Less risk more gold

The big drop in our market on Wednesday (19/5/2021), down -1.9% taking the ASX 200 below 7000 again, is being blamed on “inflation” yet again, in which case there is nothing much wrong. Inflation isn’t exactly an Extinction Level Event (ELE) because it’s going to come on slowly and for many sectors (resources, banks) it can actually be good news. Certainly the bond markets are not reflecting a new concern about inflation. This is the Australian 10-year bond yield which continues to quietly trend lower. If inflation was a significant problem it would be spiking again.

The media is looking for an excuse for the market slowdown, and inflation is their choice of worries in the absence of anything obvious. But it's so February 2021. The truth is, this wobble may just be a herd thing, a mood change. The herd momentum is slowing down as the market absorbs the constant references to peak valuations, peak sentiment, peak everything (bubble everything), the Chinese talk down the iron ore price, the banks have gone ex-dividend, the Australian market seasonally peaks now (sell in May and go away); and the news flow is about to fall in a hole as the US results season (a positive) ends (leaving a ‘good time’ hangover) and our next results season is over two months away. Time for a pause. Nothing serious (barring something serious) just a rest.

In our STRATEGY section in the newsletter on Tuesday we listed a bunch of sentiment indicators to watch. Things that reflect market optimism, the mood of the herd. It's a list of indicators you should keep on a watch screen for the day they all turn together, as they have now. They are almost all pointing to a market peak.

Here are three month charts of some of the factors we consider (lead) indicators of market sentiment and can help you spot ahead of time a market top and bottom. They include:

Bitcoin - A global barometer of irrational exuberance. Momentum lost.

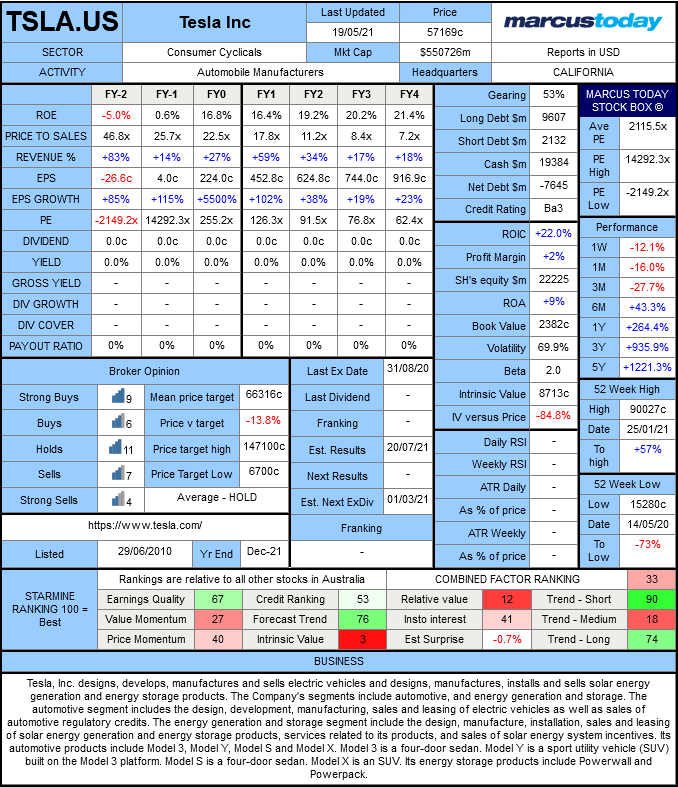

Tesla – Another barometer of risk appetite. Forward PE of 126x. By the way you can get up a STOCK BOX on our website of any Australian or S&P 500 stock. For US stocks find out the code and put “.US” on the end. So Tesla is TSLA.US for instance. STOCK BOX below:

The ASX Information Technology sector - it’s only a small sector in Australia (4.2% of the ASX 200) but it does reflect Australian risk appetite. It has obviously peaked as well.

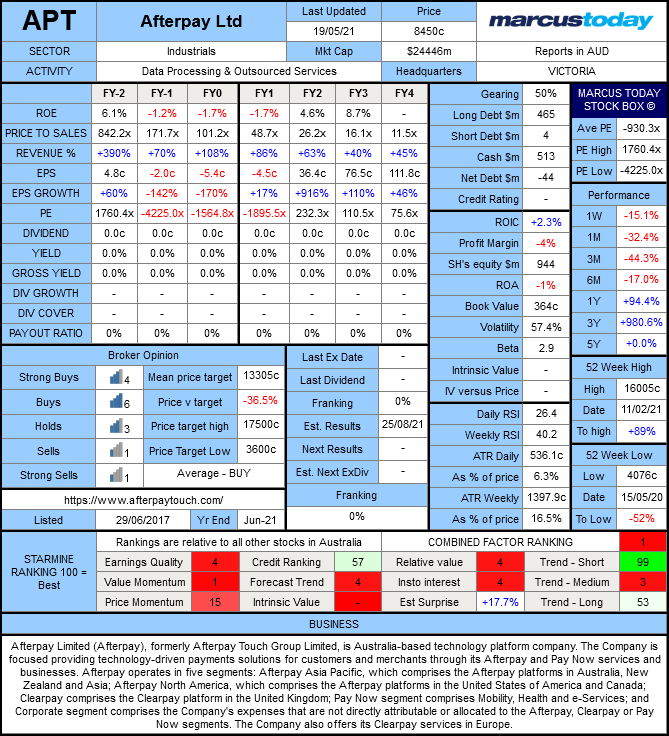

Afterpay (APT) - A stock at the pointy end of the pointy sector. Game over for the moment (I think BNPL has a lot longer to run as a theme and there is a great buying opportunity coming but clearly not at the moment, not in this trend). STOCK BOX below. PE of minus 1895x does tend to scare off the nervous (if only they understood why it doesn't matter).

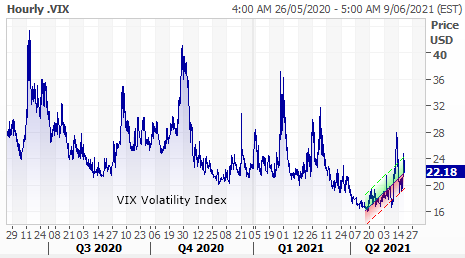

The VIX volatility index (US) is now trending up again. It is seen as a barometer of fear and greed and fear seems to be on the increase. For a moment there we got down to multi-year lows. If you are supposed to buy when others are fearful and sell when others are greedy, this is your index. We are coming off “Max Greedy”.

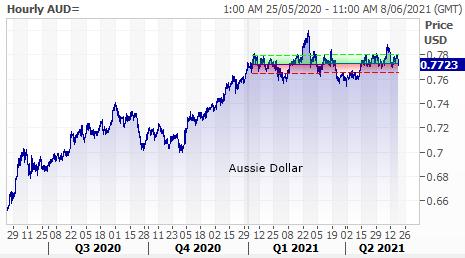

The Aussie dollar - We see this as a reflection of global economic optimism (it is a commodity currency that rises with commodity prices, which rise with economic optimism). The way the iron ore price and metal prices are performing at the moment the Australian dollar should be flying along, but it has plateaued. The recovery optimism has arguably peaked as well.

The Gold price - The Gold price is a hedge against disaster and you can see that it has started to rally in the last couple of weeks, breaking the downtrend. We have bought a couple of gold stocks. Hard to predict but it is telling you something at the moment, somebody somewhere is betting on disaster.

You make your own mind up, but in the last week we have cashed up from zero to 10% (first time we've cashed up this year), we have sold technology stocks and bought a couple of gold stocks. Just in case.

By the way, our morning strategy debates this week have all been about whether we should cash up more.

(Opinions on the market are short-term and subject to regular change!)

If you would like a free, 14-day trial of the Marcus Today newsletter, which includes a STOCK BOX on every stock in the All Ordinaries and the S&P 500 (and we can add others on request) - Click here.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

1 stock mentioned