Jackpot! A growth stock that still screens as cheap

With very little fanfare, Light & Wonder (ASX: LNW) quietly started trading on the ASX last year as a secondary listing of the $8 billion Nasdaq-listed company of the same name founded in 1973 and headquartered in Las Vegas. It offers local investors access to a growing gaming sector that provides products such as slot machines, table games, shuffling machines, and casino management systems.

Under new leadership Light & Wonder has been a turnaround story that has repaired its balance sheet after years of debt-riddled underperformance. Around 60 key employees have joined LNW from Aristocrat (ASX: ALL) - arguably the best-run gaming company in the world. The Chairman Jamie Odell, CEO Matthew Wilson, the Chief Product Manager and the Chief Technology Officer are all Aristocrat alma mater.

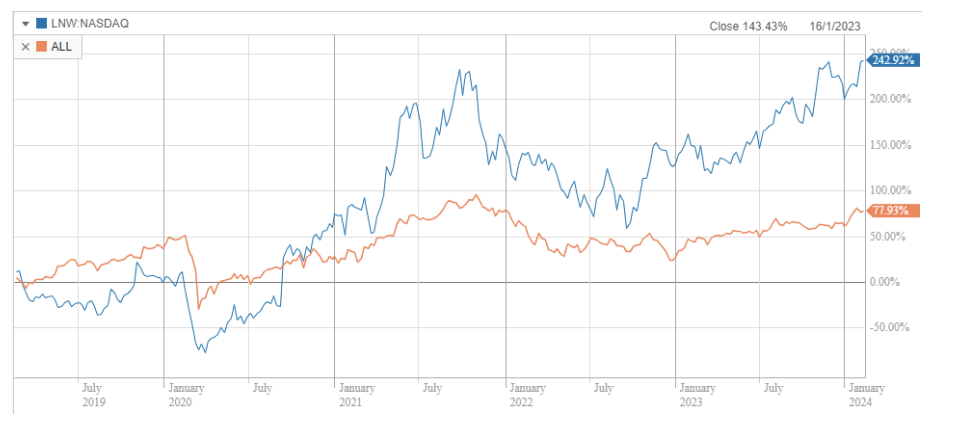

LNW has significantly outperformed ALL since Jamie Odell’s appointment in 2020.

Why does it look cheap?

One ratio we can use when evaluating if a stock is cheap or expensive is the Price/Earnings-to-Growth (PEG) ratio. The PEG ratio will tell you if you are paying a premium for growth or getting it at a discount. A PEG of 1 means that the company is perfectly priced when considering the future growth in earnings per share. Any number over 1 assumes you are paying a premium and a number under 1 assumes you are buying growth at a discount. This data is sourced from Morningstar.

| Ticker | Company | PEG Ratio |

| LNW | Light & Wonder | 0.49 |

| ALL | Aristocrat | 0.96 |

| GOOG | Alphabet | 1.45 |

| TSLA | Tesla | 2.16 |

| ANZN | Amazon | 2.54 |

| MSFT | Microsoft | 2.63 |

When you compare the PEG Ratios of mega-cap Nasdaq-listed growth companies (plus Aristocrat as a good side-by-side comparison) you can see investors are currently paying a premium for growth companies. This could still be warranted, the market's earnings expectations have consistently been beaten and if this continues the PEGs are lower than they appear. Time horizon of course also plays a part. It does tell us though that if Light & Wonder can grow its earnings in line with analyst forecasts consensus, then the share price today screens as cheap.

We’d also add of course that you must use a number of measures when assessing valuation.

2024 holds several catalysts for the company. Light & Wonder upgraded earnings leading into the end of CY23 and clearly has solid sales momentum. The rolling out of several key ‘hits’ in the Australian market across into the America’s will hopefully accelerate that sales growth. The company has put out a goal to the market of US$1.4 billion of EBITDA in FY25.

We would note that having considered a number of analysts' forecasts, the consensus remains well below the company's target. As this year plays out, if the company can demonstrate it is incrementally closing in on its target, there is plenty of room for consensus earnings upgrades and the PEG may be even lower than it currently screens.

4 topics

2 stocks mentioned