Is there change in the air for this fintech?

The allure of “fintech” is undeniable. The persistent shift from cash to digital payments around the world has left many legacy financial institutions behind. Burdened by outdated and patchwork technology, they find themselves vulnerable to innovative start-ups. However, despite the favourable tailwinds, history is littered with fintech failures. There is challenge in merging the “move fast and break things” ethos of technology with the intense regulation and bureaucratic processes of the financial and payments sectors.

For most of its history, it appeared that Change Financial (ASX: CCA) would follow this path.

From digital bank to payment processor

Change began its ASX-listed life as ChimpChange, a digital bank focused on the US market. The business’ core banking service had modest success, but difficulty in cross-selling higher-margin products left it lacking scale. After management and board turnover, it was decided to exit consumer banking and focus on the nascent payment processing platform built in the background on the Mastercard network. Some small pilot customer programs were won, but before they could be rolled out, the focus of the business shifted again when Change purchased the Australian and New Zealand assets of Wirecard, the German fintech giant that collapsed in 2020 due to endemic fraud.

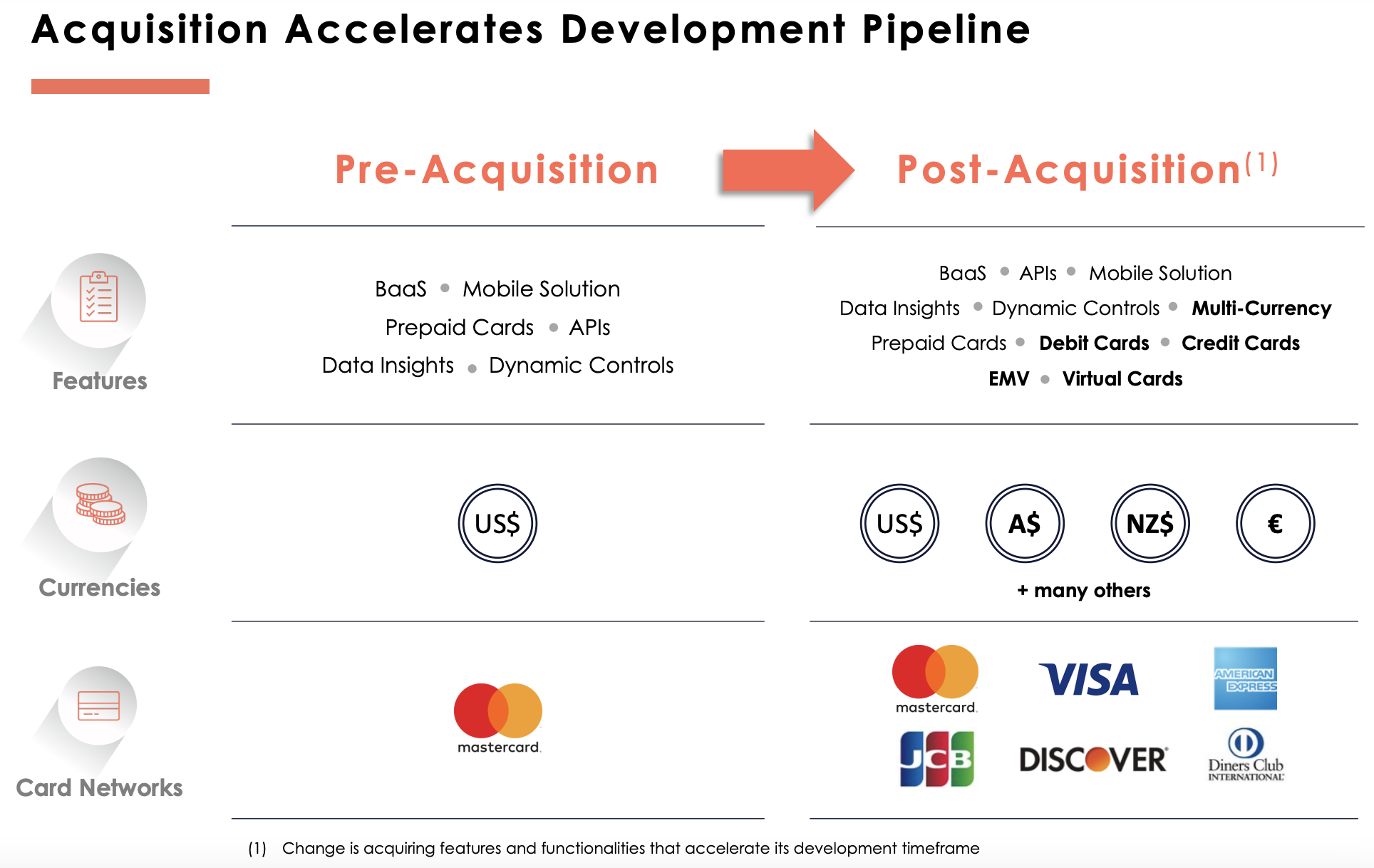

While the acquisition of the Wirecard assets brought established customers and revenue, it also brought a legacy payment processing platform deployed on-premise to customers under license agreements. Led by former EML Payments (ASX: EML) COO Alistair Wilkie (who has since retired to a non-executive board role), Change commenced a large development project to unite the platforms. The aim was to combine the agility of their in-house cloud platform with the comprehensive features of the legacy Wirecard one:

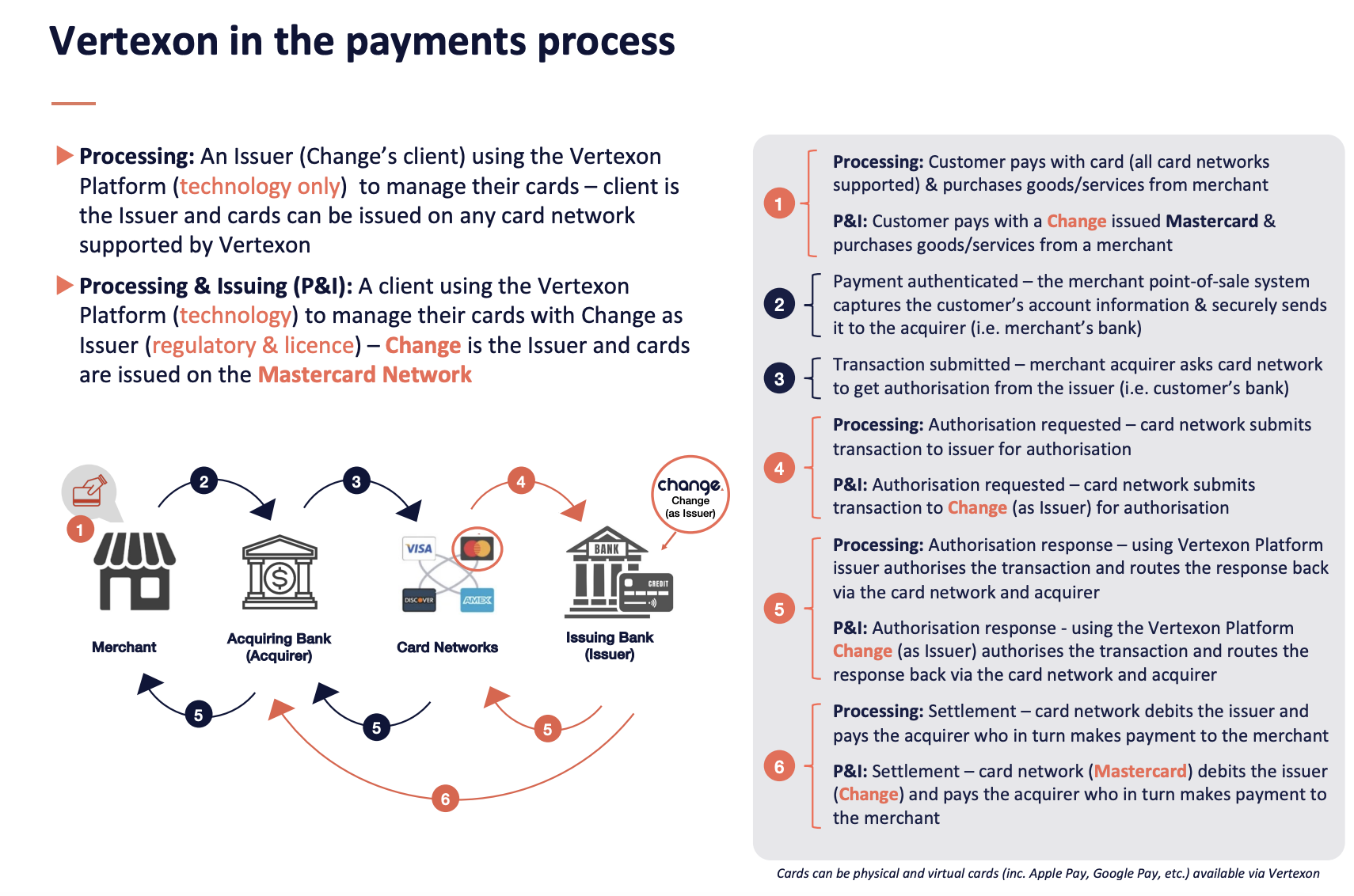

As is often the case with large projects, things took longer than expected with development taking nearly three years. However, good things take time. In 1H24, Change began to reap the rewards as what is now known as the “Vertexon” cloud platform began on-boarding its first customer card programs. Vertexon’s position in the digital payment cycle is best outlined in the following diagram:

Success across the ditch

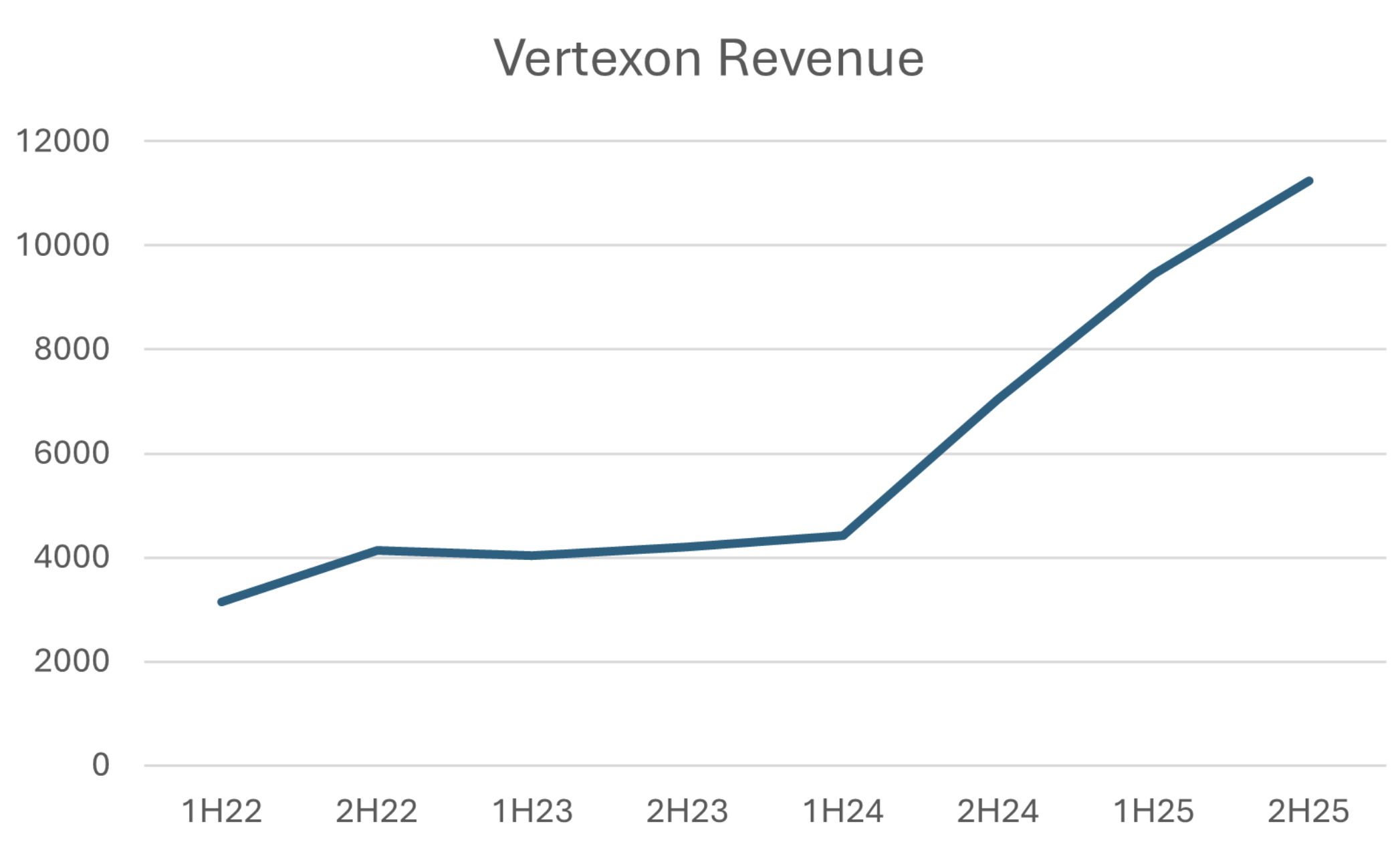

While Change was in the middle of developing Vertexon, it won a key contract that would underpin its future growth. Through a partnership with New Zealand banking software company Finzsoft, Change announced it would be the processor and issuer of debit cards for four New Zealand credit unions. Initially estimated at $3 million revenue per year for over 35,000 cards, Change recently upgraded this to over $5 million per year due to significantly higher transaction volumes than expected from the first batch of activated cards.

Following the success of these initial customers, Change announced that the largest credit union in New Zealand, Unity Credit Union, had also signed on to the Vertexon platform with expected revenue of over $3 million per year for its 20,000+ debit cards. Once Unity is on-boarded in 1H25, Change will become the largest non-bank issuer of debit cards in New Zealand.

With the legacy Wirecard customers generating a steady ~$4 million each half year, the step change in revenue as the New Zealand credit union customers are on-boarded is best understood visually:

Inflection to profitability

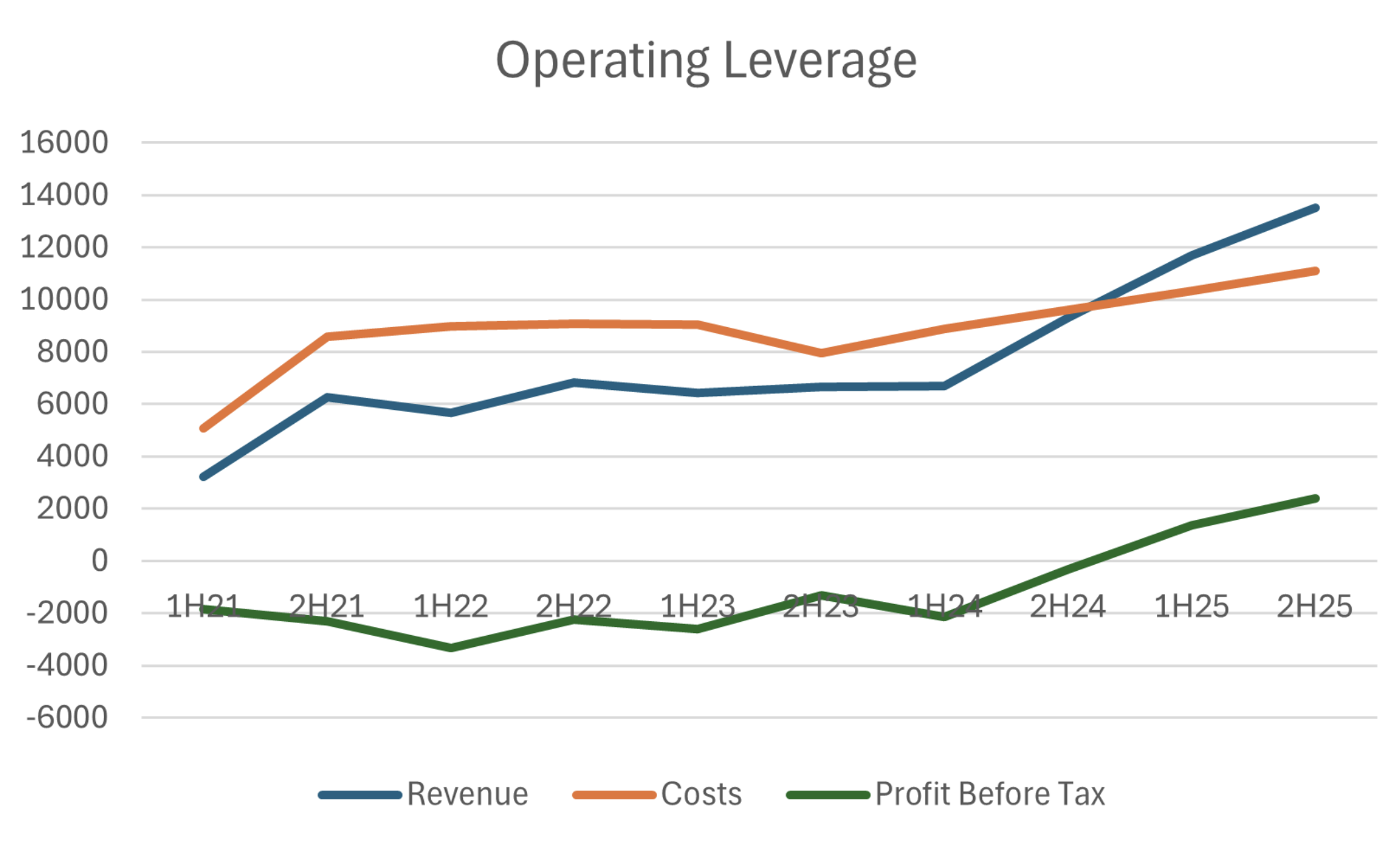

What excites me the most about Change is that it operates a genuine platform business model with the attractive characteristic of exceptionally high incremental returns. The large investment to build the platform (both time and money) is a sunk cost not to be repeated. As the graph below shows, Change has maintained a remarkably steady cost base for the past three years, allowing for strong operating leverage when Vertexon revenue inevitably inflects in FY25:

In a recent trading update, management confirmed they are on track to achieve their target of monthly EBITDA and operating cash flow breakeven by the end of FY24. I expect growth from the New Zealand credit union customers to drive statutory profitability in FY25, with a forecast profit before tax of $3-4 million (depending on the smoothness of the Unity on-boarding).

With a current market capitalisation of $45 million, that level of profitability leaves Change attractively priced without the potential growth from winning other non-bank financial institutions in New Zealand and Australia. There is also expansion from legacy Vertexon customers transitioning to the cloud platform, as well as the blue-sky potential of the US, where Change maintains a footprint from its early days.

With former CFO Tony Sheehan stepping into the CEO role after Alistair Wilkie’s retirement, Change is well positioned with a fully developed payment platform, continuity at the executive and board level, and contracted revenue growth to bring on-board through FY25. Change might be well and truly in the air!

1 topic