Last call on A$ AT1

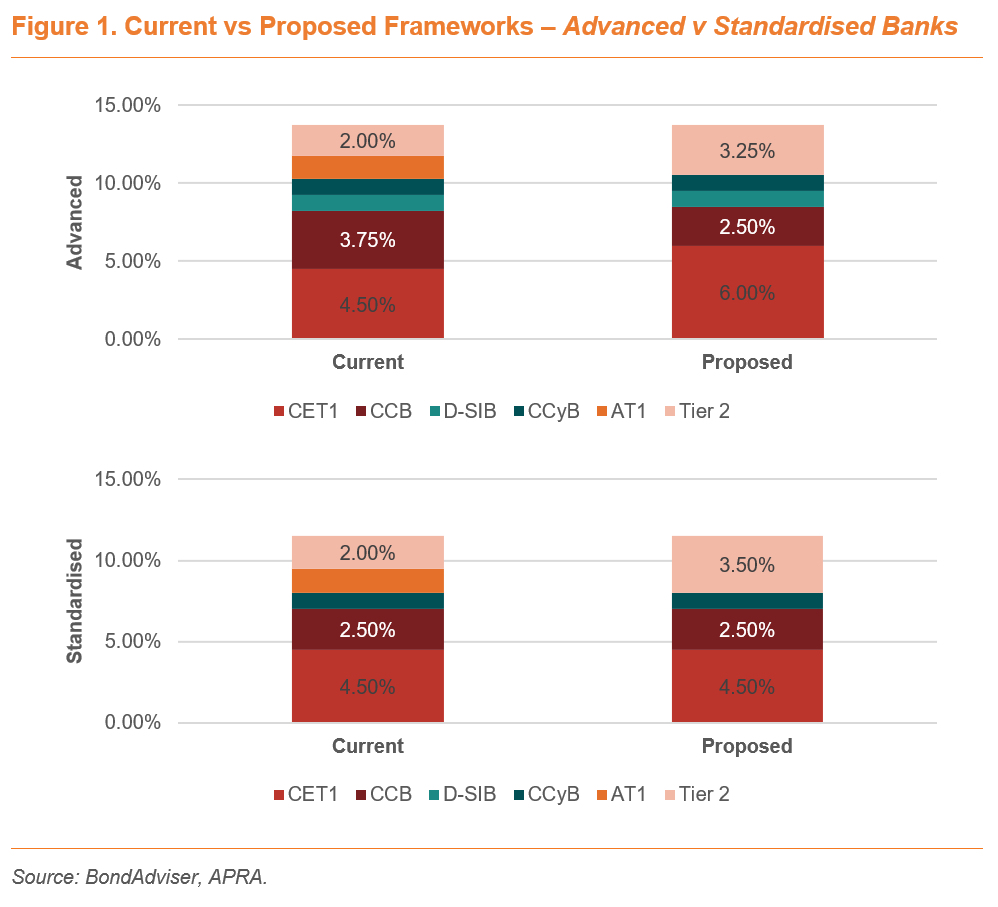

On Tuesday 10 September 2024, APRA announced its long awaited proposed changes on a more effective capital framework for a financial crisis. It is a gutsy document that tears up the playbook on bank regulatory capital funding. APRA wants to simplify the capital framework for banks. It wants to remove AT1 and replace it with mainly Tier 2 and some CET1.

In short, the AT1 hybrid market for Australian banks will cease to exist. For insurers, it looks like it will remain unchanged, for now. APRA does not expect to see banks increase AT1 from current levels or extend call dates beyond 2032.

Here's wonderwall

The transition will be orderly – or so APRA says. From Jan-2027, outstanding AT1 bank hybrids would be eligible for Tier 2 capital treatment until their first scheduled call date. What happens after that is not clear. It is also not clear what happens to bank-related NOHC structures like MQG and AMP.

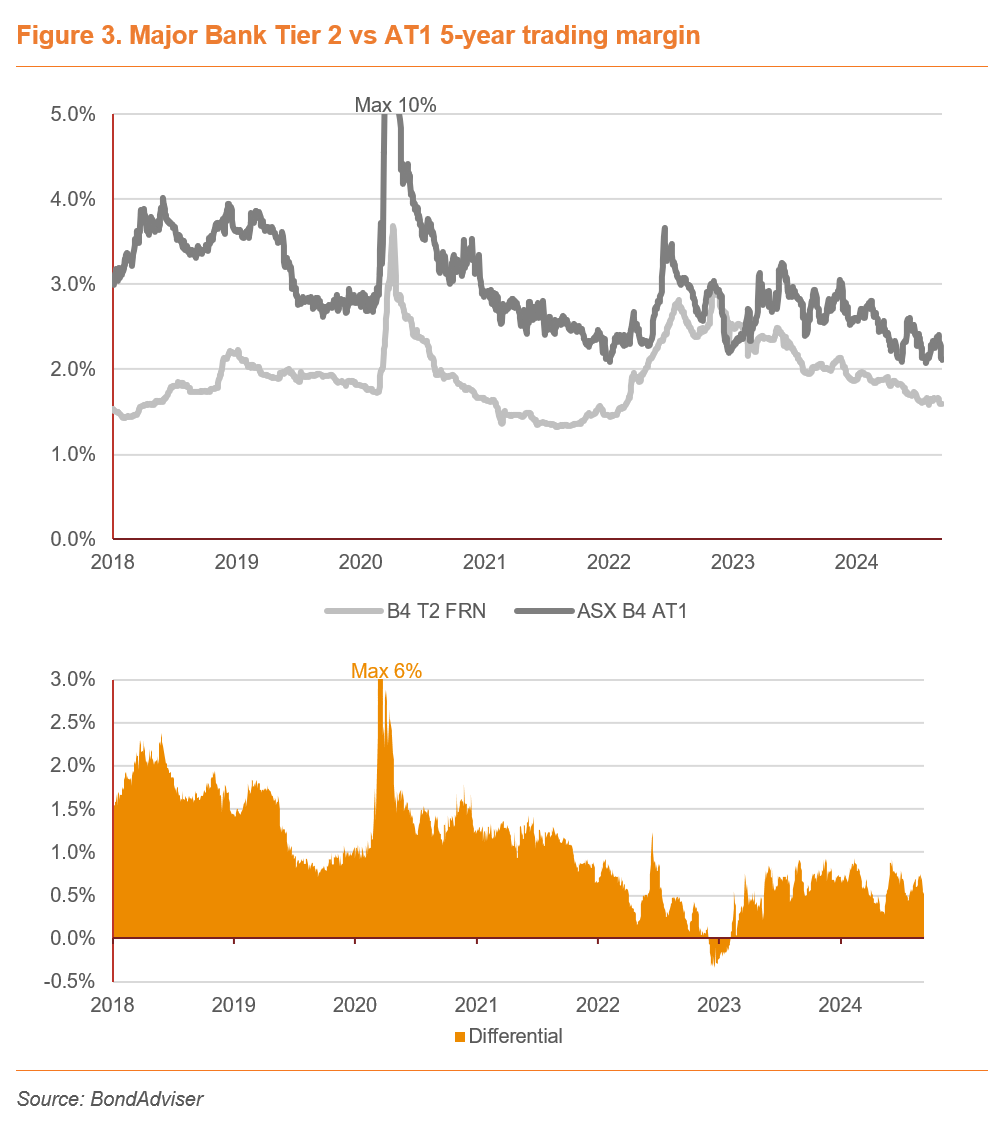

There are obvious funding implications. More Tier 2 supply = wider spreads. Less AT1 supply = tighter spreads. There is a perceived assumption that AT1 investors will just pack-up and roll into Tier 2. Whilst this may be true for the institutional investor, for those that love hybrids for tax efficient franking credits, it seems just as likely they will stay in the hybrid market for up to the next eight years. The point here is that we do not think AT1 investors that have the ability to purchase OTC securities will just like-for-like transfer the demand into Tier 2.

Importantly, APRA’s document has started what appears to be the unofficial transition for bank AT1 capital. It is unclear as to if any more AT1 bank hybrids will be issued. Strictly speaking, APRA does not expect AT1 levels to increase, so a refinance could be on the cards, so long as the call period is before Mar-2032 (NABPK’s first call date). You can make the argument that until Dec-26, ASX-listed bank AT1 transactions could still occur (noting the term is still greater than five years to first call meeting reg-cap eligibility requirements). Assuming otherwise, i.e. no more bank hybrids, then the next ASX AT1 may be issued by CGF, which has CGFPC’s first call in May-2026, closely followed by SUNPH in Jun-26. That is 1 ¾ years away!

Higher spreads in Tier 2 markets increases the risk of uneconomic non-call events. This is not being priced in, particularly for the non-major banks, where we expect the funding impact to be worst at the Tier 2 level – which is contrary to APRA’s opinion. The risk of non-call is not present in the AT1 market.

These are proposed changes. There is still additional consultation being sought. But the Rubicon has been crossed, and it is highly likely that from Jan-2027 the new requirements will be effective, and the official transition will have started.

This will be a gold rush. There is some c.$43 billion in AT1 hybrids locally, the Big Five (including MQG and MBL) make up c.$38 billion of that. Investors will need other forms of income, ideally franked, to replace the AT1 redemptions that occur. There will be a raft of new product issuance to meet this. Winners include LITs, ETFs, MCIs, corporate hybrids, and structured products. We do not think the ASX Tier 2 market will return based on APRA’s strong commentary surrounding the litigation risk of mis-selling, and the contagion risk it would “reintroduce” to the system.

Winners

Insurance: Biggest winners. There

are no proposed changes to the insurance capital requirements. They will be

able to issue ASX hybrids at much cheaper rates given the outsized demand. For reference, these three issuers (SUN, IAG, CGF) only

have seven securities on the ASX worth a total of just c.$2.7 billion.

Mutuals: Whilst

this has impacts to the cost of AT1 and Tier 2 (if outstanding), it likely

makes the cost of Mutual Capital Instruments (MCIs) much cheaper. MCIs were not

referenced in the report, and we think they will not be impacted. Like the

insurers, mutuals will benefit from being able to issue ASX MCIs at tighter

spreads via bigger bookbuilds.

Corporate Hybrids / Listed Bonds: Could we see the return of the ASX corporate hybrid

market off the back of this change to the market? It is possible, and the

insatiable demand for franking credits and steady income means some attractive

funding rates could be found for crafty corporate boards.

Income LITs: Listed

investment trusts have been shunned by new issuers since the removal of

stamping fees. We expect investors to pile into existing private debt products

(MOT, MXT, QRI, et al.), but also for new issuers and products to emerge to

fill the gap.

Losers

Tier 2 bonds: Tier

2 bonds are at risk of three problems. (1) Higher supply, (2) credit ratings

downgrade, (3) extension risk.

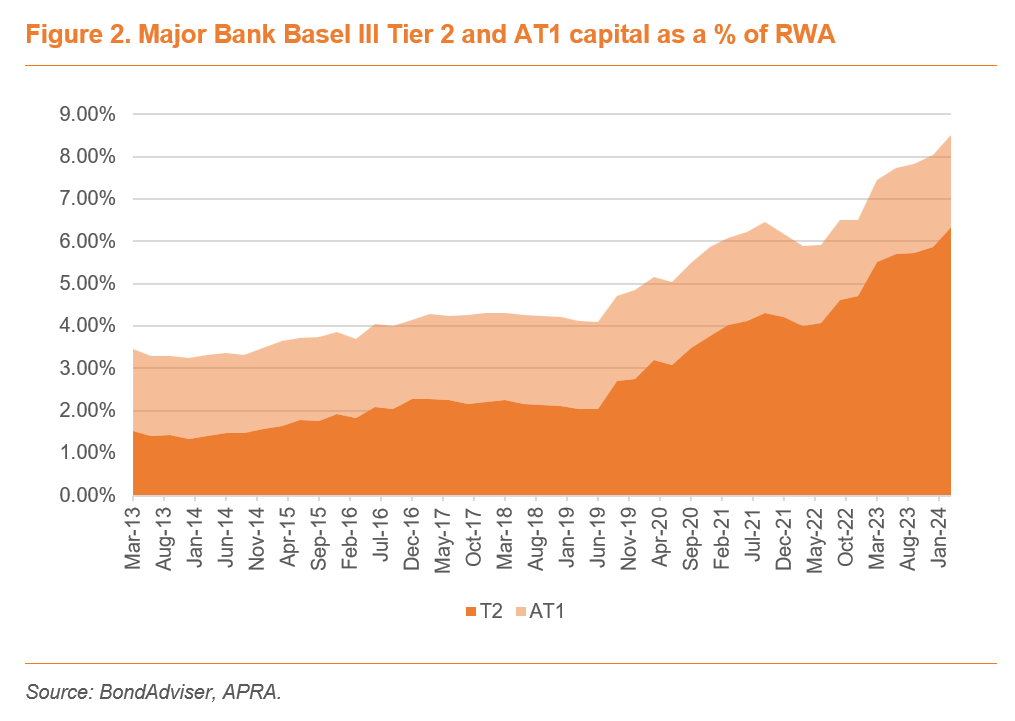

- The passive roll-over from listed-AT1 into unlisted-Tier 2 is not as simple as it sounds. Retail investors cannot access OTC markets and remaining suitors will likely progressively demand a higher premium to swallow up to $40 billion of fresh Tier 2 supply. We question whether $A Tier 2 and legacy AT1 valuations could converge as a result. While APRA has stated it will only require Tier 2 capital equivalent to 1.25% of RWAs to replace the 1.50% minimum requirement for AT1 capital, banks will likely continue to hold healthy buffers as they done historically (the Majors hold AT1 capital over 2% of RWAs for context) and as a preference over issuing more equity.

- Tier 2 instruments are currently notched-down up to 3 notches from senior unsecured ratings of Australian banks (A- versus AA- in the case of the Majors) and will become the secondary layer of loss absorption behind CET1 capital under APRA’s proposals. While there is a lack of global precedent to go off, we question whether Tier 2 capital could be notched down further to account for the additional implied subordination. We note AT1 hybrids are typically 2 notches lower than Tier 2 instruments (or BBB for the Majors). This requires a deeper examination, which we will be doing over the coming days for our clients.

- If Tier 2 spreads trend wider over the coming the years, the outstanding vintage of Tier 2 bonds, issued at tight spreads, may not be called on first date given the uneconomic nature to the issuer of an early refinancing at a higher rate. APRA have been strong on this in the past, and if a 100bps differential opens up the risk is real. We note for this to occur, point (1) and (2) probably have to be correct.

Regional and smaller banks: These banks struggle to attract big orderbooks for Tier 2 as it is. They will have to pay away even more to get the local market to pay attention. Amplifying this is that they do not have great access to international debt capital markets. APRA is assuming that from an all in funding cost the Regionals and smaller banks will actually be better off. We are not convinced this will be the case and expect these bank Treasurers to be rueing the day given the loss of deep funding diversity.

Imputation credit investors: This change means there are less ways for investors to get access to a steady stream of franking credits outside volatile common equity ownership.

5 topics