Is there a better way to capture ‘credit like’ premiums?

The recent selloff in credit premiums has resulted in many investors experiencing a negative return on exposures within their portfolios. This highlights the downside to reliance on credit premiums as a source of return enhancement. While, over the longer term, credit premiums are one of the most reliable sources of return enhancement they can, and do, experience periods of material underperformance. This raises the question as to whether there is a better way of accessing ‘credit like’ premiums while reducing the overall exposure to movements in credit spreads.

Credit premiums over the longer term provide a reliable source of return enhancement within fixed income portfolios. This is particularly the case with Australian investment grade credit which tends to be high quality and so exhibits relatively low levels of default risk. The result is that the major risk which investors are exposed to is ‘mark to market’ risk as credit premiums move over the cycle.

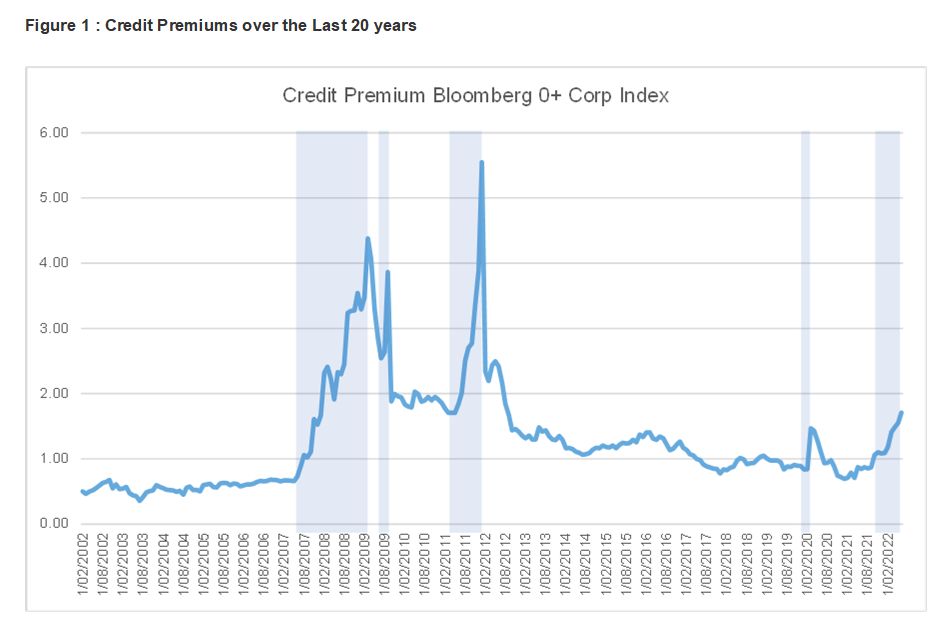

It is this ‘mark to market’ impact which can adversely affect returns as credit premiums widen. Indeed, over the last 20 years there have been four episodes (shaded areas in Figure 1) where credit premiums have moved out materially over relatively short time periods.

Fortunately for investors, intervention by central banks has meant that the majority of these ‘mark to market’ corrections were relatively short lived. This however may not always be the case and raises the question “Whether there is a better way to earn ‘credit like premiums’ while reducing the exposure of the portfolio to such ‘risk off’ events?”

There are various ways that investors can combine strategies to reduce a portfolio’s overall exposure to credit premiums. What follows is a simplified example of the type of approach an investor could take within a multi manager framework to address the issue. As a starting point it is important to specify the objectives for the investor. These can be considered in terms of separate Risk and Return objectives specifically :

- Return Objective: Earn longer term returns in line with an investment grade credit premium.

- Risk Objective: Materially reduce, but not eliminate, the correlation between the returns on the Aggregate Exposure and movements in credit premiums; i.e. reduce the credit premium beta of the portfolio.

Before proceeding it is worth highlighting a couple of points.

Firstly, there are different dimensions to considering risk. Though for the purposes of this article the focus is on correlation with credit premiums, in practice investors need to consider the broad range of risk characteristics associated with any investment solution. The utilisation of a structure which provides the flexibility to reflect desired risk characteristics therefore becomes important for the investor.

Secondly, the focus will be on modelling a floating rate solution to ensure that the exposure to credit premiums is isolated; i.e. desire to avoid commingling interest rate and credit premium exposures. The benefit of such a structure is also that removing interest rate risk allows the investor the additional flexibility to utilise an interest rate overlay to incorporate the level of interest rate exposure desired.

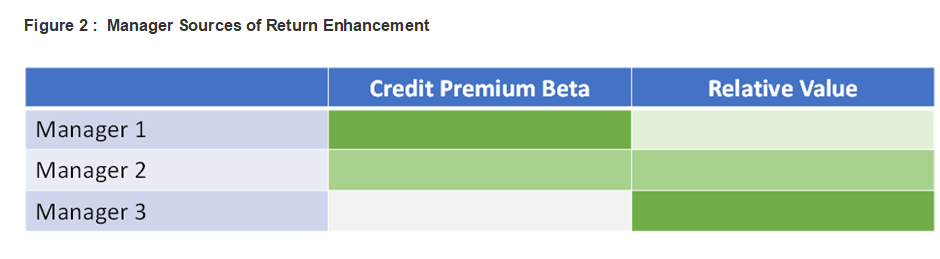

The approach to portfolio construction will be to utilise differences in manager styles to achieve the desired risk and return objectives. With respect to classifying manager styles, a distinction will be made between utilising (a) credit premium beta and (b) relative value trading to enhance returns. It is the differing reliance between these two sources of return enhancement which will be used to distinguish between manager styles. Importantly, it is assumed that relative value trades will be less correlated to movements in the underlying credit premium. Exactly how ‘less correlated’ to credit premiums will depend on the nature of the relative value trades utilised by the respective managers.

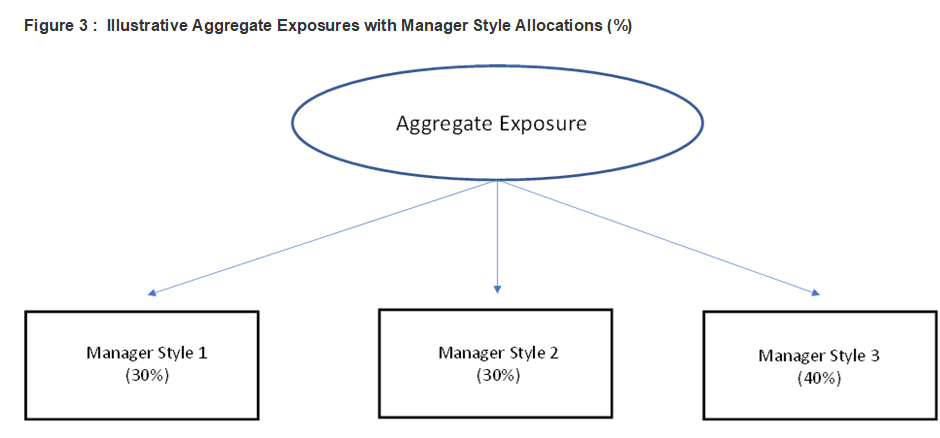

By combining managers with varying exposures to credit premiums, the resulting portfolio is aiming to earn a return in line with the credit premium while at the same time being less sensitive to the ‘mark to market’ impacts from movements in credit spreads. This is achieved by combining managers with different levels of reliance upon credit premiums within their strategies to enhance returns. This highlights one of the advantages of utilising a multi manager structure in that it provides the flexibility to (a) manage underlying costs and (b) tailor the exposures to reflect the risk preferences of the investor.

The resulting exposure maintains an underlying credit premium as the main source of return enhancement. That said, by combining different manager styles the reliance on credit premiums has been reduced as a greater proportion of return enhancement is now being derived from a range of credit related and non-credit related relative value strategies.

But does this type of structure work in practice in achieving the dual objective set down by the investor?

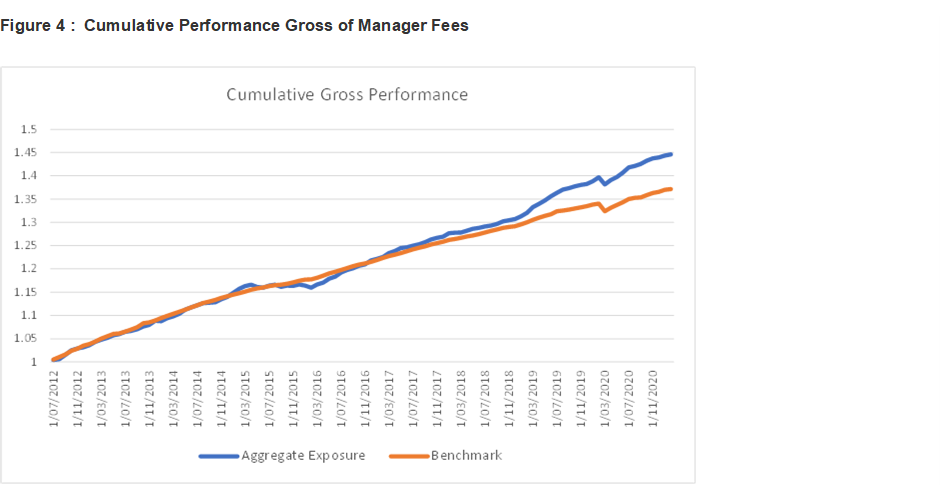

Looking first at the Return objective, one can compare the Aggregate Exposure to the return from Manager 1 which represents the long active credit premium style of strategy; i.e. Manager 1 becomes the effective Benchmark for the Aggregate Exposure[1]. To provide a higher hurdle rate the timeframe chosen for the analysis is the period from July 2012-Feb 2021 which characterised a period particularly favourable to credit premiums. Over this period credit premiums experienced a material ‘tail wind’ as a source of return enhancement as credit spreads declined from over 200 bps to sub 100 bps.

The cumulative return highlights how the Aggregate Exposure has performed in line with the Benchmark over the period from July 2012- Feb 2021. So at a high level we can conclude that at the very least the return objective has been achieved.

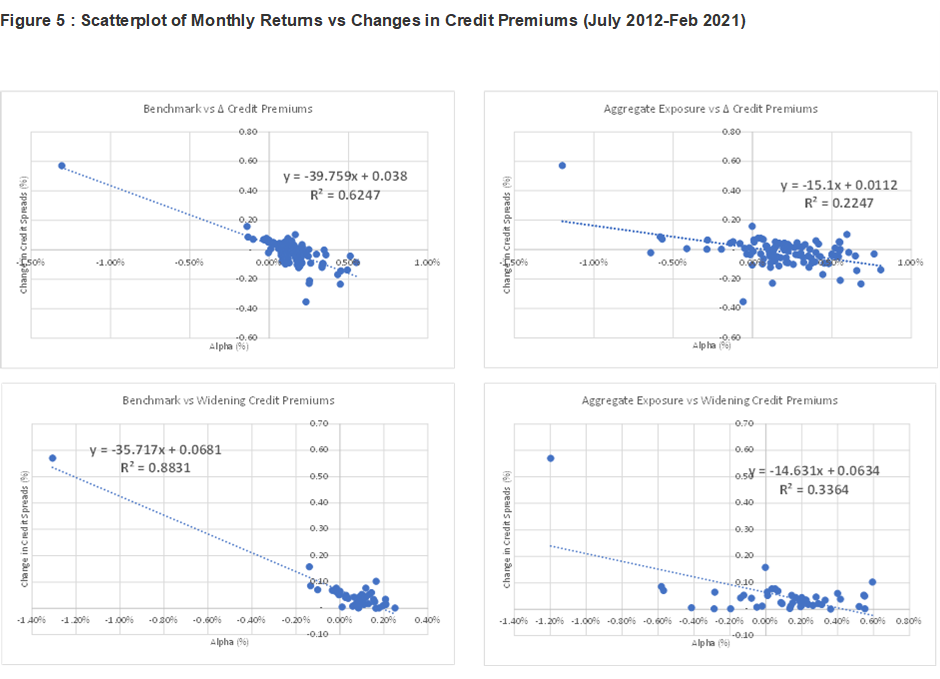

The more interesting objective is that associated with the Risk objective whereby the aim is to reduce the exposure to credit premiums. To quantify the impact two measures are utilised namely (a) correlation to changes in credit premiums and (b) correlation to widening credit premiums. The second measure of risk is particularly important as it is exactly the widening in credit premiums associated with ‘risk off events’ that the investor is seeking a degree of protection from.

By utilising a combination of different manager styles within a multi manager framework the investor has been able to reduce the correlation (‘R2’) to credit premiums by over 50% compared to the Benchmark. Accordingly, it can be concluded that the structure has achieved the dual objectives as set out by the investor.

It is worth noting that many active managers do overlay active strategies to achieve the same type of diversification exhibited in the above framework. The potential advantages of the framework set out above are that the clearer separation of strategies allows :

- Value add from each strategy to be more clearly monitored and attributed; and

- Greater flexibility to alter allocations to strategies as market conditions and investor risk appetite change over time.

Credit premiums have proven to be a reliable source of return enhancement for investors over the long term. Yet this often overlooks the potential that there can be material periods of underperformance resulting from major ‘risk off’ events. To avoid the pain of such ‘risk off’ events it is possible for investors, through appropriate strategy and manager selection, to create aggregated exposures which can materially reduce the exposure to movements in credit spreads, while allowing the earning of credit premium like returns. The ability of investors to tailor such solutions to their needs can provide greater flexibility to achieve their desired investment objectives.

[1] For illustrative purposes the following products are utilised for the calculations :

Manager 1 : Perpetual High Grade Floating Rate Fund

Manager 2 : Coolabah Cash + Fund

Manager 3 : Ardea Absolute Return Strategy

2 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...