Is there something systematically wrong with Victoria's COVID-19 performance?

Our data scientists’ analysis of Victoria's COVID-19 infection trajectory has unearthed a disturbing finding: it would appear that since April our southern neighbour has systematically underperformed the rest of Australia's key conurbations in terms of its ability to contain this wicked virus and flatten their curve.

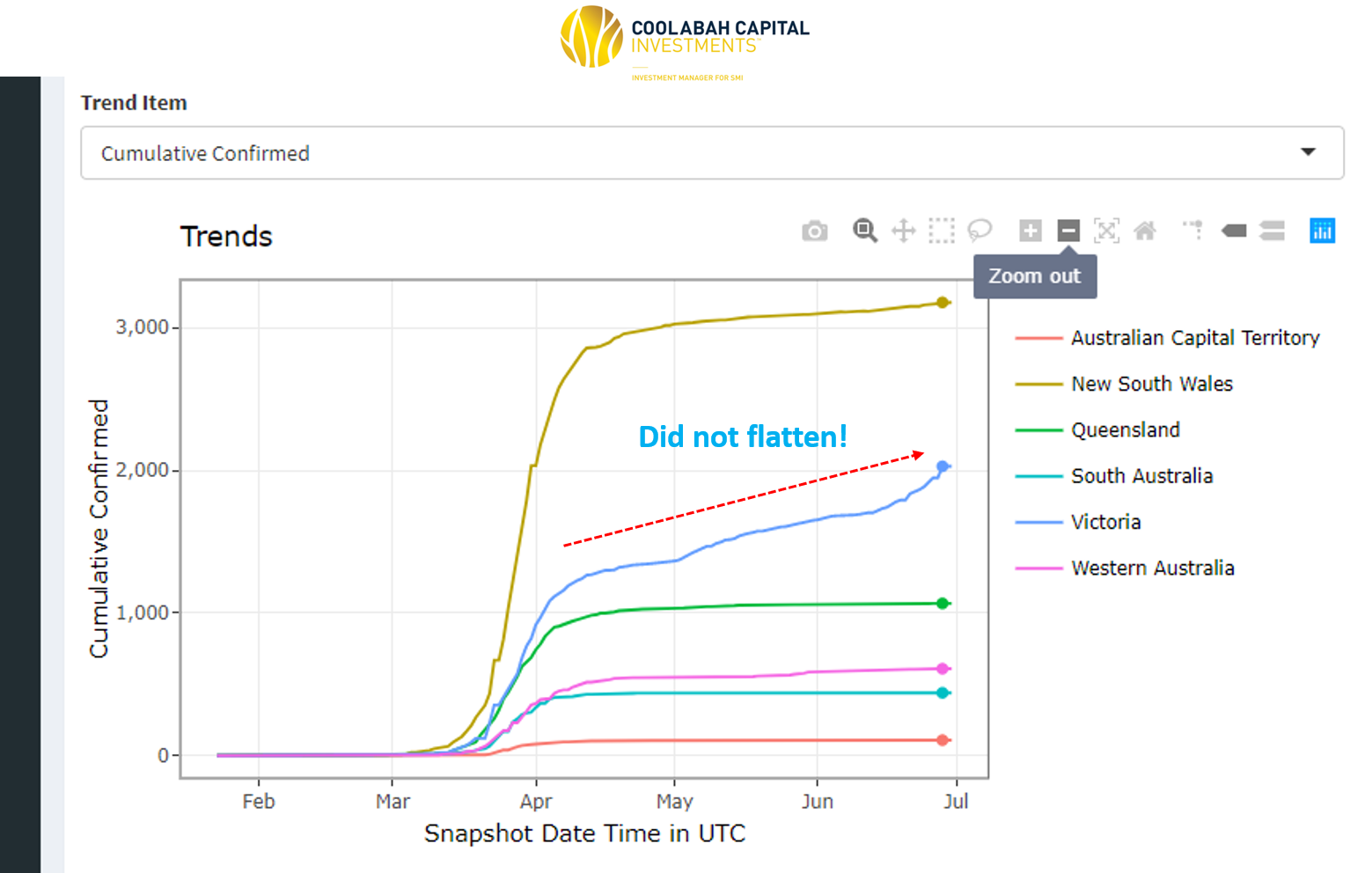

The first chart below is a screenshot from our internal, real-time system that tracks the cumulative number of daily infections. This highlights that Victoria has been struggling to contain COVID-19 since the start of April in striking contrast to the rest of Australia, which has done a brilliant job of flattening their curves. (Click on the image to view a higher resolution version of it.)

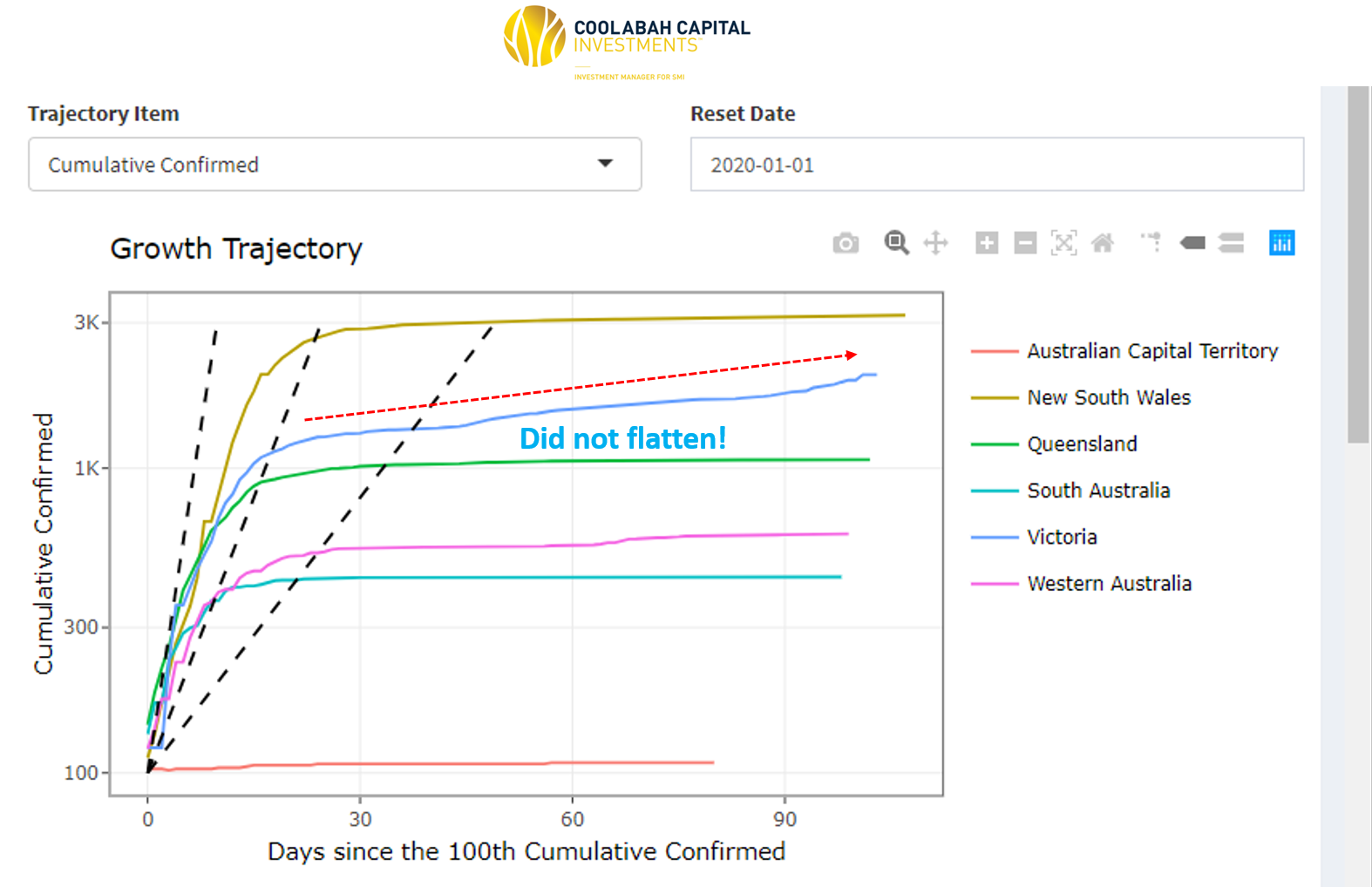

The second screen-shot from our systems presents the growth in cumulative infections on a state-by-state basis in logarithmic terms, and it shows a similar story: there is something in the Victorian experience---either its policy reaction function or perhaps the composition of its population---that has prevented it from flattening the COVID-19 curve like all other states. Put differently, Victoria's curve has been increasing, not flat-lining, for a number of months now in contrast to the other major metro markets.

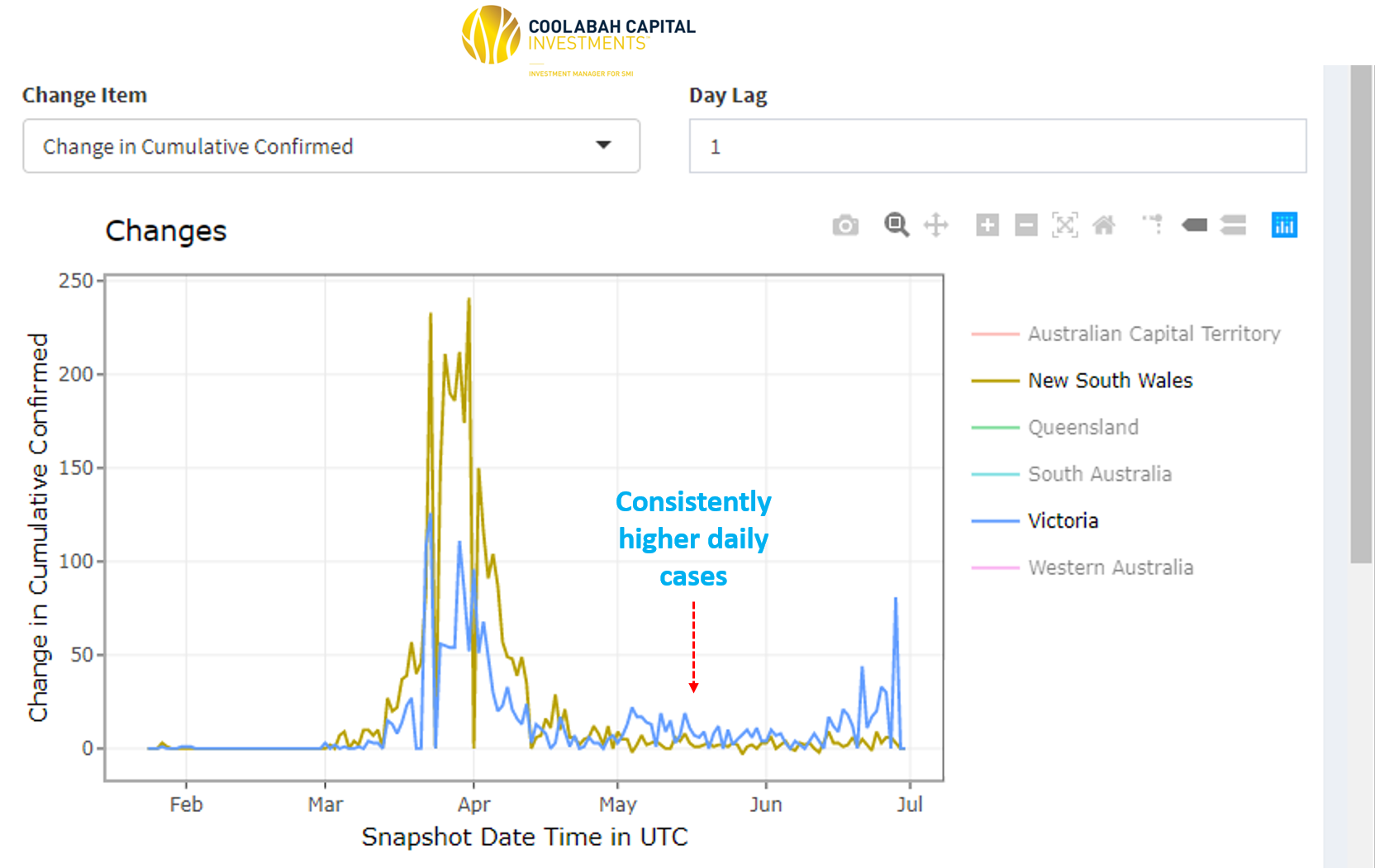

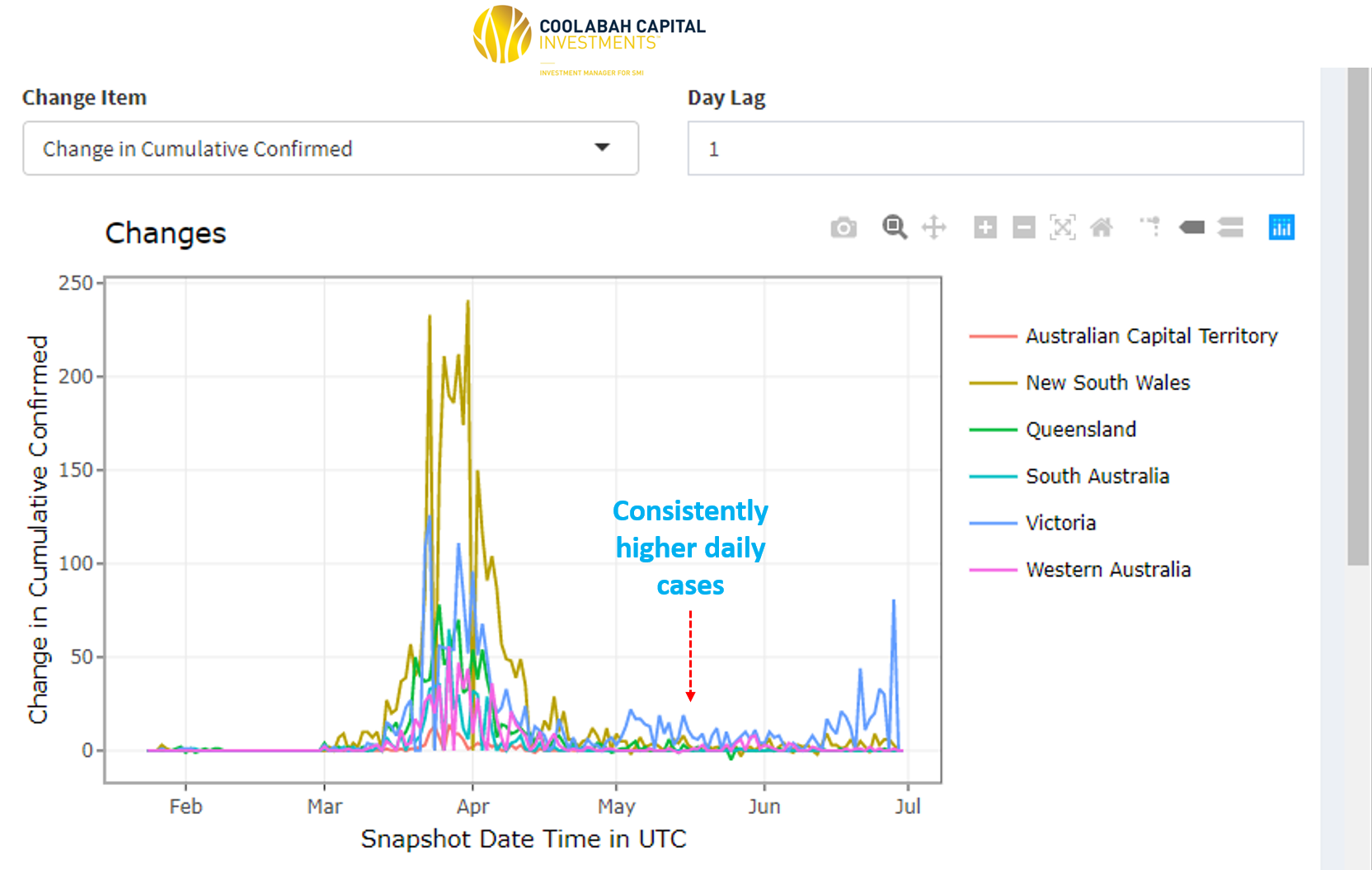

If we then look at the daily change in the number of new infections, one can see that Victoria (blue line) has reported persistently higher cases than NSW (brown line), which is the comparison in the first screen-shot below, and all other states, which are included in the second screen-shot.

While I might want to beat-up on my Victorian brethren, when we turn to consider our real-time Google mobility data, on almost every score Premier Andrews has been a lot tougher than the other states. You can click on the screen-shot below to see our Google activity data in more detail. Victoria is the purple line and has experienced, for example, lower retail/recreation activity, public transport usage, workplace attendance, participation in parks, and longer stays at home. (The residential screen tracks the duration of time that people spend in their homes.)

It therefore remains something of a puzzle as to why the Victorians have been such poor COVID-19 performers. I suspect it has to do with the composition of their population, and predispositions among certain cohorts of individuals that have higher COVID-19 transmission propensities through their personal interactions. This makes sense given Victoria's recent outbreaks have been reportedly focussed on specific family gatherings.

Get investment insights from industry leaders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

3 topics