Is the Rebound Risky?

“In finance, everything that is agreeable is unsound and everything that is sound is disagreeable.” Winston Churchill

With the S&P 500 Index enjoying a rebound of ~28% from the low of late March it may well feel like the worst of the Covid19 hit to markets is behind us.

But is the rebound reflective of the entire market? At heart, the index is an instrument to reduce risk via diversification. As of today however it is not doing that.

In fact over 50% of investors in the US stock market are passively following the index, through various index funds. Meaning the recent rebound has accelerated concentration and valuation risk.

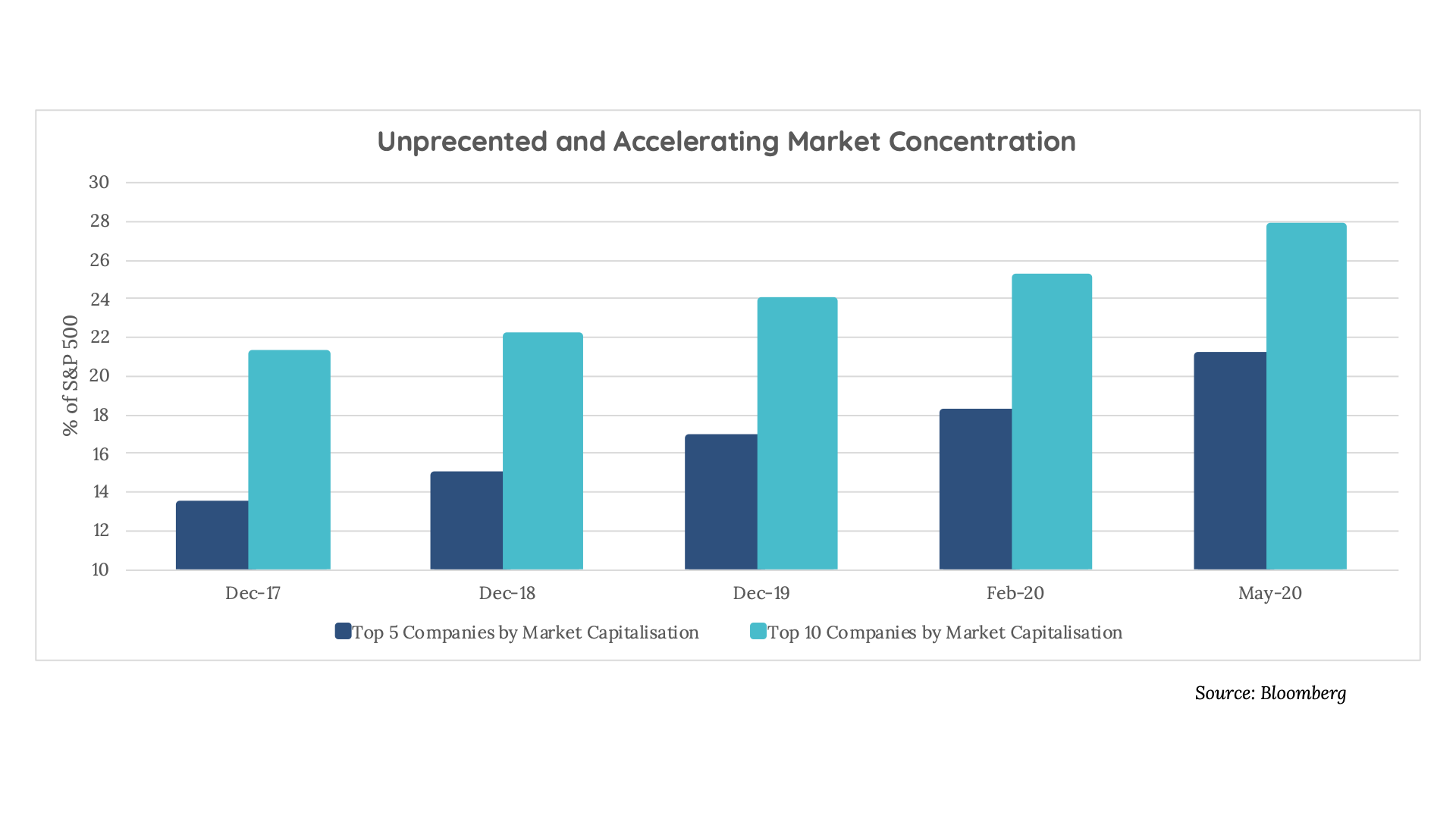

The largest 5 companies now account for over 20% of the index, the top 10, nearly 28%.

The S&P 500 has never had this level of concentration.

Or to put it another way, only 2% of companies equate to 28% of the index.

As at 12 May 2020, having 28% of your portfolio concentrated in the largest 10 stocks was insufficient to beat the index. Rather, an investor would likely require concentration of over 40% of their portfolio in these stocks. Such a portfolio would have a very large relative bet on the highest priced stocks - which are majority owned by totally price insensitive passive shareholders.

Clearly benchmarks are rapidly “UNdiversifying.”

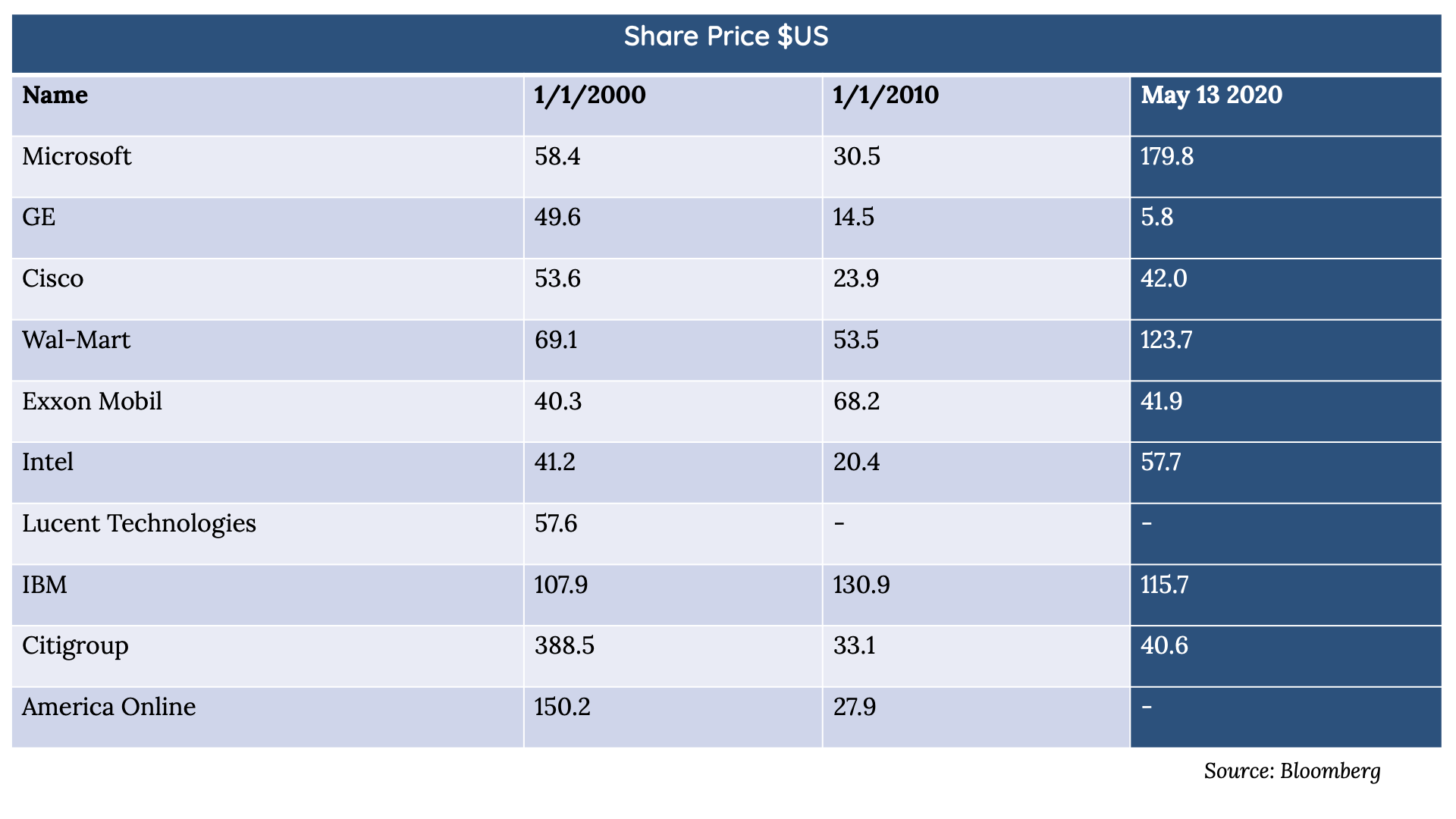

The lessons of price insensitive buyers in history - such as those in the 1960’s or the 1990’s Dotcom Bubble are pretty clear – when the market turns there’s nowhere to hide. This can be further amplified if large institutional investors in these stocks all exit at the same time, exacerbating the price decline.

But how likely is this?

Times are still uncertain, so to that end, a lot of things are possible. But what’s likely given an unprecedented shut down of the global economy, record high unemployment levels, slashed dividends and no imminent vaccine is this still has a while to play out.

If the benchmark is your yard stick at this point be sure you’re comfortable not being diversified.

What’s the alternative?

Perhaps index creators will need to cap weightings of stocks in benchmarks - which would be terrible for the index returns and undermine the Federal Reserve’s stated aim of increasing asset prices. Or, the index could simply continue to UnDiversify in which case it needs to be renamed - as it simply isn’t a benchmark for the stock market.

Current consensus expects the top 5 S&P 500 companies to add almost $700bn of additional revenue over 5 years – and $150bn in 2024 alone. This is more than the combined revenue base of Johnson and Johnson, Pfizer, JP Morgan, Caterpillar, Goldman Sachs, American Express, Starbucks, McDonalds, Visa, Kraft Heinz, Coca Cola, General Electrics and Nike. And that is simply the embedded expectation.

Lack of diversification is a bad thing in many parts of society, including finance. In 2000 the top 10 stocks in the S&P 500 represented 24% of the index... Of those – 8 were lower in absolute terms 10 years later and 5 were lower 20 years later.

That is why the current concentration of a few companies dominating the market is ultimately a bad thing for investors in the market as a whole – creating less diversification and higher prices.

But there are alternatives, including diversifying across sectors and geographies, and favouring active managers over passive index funds.

Especially during uncertain times like these, it pays to diversify.

4 topics