Is the CLO Boom of 2021 Being Repeated in 2024?

The first quarter of 2024 has seen a boom in collateralised loan obligation issuance in the US. As volumes increase parallels with the CLO boom in 2021 may initially appear to be justified. Such comparisons risk being misleading as the factors driving the increase in 2024 issuance are quite different compared to those behind the 2021 CLO boom.

What is a CLO?

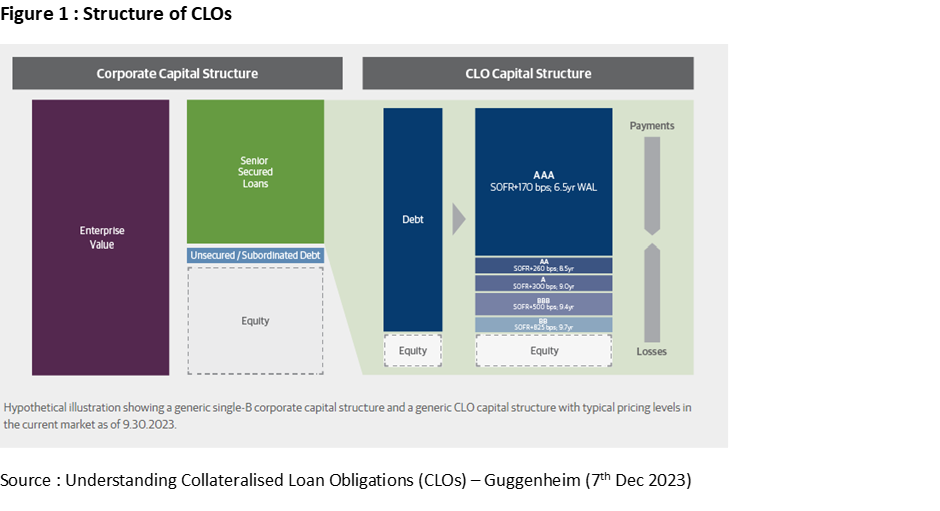

A collateralised loan obligation (‘CLO’) is simply a securitised pool of assets acting as collateral for a single marketable security. CLOs are therefore similar to collateralised mortgage obligations only the underlying debt acting as collateral is different being a company loan rather than a mortgage. These company loans, also known as bank loans or leveraged loans, typically occupy a first-lien position in the company’s capital structure, are secured by the company’s assets and rank first in priority of payment ahead of unsecured debt in the event of bankruptcy.

Though the exact characteristics may vary from one CLO structure to another the common feature is the ‘tranching’ of the securities into different sleeves according to seniority and accordingly risk. Notably the central characteristic of ‘tranching’ is that (a) cash flow distributions begin with the senior-most debt tranches of the CLO capital structure and flow down to the bottom equity tranche and (b) losses begin with the most junior equity tranches and flow up. This process, or methodology, of distributing cashflows etc between the different tranches is known as the ‘waterfall’. Given the nature of the waterfall the CLO’s most senior and highest-rated AAA tranche carries the lowest coupon but is entitled to the highest claim on the cash flow distributions and is the most loss-remote. Mezzanine tranches pay higher coupons but are more exposed to loss and have lower ratings. The most junior and riskiest part of the CLO capital structure is the equity tranche which is neither rated nor coupon bearing. Instead, the equity tranche represents a claim on all excess cash flows that remain once the obligations for all debt tranches have been met. The equity tranche is usually referred to as being in the ‘first loss’ position and is often retained by the originator of the CLO to ensure an alignment of interests with external investors.

CLOs are also governed by a series of coverage tests to measure the adequacy of the collateral balance and of cash flows generated by the underlying bank loan collateral. Such tests include :

- Overcollateralization test (OC test) : ensures the principal value of the bank loan collateral pool exceeds the outstanding principal of the CLO debt tranches. If the bank loan collateral’s principal value declines below the OC test trigger value, cash that otherwise would have been distributed to the equity and junior CLO tranches will be used to instead pay down senior debt tranche investors.

- Interest coverage (IC test) : ensures the adequacy of cash collected from the bank loan collateral to pay CLO tranche interest. If collateral collections decline below the IC test trigger value, cash that otherwise would have been distributed to the equity and junior CLO tranches will again be used instead to pay down senior debt tranche investors, in a manner similar to the OC test.

Despite the structuring that goes into CLOs, investing in CLOs is not without risk. As with other securities, CLOs are subject to credit, liquidity, and mark-to-market risk, and the basic architecture of CLOs requires that investors must understand the waterfall mechanisms and protections as well as the terms, conditions, and credit profile of the underlying loan collateral.

The 2021 CLO ‘Boom’

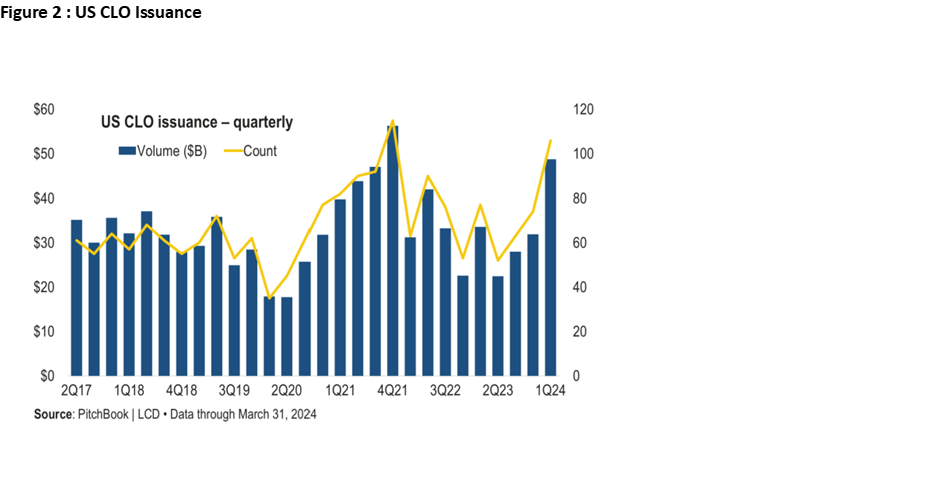

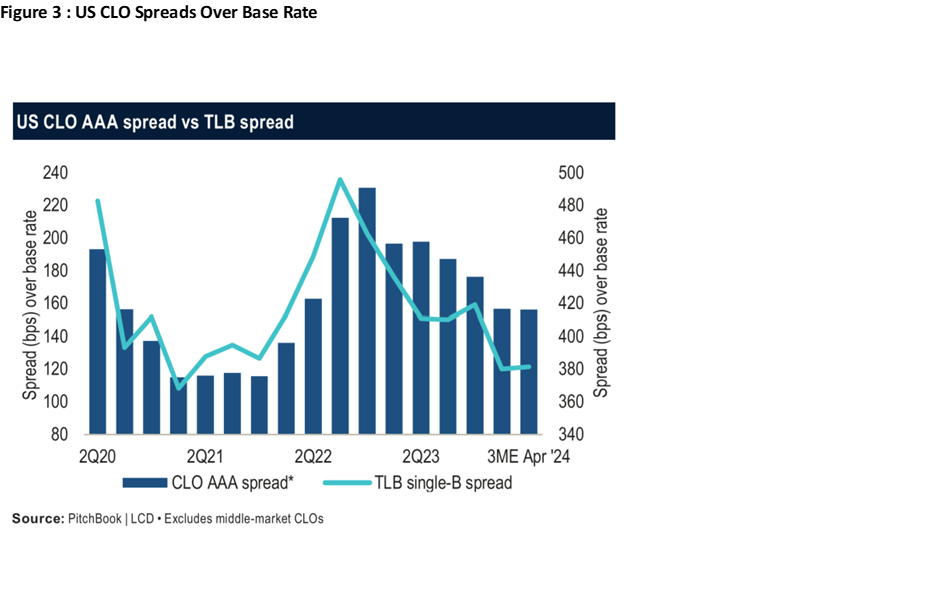

Turning to the market dynamics impacting the US CLO market, the US CLO boom in 2021 stands out given that prior to this the CLO market had exhibited relatively steady issuance. Not only did issuance per quarter more than doubled in 2021 to peak at around USD60bn per quarter (compared to around USD30bn per quarter in the preceding 4 years) but spreads over base rates nearly halved to just over 100 bps for AAA CLOs.

To better understand the US CLO ‘boom of 2021’ it is important to appreciate that it was the result of a range of supply and demand factors arising from the abnormally low interest rate environment which existed in response to the impacts associated with the COVID pandemic. On the demand side 2021 saw an expanding investor base for CLOs as low interest rates drove many investors to chase higher yields to achieve return targets. In such an environment the higher yields provided by CLOs, coupled with the more diversified pools of underlying corporate loans, proved increasingly attractive to many investors.

To meet this demand there were three main dynamics on the supply side increasing bank loan origination which were again driven by the lower level of interest rates at the time. The lower funding costs available in 2021 resulted in a (i) marked increase in Merger & Acquisition (‘M&A’) activity, (ii) dramatic rise in refinancing of the 2017-2020 deals and (iii) pulling forward of 2022 deals by sponsors. The result was a material increase in bank loan origination.

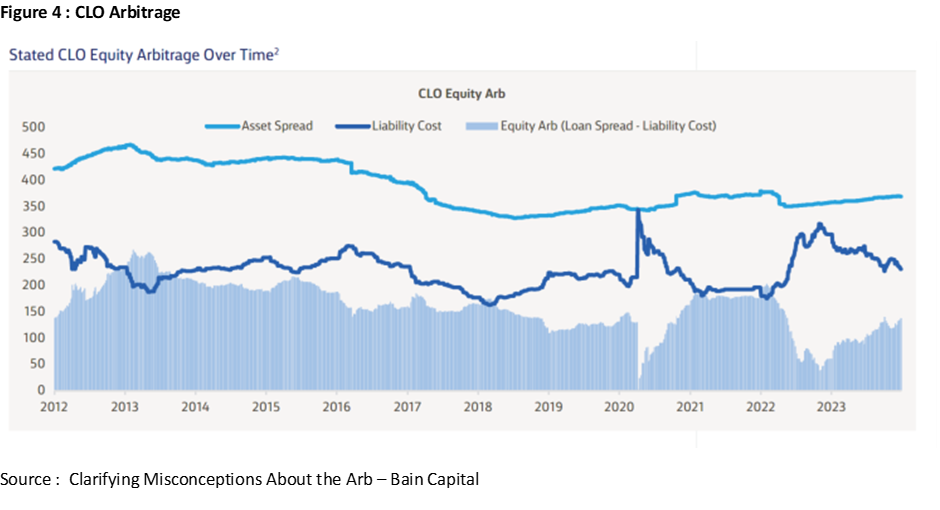

But it is one thing to say that there is a boom in bank loan origination and saying there is a boom in CLO issuance. A key dynamic shifting bank loans into the CLO market is the existence of a material equity arbitrage. The equity arbitrage is simply the difference between the interest received on the portfolio of loans (Asset Spread) and the cost of funding the debt tranches (Liability Cost) issued by the CLO. Obviously, the equity holders in the CLO structure prefer the issuance of CLOs when this differential is maximised and so is one of the major determinants of CLO issuance. Interestingly the key factor driving the equity arbitrage over the shorter term is the movement in the liability cost as the asset spread tends to remain relatively stable over time. As Figure 4 highlights the material decline in liability costs increased the equity arbitrage available in 2021 thereby making it more profitable to shift a higher proportion of the increase in new bank loan supply to the CLO market.

The result was a boom in both CLO issuance and investor demand which saw record issuance, materially lower spreads and record number of new issue managers in 2021.

A by-product of the CLO boom being driven by low base rates was that the 2021 vintage has generally been viewed with a degree of wariness by many investors. Investor wariness revolves around the abnormally low base rates having a favourable impact on loan coverage ratios thereby elevating doubts over collateral quality as conditions normalised. Such wariness has proven somewhat justified as, though performance of the underlying collateral has to date been quite solid, 2021 IRRs have lagged other vintages as spreads normalised; i.e. approx. 9% IRR 2021 vintage versus average of around 10.75% p.a. for 2019, 2020 & 2022 vintages.

The 2024 Rebound in CLO Demand

After the 2021 CLO boom there was a relative hiatus in new issuance over 2022-2023 as new loan supply and the equity arbitrage declined materially. Acting as a headwind to new issuance was not only the pulling forward of deal flow into 2021 but, more importantly, the material increase in base rates as central banks around the world responded to higher inflation. The marked increase in base cash rates not only adversely impacted on investor demand but also resulted in M&A activity declining by around 75% compared to 2021; i.e. averaged around USD20bn per quarter from 2022-2023 compared to approx. USD80bn per quarter in 2021. It is against this hiatus that the recent resurgence in CLO issuance should be viewed. Indeed, the rebound in 2024 appears to be more of an opportunistic response to lower credit spreads pushing up the level of equity arbitrage.

But what is driving this decline in credit spreads? Like 2021, the decline in credit spreads in 2024 appears to be driven by an increase in demand. Unlike 2021, the drivers of the decline in credit spreads are not associated with materially lower base rates. In this cycle the increase in investor appetite is better understood by considering it as comprising two distinct sub-markets namely bank and non-bank investors. For non-bank investors the increase in risk appetite is the result of improving investor confidence regarding the economic outlook and that the central bank tightening cycle has peaked. For bank investors the return to the bank syndicated market, which had basically dried up while the Fed was raising rates in 2022-2023, has put further downward pressure on credit spreads within the higher risk loan market. Accordingly, one could argue that there are more solid fundamentals behind the recent increase in overall investor demand.

On the issuance side the stabilisation in base rates has supported more solid levels of issuance from the two main drivers. Firstly, M&A activity in 2024, though well below the levels seen in 2021, is well up on the levels seen in 2022-2023. Secondly, the equity arbitrage opportunities are more favourable for CLO issuance meaning that it is more attractive for bank loans to move from the bank market to the CLO market. Of note is that, with a lower level of new supply from M&A activity to fund the increase in demand from equity arbitrage, the boom in CLO issuance in 2024 points to a far larger proportion of refinancing as borrowers take advantage of lower credit spreads.

The increase in CLO issuance in Q1 2024 takes the market back to levels last seen in the 2021 boom. Despite this rebound the dynamics appear to be quite different this time around. The 2021 CLO boom was characterised by abnormally low interest rates ‘pushing’ new borrowers and lenders into the market. By contrast the 2024 resurgence in CLO issuance appears to be driven more by renewed confidence that the peaking in rates will coincide with the avoidance of a US recession thereby boosting investor risk appetite and encouraging borrowers to refinance facilities. This difference in drivers not only points to the potential that the 2024 rebound in CLO issuance is being supported by superior fundamentals but also may be less sustainable compared to that in 2021.

2 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...