J.P. Morgan warns investors: No "immaculate disinflation" on the cards for markets

Like the movie of the same name, investors have enjoyed an "Everything Everywhere All at Once" rally over the last few months on expectations of the end of the rate hiking cycle.

Take the S&P 500, for example, which has rebounded 11% over the last six months. Or the NASDAQ, up more than 16%. Locally, the All Ords has lifted more than 4% in that same period. Fixed income investments, benefiting from higher official cash rates, are also enjoying a heyday.

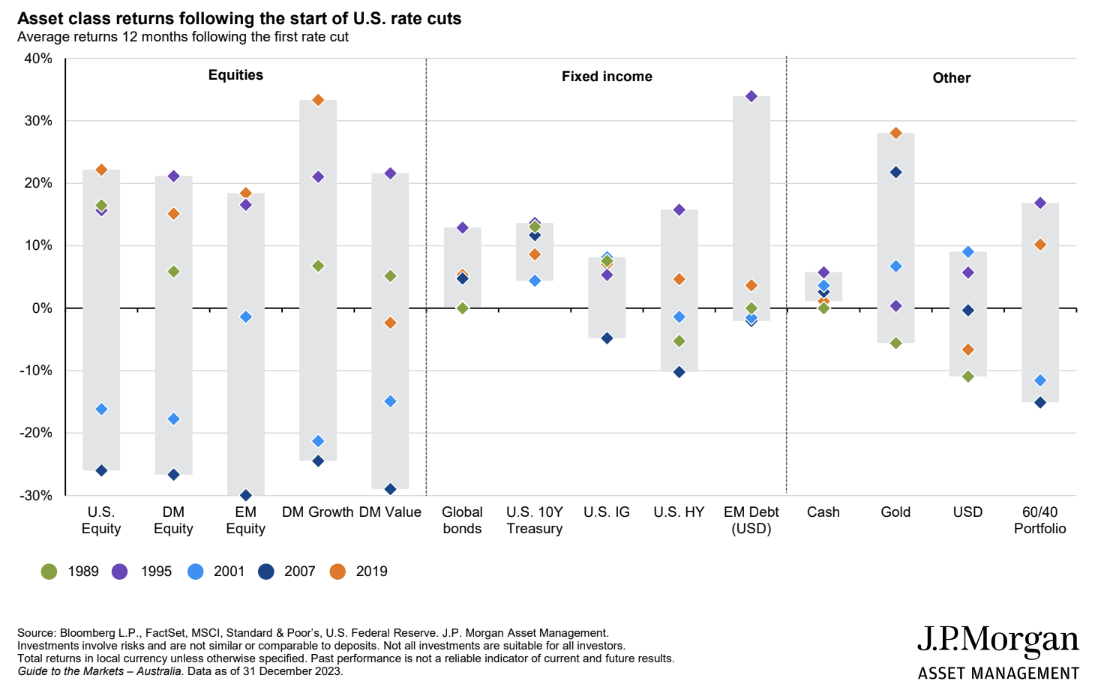

But, and this is the not-so-pleasant part, if we do see a cut (or cuts) over the year ahead, not all assets will enjoy the same fortunes as they have when rates have remained on hold. That's according to J.P. Morgan Global Market Strategist Kerry Craig, who believes asset class performance from here will likely be far more varied.

"This is not the end of a rate-hiking cycle, where everything does well, which is what we experienced at the end of last year," he told a room of journalists on Thursday.

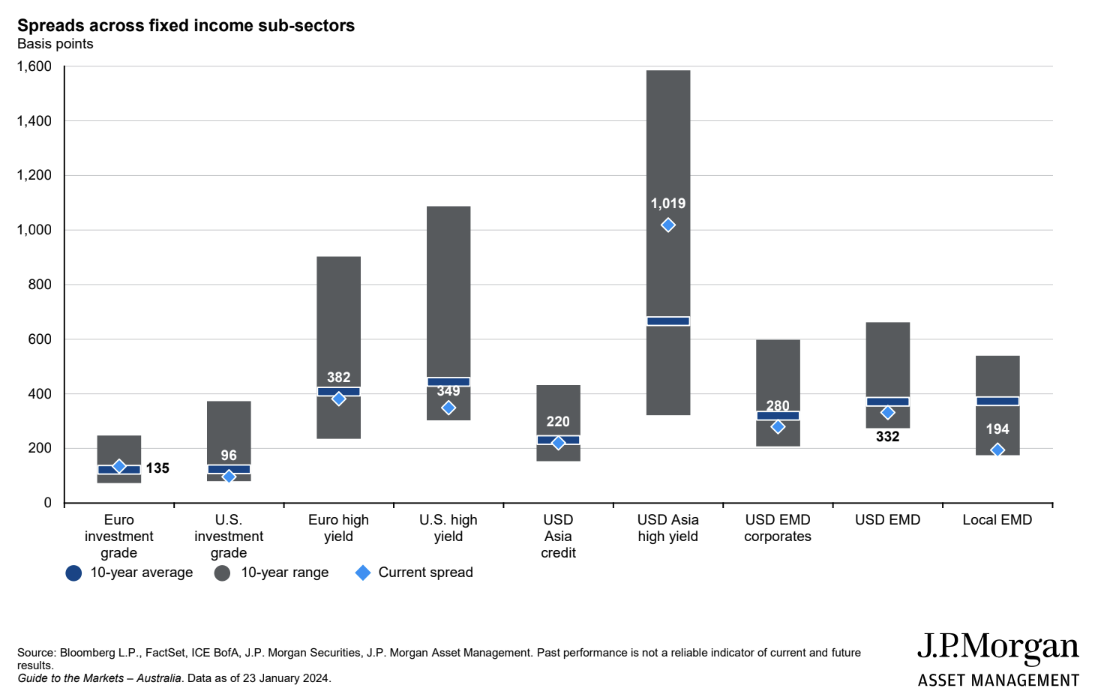

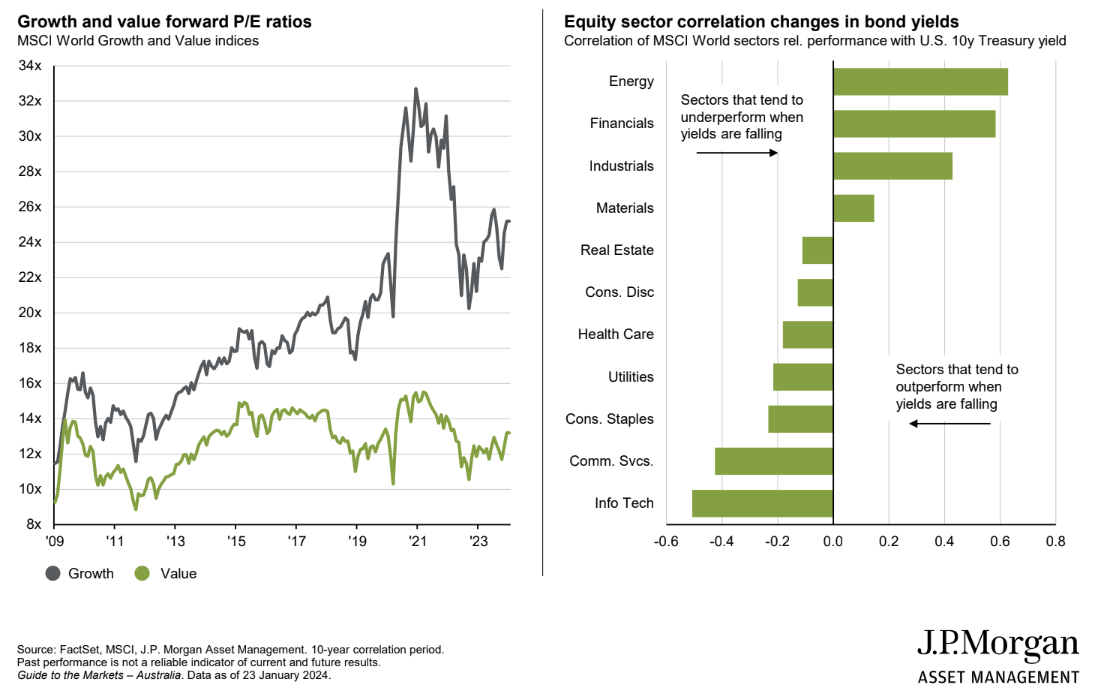

"When we think about a rate-cutting cycle, the asset class performance becomes slightly more nuanced." (see chart below)

That said, Craig still sees opportunities in fixed income, and - as long as we don't have a recession (which he doesn't believe we will), equities will still have an overweight in portfolios - although the skew is definitely more towards quality.

In this wire, I'll summarise some of the key learnings from today's J.P. Morgan media briefing, including where Craig and his usually UK-based colleague Seamus Mac Gorain, Head of the Global Rates team in Global Fixed Income, Currency and Commodities, are seeing the most opportunity (and the major risks) in 2024... and it's not in small caps, as some in the market would have you believe.

Moderate growth but no Goldilocks

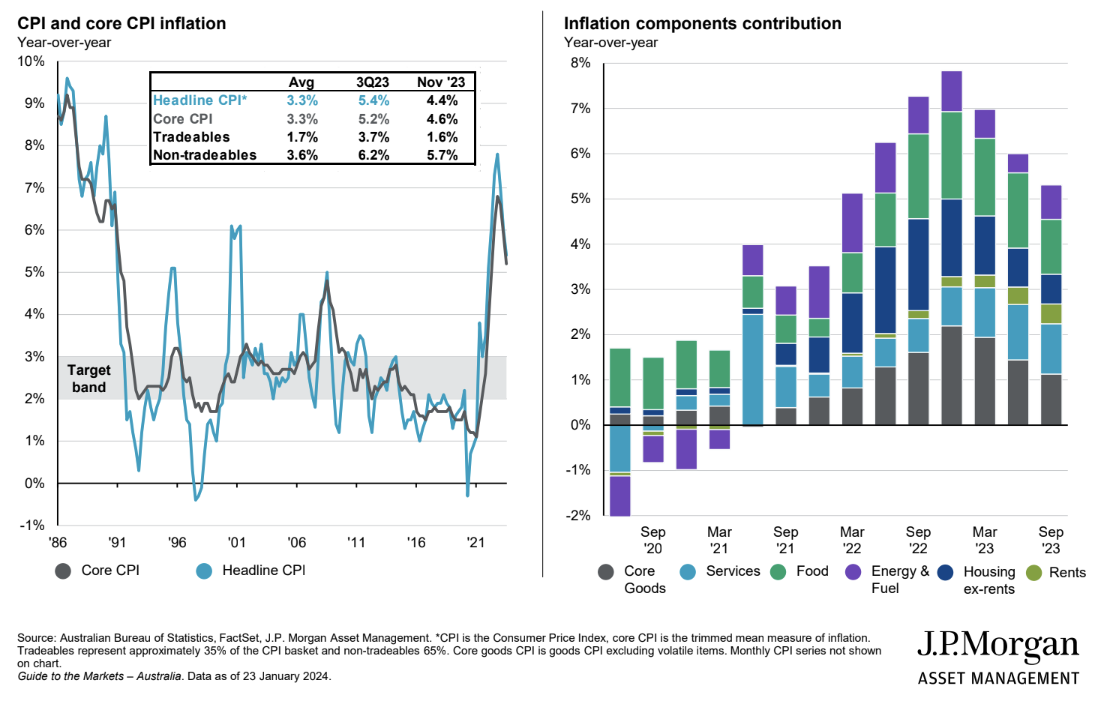

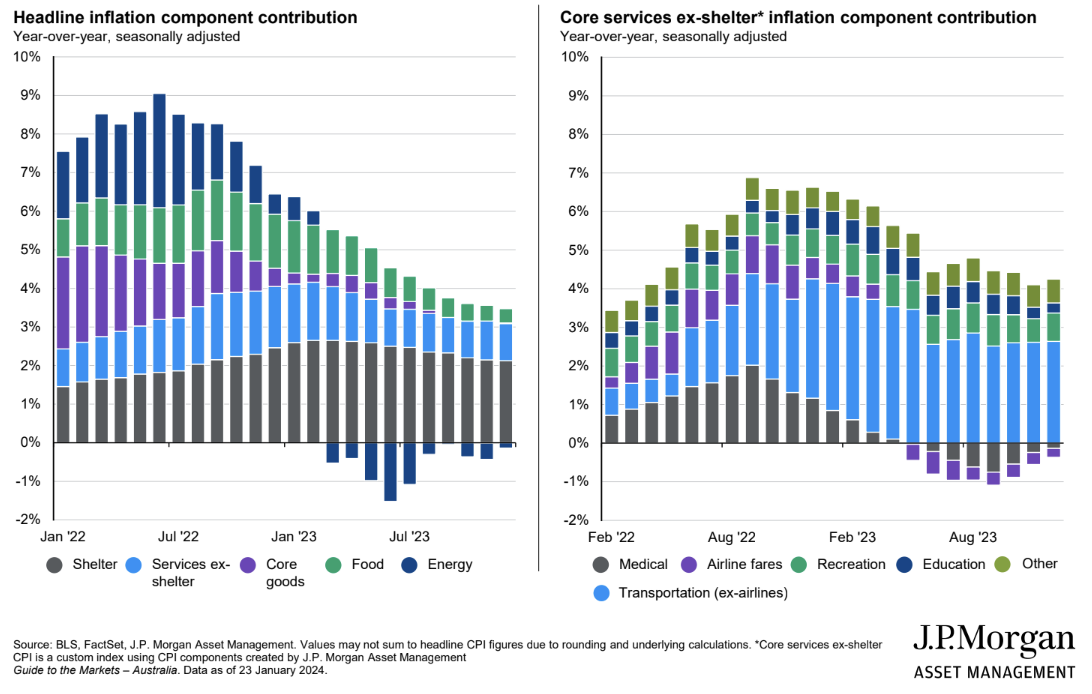

While we may not see "immaculate disinflation" for markets, Craig believes that inflation pressures will cool off over the next 12 months, mostly because higher interest rates are finally taking a toll on the economy (and people's pockets, thanks to higher mortgage repayments).

The growth story of 2023 is likely to slow in 2024, with government support, household balance sheets, and other supportive measures all fading over the year ahead.

So, why have we not seen higher rates bring down economic activity, leading to a recession? According to Craig, it's all in the tight labour market.

"There are signs of loosening, but quite frankly, it's still pretty good out there if you're looking for jobs," he said.

"We still have wage growth in places like the US - which is actually above inflation - so you can think about that real wage outlook normalising, which has been somewhat of a buffer and remains somewhat of a buffer in terms of thinking about why we wouldn't expect the economy to collapse."

So, even though we may get the "soft landing" of our dreams, Craig doesn't believe investors can expect economic growth to accelerate from here - unless it comes from productivity gains from AI - although that's far more likely to be something that develops further out than in the next 12 months.

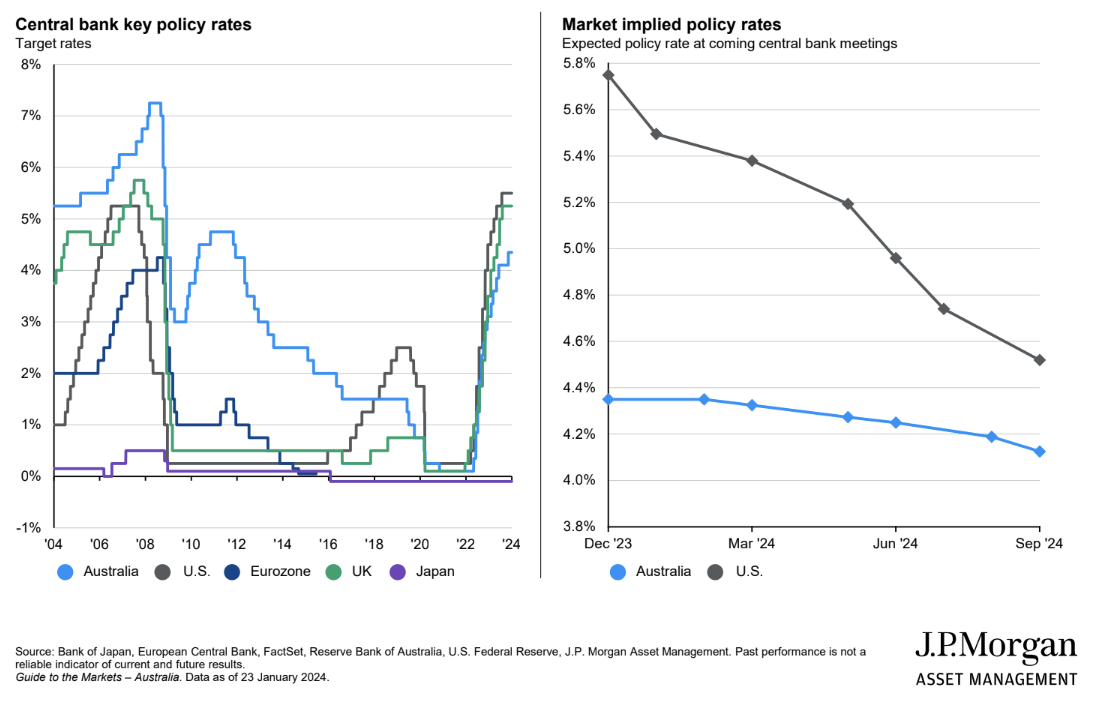

"I think Goldilocks might be a bit strong in terms of how we view the world... But it is one of quite moderate growth around the world and falling inflation but that also means falling rates, which is really the thing driving the markets at the moment," Craig said.

It could take a little longer than expected for inflation to get back down to central bank targets, Craig added, but he's not too concerned about an acceleration in inflation, or that growth could be too strong.

"The end of that rate hiking cycle provided an 'everything all at once' rally and as we think more around a rate cutting cycle, it's a little bit more nuanced in terms of the assets you want to allocate towards and keeping in mind some of those risks that are still out there for the growth," he said.

Where J.P. Morgan sees opportunity in a late-cycle environment

FIXED INCOME

"We do think that duration and state government bonds are pretty attractive. You get a 4% yield in Australia and a 4% yield in the US," Mac Gorain said.

"For the first time in a long time, it's an asset that will give you a decent income but also will give you the prospect of big capital gain if you do see a downturn, whether it's this year or next year or the year after. And so I think that combination of a decent yield and a portfolio hedge is pretty attractive."

Historically, bonds have typically tended to perform well in the two years post the end of the hiking cycle, he added, so duration is pretty attractive today.

"I also think the credit markets are attractive now. This environment of pretty high yields, central banks easing - but easing because inflation is falling, not because there's really poor growth, that's really a bit of a sweet spot for credit," Mac Gorain said.

That's true for all credit, he added.

"But it's especially true for the sectors in credit where their spreads are a little bit wider. That means things like high-grade credit in Europe, AT-1 securities or CoCo bonds issued by banks. And it means things like mortgage-backed securities in the US," he explained.

"Broadly speaking, it's a good environment for duration - for safe government bonds. It's a good environment for credit and it's an especially good environment for credit in the sectors where there's a little bit of room for yield compression."

EQUITIES

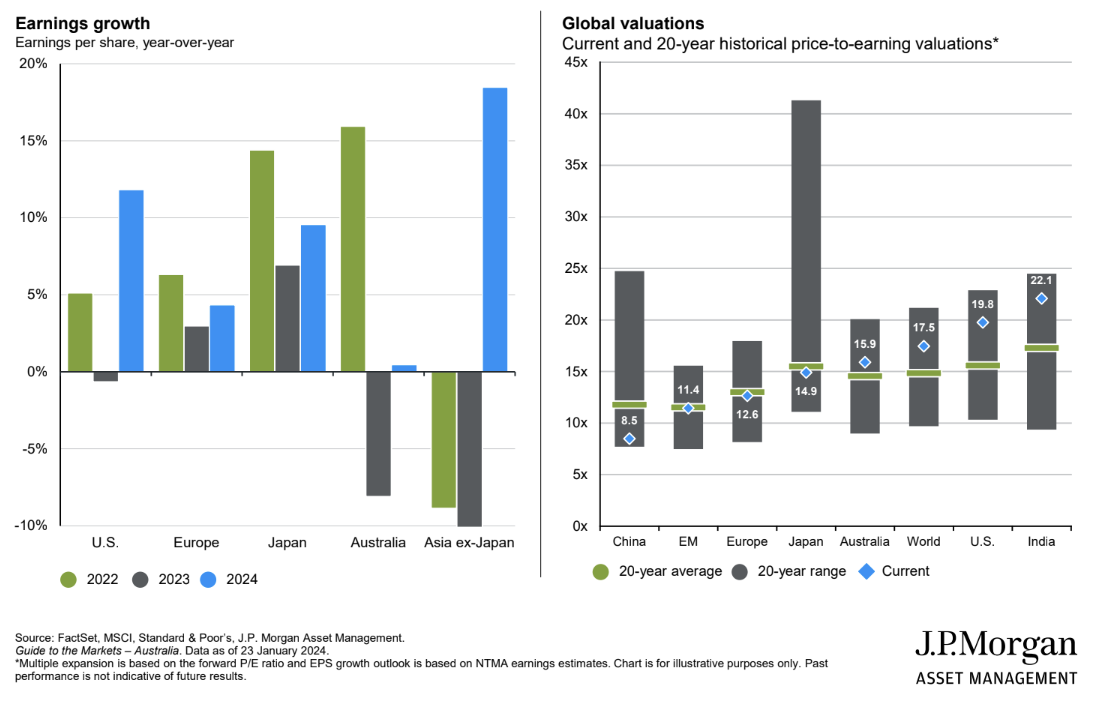

In terms of equities, the Aussie market is trading on roughly 16.5 times on a forward P/E basis, while the US is nudging towards 20 times - so investors can't expect valuation support or a re-rating to drive equities higher.

"It is all about earnings growth and the ability to protect margins," Craig said.

He believes earnings expectations in the US, currently 11% growth over the next year, are too high, and believes that investors are likely to see greater dispersion in the performance of the "Magnificent Seven" in 2024.

"The performance of [the Magnificent Seven] may be a little bit more muted, whereas the other companies are going to beat that hurdle because it's much, much lower," Craig said.

"There is going to be some valuation support as bond yields come down for things like utilities or some of the more rate-sensitive names. And then you are going to see some benefits in things like industrials if the economy doesn't fall into recession - you get that sort of inventory rebuild cycle coming through."

In terms of Australia, Craig predicts earnings growth will be lower than our global counterparts. Japan and Europe look attractive, as do Emerging Markets, but China is likely to continue to struggle in the face of a property crisis.

Interestingly, Craig goes against the consensus when it comes to market cap - he doesn't believe investors are in for a broad-based recovery in small caps.

"There have been no cases of dash to trash in the past which have really paid off," he said.

"I think if we had a stronger view, rather than saying the economy looks relatively stable, the growth is sort of on-trend - if we were thinking about a re-acceleration in growth, but it's hard to do that when you have a tight labour market."

Typically, small caps will outperform post a recession - like they did in 2009, he added.

"We didn't get that recession, we didn't get the thing that would say the economy has got a lot of upside growth to see [small caps perform] really strongly. So we are just a little bit cautious around small caps," Craig said.

In terms of investing locally, J.P. Morgan is still "relatively defensive" when it comes to its portfolio positioning.

"The earnings outlook is still relatively subdued, with valuations being about one standard deviation above their long-run average here in Australia," he said.

"We'd be looking at some of the more rate-sensitive sectors - so utilities, REITs, healthcare for a defensive bias, and being less favourable on some of the consumer side of things - given we still see the impingement coming through on consumers and retail sales numbers being quite lumpy... [and] rates being a little bit higher here for longer than other markets.

"So I would be leaning away from consumer discretionaries, consumer staples and even financials because we think the banks are probably going to face pressure around that."

Craig also sees opportunities in Emerging Markets - in particular, the North Asian economy - such as Korea, Taiwan, and India (although the latter is looking a little expensive) with capacity for improving inventory/goods cycles in these regions.

"There's scope for these central banks to cut rates as inflation has come down to support domestic growth. We're not seeing that in many of the ASEAN economies just yet. And then outside EM in Asia, we do still like Japan to a certain extent," he added.

4 topics

1 contributor mentioned