KKR: 2 sectors to buy, 1 red flag to watch for as the mid-cycle rolls on

Against a backdrop of rising wages alongside increasing commodity prices and house prices, the recovery of the US economy – and therefore most developed markets – is very different from those that have gone before.

Wage growth, the energy transition and housing are “the three horsemen that will drive inflation structurally higher, with massive investment implications,” said KKR’s head of global macro, Henry McVey, during a recent webinar.

Key points

- Developed markets are mid- not late cycle

- 3 reasons why inflation is structural

- Why it’s different this time

- KKR’s preferred equity sectors

- Which credit markets are best placed now?

In response to his outlook of a “higher resting heartrate” for inflation versus the previous cycle, McVey believes investors should shorten the duration of their credit assets and diversify across asset classes.

“Last year we were talking about getting longer duration to fixed income, but we’ve got almost the opposite message this time,” McVey said.

“Volatility is rising, and financial conditions will tighten but that should happen in what is a constructive environment for growth.”

He believes inflation will be more persistent than financial markets currently indicate.

In simple terms, McVey and his colleagues who manage KKR’s credit and equities portfolios have been shifting from a “buy the index” mentality toward more targeted security selection.

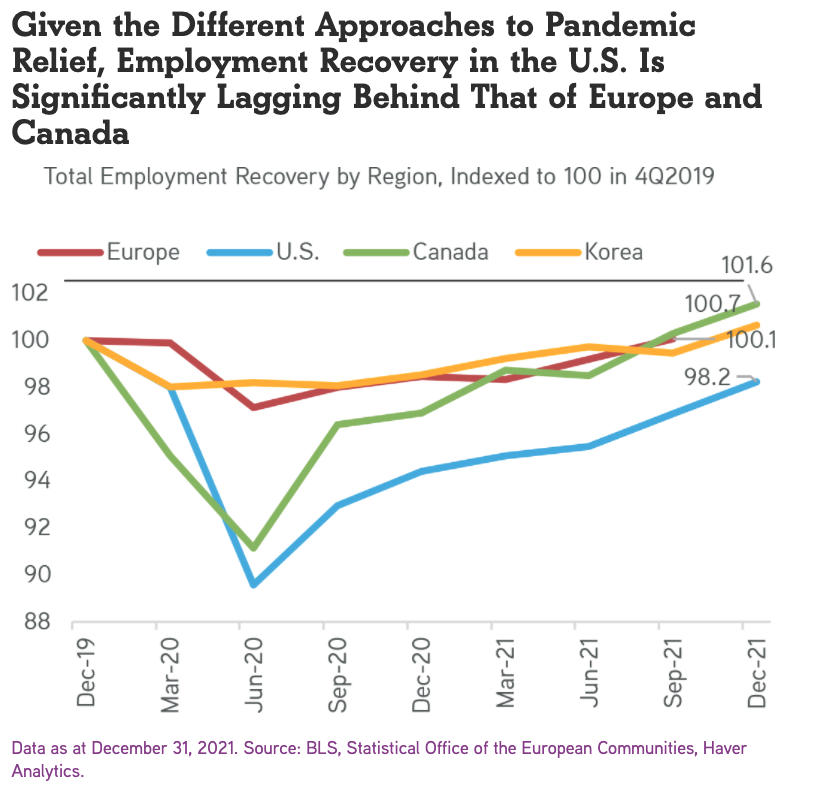

Talking through the implications of what KKR sees as structural labour shortages around the world, McVey noted the phenomenon is most dramatic in the US. North America, where the “great resignation” tag originated, lags most other developed economies in getting employees back into jobs.

As US employees have dropped out of the labour force, it has created lower demand for goods and services as incomes have dropped but has also reduced supply. As McVey explained, something similar occurred in Japan in the 1990s, but:

- Globalisation was a much more active issue then than it is today. For example, the average US salary is now only around four times higher than the average Chinese worker. “This is about 10-times less than it was in the 1990s – you no longer have the same type of global labour arbitrage,” McVey said.

- A shift away from unionised workforces was a persistent issue through the 1990s and 2000s, which is now stabilising. For example, the US$1 trillion Infrastructure Law in the US promotes union jobs and has empowered collective bargaining as the pandemic has highlighted equality issues, especially for lower-wage workers.

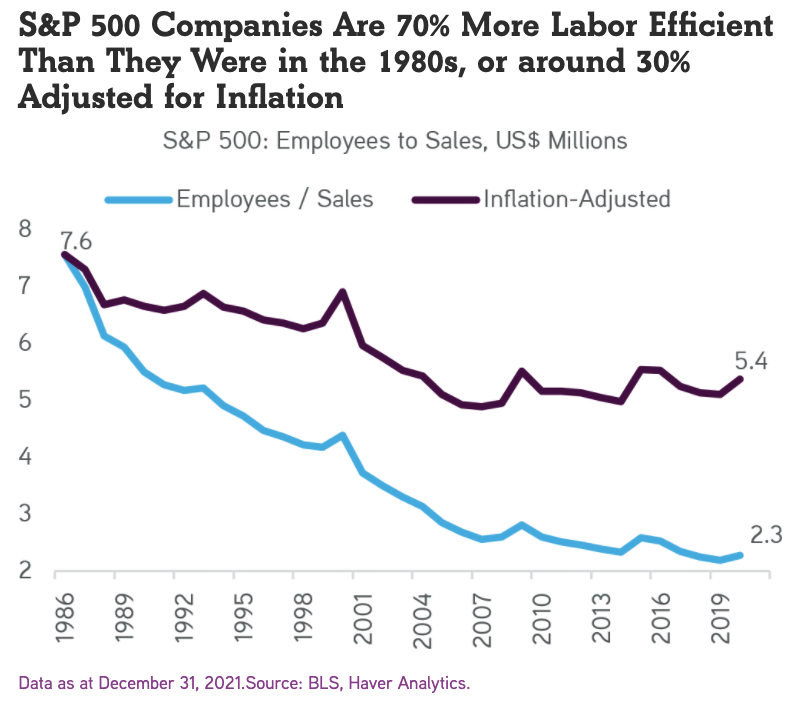

But these factors are offset by the surge in productivity that has occurred inside corporations, as companies learned to do more with fewer people. This has increased margins and reduced the need for price increases.

What this means for portfolios

For equities, this margin expansion should continue to drive earnings of S&P 500 companies throughout 2022 before they start pulling back between 2023 and 2026.

In picking preferred sectors of the equity market, KKR weighs:

- The labour intensity of companies

- An industry’s pricing power in terms of its margins

- Likely turnover of staff.

McVey highlighted companies in the Technology and Communication services sectors as the most appealing.

On the other hand, Consumer and Industrials are the most concerning.

“The punchline is about productivity, pricing power and ultimately about unit volumes,” McVey said, labelling companies that score high across these metrics as the “price makers”.

“Those on the other side are the price takers that could be compromised. This is what we’re seeing in the earnings releases from companies now and we think that story will continue, which ties into our macro view from the beginning of the year for a different kind of recovery.”

And in this environment, he emphasised the need for investors to be positioned for a mid-cycle rather than a late-cycle. Real interest rates will continue to lag during this cycle, and KKR doesn’t see these turning positive again until the middle of the decade.

“Even then, real rates will still be below where we were pre-pandemic,” McVey said.

The draining of speculative stocks

McVey described what’s happening currently in equity markets as a “draining” of speculative stocks, where the proportion of those getting hit is far worse than the index suggests.

“We haven’t seen this type of carnage since 2000 and 2007. The Fed is getting what it wants, IPOs and speculative stocks are getting hit, Growthier stocks and other types of capital formation vehicles are getting hit.”

Despite this, he doesn’t see our current environment as the latter stages of a bull market.

“We think we’re still mid-cycle. Company earnings will still grow because unit volumes will go up but ultimately, multiples will contract. This becomes a stock pickers or credit pickers market.”

Chris Sheldon, KKR’s co-head of credit & markets, said the mid-cycle expansion is characterised by:

- higher growth and optimism

- tighter labour market

- a resurgence of M&A activity

- lower default rates

- neutral monetary policy.

A red flag to watch for

As the market progresses through this mid-cycle, the main red flag Sheldon and his team are watching for is a breakdown in company performance – not just at the level of the debt security or the stock, but in the businesses themselves.

“We’re not seeing that yet,” McVey said.

He argued that in a recession, consumers are usually carrying high amounts of debt at the same time as unemployment levels are rising sharply.

“We’re seeing the exact opposite given the government stimulus, low unemployment and corporate debt has shifted to longer duration, we think credit markets will hang in there better for longer in this mid-cycle phase.”

But at the same time, the longer-term outlook for higher inflation brings more duration risk for credit investors.

How should you think about duration versus yield?

Sheldon believes that even on a broad view of the space, credit markets look good, which has given the KKR team decent yields without taking on the higher interest rate or duration risk.

“But if you dig deeper, not all types of credit are looking so great,” he said, referring to investment-grade credit as an example.

BBB-rated Collateralised loan obligations (CLOIEs) are among KKR’s preferred areas currently. “You get a healthy pickup in yield, you’re floating-rate so have no duration risk, and with defaults remaining low, this asset class should do well,” Sheldon said.

“If you really believe the economy is on a strong footing, defaults are low and rates are moving higher, rotating from a core fixed income focus into credit or the high yield market makes a lot of sense.”

Though the next 12 months is likely to be more volatile than the previous year, the KKR team believes now is not a time to favour investment-grade fixed income.

“It’s a truly unique time. You can increase your risk profile in credit by allocating to sub-investment grade debt or into private credit strategies to pick up incremental return and income without taking a tonne of risk,” said Sheldon.

Read the full report

Click here to read the full report. To learn more about LIT available to wholesale and retail investors in Australia & New Zealand (ASX:KKC) please visit the KKR Australia website.

1 topic