"It's tricky": Why Morgan Stanley is holding firm to "underweight" ASX banks call in 2025

For most of 2024, Morgan Stanley's Chris Nicol has been making the case for why the performance gap between the Big Banks and the major mining and resource companies is just way too large to ignore. Speaking to our Chris Conway in October, Nicol remarked that he thought there was more of a rotation out of the banks and into the miners to come.

"The peak underperformance [of resources versus banks] was about negative 66%. I don't think I've ever seen that in my career and it was quite distortive [sic]. But the soft landing and what we are seeing out of China and its early stimulus give me some conviction that we could see more rotation opportunities emerging," Nicol said.

This was a view echoed by L1 Capital's James Hawkins at Livewire Live, who argued there is value to be found in that space.

"There is a real opportunity to make some money out of this rotation out of financials," Hawkins noted. "For a value investor, that [being in banks] doesn't make sense when you have a dividend yield that is less than the cash yield in Australia with no EPS growth."

Unfortunately for Nicol, Hawkins, and others who have had an overweight resources-underweight banks call, that gap has still not meaningfully closed - yet.

However, Nicol is sticking to his big-picture allocations ahead of 2025 despite increasing his ASX 200 target by 5%, to 8500. That figure implies an 8% upside (on a total return basis) from current levels. But where are they positioned across global and local equities to benefit the most from these calls? You can find out in this wire.

"It's tricky"

The title of Nicol's outlook is a reflection of just how challenging it is to project an outlook for 2025 when so much of 2024 confounded expectations. For instance, the ASX 200 is currently just above Nicol's year-end target, so he's had to increase his house assumption base case multiple to 17x earnings.

So, how is Nicol approaching the new year? Well, as the saying goes, timing is everything.

.jpg)

At a broad global asset allocation level, here are his calls:

- Overweight global equities (quality growth and US-exposed industrials to benefit while MS' global view of lower bond yields supports current positioning within REITS and other select defensives"),

- US Treasuries bull-steepening (i.e. buy short-term bonds and sell long-term bonds),

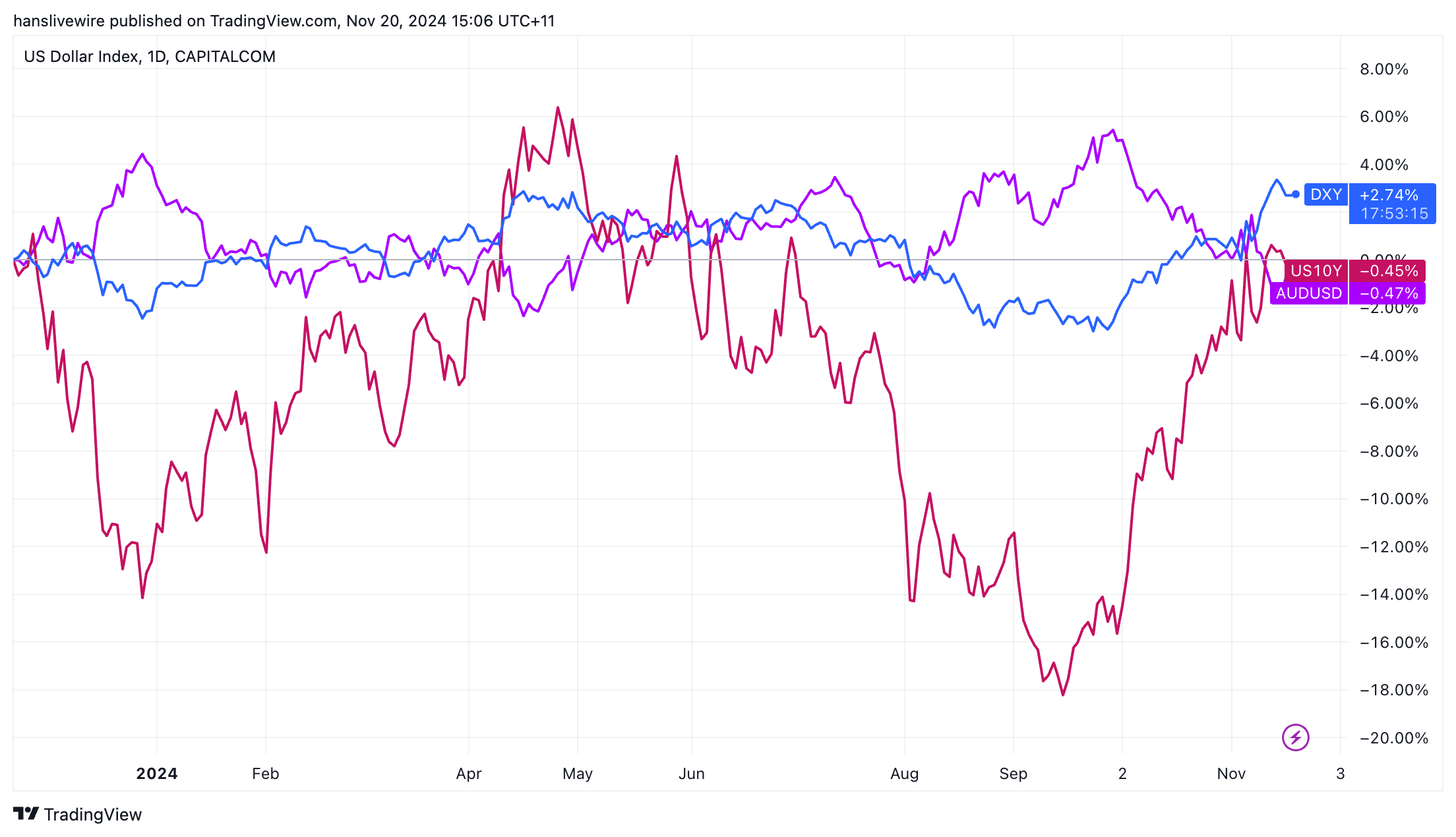

- US Dollar lower and Australian Dollar higher (72 cents by the end of 2025)

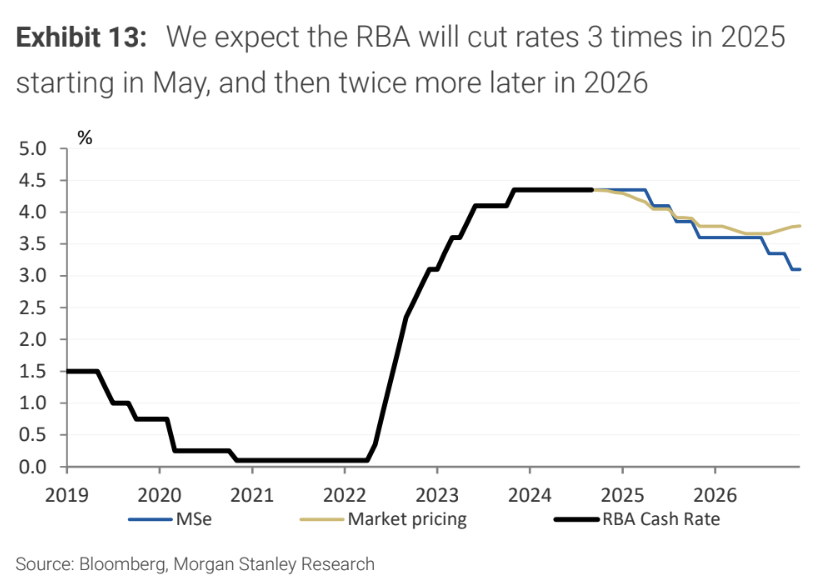

Part of this Australian Dollar call is due to its house RBA call - no rate cut until May 2025. Here is Nicol's global macro outlook in its entirety:

"The type of landing after a prolonged period of monetary tightening has been actively debated for much of 2024. Indeed with the Fed and many other peer central banks easing through this year and China on the surface at least looking to want to tackle deflationary pressures - a softer landing looked on the cards for many economies. 'Enter stage left' a meaningful shift in the US election towards policies that in essence have tempered MS global growth forecasts, raised near-term inflationary expectations and left a sniff of stagflation risk in the outlook. So for 2025, we hold off on calling the Australian landing just yet."

The 5 key debates investors need to focus on

1) Volatile yields and US Dollar

And speaking of tariffs... the second debate:

2) China: Tariffs, stimulus, and then what?

This debate is in three parts. Firstly, how big will the proposed tariffs be? If Trump gets his way, it could be as much as 60% inflicted against China and then 10% tariffs on the rest of the world. Secondly, how quickly can they be implemented? According to Nicol:

"Tariffs might come as early as the first half of 2025. Corporate confidence and financial conditions are key to watch."

And then, finally, the biggest debate of them all. How much stimulus will be unleashed, when will it be released, and at what rate?

3) Australia goes to the polls - but what impact will it have on markets?

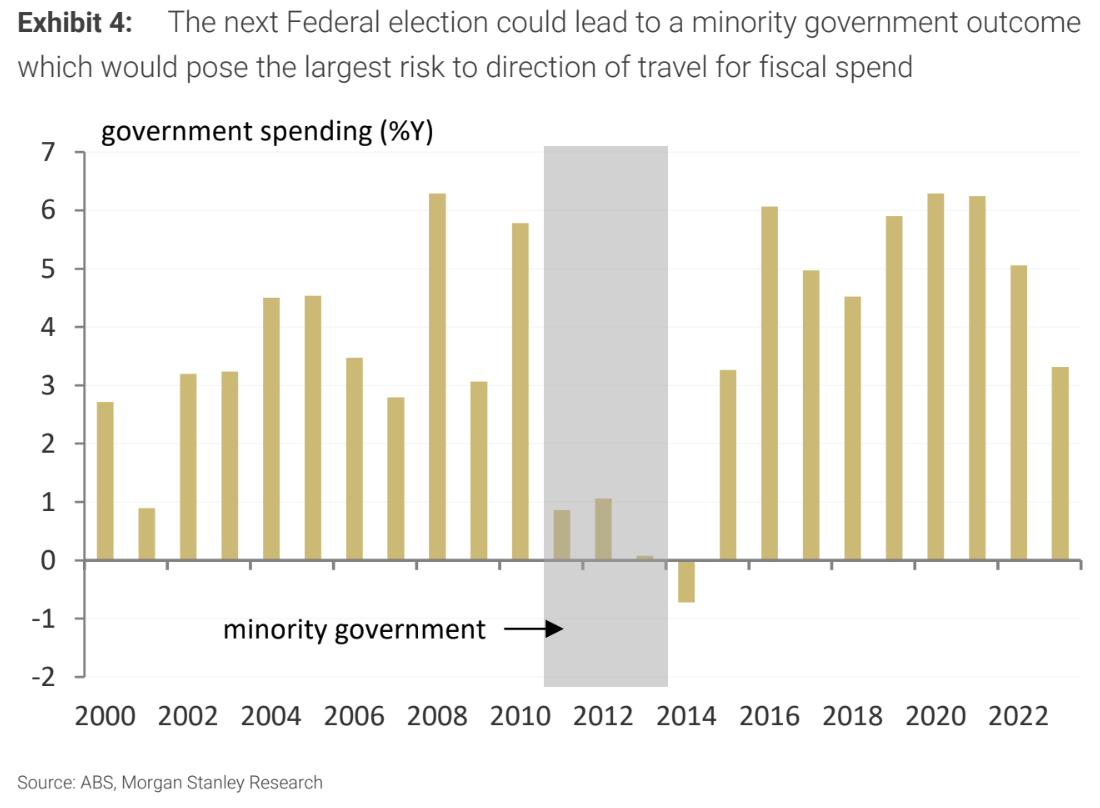

While financial markets don't normally get moved by a federal election, this time, it might matter - especially if the RBA feels it cannot cut interest rates before the election. More than that, elections are usually a chance for the political parties to splash the cash. But with fiscal spending such a key theme worldwide, the big question is how much each party wants to spend and how that spending will affect the economic growth and labour market outlooks.

"Near term, we expect that the incumbent government will look to extend the cost of living measures and the broad pulse to continue to be expansionary. Opposition policy is also likely to support spend rather than offer any curtailment as a policy alternative," Nicol said.

"Looking at tail risks, however, we believe that some attention should be given to the potential for a minority government outcome where the last experience saw a meaningful drop off in fiscal pass-through to the economy."

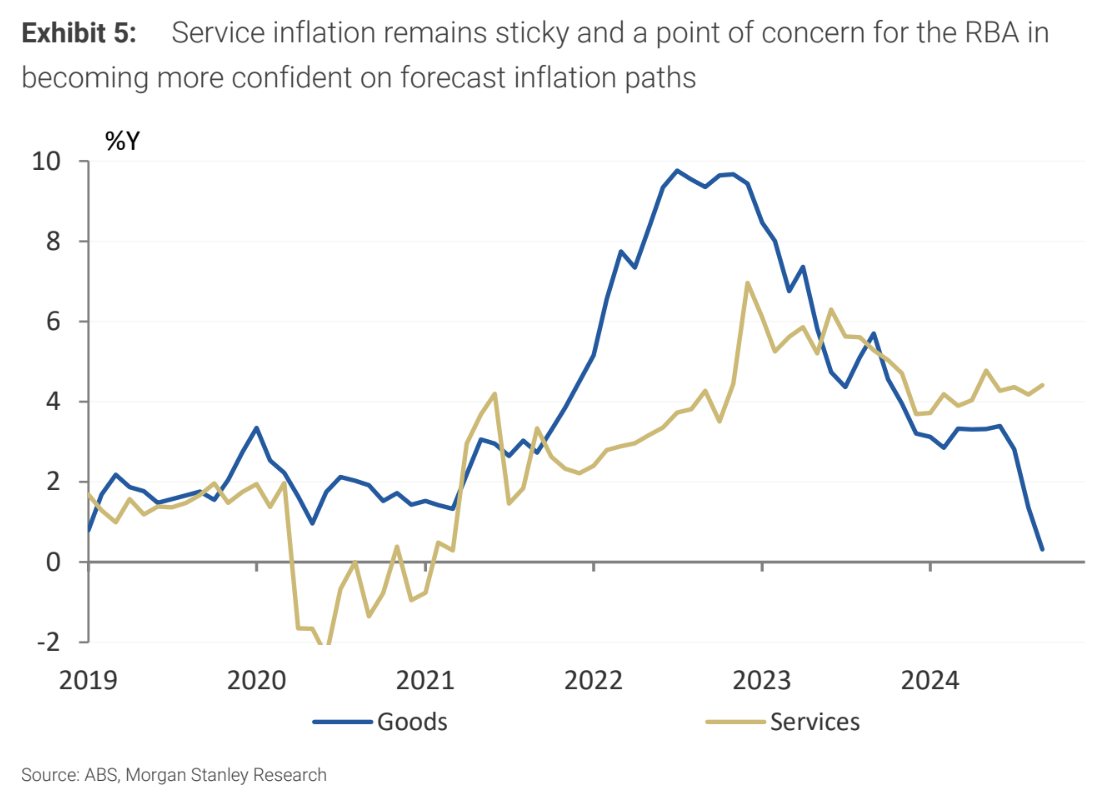

4) The thorn in the RBA's side: Services inflation

One call Nicol has nailed is that there would be no rate cuts in 2024. While the RBA made some adjustments to its forecasts, suggesting they are more optimistic, everything is open to change. The next two pieces to watch - services inflation and wage inflation - as noted in the chart below:

For its part, Morgan Stanley expects five rate cuts through this cycle. Providing these cuts are 25 basis points each, which would amount to a terminal cash rate of 3.1%, far higher than 2020 levels but still low compared to history.

5) How are consumers doing (and what will they be spending on?)

Nicol's view for some time has been to favour staples over discretionary, premised on the view that the Australian consumer would weaken over time and that they would shift to discounting/lower-priced items. This is - in Nicol's words - "par for the course", and he argues that catalysts for a rebound in consumer spending remain limited. But there is a silver lining:

The Morgan Stanley Model Portfolio

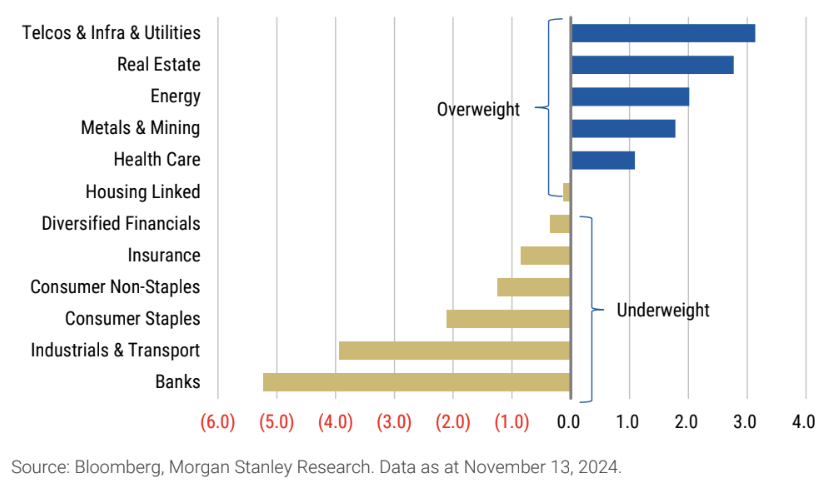

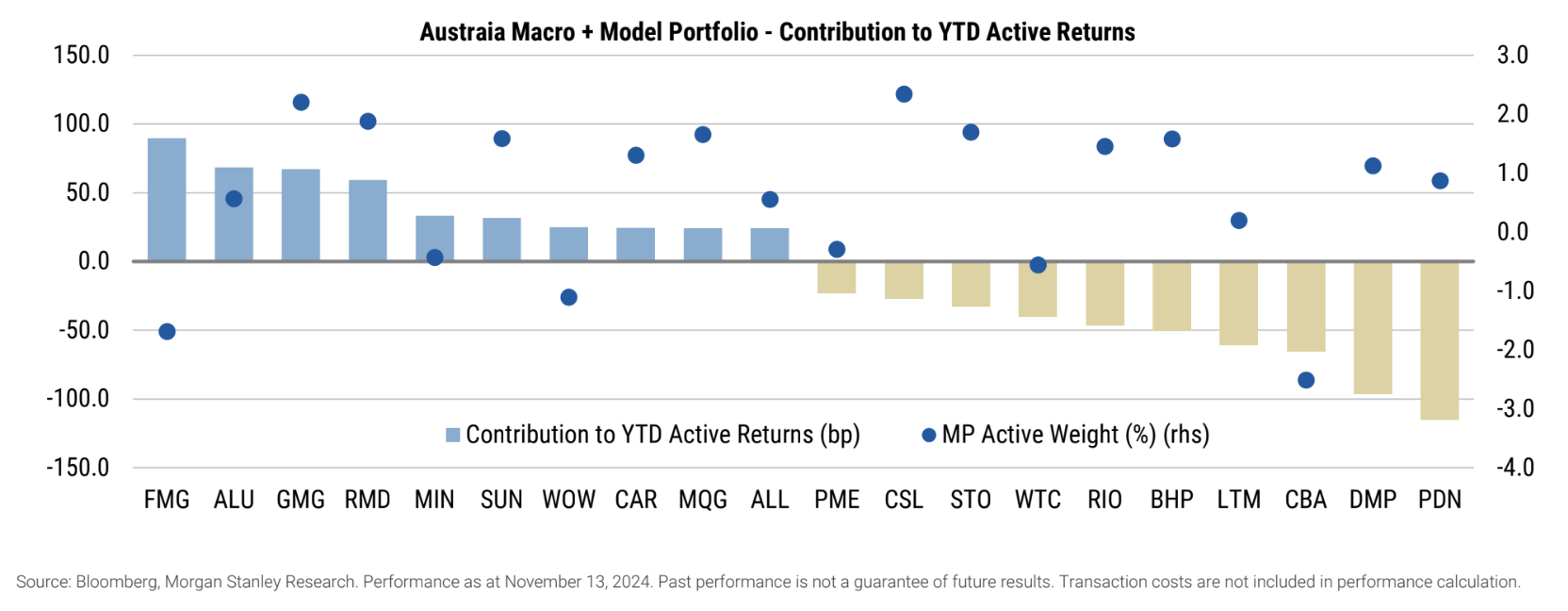

As we mentioned at the top of this piece, there have been no major changes to Morgan Stanley's model portfolio - that is, overweight resources (both energy and miners) as well as REITs and underweight cyclicals (especially the Banks.)

The current portfolio is here in this chart. Their highest value-add positions have been:

Their value-subtract positions have been:

For those who have access to cross-asset allocations, here is where Nicol and his global colleagues are recommending in 2025:

Europe is EQUAL-WEIGHTED "because of non-trivial exposure to EM, which will see more headwinds in an environment of higher trade tensions." The model portfolio is UNDERWEIGHT emerging markets equities.

EQUAL WEIGHT Fixed Income: "We are lightly positioning in government bonds ... because spread products look more attractive given better carry. We like agency mortgages and prefer USD bonds over EUR within high-quality fixed income."

11 stocks mentioned

2 contributors mentioned