It’s morning again in the $Sunshine $State!

Oh…the shame of it!

Melbourne has lost its silver medal for being the second most expensive city in the country to buy house. Brisbane has overtaken us.

Hey, I remember back in 2019 when the word was Melbourne was going to overtake Sydney as the most populous city in the country.

In hindsight, it was the kind of collective hallucination you get in markets after a big run that gets extrapolated into the future forever.

Fundamentals matter. Melbourne’s lost its mojo.

Queensland is where the actions is, and – odds on – this will continue.

There’s no one better to ask – or more happy to spread the word – than commercial property wizard Warren Ebert.

Some call him the Property Whisperer.

I call him the King in the North. His firm Sentinel Property Group has over $1 billion invested north of Brisbane.

Warren came south to colder climes last week to tell we shivering Victorians that not only is the weather better in Brisbane, so are the investing opportunities.

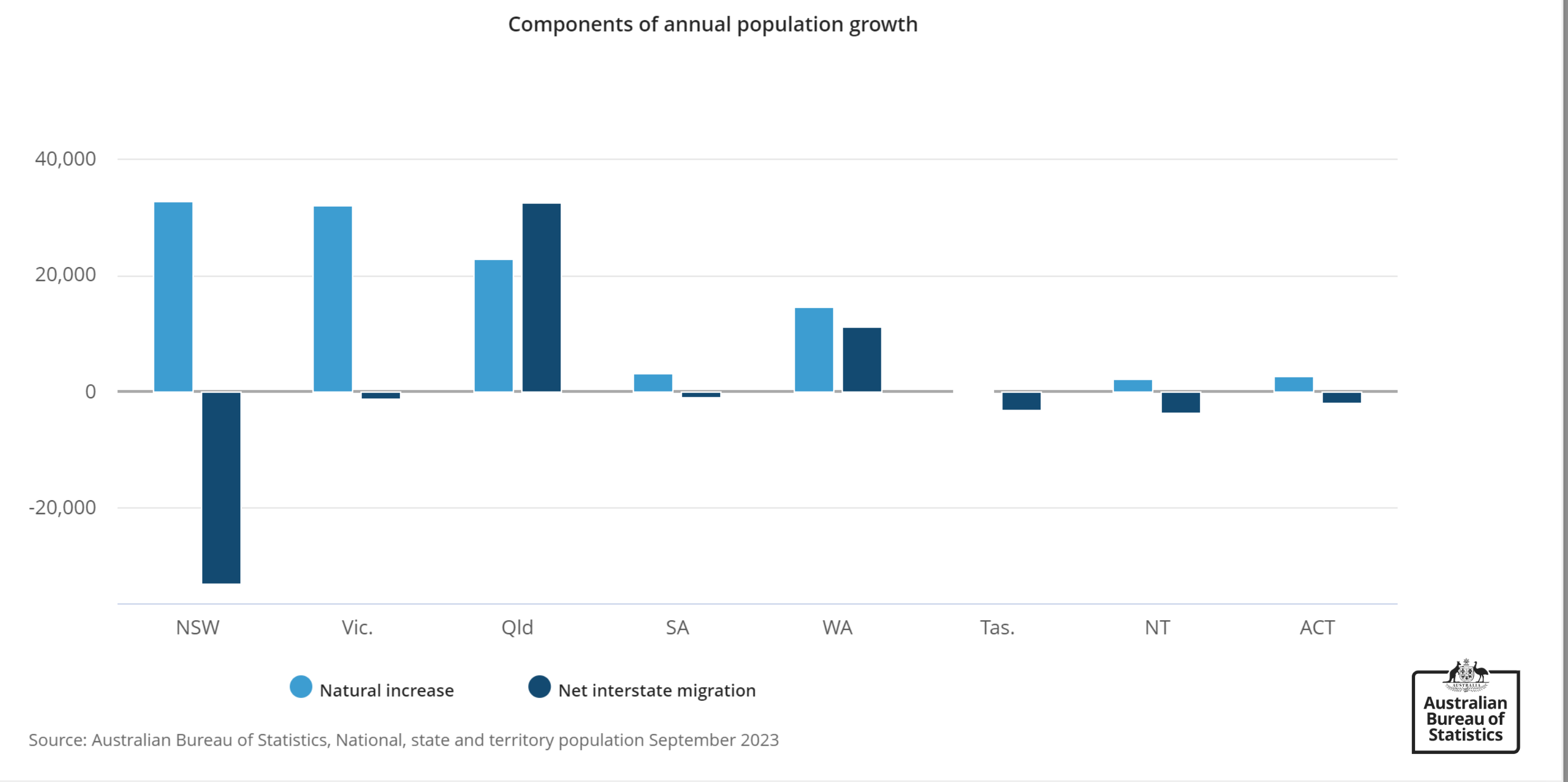

The people of Australia agree.

They’re moving to Queensland in juicy numbers, as you can see…

These northward bound pilgrims may not share Warren’s taste in 3 piece suits, but are sure the tan and the fat wallet would look just as good on them as they do on him.

Just what are those investing opportunities?

I’m a stock market guy. It’s not so easy to “play” a resurgent Queensland directly via the ASX. But there are angles to consider.

Hotel Property Investments [ASX: HPI] is a listed Real Estate Investment Trust (REIT) that holds a baskets of pubs. Most of those are in QLD.

The REIT sector has been a tough place the last few years. At some point rate cuts will come in and take some of the headwind away. It’s been blowing hard against them for a while.

HPI pays a decent yield and looks a solid hold for income. It may not be the best idea to monster a resurgent QLD, but it’s one idea.

Companies with a strong presence in QLD – or moving to create one – will likely have stronger earnings potential than those more heavily weighted to Victoria.

Land lease player Lifestyle Communities [ASX: LIC] is the reverse of this. Its entire business is in Victoria.

Long term, it’s a solid proposition. But, right now, the weak Victorian housing market is dragging on how fast LIC can drive sales from its downsizing boomer customer base.

And what does Warren say? Back Sentinel, of course! Fair play - he’s got the track record to back up the confidence.

You can’t invest in Sentinel on the ASX. But you could consider one of its trusts.

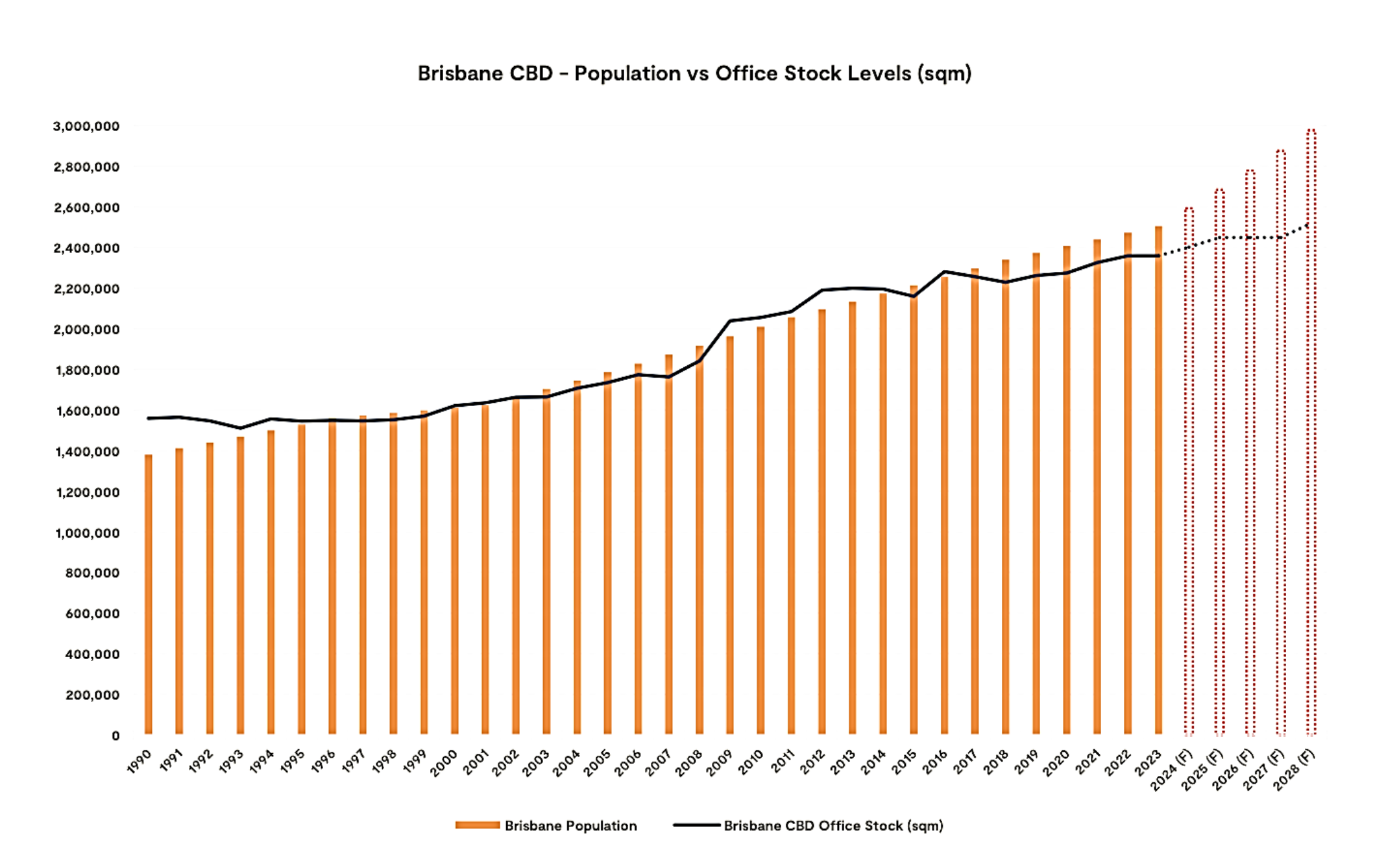

Warren told the crown last week he’s going shopping for office towers in Brisbane.

Brisbane is booming and there just ain’t enough towers in place to meet the demand…

We don’t have to take Warren’s word for this. We can see it via rising rents.

That’s not all. Supply will struggle to come in because of prohibitive constructive costs.

Office towers are one Sentinel play, with an eye to a booming Brisbane by the time the 2032 Olympics roll into town.

Warren’s also got his eyes on some regional shopping centres.

One of the nice things about Queensland is it’s Australia’s most decentralised state.

That gives some of its regional populations strong buyer power because mortgages are lower but wages can still be quite high – from mining especially.

If you believe, like I do, that the outlook for mining is very bullish, then we have every reason to believe these strong wages will persist, and even go higher.

You CAN monetise this mining dynamic on the stock market, in many different ways.

One of my favourite ideas – excluding direct miners here – is mining service stock Imdex [ASX: IMD]. It's one for the next 5 years in my book.

For Sentinel, they can position to capture this regional wealth when it shows up in a higher spend per square foot than in areas with less discretionary cash flow.

Smart man, that Warren.

Of course, you could also join the herd heading north and buy your own place in Queensland too. If you can afford one, that is.

Best wishes,

Callum Newman

Fat Tail Investment Research

PS You can see a recent interview I did with Warren Ebert at this link.

PPS. You can subscribe to Fat Tail Daily for more investment ideas here.

2 topics

2 stocks mentioned