Is this ASX miner still a buy after a 21% rally so far in 2023?

There has been a lot of M&A movement in the commodities sector over the past 12 months. But none was more important, or valuable, than BHP's (ASX: BHP) acquisition of Oz Minerals. The purchase, which was completed in May, saw one of the world's largest copper miners taken off the bourse in one fell swoop for over $9 billion.

Following the deal, Sandfire Resources (ASX: SFR) moved up the ranks to become the largest pure-play copper miner on the ASX. And it, like many other companies involved in the future-facing commodities space, has seen a huge rally so far this year. Copper, as a commodity, has seen a 9% return in the last year alone.

But the company's outlook doesn't come without challenges - least of all, a new major project in Africa and the ongoing question about how much of our minerals China will want to buy.

So what does the future hold for Sandfire - and should prospective investors be taking a closer look?

In this wire, I'll be gauging the views of Rick Squire from Acorn Capital. Sandfire Resources is currently a Top 10 holding in the Acorn Capital NextGen Resources Fund.

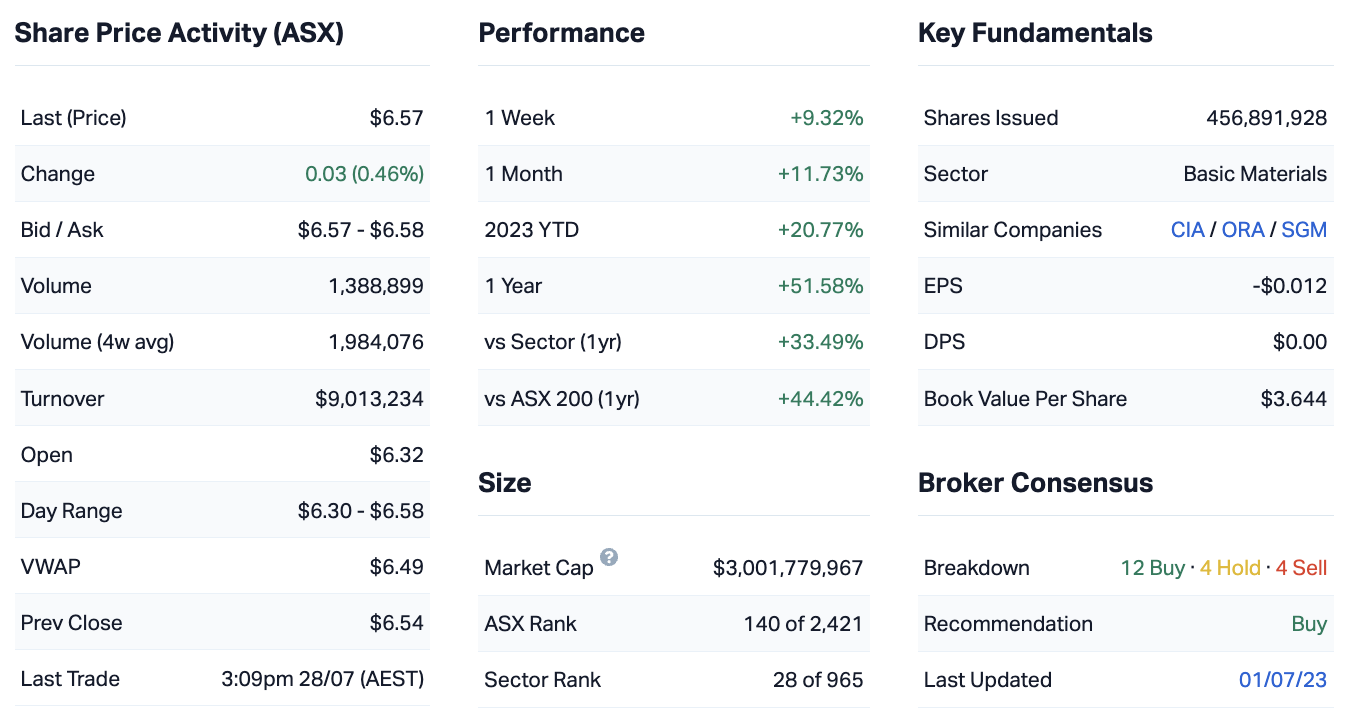

Sandfire Resources Chart

Note: This interview was conducted on Monday 31 July 2023.

Sandfire Resources Q4 Key Results

- Sales revenue of $784 million

- Group EBITDA of $246 million, 40% EBITDA margin

- 17,460T of copper produced in Q4, 84,056T for the full year

- 25,345T of zinc produced in Q4, 85,929T for the full year

- Projection for FY24: 135K tonnes of copper equivalent

Key Company Data

In one sentence, what was the key takeaway from this result?

In a market that's starved of copper opportunities, Sandfire produced a result that was good enough to keep investors happy.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

It was up 9% so it had a positive response but there was a near-term and a longer-term element to it. In the near-term, you saw that there were a few concerns around Matsa [Sandfire's Spanish project which it acquired in early 2022] in terms of the price for some of the byproducts. Zinc in particular was down. The treatment charges and refining charge (TCRCs) are up. Those elements of the revenue were being impacted.

But at the same time, Matsa, their main asset, has had a strong producing quarter because they are mining higher grade ore - probably a little bit higher than the market was expecting. So, those positive elements of more metal were offsetting some of the negative elements of lower metal prices and higher TCRCs.

On balance, what you saw is the outlook that they provided in terms of the production forecast for next financial year was positive. So investors looking into the near-term over the next 6, 12, 24 months, there was enough in there to keep them happy. I think that's how the market responded, rather than there is a little bit of caution around Motheo [its Botswana project] starting up and the risks around that. The medium and long-term outlook looks good.

Were there any major surprises in this result that you think investors should be aware of?

In terms of surprises, probably just those cost elements and the softer metal price. Obviously, the market is challenging there. Motheo is starting up and there's always risks around the commissioning of a plant.

New processing plants never go smoothly and they're always unknown risks. The outlook is good. In terms of the guidance, it was really positive but there is just a little bit of caution around their ability to deliver on some of those targets, particularly for Motheo.

Would you buy, hold or sell Sandfire on the back of these results?

Rating: BUY

We're buying but it's a cautionary one and not a ripping one. In the medium to long-term, the outlook for it is really positive.

For the next three to six months, we just want to see that Motheo is starting up well and not becoming a drag on the company. Because if Motheo goes well, the ramp up goes well. If Matsa keeps producing as it has, what we'll see is debt starting to be paid down and the company seeing a de-leveraging event there and the outlook there from that point is really positive.

Again, in a market that's starved for copper, it's producing copper at scale and potentially generating strong revenues.

What’s your outlook on Sandfire and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

I think the outlook for the sector is really positive because it's starved of copper opportunities (particularly at scale). There's a few out there, but they're quite small and Sandfire's big point of difference is that it is a larger copper producer. It has a really strong growth pipeline with Motheo coming online. There's a really, really good opportunity there in terms of the sector so the outlook for the market is positive.

The fundamentals for copper supply is quite tight. So there is a really good opportunity there. The demand is a little bit hard to read. How does China respond over the next six to 12 months? There is an offset of that with the flourishing of the EV metal market. But how much are they going to offset that demand - which is really being driven by construction in China is the difficult thing to read through.

So there's a little bit of a trade-off there. But on balance, it's quite positive for the sector. For the company, I think it's a really exciting. You've just got to be a little bit cautious on the ramp up with Motheo.

There is a new managing director in place and he presented really well at the quarterly. He's pretty positive that they can get to (at least) name plate capacity next quarter and get up to that rate. And if that's achievable, we could actually see a strong reading of the company in the near term.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious on the market in general?

Rating: 2

In terms of the market in general, it's broken out into parts because there are many commodities across the sector. The commodities I think that are performing really well include copper. Lithium is continuing to do well and gold is actually looking quite good in terms of its potential to break out.

But at the same time, you're seeing some commodities that are really struggling like graphite and rare earths. They're really been curtailed by the suppression of commodity prices. When you talk about the demand for electric vehicles, it's growing and lithium is going really well. But then you look at other commodities that are in there, like nickel, rare earth elements, and graphite, it's quite a different story. So, it's a mixed bag and investors have got to be quite nimble in terms of where they see the opportunities.

In that market, there are some commodities that are performing well and then there are stocks that are performing well. And even in lithium, we're seeing some stocks performing really well but we're seeing also some that are really starting to struggle.

It's not lifting all boats like it did last year. It's the better quality stocks that are actually performing better. So, the ability to identify the quality projects is really starting to shine through at the moment. But I think it's quite cheap, especially at the small end of the market (less than a billion dollars in market capitalisation). I'd say it's a two - quite cheap.

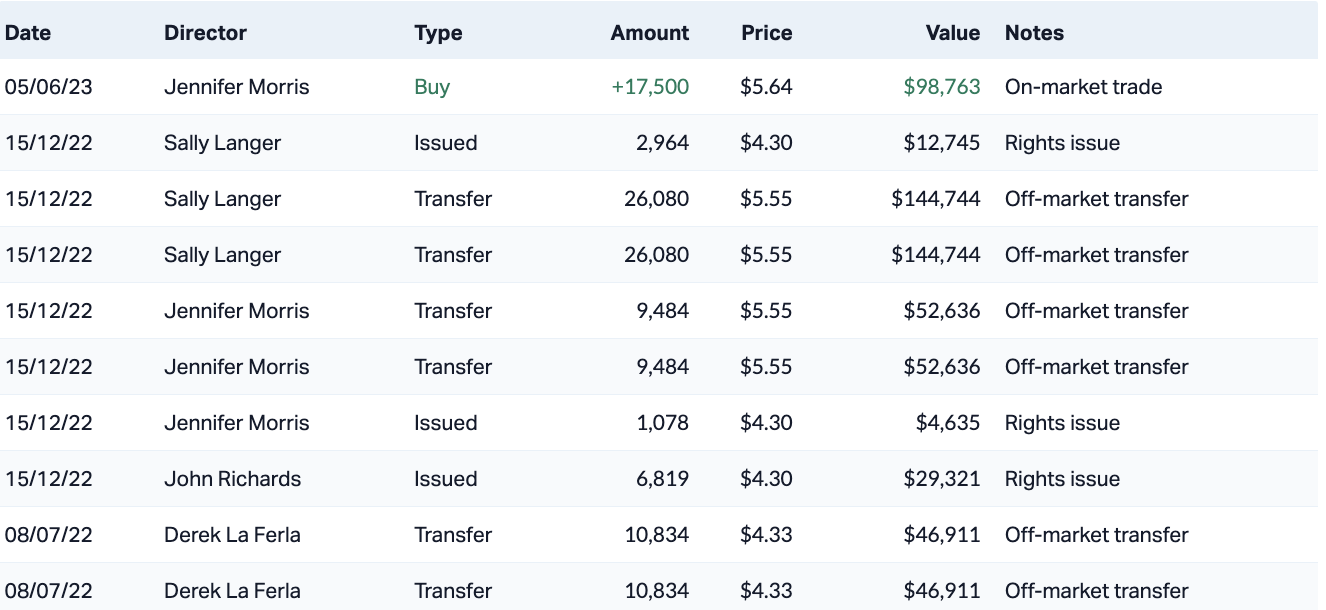

10 most recent director transactions

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.3 topics

2 stocks mentioned

1 fund mentioned

1 contributor mentioned