Listed Credit: Are you getting the diversification you're looking for?

In the writings that I have done to date, I have focused on growth assets. At CTE, we also manage a portfolio of credit investments through our Credit Opportunities Trust. Analysis we have done of this asset class segments has revealed some counter-intuitive results that merit consideration in your investment decision making.

At CTE, we spend a lot of time thinking about effective diversification. It is a well held belief that credit investments in general have very low correlation with equities. While this is often true, our recent research shows that there is one area of credit where this correlation is not as low as one might believe.

In this article we discuss:

- the level of correlation of listed credit with the equities market;

- the impact of market crises on listed credit products;

- the risks of using listed credit assets as a diversifying option; and

- some of the pitfalls of listed credit compared to its unlisted cousin.

So, we start with the premise that credit and equities have a low level of correlation. And if the only data you had was the chart below, that conclusion with respect to listed credit in Australia may broadly hold true.

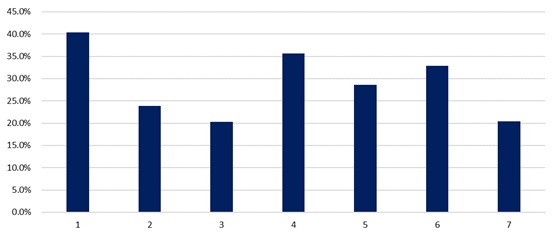

Chart 1 shows the correlation of seven randomly selected ASX listed credit funds with the ASX200 index. The correlations range between 20% and 40%, which would lead an investor to believe that they are making a reasonable investment decision by investing in one or more of these funds to achieve diversification against the Australian equities market.

Chart 1: Listed Credit Fund correlation with ASX 200 index

Note: Each column represents the daily correlation between an ASX listed credit fund and the ASX200 index from its inception to 31 October 2022

Source: Refinitiv Ltd, CTE analysis

However, there are many factors that come into play in analysing correlation. Analysing aggregate data often leads to generalisations. In this case – equities and credit – there is a fundamental difference between the upside and downside cash flow possibilities that has a material effect on their correlation.

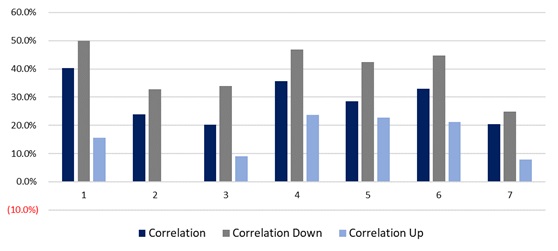

If one splits the data from Chart 1 between up and down days for the ASX, we note that the downside correlation of these funds is significantly higher than the upside correlation (Chart 2). The implication of this is that when the ASX 200 goes down, these listed credit investments are far more likely to fall than when the ASX 200 goes up.

Chart 2: Listed Credit Fund correlation with ASX 200 in Up and Down markets

Note: Correlation shows the data from chart 1. Correlation Down shows the correlation for each ASX listed credit fund with the ASX200 index on days when the ASX200 recorded a negative return. Correlation Up shows the correlation for each ASX listed credit fund and the ASX200 index on days when the ASX200 recorded a positive return.

Source: Refinitiv Ltd, CTE analysis.

Correlation of between 40 and 50% indicates a moderate not a strong correlation. However, it is significantly higher than one might seek in building a diversified portfolio and the skewness represents a factor that may not have been built into an investor’s decision process, especially when the skewness goes against the investor.

There are two major contributors to these results: skewness of returns and the power of beta.

Return skewness

The return profiles on debt and equity investments are inconsistent. With any credit investment the maximum capital return that one can expect to receive is the amount of the loan; hence, the upside is capped. This is not the case for equity investments, which can grow in capital value to perpetuity. On the downside it’s a different, but consistent story. Both investments can go to zero; hence in a down macro market we observe higher correlation.

The power of Beta

It is well understood that the primary driver of all returns on a market is the market itself. If markets go up, most shares go up. If markets go down, most shares go down. This is the same but to a lesser extent for listed credit investments.

But the story does not end there. Correlation is a directional not a relative measure of relatedness. It measures the relationship of the direction – up or down – between two variables, but not the amplitude or, importantly, the causality. So, while there may be a higher level of correlation in down markets, one might expect that the magnitude of the fall in credit investments would be lower than for equities, so an investor still has a level of protection.

Yet, in the last two major down equity periods in Australia, many of these listed credit funds performed significantly worse than the market itself.

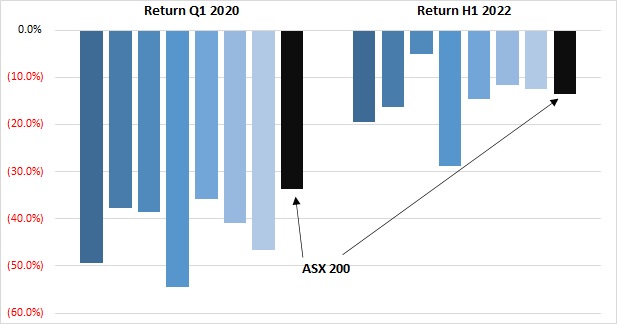

Chart 3 below shows the performance of these seven listed credit funds and the ASX 200 in two recent times of crisis being Q1 2020 and the first half of CY 2022. As can be seen in most instances these funds experienced drawdowns larger than the market itself.

Chart 3: Listed Credit Returns in times of Crisis

Note: Each data set records the return on each listed credit fund for the period in question in comparison to the ASX 200. These returns do not include distributions.

Source: Refinitiv Ltd, CTE analysis

One of the primary reasons for these material drawdowns in these credit funds is liquidity. The market capitalisations of these funds are materially smaller than those of the large Australian companies in the ASX 200, and their daily trading volumes are significantly lower. In times of crisis these funds can suffer major liquidity drawdowns, when investors are all running for the door and demand disappears.

Conversely, this factor should be expected to assist in price recovery as demand returns to the market. Yet, in comparing the data by the time that the ASX had fully recovered its losses, most of these funds were still experiencing material drawdowns compared to their previous highs.

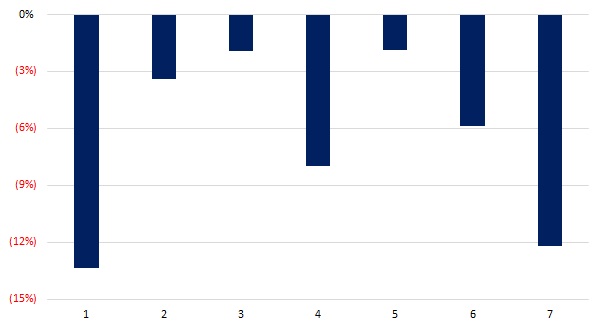

Chart 4: Listed Credit position after Market Recovery

Note: Shows the difference between the price of each security between the market high of 16 December 2019 and the day of the markets recovery to that position.

Source: Refinitiv Ltd, CTE analysis

Some of these companies have had (and still have) net asset values materially higher than their market price. However, their security prices have still not fully recovered since the March 2020 drawdown, some 2.5 years later [ii]. One would expect that this discrepancy would diminish to zero and, with time, one should ultimately receive all capital back as market rationality returns. Unfortunately, that in some respects defeats the purpose of having a listed product.

The last factor that I wish to discuss is risk.

Risk is a very complex metric. Few think of upside volatility as risk. They just think of that as superior return. Risk is really seen as the potential for downside capital loss. Yet in finance, risk is measured by the standard deviation of an asset’s price movement both positive and negative.

Put simply, if a product has a higher standard deviation than another, it is seen as a riskier product because the possible range of future return outcomes is higher. For an investor to receive a fair compensation for taking on additional risk, they expect to receive a higher return. On that basis, one would expect that as these listed credit funds have lower returns than the market overall, they would have lower risk profiles as well.

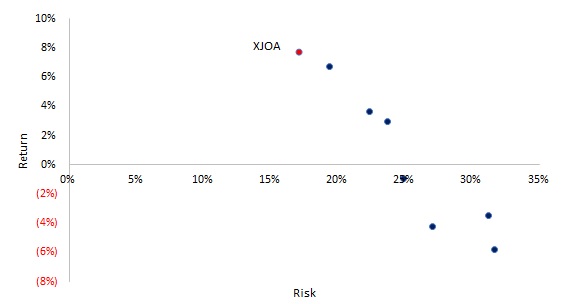

Yet once again this did not prove out. If we plot the returns of these listed credit assets and the ASX200 against their risk, we see that in all instances risk, as measured by standard deviation of the market price is higher and return is lower than the broader market.[iii]

Chart 5: Risk vs Return

Note: Shows the risk of each of the seven listed credit products for the period from inception through 30 September 2022 against the annualised return for the same period. Also shows the same risk and return data for the ASX200 Accumulated Index (XJOA) for the longest dated fund.

Source: Refinitiv Ltd, CTE analysis

So, what does all this mean? …

- It is important to understand that the best one can hope for from an investment in a listed credit fund is the return of all of your capital plus the yield of the underlying credit investments[iv], yet it is possible to lose it all.

- In times of crisis, drawdowns can be very material; often more than the market itself.

- The impact of the market and the skewed nature of credit returns is such that there is more medium-term downside risk than upside risk in a listed product than an unlisted one.

- While investing in listed credit is convenient and generally reasonably easy to get into, in times of crisis it may not offer an investor the level of diversification, liquidity and protection that they were expecting.

- In times of crisis markets tend not to distinguish between asset classes and drawdowns may be irrational.

- It might take a significant period of time for these irrationalities to be removed. Investing in listed credit investment may come at a cost at times of low liquidity. As the old adage goes: “the market can remain irrational for longer than you can remain solvent” – J.M. Keynes.

… and what can you do about it?

Options in this case once again depend on whether or not one is a Retail or Wholesale investor. However, it's not as bad as is the case when one is making equity investments. There are a number of unlisted credit funds that offer varying degrees of liquidity that can be accessed by both the retail and wholesale investor.

As always, it is critical to do the appropriate level of due diligence to understand whether or not the investment is appropriate for you. In terms of its expected return, risk and liquidity.

Unlisted credit investments generally have the benefit of a fixed life. A complete understanding of an investor’s own cash flow needs will enable them to match their cash flow requirements with the maturities of those unlisted credit investments.

Finally, investors must always know what they're investing in and what the underlying assets are in their investment. In equities, a mining stock is different to a tech stock, which is different to a consumer discretionary stock. Similarly in credit, both listed and unlisted, the underlying investments are different. While coming under the classification of “listed credit” the seven examples here are invested in materially different assets. Credit can be investment grade or sub investment grade; secured or unsecured; domestic or foreign; first ranking or mezzanine. These and many other factors are critical in determining risk and expected returns and hence appropriateness.

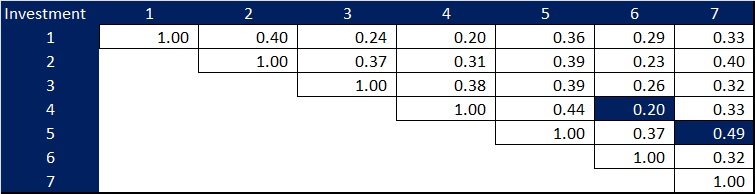

To illustrate, the table below details the correlation between each of these listed credit investments. As can be seen, certain of the investments have substantially higher correlations to each other than others, which similar to building an equities portfolio, is another factor that should be factored into an investor's analysis in building a diversified portfolio.

Table 1: Correlation between Listed Credit Investments

Those who read my last article may recall that I used a Mark Twain quote and it seems appropriate to use another one here.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain.

Credit, while generally lower risk than equities by reason of its equity protection, is still fraught with risk and requires a high level of analysis and understanding. Most importantly, an investor must ensure that it meets their investment criteria and long-term investment goals.

NOTE 1: This article does not address the change in the nature of the relationship between equities and bonds from zero or negative correlation to a positive correlation. This topic is covered in a different article entitled Will bonds protect you in the future?

NOTE 2: This article considers the returns over the past five years from a set of credit products listed on the Australian Stock Exchange. It considers a subset of the entire data set and a relatively short period of time from an investment horizon perspective but for each of these products covers the entire period of listing.

It is not designed as an academic review but to highlight some of the risks associated with the listed credit asset class[i]. It is definitely not a comment on any individual listed credit product.

CTE Investments has and will continue to invest in this asset class including some of the products in this analysis. However, it is important to understand that we invest in listed credit for a variety of reasons, not just for yield or diversification from equities. We understand the risks associated with these products and feel you should too.

[i] As is the case with all analysis we do, we have included all data reviewed in this paper and have not excluded any information that disproves our hypotheses. We consider that the seven examples in this analysis represent a fair sample of the market.

[ii] A number of these funds have excellent credit management teams and did not experience any diminution in the net asset value of their assets. The reason for the decline in their security prices is purely market sentiment.

[iii] In completing our review, we noted that a number of the investment managers preferred to disclose both return and standard deviation compared to the net asset value of the product rather than the market price, as this artificially improved returns and lowered standard deviation.

[iv] If one buys one of these investments at prices above or below their net asset value, the argument changes. This statement also ignores, for simplicity, the impact of any warrants or convertibility clauses that may exist in a credit instrument.

3 topics