Is the US budget deficit sustainable? – Part 1/2

There is little doubt that the US plays the largest and most influential role in global capital markets. With all due respect to London, to Singapore, to Hong Kong, and to anywhere else on the planet, New York is THE global hub of financial markets. That delivers a significant privilege to the US, but does it also involve an obligation?

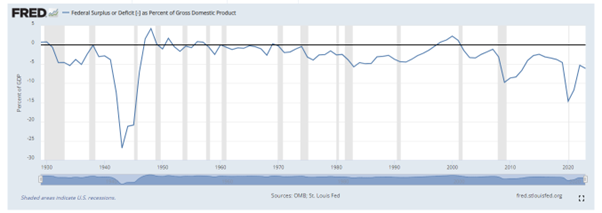

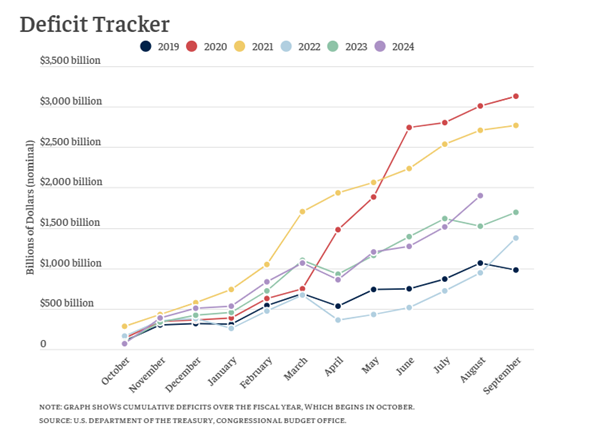

Recently released data shows that the annual budget deficit for the US has hit US$1.9T, or around 7% of GDP, with one month to go in the fiscal year. The rolling 12-month deficit is US$2.1T, almost 8% of GDP. To put that in perspective, during high Government spend periods like post-Civil War, and post-WW1, and post-WW2, this number is massive considering:

- The US is not at war,

- Setting aside two regional conflicts (and they are regional conflicts for now), the globe is not at war,

- There is no national emergency, and

- The economy is in pretty good shape (unemployment around 4% and nominal GDP growth around 5%).

The percentage of GDP for the (modern day) US deficit during “war economies” was as follows:

- WW1: 52.0%

- WW2: 26.9%

- Korean War: 1.7%

- Vietnam War: 3.9%

And in other situations:

- 70s and 80s inflation: 5.7%

- Early 90s recession: 4.5%

- Tech crash / 9-11: 3.4%

- GFC: 9.8%

- COVID: 14.7%

In the context of that data, a current-day number of 8% sticks out.

Furthermore, there is clearly not even an inkling of concern from either US Presidential candidate, from the US Congress, or even (seemingly) from US voters. So given what is essentially an unprecedented level of deficit spending in the US, it begs the question:

Is the US budget deficit sustainable?

At the current pace, and at the current rate, the answer is likely no. But that’s in a vacuum and investing is nothing if not relative. If the US can maintain a real GDP growth rate above the rate of growth in the debt pile over time, it won’t, or maybe it shouldn’t, become burdensome.

If the theory behind that premise holds true, and it may or it may not, the majority of people reading this post will be dead before it comes home to roost for the US. In part 1 of this two-part wire, let me walk through the big 4 reasons I believe that’s mostly likely to be the case.

Reason 1: The world is short US Dollars

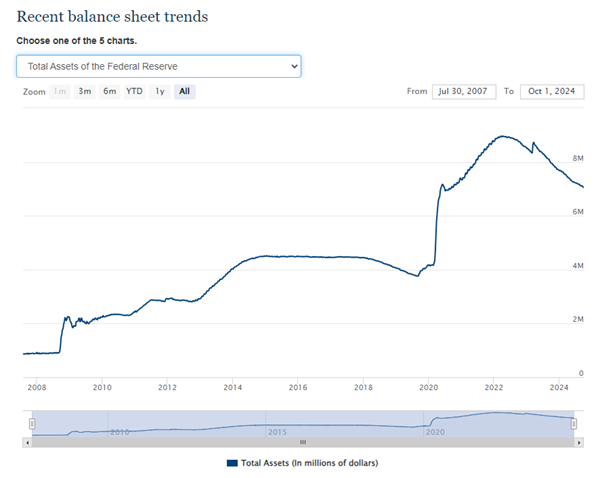

Two-thirds of all US Dollars in current circulation were “printed” since 2008. Read that again. Two thirds. Over US$3T was printed just in 2020. Yet, there are no unique financial problems for the US. Inflation in the US, for example, wasn’t a unique problem. US Treasury yields did not uniquely rise. The stock market was not whacked. That’s because, as it turns out, the world is short US Dollars. Ever since the world went global, it has become painfully obvious how reliant the global financial system is on the US Dollar. That includes the dark parts (exchanging US Dollars for Argentinian Pesos in back alleys, for example). That includes the day-to-day parts (5 US territories and 11 foreign territories, countries included, use the US Dollar as their currency). That includes the global capital markets (all commodities like oil, copper, and coffee, are solely traded in US Dollars). The truth is that no one knows the point at which the world is no longer short US Dollars, but we do know this – even after two-thirds of the total float got printed in very quick time, it wasn’t then.

I’ll shortly post the second part of this wire with the 3 other reasons why the US Dollar will most likely maintain its status as the world’s reserve currency for a little while.

Good luck out there.

Part 2: (VIEW LINK)

5 topics