Is there upside in Downer?

It is common for the Allan Gray Australia Equity portfolio’s investee companies to be out of favour. This is often an important prerequisite for us to be able to buy companies at prices lower than our assessment of their intrinsic value.

Companies fall out of favour for many reasons. Sometimes it is the result of a deep and protracted cyclical downturn where investors struggle to see a catalyst for change. An example of this might be energy companies in 2019.

In other cases, it might be due to known structural challenges that make predicting the future particularly challenging (e.g. free-to-air broadcasters today) or, increasingly the case in recent years, the result of perceived environmental, social and governance (ESG) indiscretions. But sometimes companies fall out of favour due to company-specific missteps that destroy shareholder value. Downer EDI Limited (ASX: DOW) fits into this last category.

About Downer EDI Limited

Downer builds, operates and maintains infrastructure and industrial assets in Australia and New Zealand. Despite only listing in Australia in 1998, Downer has a rich corporate history dating back to the 1800s. Prior to and after its listing, Downer has been a very acquisitive company, favouring inorganic expansion via ‘bolt-ons’ over the slower but less risky organic growth alternatives. In 1998 it acquired Technic, a leading roads contractor.

In 2001, it merged with Evans Deakin Industries, a rail business, to become Downer EDI. It expanded its roads business in 2006 with the acquisition of Emoleum, a road-surfacing company. In 2014, Tenix, a leader in the electricity, gas and water sectors, joined the fold. And in 2017, it merged with Spotless, an ASX-listed facilities and asset management business.

While not an exhaustive list of acquisitions, these form the foundation of Downer’s operations. Today the company divides its business into three operating segments:

- The transport segment includes the group’s road services, transport infrastructure and rail businesses. Services include routine road maintenance services, the manufacture and supply of bitumen-based and asphalt products, the design and manufacture of rail systems, and rail fleet operation and maintenance.

- The utilities segment includes the group’s power, gas, water and telecommunications businesses. Services include operating and maintaining power and gas network assets, providing water solutions for municipal and industrial water users, and operations and maintenance works across fibre and copper networks.

- The facilities segment provides outsourced facility services to customers across defence, education, government, healthcare, resources and hospitality sectors.

How Downer makes money

Downer mainly services existing or operating assets, with construction of new assets accounting for a relatively small part of the business. Much of its work is performed directly or indirectly for governments.

Annual revenues are approximately A$12b and given the asset-light/people-heavy nature of its work, it measures its financial outcomes in terms of margins (specifically EBITA or earnings before interest, tax and amortisation of intangibles) achieved. It targets a 4.5% EBITA margin.

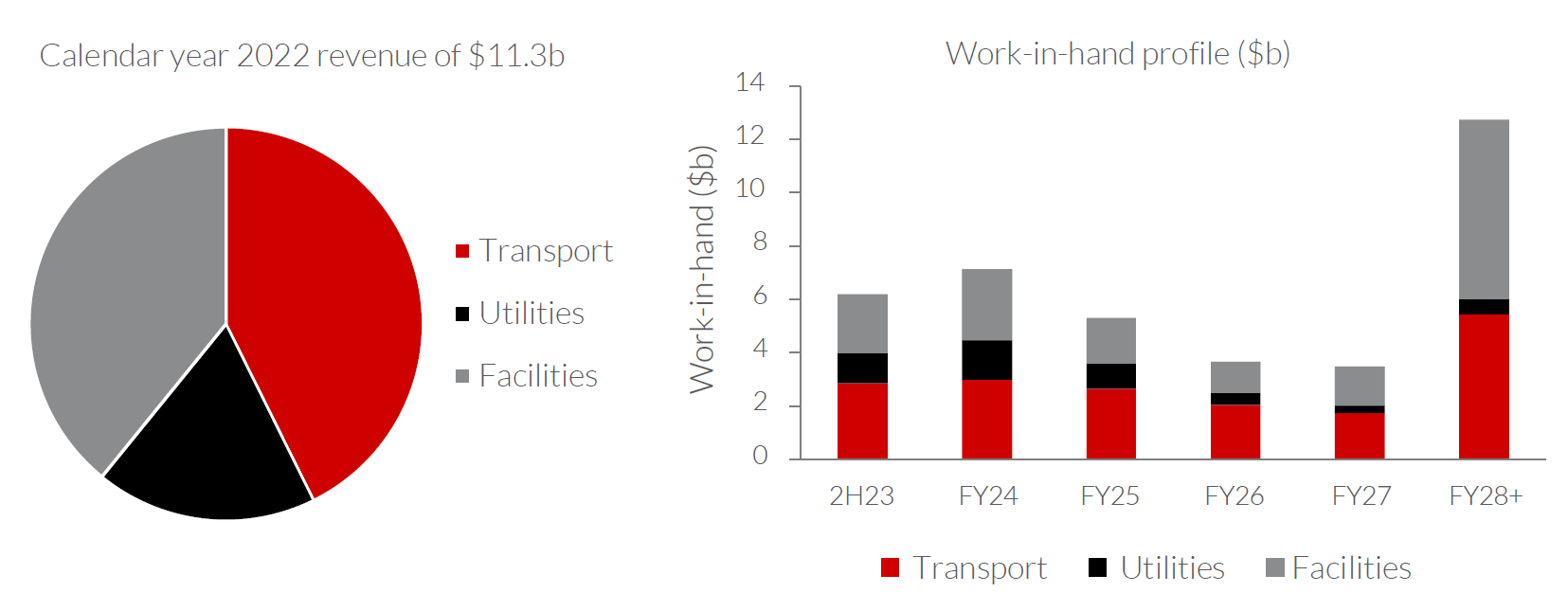

Graph 1 shows a split of Downer’s revenue between the three segments. Contracts range in length from less than a year to over a decade. As at December 2022, Downer had A$39b of contracted work-in-hand, which is expected to underwrite half of its revenue in the coming years (consistent with prior years).

GRAPH 1 | Downer’s revenue split (2022) and work-in-hand profile (December 2022)

Source: Allan Gray, Downer (2022 financial year and 2023 half year reporting).

Major costs to service these contracts include employees and subcontractors (70%) and raw materials and consumables (15%). The bulk of Downer’s facilities management and operation and maintenance work should have relatively predictable cash flows, with mechanisms in place that attempt to protect Downer from costs changing over time. Some contracts are more risky, due to the nature of the work (e.g. construction) or where protection mechanisms are limited or poor. Other contracts can be viewed as safer (e.g. cost-plus contracts).

The key to Downer’s profitability is pricing and structuring contracts such that they cover future costs and deliver a reasonable level of profitability. In this regard, it has mostly failed, but we’ll get to that shortly.

Downer operates in a competitive landscape

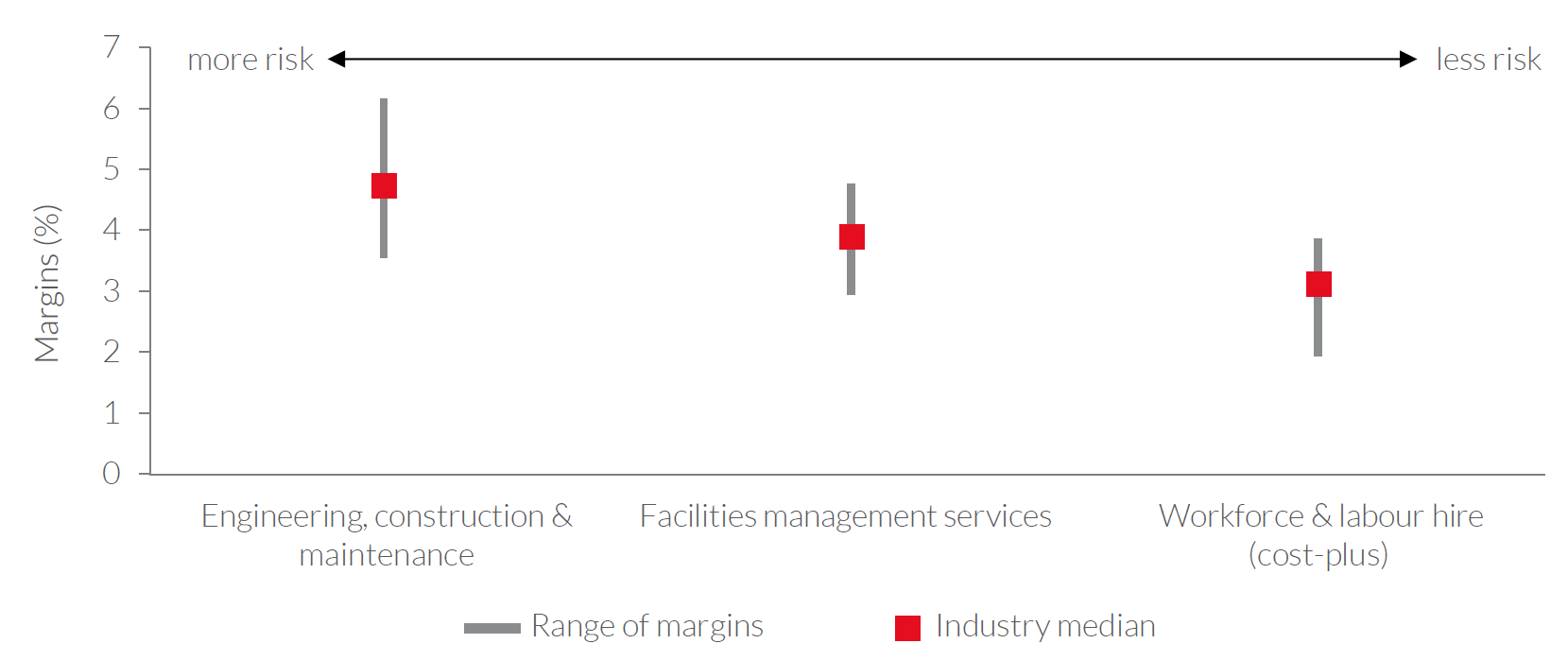

Unfortunately for Downer, a lot of its work is essentially ‘labour for hire’ and there is often little to differentiate competitors. This is reflected in relatively low margins across the industry. Graph 2 shows the typical operating margin in industries across a risk spectrum similar to those in which Downer operates. Margins tend to be higher for more complicated work (until things go wrong), and is typically lower where contracts are low risk (e.g. cost-plus). Most of Downer’s work sits somewhere between these two bookends.

GRAPH 2 | Typical industry operating margins

Source: Allan Gray, S&P Capital IQ.

Two Australian companies most comparable to Downer are Ventia and Service Stream. Both are listed companies and operate with margins in the low 3% to low 5% range. Targeted operating margins of 4.5% seem reasonable when one considers:

- the performance of these companies,

- the slight differences in the mix of their business and, in Downer’s case,

- Downer’s somewhat higher capital intensity (mainly from the transport business that operates a reasonably significant fleet of plant and equipment).

An endless saga of missteps

A lot has gone wrong for Downer. Much of this is its own doing but a little, if we’re generous, is not. Downer’s woes relate to capital allocation, management actions in the face of an extremely competitive landscape and alleged corrupt practices by employees.

Over many years, Downer has made a series of strategic acquisitions and divestments. Acquisitions appear to have targeted recurring earnings streams for which Downer has paid handsomely, only to find that the earnings streams have been far less recurring than the revenue streams. Divestments have been concentrated in ESG-undesirable businesses or low-margin businesses with little regard for the sales price achieved. In almost all cases optics have won, leaving shareholders short-changed. Two acquisitions and one divestment stand out from a capital (mis)allocation perspective: the acquisitions of the Spotless Group in 2017, Tenix in 2014, and the divestment of its mining services businesses in 2020 and 2021.

Downer’s March 2017 $1.15 per share offer for all of the shares of Spotless valued the business at A$2.1b, including its eye-wateringly high level of debt of $800m. At the time, Spotless guidance implied EBITA of $160-175m in 2017 and $165-190m in FY18. At face value, the price tag might have seemed reasonable, but Spotless appeared to be over-earning, and was being held together by the smell of an oily rag. Today, more than five years later, the facilities segment of Downer (of which Spotless is a part) makes approximately $185m of EBITA before an allocation of corporate costs (roughly 0.8% of revenues) or roughly $150m net of this. In short, Spotless has likely gone backwards and has certainly contributed far less to Downer than shareholders would have expected given the price tag.

Tenix, acquired for $300m in 2014, was a similarly bad transaction in hindsight, but luckily much smaller. Today it makes up a meaningful portion of Downer’s utilities segment, which reported losses in aggregate in its recent half-year report before the allocation of corporate overheads.

Downer’s exit from its mining services business happened in piecemeal fashion across its 2020 and 2021 financial years. In total, sales proceeds of approximately $500m were received for its blasting services, tyre management, underground mining and open-cut mining businesses. These businesses had depressed operating earnings of $80m in 2020 and 2019, and peak earnings of $130m in 2015 and 2016. Relative to even their depressed earnings, the sale proceeds for Downer’s mining services businesses were extraordinarily low. Downer’s self-inflicted destruction of shareholder value seemed to know no end!

Combined with this woeful allocation of shareholder capital has been Downer’s aggressive bidding for new works which has resulted in sub-optimal margins or excessive risks being assumed by the company. This has been an unwelcome feature over the last several years which has cost shareholders over $600m in lost profits which includes:

- problematic contracts and business exits ($370m),

- restructuring costs ($130m),

- legal and remediation costs ($85m), and

- the most recent dubious accounting (aka possible fraud?) that has set shareholders back a further $50m.

Recently, various ex-employees of Downer have been implicated in corrupt practices in an ongoing Independent Commission Against Corruption (ICAC) investigation. They are alleged to have received kickbacks whilst subcontracting work on projects for Transport for NSW while employed by Downer. If found to be true, this suggests a serious deficiency in both controls and corporate culture.

Downer’s ability to continue to disappoint the market has been staggering. Recent company disclosures identify rain and labour shortages as reasons for contract underperformance and it is here that it might be worth giving the company the benefit of the doubt. However, when contracts bake in wafer-thin margins, the company needs to contract out risks like these!

It sounds awful, so why own it at all?

Like all of these questions, the short answer is ‘price’. Despite Downer’s rap-sheet of missteps and own-goals being nothing short of spectacular, it performs essential works that society needs. Under the right leadership Downer should be able to generate modest profits with little risk. There’s no reason that Downer can’t earn its operating margin target of 4.5% on its $12b in revenue. At this level of profitability, Downer would trade at half the multiple of after-tax earnings that the broader share market does.

And there is reason for optimism here. Shareholder frustration has led to significant change to its management ranks and board composition. This is likely a first but large step towards an institutionalised culture of accountability that should greatly reduce the risks of entering loss-making contracts in future. The company is in the process of simplifying its business and reducing its exposure to risky contract work. Over the coming three or so years, the new management team should be able to replace the company’s work-in-hand contracts with new and renewed contracted work that considers the risks that ensue and the returns on offer.

Like all investments, there are risks that can’t be ignored

But we feel that most of them are adequately priced in. A bad outcome would be a management team that reacquaints itself with the hamster wheel of old. Operating margins would continue to be less than 3% (December 2022 half year margins were 2.3%) and profits would be approximately half the targeted levels. But even this scary outcome sees investors paying little more than the broader market average, so while a risk, it is not the kind that would see investors lose their shirts.

By far the biggest risk to investor capital is Downer continuing to misallocate it through expensive acquisitions or cheap asset disposals. These risks present with all companies, not just Downer. In Downer’s case, we hope the bloodletting at senior management and board levels gives them some pause here. If nothing else, its balance sheet should assist. Downer has approximately $1b in debt and a shareholder base that is ill-inclined to give them any more money for strategic missteps (acquisitions). From here, we believe there is little choice for Downer than to focus on its existing businesses and reduce its gearing the old-fashioned way.

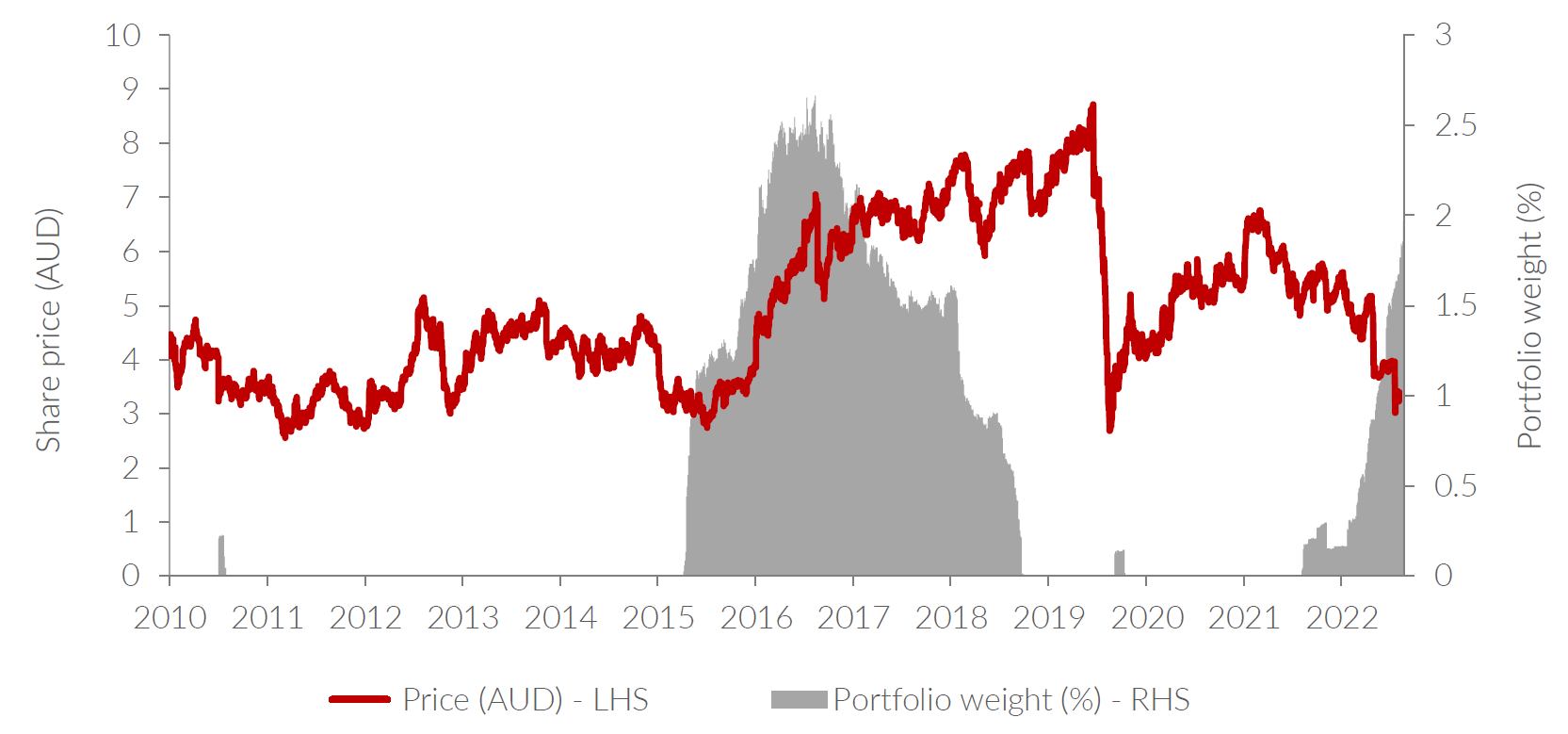

While we acknowledge the risks that come with the Equity portfolio’s investment in Downer, we believe it is priced accordingly and potentially offers the kind of asymmetric upside skew which we expect from the portfolio’s investments. At the time of writing, Downer is around 2% of the Equity portfolio’s assets, as shown in Graph 3.

GRAPH 3 | Downer’s share price and its weight in the Allan Gray Australia Equity Fund

Source: FactSet, Allan Gray, 24 March 2023. The Allan Gray Australia Equity Fund is representative of the Equity portfolio, which includes institutional mandates that use the same strategy.

Written by Simon Mawhinney, CFA, Managing Director and Chief Investment Officer. Acknowledgements: Contribution from Tim Hillier, Analyst. The above wire is an extract from Allan Gray Australia’s March 2023 Quarterly Commentary, which you can read in full here.

Want to learn more?

Contrarian investing is not for everyone, however there can be rewards for the patient investor who embraces Allan Gray’s approach. Visit the Allan Gray Australia Equity Fund profiles to find out more.

1 topic

1 stock mentioned

1 fund mentioned

1 contributor mentioned