Listed Investment Company (LIC) options: Ready to strike?

This article intends to help investors understand the history of the LIC market that led to the innovation of LIC options, as well as the current LIC option market. It will furthermore provide a user guide should an investor own or wish to own LIC options.

According to the Morningstar/ASX LIC series report for August 2018, the 105 listed investment companies (LICs) trading on the ASX have a combined market capitalisation of approximately $40 billion. The sector, which dates back to the 1920s, has evolved significantly over the last decade courtesy of favourable legislative changes, the strong growth in SMSFs and increasing investor preferences for cost-efficient and easy-to-access managed investments.

More recently, the LIC space has undergone significant change around initial offer costs, specifically whether this cost is borne by the investor or the issuer of the LIC. Previously it was common for new LICs to issue investors who acquired shares in a LIC IPO with free ‘bonus’ options to compensate for the impact of listing costs. Such bonus options have been replaced by other mechanisms since mid-2017, however a few still trade on the ASX that are of potential value to investors.

What is an option?

Options give an investor the right, but not the obligation, to buy or sell shares at a set price before the expiry date. This set price is known as the “strike” or “exercise price”. An option to buy the underlying share is known as a “call” option, whereas an option to sell is known as a “put” option. For the purpose of LICs, options are always call options attached to the issue of new shares in the LIC they are attached to.

If an option holder wishes to act on their option, this is known as “exercising” the option. If the share price is trading above the strike price, then a call option is considered to be “in the money”. If a share price is trading below its strike price, then it is considered “out of the money”.

The evolution of LICs

As mentioned previously, the LIC sector in Australia has origins dating back to the early 20th century. With age comes evolution, and LICs have not been immune to the structural changes and innovation that have taken place across the investment management industry.

Managers have subsequently had to find new ways to cover the legal, accounting, listing (ASX), and broker fees as well as other costs associated with new LICs. The big one typically being the broker capital raising fees.

In assessing the evolving nature of the cost structure of issuing a new LIC, we can break it down into three phases:

Phase 1: Investors pay the offer costs at IPO

Since the inception of LICs trading on the ASX, investors have typically had to foot the bill for the offer or listing costs. This means that on day one of listing, the company’s net tangible assets (NTA) reduces by this cost. Assuming an offer cost of 2%, a LIC with a NTA of $1.00 on day 1 will immediately drop to $0.98. Put another way, an investor’s $10,000 investment could drop to $9,800 on listing if the LIC share price tracks the NTA on listing day.

This practice was likely replicated from traditional company IPOs where the listing costs are mostly absorbed by the company being listed (and thus borne by shareholders of the company). This phase was soon stamped out as the industry sought better ways to ensure the investor is not adversely impacted by the payment of these upfront listing costs.

Phase 2: LIC issuers offer free options to IPO investors

Since the early to mid-2000s, LIC issuers (chiefly fund managers) and their respective boards moved to solve this problem by granting IPO investors a free option for every share purchased at IPO. This solution could compensate investors if the options were “in the money” and sold or exercised to provide additional value.

For example, if an investor purchased 10,000 shares for $1.10 at IPO, they may have also received 10,000 ‘bonus’ options for their $11,000 investment at no extra charge. Assuming the option expiry date was 2 years after the IPO and the exercise price of the option was $1.10, if at the 2-year expiry date the LIC share price was $1.20, the ‘value’ of each option would equal 10c. As such, the IPO investor would have achieved a total gain of $2,000: a $1,000 gain from their LIC shares ($12,000 value less $11,000 cost) and an additional $1,000 gain from their options ($1,000 option value less zero option cost).

The intention of this ‘bonus’ option approach was sound in that it was an attempt to make LICs more investor-friendly by seeking to compensate IPO investors for the initial offer costs. However, the industry has since moved on from offering options, primarily given their relative complexity, the potential impact on non-IPO shareholders and the need to fund the option upon exercise to realise its value (assuming the option is not sold on market).

Phase 3: Managers absorb the offer costs

To overcome the drawbacks of issuing ‘bonus’ options, the market has now shifted to a model whereby the manager, who is appointed by the LIC (and receives fees for managing the assets of the LIC), pays for the IPO offer costs.

This intends to prevent a drop in day 1 NTA due to offer costs. This model provides a potentially better outcome for investors as it removes the uncertainty of needing to factor in the uncertainty of an option value. However, there is likely an unintended consequence of making LICs the domain of larger fund managers who can afford to pay the (often considerable) offer costs. This could, for example, impact the ability for investors to access the investment capability of smaller fund managers via a LIC.

Current LIC option landscape

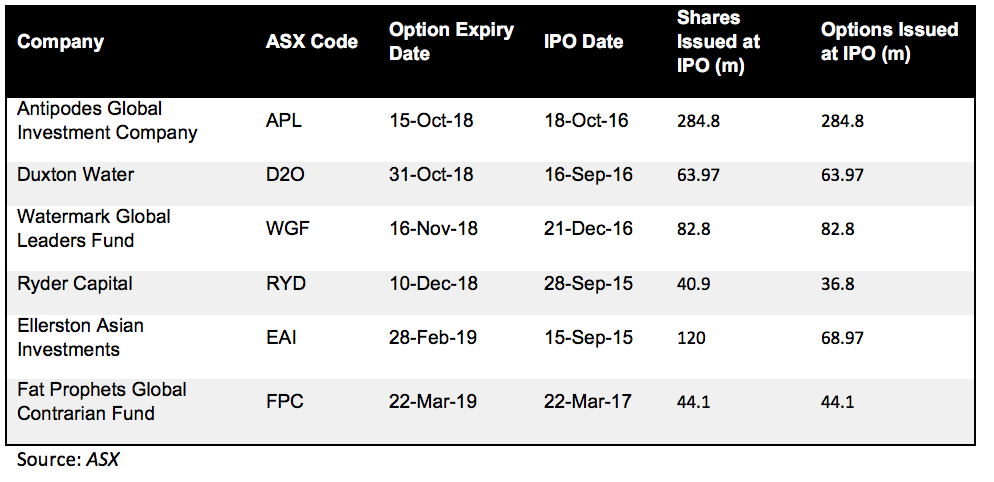

Only a small number of fund managers currently make up the LIC option landscape. As shown in Table 1.1 below, the current crop of LICs display a number of similarities. Most notably, options are typically offered on a 1:1 basis, meaning an investor receives 1 option for each share purchased at IPO and the LIC may double in size if 100% of the options are exercised.

Options typically have a 2-year lifespan allowing ample time for the share price to rise and thus the option to have value. Ryder Capital (RYD) and Ellerston Asian Investments (EAI) are two notable exceptions with option terms longer than 2 years.

Table 1.1: ASX-traded listed investment companies with upcoming option expiry dates

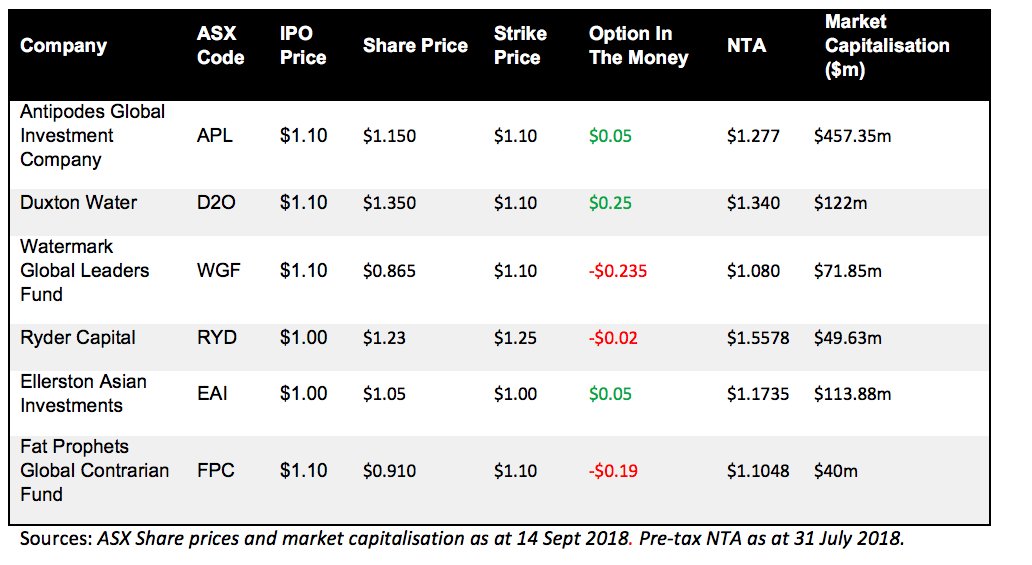

In analysing how these LICs have performed, table 1.2 shows that only Antipodes Global Investment Company (APL) and Duxton Water (D2O) are comfortably ‘in the money’. The fact that so few of the options outstanding are in the money despite most of them being no more than six months before expiry highlights one of the key problems with LIC options as a solution to covering the offer costs of LICs.

Table 1.2: Trading performance and option value of ASX-listed LICs with upcoming option expiry dates

The dilutive effect of options

An important issue that LIC shareholders must consider is the potential dilutionary effect of options exercise on the NTA of the LIC. This dilution is caused by shares being issued by the LIC at the strike price of the option that is below the NTA of the LIC.

For IPO shareholders who exercise their options, the dilutionary impact of the options being exercised on the company NTA is offset by the new shares they acquire at a discount to the prevailing NTA (as it is their option exercising that is causing the NTA dilution). Think of it like following your rights in a company rights issue at a discount.

On the other hand, option holders who do not exercise, as well as LIC shareholders who are not option holders, will see the NTA per share on their LIC holdings dilute. It is therefore vital that LIC shareholders understand the value of their investment relative to the “fully diluted NTA” in addition to the ASX required disclosure of the LICs pre-tax NTA. The fully diluted NTA simply refers to the company NTA if 100% of all options are exercised, and therefore quantifies the ‘worst case’ dilutive effect if all options were exercised.

For example, a LIC (that has outstanding options) with a pre-tax NTA of $1.20 and a share price of $1.15 represents a discount to NTA of just over 4%. For the purpose of this example, the fully diluted NTA of this LIC is $1.18 and thus the discount to this fully diluted NTA is 2.5%.

It is of course possible that less than 100% of LIC options are exercised. Precedents would suggest that for options that have been in the money, anywhere between 50% and 75% of options were converted. If less than 100% of options are exercised, then the diluted NTA would be higher than the fully diluted NTA. By looking at both the pre-tax NTA and the fully diluted NTA, LIC investors and option holders will know the upper and lower bands of NTA, which can assist in the decision making process of whether to buy the LIC shares and/or exercise their LIC options.

What to do: The three main choices for option holders

Assuming a LIC option is in the money and therefore has value, option holders essentially have one of three decisions to make:

1: Exercise the option

Aside from the aforementioned profit potential, benefits from exercising may include:

- no brokerage fees;

- lowering the impact of fixed costs;

- motivating the manager

- access to future dividends if the shares issued from exercise remain unsold;

- greater market liquidity; or

- purchasing an asset at a discount.

2: Sell on market

Options are listed on the ASX and can be sold just like a share. The option holder can liquidate by selling the option on-market.

3: Do nothing

An option holder would generally only consider this if the option was “out of the money”. If an investor were to do nothing and the options were about to expire, they could be leaving money on the table as they would benefit from either selling or exercising the option to realise the option’s value.

Conclusion

As at September2018, there are approximately $500m worth of options expiring of which Antipodes Global Investment Company (APL) accounts for nearly 50%.

The LIC space is a constantly evolving area of the funds management industry where greater emphasis on cost and investor outcomes are driving structural change and influencing manager behaviour.

While the LIC market has moved on from using options to compensate investors for offer costs, there are instances where significant value can be derived for investors from these options. Examples include APL and D20, both of which have option expiry dates within the next two months and options that are ‘in the money’.

LIC option holders should make sure they understand their option terms and pay close attention to the value of their options and timetable to exercise those options, or risk walking away from that potential value should they do nothing. Investors must also be mindful of the factors impacting option value and, if necessary, seek financial advice to assist with their decision.

--

This document was prepared by Pinnacle Investment Management Limited (ABN 66 109 659 109 AFSL 322140) (‘Pinnacle’). Whilst Pinnacle believes the information contained in this document is based on reliable information, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only. The information in this communication has been prepared without taking account of any person’s objectives, financial situation or needs. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Persons considering action on the basis of information in this document are to contact their financial advisor for individual advice in the light of their particular circumstances. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Pinnacle. Past performance is not a reliable indicator of future performance.

2 topics

5 stocks mentioned