It’s time to sell ASX bank shares and buy resources says this major broker

For the last couple of weeks, I have remarked in the Evening Wrap I write for Market Index each trading day how powerful thematic sector rotations can be when fund managers decide to flick the switch. The latest rotation was sparked by last week's announcement of a range of stimulus measures relating to the Chinese economy and Beijing's promise that even more sweeping measures are to come.

You might have noticed the impact within your own portfolio – resources and energy stocks have been booming since last week, but financial, consumer, and other previously prospering stocks have suddenly faltered. You might automatically ask the question, has anything fundamentally changed for the stocks that have struggled since resources and energy stocks have gained a new lease on life?

I’d argue that very little has changed since just last week – major stock and bond markets have barely moved, and there have been few company-specific, micro, or macroeconomic factors to explain such underperformance. So, if the fundamentals are largely the same, why have the share prices in some sectors, particularly ASX banks, fallen?

The most basic answer is stocks in the losing sectors are experiencing greater supply of their shares than demand. Fund managers want out of these sectors to raise the cash to buy into others. If we assume some fund managers have a fixed amount of capital, it makes sense they must first sell some positions before entering new ones.

This is “sector rotation”. It is caused by active fund managers shifting between sectors they feel are overvalued and about to underperform into sectors they feel are undervalued and about to outperform. The term “active fund manager” refers to fund managers who allocate capital with the goal of outperforming a benchmark index. On the other hand, a “passive fund manager” aims to allocate capital according to weightings within a benchmark index, with the goal of tracking its performance perfectly.

“Time to Rotate” says Morgan Stanley

“Time to Rotate” is the title of a research report released this week by major broker Morgan Stanley in which it advises clients that it's now time to “rotate” out of ASX-listed banks and into ASX-listed resources. The broker believes that some of the key factors that have supported the share prices of banks over the last 12 months are likely to work against the sector over the next 12 months, and at the same time, work in favour of commodity prices as well as the stocks that produce them.

"It's been better to sell mortgages and deposits rather than iron ore or oil and gas"

–Morgan Stanley

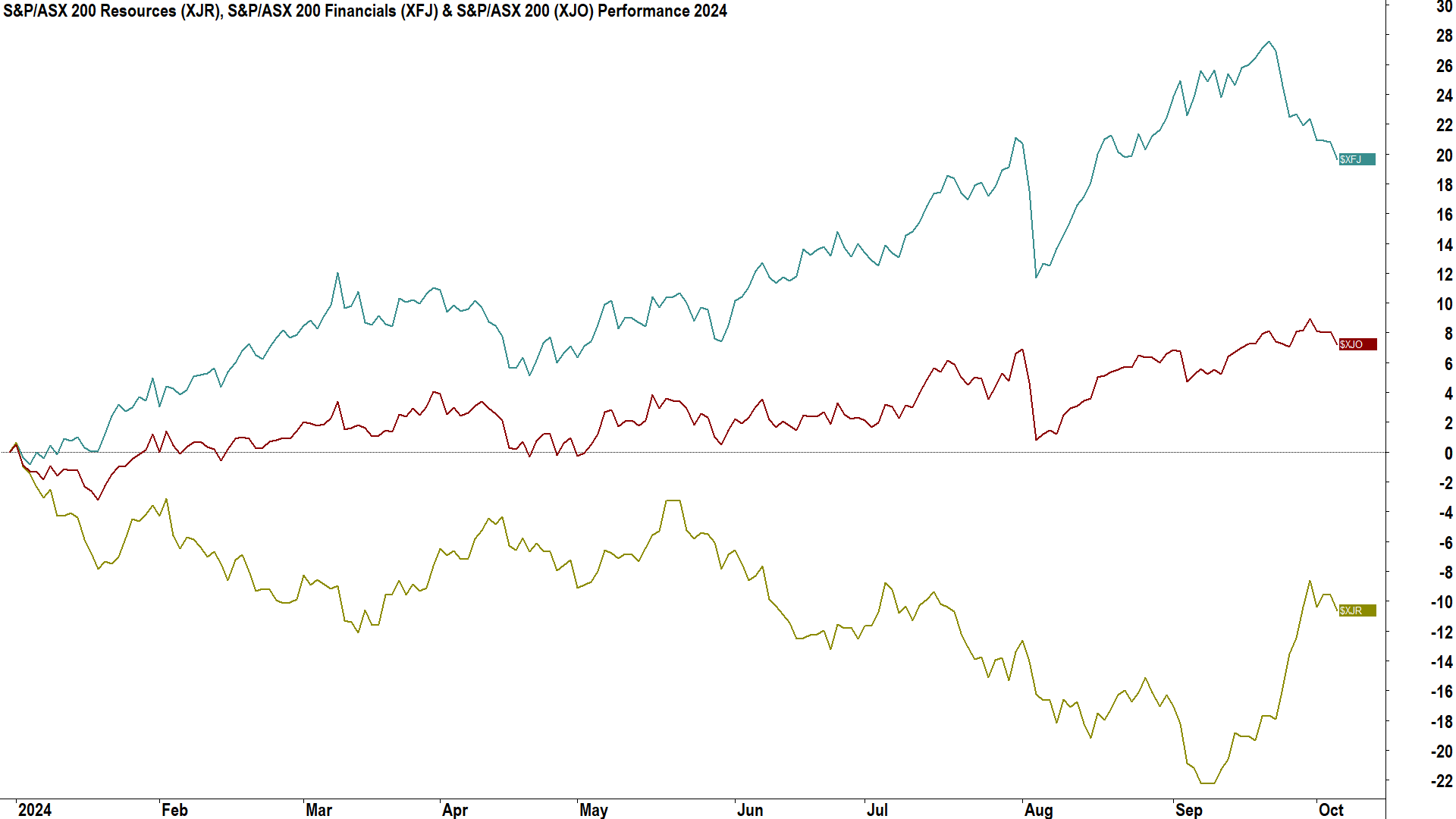

Certainly, if we look at the relative performance of the S&P/ASX 200 Financials (XFJ) and S&P/ASX 200 Resources (XJR) sectors since the start of the year, they have moved in almost lock-step-opposite. The big banks make up the vast majority of the XFJ by weighting, so we could say that the banks’ fortunes appear to have come at the expense of Resources companies.

It's also clear that the relationship has maintained over the last couple of weeks as resources companies have rallied – the share prices of banking stocks have dutifully declined. The big question, which to be fair Morgan Stanley is kindly answering for us, is whether the recent trend of resources outperformance will continue.

Morgan Stanley provides the following reasons why it believes bank stocks could continue to struggle over the next 12 months:

- Banks' outperformance this year has been partly due to a 'safe-haven' status within the Australian market, and in particular, due to significant overcrowding within the sector by major superannuation funds

- The US is now in a rate-cutting cycle, and along with China stimulus, there is now “a firmer consensus of a soft landing and potential improvement in commodity signals”, which the broker feels “should support a rotation out of banks”.

- Bank sector valuations remain unattractive, with multiples still “elevated”, the average major bank P/E Ratio is 17.5x (down from a peak of 18.5x), and this is above the 10-year average and the 3-year post-COVID average.

Commonwealth Bank of Australia (ASX: CBA) is the most overvalued bank, says Morgan Stanley. Even after its recent pullback from over $145 a share at its peak in early September to around $132 today, the broker notes CBA is still trading at a +4.8x premium to its 3-year post-COVID average P/E Ratio. Westpac Banking Corporation (ASX: WBC) is the next most overvalued ASX banking stock, trading at a +3.9x P/E Ration premium, followed by National Australia Bank (ASX: NAB) at +2.8x, and ANZ Group (ASX: ANZ) at +1.7x.

Morgan Stanley points out that NAB remains the only Aussie bank it thinks clients should be OVERWEIGHT. It currently has a price target of $38 which implies roughly a 2.7% upside based upon yesterday’s closing price for the stock. The broker is EQUAL-WEIGHT rated on WBC (PT $29.70 implies 3.2% downside) and is UNDERWEIGHT rated on ANZ (PT $27.50 implies 8.6% downside) and CBA (PT $113.50 implies 15.7% downside).

If banks are out, which mining stocks are in?

To answer this question, we must go to a separate Morgan Stanley research report, this time called “China and the Miners”, released last week, just after the Chinese stimulus measures were announced.

In this report, the broker outlines which commodities, and therefore which ASX mining stocks could benefit the most from an improvement in the Chinese economy. Top of the list is metallurgical “met” coal, suggests the broker, noting one key upshot of the stimulus measures would likely be a higher Chinese steel output. Here, Morgan Stanley prefers Whitehaven Coal (ASX: WHC), which it notes will soon have as much as 65% of its revenue coming from met coal production.

The other key component of steel is iron ore. In this sector, Morgan Stanley’s top pick is Mineral Resources (ASX: MIN). The broker likes the impending ramp-up of volumes at the company’s Onslow Iron project, noting its contribution would be transformational and likely to de-lever MIN’s balance sheet from 2025.

The broker also likes Rio Tinto (ASX: RIO) for its iron ore exposure, noting the mineral will make up 65% of the company’s 2024 EBITDA. But, says Morgan Stanley, RIO’s copper footprint is becoming increasingly attractive too. The broker expects copper’s contribution to group EBITDA will rise from the current 16% to 25% next year.

Finally, BHP Group (ASX: BHP) rounds out Morgan Stanley’s top iron ore picks, with the broker noting the company’s attractive growth prospects, relatively lower capex than its peers, and a likely imminent resolution to the company’s Samarco liability.

This article first appeared on Market Index on Friday 4 October 2024.

5 topics

8 stocks mentioned