It's raining Dividends - bring a bucket

While it might not feel like it this year, the big wet is usually a seasonal occurrence.

Dividends too are seasonal, with the traditional dividend ‘wet season’ about to commence. However, like the Farmers' Almanac, it’s a lot easier to forecast the next two months than it is the next two years.

The next two months

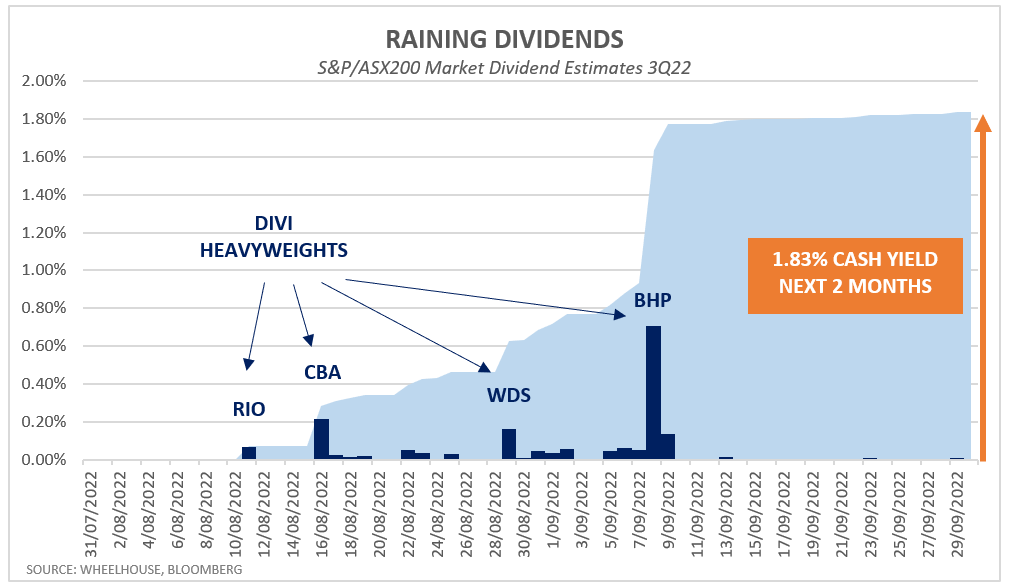

From this week through the end of September, 113 of the 200 members of the S&P/ASX200 will be going ex-dividend and distributing income to shareholders. The total yield forecast for the S&P/ASX200 Index to be paid out during this two-month period is over 1.8%, although with the benefits from franking the gross yield will likely be closer to 2.5%.

For investors who prize fully franked dividends, now may be the time to consider their investment strategy. Although we’d caution that investing is never all about income. Even in Australia, where the income component (as a % of total return) has been exceptionally large relative to other global equity markets, the underlying capital valuation, and the sustainability of future dividend payouts needs to be considered.

Let's dig a little deeper into sustainability

Since we wrote on this issue last month, RIO’s declared interim dividend payout was US$4.3bn, down over 50% from the US$9.1bn it returned during the same period last year. The payout ratio also fell to 50% of underlying earnings, down from the 75% it paid last year when it also announced a special dividend. While reserving their options for paying another special dividend later this year, the message is clearly a little more cautious.

Looking more broadly across the dividend heavyweight sectors of Materials and Financials, we’ve plotted the dividend per share (DPS) expectations from a leading local broker.

Based on these estimates, 2022 may mark the peak in dividends from the miners whilst the trend is clearly negative for future years. DPS expectations nearly halve for RIO and FMG and are also declining for WDS and BHP after a pop in 2022.

Flipping this trend are the dividend expectations for the banks. Market estimates show consistent small growth in dividend payouts over the next 2-3 years.

To be 100% clear – these are broadly consensus expectations based on the stock analyst ‘experts’ and, like all forecasts, could well be proven quite wrong. Even one more year of elevated commodity prices could make a material difference to the miners’ income generation, as would the prospect of a more aggressive property correction for the banks. As always, investors could make a lot of money betting against consensus… and being right.

Regardless of whether these forecasts prove accurate or not, the shifting sands of profitability highlight the benefits of diversification. Particularly for investors that rely on fully franked yield, spreading the sources of income meaningfully across the broader index reduces the risk to future income streams.

Other ways to diversify the source of yield

For investors reliant on yield, the investment strategy can also play an important role in diversifying and reducing the reliance on one particular sector or company for reliable yield.

Our Australian fund for example seeks to receive twice the dividend yield of the market and uses a unique strategy to reduce and manage risk. There are other specialist income strategies around too that are designed for income-seeking investors, particularly where the investments are in Super and franking can be more fully utilised in either compounding wealth creation or indeed in providing a little boost to annual distributable cash income.

In any case, dividend season is nearly upon us,

and at Wheelhouse, we always enjoy it when the rain comes. We just make sure to bring

along a larger bucket.

.png)

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic

8 stocks mentioned