Know your enemy: defining (and dodging) dividend traps

Income investors, many aged 65-years and over, were knocked for six last year as dividends dried up. Each of Australia’s big four banks either suspended or slashed dividends ahead of last year’s interim earnings season, as the financial regulator capped payout ratios at 50% of earnings for FY2020. Other local yield stocks across the healthcare, travel and retail sectors also cut or cancelled dividends.

Of course, this isn’t a phenomenon unique to the COVID crash of 2020, with corporate dividends a fickle beast at the best of times.

What is a dividend trap?

As Plato Investment Management's Peter Gardner explains, dividend traps occur when a stock is trading on a very high historic yield, when in fact earnings and/or dividends are likely to be cut.

“The threat of dividend traps rose throughout the pandemic, as certain industries were significantly impacted,” Gardner says. He believes this risk has decreased significantly in the past few months as the Australian economy has improved, but suggests another dimension of this has now opened.

“A current risk is that particular COVID-winners (such as supermarkets and some consumer discretionary stocks) will suffer reductions in earnings and dividends as re-opening continues and people spend more on experiences (such as travel) and less on goods,” Gardner says.

In the following wire, another fundie and a wealth manager, Merlon Capital Partners' Neil Margolis and Todd Hoare of Crestone Wealth Management, also define dividend traps. They discuss whether such traps are more, or less, prevalent amid post-COVID uncertainty. And Margolis reveals some local names where he believes dividends are severely threatened, alongside a couple of outperformers you might have missed if you relied on headline yield figures.

Biggest dividend upgrade in two decades

Todd Hoare, Crestone Wealth Management

Avoiding “dividend traps” is an important part of building an income-focused portfolio. In a market sense, the term refers to the risk of buying stock in a company purely on the expectation of high dividends. In the worst examples, shareholders can see these dividends reduced or the share price fall – or both.

Unfortunately, COVID-19 has made an assessment regarding dividend traps more difficult than usual. This is because of both the unique nature of the impact and the fact that many businesses saw significant top-line impacts and uncertainty, which in turn caused cuts to dividends. In 2020, around 25% of dividend-paying companies in the MSCI World Index cut their dividend.

Australia witnessed one of the largest cuts to dividends in the August reporting season. On the other hand, we also saw the largest upgrade to ASX200 dividends in 20 years during the recent reporting season. But the COVID repair is still ongoing, as a little less than 80% of ASX 200 companies paid a dividend, versus the long-term average of around 86%. This is higher than the 69% of companies that declared a dividend in August 2020 but lower than the 87% figure of one year ago.

“We never invest on headline yields”

Neil Margolis, Merlon Capital

Dividend traps are when the headline dividend yield is high but the investor either never receives the expected dividend or receives it only to find the share price collapsing shortly thereafter. There are a few possible reasons for this:

- Earnings are about to decline,

- The cash-flow doesn’t match the earnings or

- The company has too much debt.

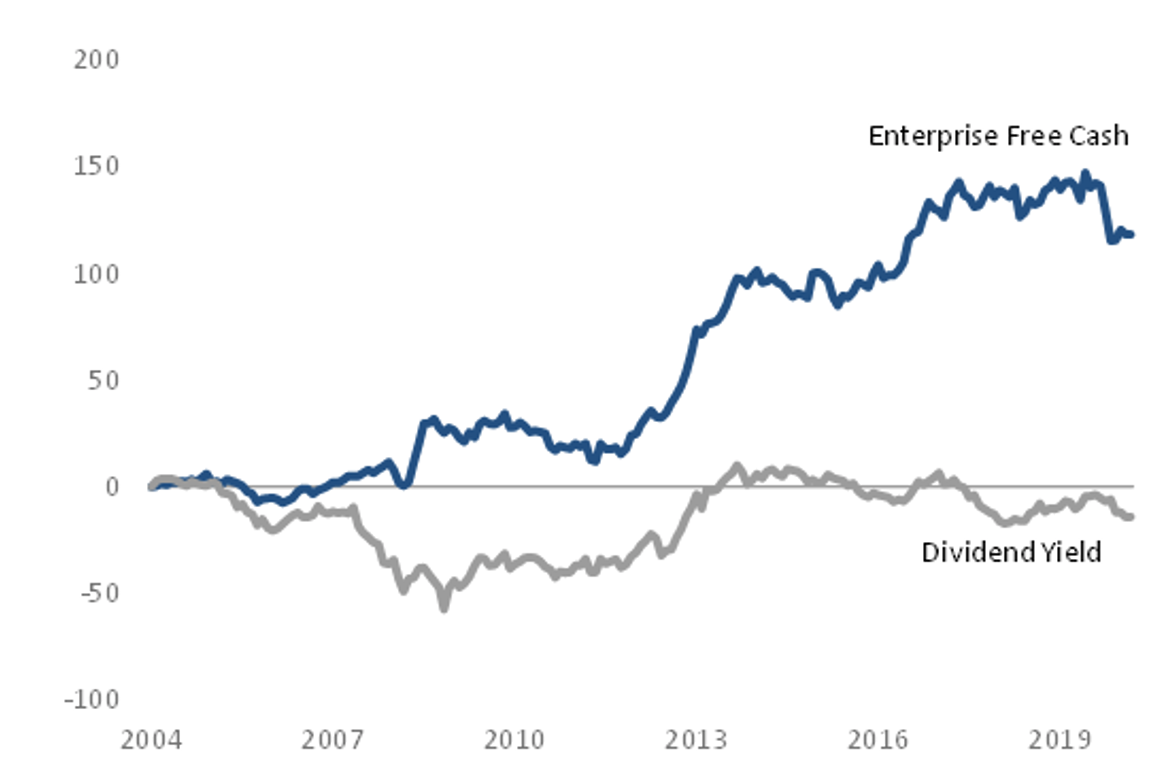

There is an old adage in funds management, that once the forecast dividend yield is above 10%, the yield is unsustainable. For this reason, we never invest on the basis of headline yields. This is supported by our research, which shows an approach based on headline yields is far inferior to investing on the basis of free cash flow.

Free cash flow a better measure than dividends

Source: Merlon, Bloomberg

The threat of dividend traps was high leading into COVID, as many companies took on too much cheap debt and recessions were a distant memory. But while many dividends were cut or postponed, companies generally surprised us with cost-out programs (including government subsidies), fresh equity raisings and debt covenant relief from the banks. The good news is this means the risk of dividend traps now is lower.

Based on Bloomberg broker forecasts, there are only two stocks in the ASX200 with forecast yields above 10%, being Fortescue (ASX: FMG) and Rio Tinto (ASX: RIO), reflecting historically high iron ore prices.

Other stocks with high forecast yields, but which aren’t necessarily dividend traps, include:

- Rail freight and infrastructure firm Aurizon (ASX: AZJ), because the market is concerned about the outlook for transporting coal,

- Furniture maker Nick Scali (ASX: NCK), which is benefitting from pandemic-induced sofa sales, and

- Financial services firm IOOF Holdings (ASX: IFL), because of market doubts around the integration and quality of the MLC business it acquired from NAB.

The futility of relying on headline dividends is best illustrated by companies such as BlueScope Steel (ASX: BSL) and Metcash (ASX: MTS), which cut dividends to zero a few years ago but cash flows recovered, dividends were resumed and the share prices subsequently more than quadrupled.

Conclusion

Investing for income via direct share investing seems particularly fraught, especially if you’re relying on your portfolio for a large chunk of your day-to-day expenses. That’s not to say it should be avoided at all costs. As Merlon’s Margolis suggests above, the pandemic’s clean-out of unprofitable companies, and the survivors’ shoring up of balance sheets, means the risk of dividend traps is perhaps lower than it’s been in years. But it seems clear that taking a broad view is the sensible approach, rather than relying on either trailing or projected yield figures alone.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series. In part one, the contributors discussed how they discern some of the best dividend opportunities. And in part two, our trio each discuss the oversized role franking credits play in Australian company dividends.

3 topics

7 stocks mentioned

4 contributors mentioned