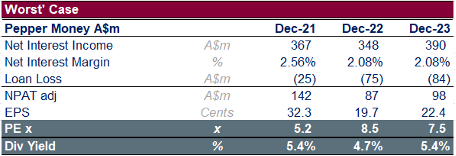

To understand our downside risk, we have run a PPM model with the ‘worst’ data from the past decade – the lowest NIM, highest loan losses and lowest growth taken from any year – and combined them for the ‘perfect storm’. It is unlikely that we will see some of these numbers again, let alone all in the same year. But it provides a strong level of comfort should the worst occur.

As we can see, if everything ‘goes wrong’ in the coming year, NPAT is still forecast to be in the order of $90m. On the ‘worst case’, PPM will still be trading on a PER of <9x earnings, versus the market at closer to double that.

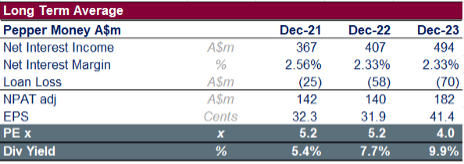

A more probable outcome is of course to run the model using the long-term averages as inputs. Doing this produces earnings that really are nothing short of astounding. Based on the ‘average’ experience over the past decade or so, the earnings decline slightly in the current FY, but then increase by over 30% to $182m in 2023. If we experience an ‘average’ outcome, the stock will be trading on a PER of 4.0x one year out and a dividend yield of 9.9% fully franked. And of course, this growth in profit and dividends is expected to continue thereafter.

Summary

Risk aversion will prevent losses. But being overly risk-conscious will prevent profits.

Over the years, we have no doubt missed good opportunities by being overly focussed on ‘noise’. PPM is on a PER of 5x, has averaged 20%+ growth per annum over a long period of time and has a strong business model, management, brand, and IP. Value – growth – quality. Now all that is required is a little patience.

3 topics

1 stock mentioned

.jpg)

.jpg)