Is this the best growth company on the ASX?

Without putting too much mayo on it, Life360 (ASX: 360) has thrown its hat into the ring for the best result and reaction of the season - the share price was up 18% today.

As Tribeca Investment Partners' Lead Portfolio Manager for the Alpha Plus Fund, Jun Bei Liu tells us, 360 "beat expectations on every front", which is made all the more impressive by the fact that analysts had lofty expectations going in.

Beats on the revenue line and upgraded forecasts were impressive, but Jun Bei was equally impressed by the fact that the Life360 app continues to move up the rankings in terms of usage in the United States, which she says "is the strength of their business" as it highlights just how often people use their product.

With future revenue opportunities also on the cards, Jun Bei suggests 360 "is now one of the highest quality growth companies here in Australia". Read on to find out more.

Key Results

Q2 Revenue of $84.9 million vs expectations of $84.6 million

- Global MAU net additions of 4.3 million to around 70.6 million (expectation was 69.4 million)

- Global Paying Circle net additions of 132,000

- Net income of -$11 million vs expectations of -$7 million

FY Guidance (Dec 2024):

- Adjusted EBITDA $36-41 million vs prior guidance $30-35 million

- The company expects to continue to be adjusted EBITDA-positive on a quarterly basis going forward. It also expects to achieve positive EBITDA in Q4 due to usual seasonality and to be consistently EBITDA positive quarterly in 2025

- Revenue guidance was also raised to $370-378 million vs prior guidance $365-370 million

- For more financial data on 360, head to Market Index

Note: This interview took place on Friday 9 August 2024.

The

key takeaway is that 360 pretty much beat expectations on every

front and this is particularly impressive for a growth company where everyone had a huge set of numbers for them to beat.

2. Were there any major surprises in this result that you think investors should be aware of?

They also upgraded their prior guidance.

A couple of notable areas of upgrade, I think the biggest one was the core subscription revenue - upgraded from 20% to 25%. It goes to show acceleration in that core revenue. It's SAS-like revenue, so it's very defensive, and for the growth to pick up it's a really good sign of users finding benefit in the product.

Given the revenue upgrade, consensus will need to upgrade their expectations by probably somewhere in the double-digit vicinity. In terms of subscription growth, it's probably somewhere in the 5 to high-single-digit percent growth.

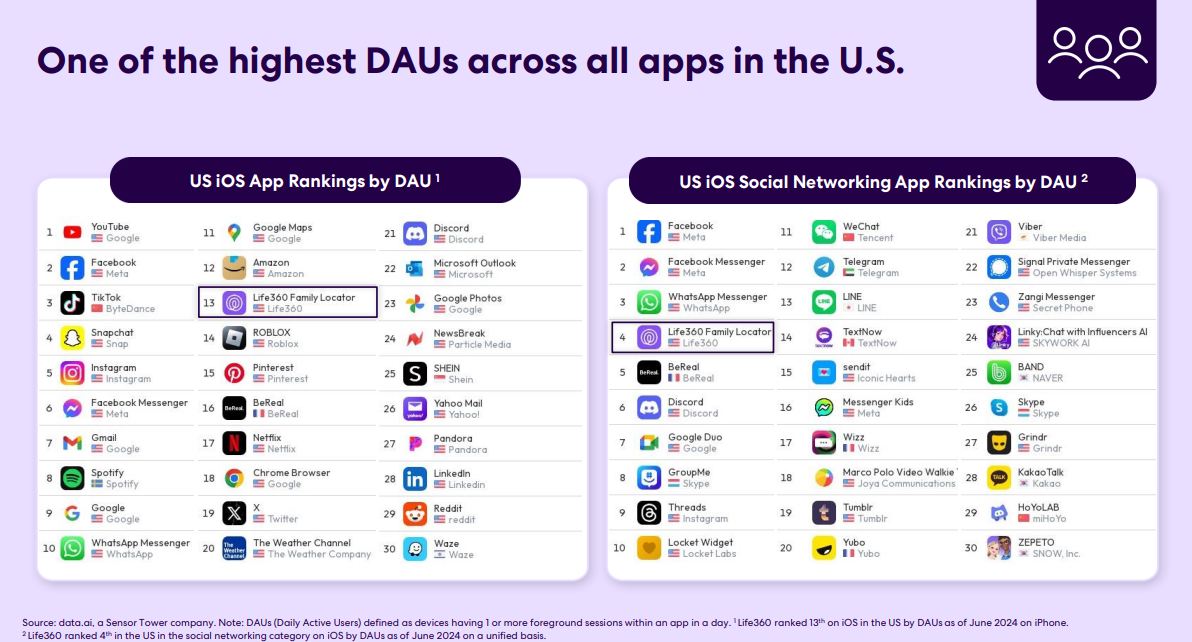

Aside from the financial metrics, a couple of charts look really interesting from the presentation.

They show you their app ranking in the US - which is really the strength of their business and shows how often people use their product.

The US iOS app ranking by DAU (daily active user) shows that ranked 13 - up from 15. That has been improving steadily.

The other impressive ranking, based on social media apps, shows that they are in the top four now (up from number 5), and just below WhatsApp.

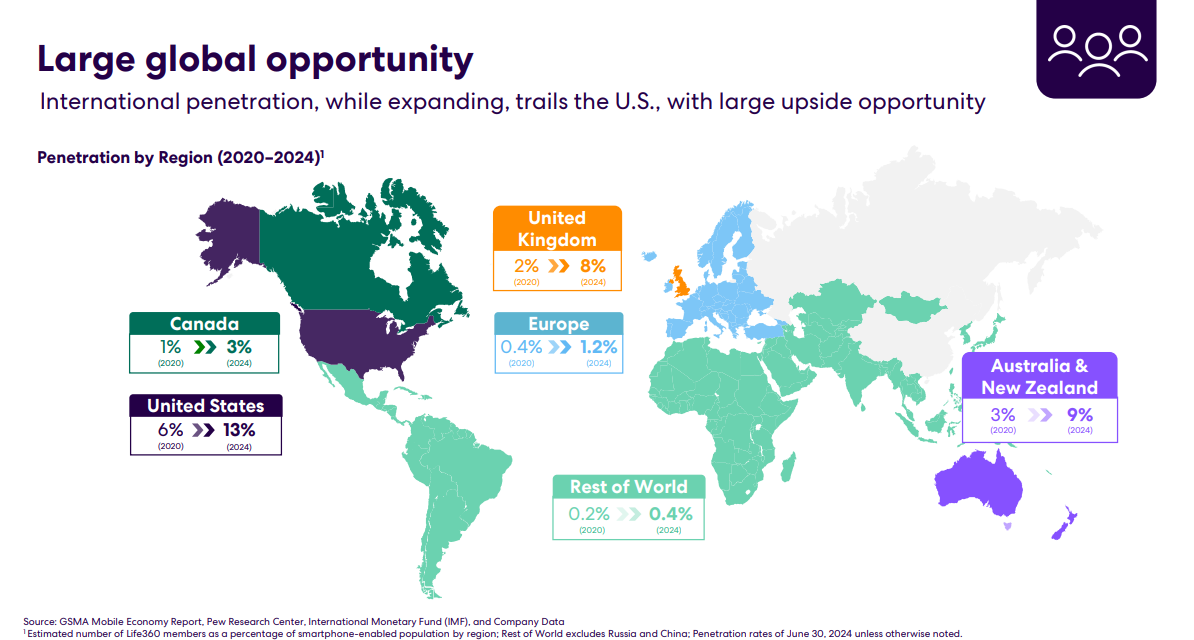

They also show the potential growth going forward. Penetration in the US is still very low for this company - around 13%.

For other global regions, they show that growth is still in its infancy - we can surely expect that 360 should achieve a similar sort of penetration.

360 is still in the early stage of its growth, the addressable market is enormous and the company is executing well in the US. There are also other verticals and other revenue-generating opportunities that the company has talked to, such as advertising to users on the freemium subscription.

3. Would you buy, hold or sell this stock on the back of this result?

Rating: BUY

Despite the share price being significantly higher on the back of the results, I would still be buying Life360 now.

The share price is simply reflecting the earnings upgrades, and it is still not pricing in any part of those potential future revenues.

At the same time, it is now one of the highest growth companies here in Australia and it has SAS-like revenue which is very defensive and very high quality, not to mention that its potential market is enormous.

5. From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious about the market in general?

Rating: 2

I'm excited. I see value in the market, particularly given the selloff this week.

We think pockets of the market look very interesting. The economic backdrop is that things are slowing but we know that interest rates will be cut and, if anything, may get cut a little earlier than people are expecting.

Typically, equities perform well when rates are cut and we should see a meaningful rebound. So we are using the selloff, or weakness in terms of earnings, as a buying opportunity - particularly for cyclical businesses.

We can look through the weakness in terms of earnings - that will bottom in the next six months - and the equity markets always look forward so we think valuations look quite interesting now.

3 topics

1 stock mentioned

1 contributor mentioned