Lessons in avoiding value traps

Travel, asset tours, and spending time with line or operational managers is part of the everyday research effort in investment management. I recently spent two weeks in the US visiting a number of companies, their competitors, suppliers, and industry experts across a broad range of industries and sectors. The trip reinforced the importance of avoiding value traps.

In addition to constant due diligence on portfolio holdings, a lesson I learnt early in my career is that underweight positions can hurt investment performance just as much as an overweight holding.

What I mean by this is that Alumina (ASX: AWC) (a stock we do not own), the second largest index stock in the small-cap benchmark (at 1.7%), is equally as important to our investment performance as Hansen Technologies (ASX: HSN), an important position in our portfolio (+1.7% active).

This means we spend just as much time looking at large, non-portfolio stocks as we do portfolio holdings, ensuring that our conscious decision to not own them is grounded in sound investment reasoning and supported by appropriate due diligence.

My trip to the US was insightful on both fronts.

Most relevant to our direct portfolio holdings was time spent in Indianapolis with PWR Holdings (ASX: PWR) and Telix Pharmaceuticals (ASX: TLX), meetings in Chicago to see competitors of AUB Financial (ASX: AUB), time spent in New York City and San Diego seeing Webjet (ASX: WEB) competitors, and a stop in Los Angeles with peers of Integral Diagnostics (ASX: IDX).

With respect to non-portfolio stocks, I also spent a considerable amount of time meeting with a number of listed and unlisted companies in the automotive retailer and car dealership space.

The key takeaways from my research trip were:

- New car supply has been normalising in an orderly fashion post-COVID, with car manufacturers fixing their supply chains at different times.

- USA dealerships have seen a reversion of gross profit margins from their COVID highs. In fact, the CFO of a large national dealership was adamant that gross profit margins would most likely overshoot to the downside and then settle back to their pre-COVID levels. This forecast was based on her observations on the behaviour of car manufacturers, who have begun employing more aggressive tactics to win back market share.

- Digging into the granularity of the industry, electric vehicle (EV) take-up in the USA looks to have peaked at levels well below expectations, with only 7% of new car sales being EVs (and trending down). This is much lower than nations such as Norway (80%), Sweden (32%) and China (22%). The primary reasons given are related to the lack of charging stations, the uncertainty and risk around the resale value of an EV, and the costs - given the US has limited subsidies compared to many EU nations. In the US, hybrid vehicles have been the clear winner (15% of new cars sold).

- Surprisingly, dealers are yet to see buyers trade down, which is usually the first sign of a weakening consumer.

The Australian automotive sector: Undervalued or value trap?

At this time, our Small Companies Fund is not invested in any Australian listed automotive retailers, despite all of them trading on very low price-to-earnings ratios (a traditional marker for a “cheap” stock). In our opinion, the automotive retail market is traditionally a very tough industry, characterised by razor-thin margins due to dealerships competing aggressively to sell a car to a consumer that has a multitude of options.

Surprisingly, COVID was a blessing for the industry, with the reduction in new car supply, coupled with government handouts, resulting in demand for new cars far exceeding supply. Discounting quickly became a thing of the past, with patchy supply and long wait times enabling dealerships to sell vehicles at the undiscounted sticker price. Who didn’t hear of anecdotal stories of people buying display cars for more than the price of a new vehicle because they didn’t want to wait 12 months for delivery?!

This type of consumer behaviour saw dealerships including Eagers Automotive (ASX: APE) and Peter Warren Automotive (ASX: PWR) double their margins and profits. These “supernormal profits” meant these stocks appeared to exhibit “value” characteristics, as they were trading on low price-to-earnings ratios. For Tyndall, the key to avoiding value traps is to value companies on sustainable earnings, rather than capitalising companies when they are overearning.

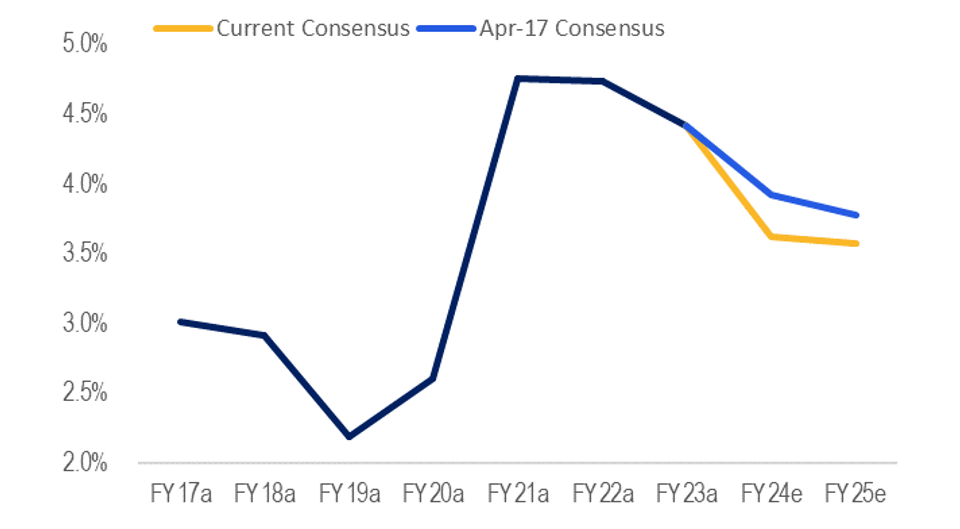

As can be seen in Figure 1 below, the market believes car dealerships will deliver structurally higher margins, and thus structurally higher profits. Our investment thesis on why we avoided this segment was that once new car supply normalised, so too would margins, and thus profitability.

My trip to the US and our dealings with comparative companies have reinforced our investment thesis; the US market – typically six months ahead of the Australian market – is witnessing a reversion of elevated margins.

Figure 1: APE’s Historic Profit Before Tax Margins and Consensus Expectations (pre and post-earnings downgrade)

Source: FactSet, July 2024.

How are these insights likely to play out? In the past month, we have seen both Eagers Automotive and Peter Warren Automotive downgrade earnings, as the normalisation of new car supply led to greater discounting, and thus a compression of profit margins.

The question we continuously ask ourselves is whether the share price reaction provides a good opportunity for a value investor. As can be seen in the chart, our view is that while the market has downgraded expectations, expectations are still too optimistic around the industry’s long-term prospects, with APE’s margins still being capitalised well above historic levels (and even post the recent downgrade).

Therefore, we believe that buying low P/E automotive retailers is more likely akin to buying value traps, where the earnings downgrade will more than offset the current low P/Es. As a result, we remain underweight the sector in our portfolio.

Disappointing demand for EVs (and what this means for lithium)

The final key insight from this trip was the demand, or lack thereof (!), for EVs, and therefore a key commodity that underpins EVs, namely lithium. Due to its efficiency in high-stress situations (unlike lead acid, temperature fluctuations don’t impact its efficiency), lithium is a key commodity in EV batteries. In fact, 75% of the current demand for lithium is specifically for EV vehicles.

As the second largest auto market in the world, the slower uptake of EVs in the US clearly has ramifications for lithium demand. Against this backdrop, it is difficult to envisage lithium demand surprising on the upside. As a result, we also continue to avoid this sector until we see a more balanced supply and demand dynamic.

In summary, while gathering insights into portfolio companies is always rewarding, it’s equally important to generate insights into non-portfolio stocks. Capital preservation is a key aim of our Small Companies strategy, meaning our work to avoid value traps is equally as important as our research to uncover the next hidden gem.

8 stocks mentioned

1 fund mentioned