Lithium prices have bottomed: These are the highest rated ASX lithium stocks

As a technical analyst, I watch the charts of most major commodities very closely. As an avid analyst of ASX commodities stocks, it is prudent to also chart the commodities those stocks aim to produce. (If you’re interested in following my commodities technical analysis, be sure to read the ChartWatch section of the Evening Wrap I write daily for Market Index.)

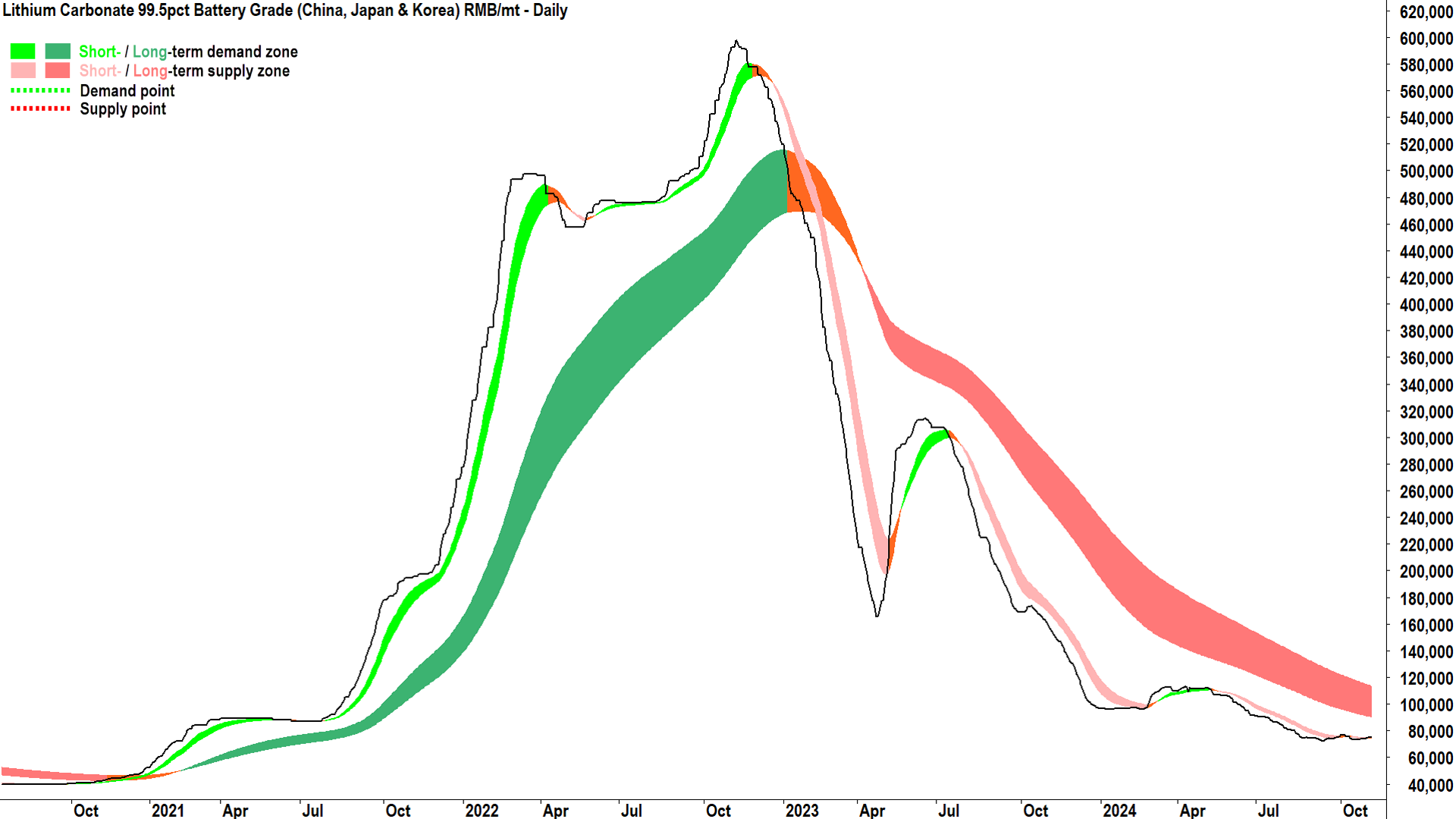

Lithium is one commodity I watch particularly closely, having charted the prices of several major lithium minerals by hand since 2021. It was in that year lithium minerals prices were beginning to rocket, and so too were the share prices of most ASX lithium stocks.

As a trend follower, I knew I had to have detailed lithium minerals price charts to analyse – but I found it was nearly impossible to get freely available or low-cost historical price data – let alone actual price charts showing enough price history to conduct my analysis. It was, however, easy enough to obtain free end-of-day data from reputable data providers such as SMM. So, I decided to begin manually collecting and collating this data myself.

The lithium minerals price charts I collated were particularly valuable as the price of each lithium mineral peaked in late 2022, and by early 2023, each chart I monitored had flagged the end of its respective long term uptrend. I appeared in several media outlets at the time calling the end of the lithium bull market, and not long after, I called that a bear market in lithium had begun. The rest is history.

Fast forward to today, and I am finally seeing some signs that lithium prices are bottoming out. They are nowhere near transitioning to a bull market – which I classify as the transition to a long term uptrend based on my technical model (the price must be trading above the long term trend ribbon and the long term trend ribbon is acting as dynamic demand - see my Technical Analysis Primer for more details).

To illustrate my claim that lithium prices are “bottoming out” but are nowhere near trading in a bull market, note that in the chart above of the Lithium Carbonate Index, and in the chart below of benchmark Lithium Carbonate futures. Note that we’re not even observing a short term uptrend yet in either – let alone long term uptrends!

But, with short term trend ribbons neutralised in each chart, and with the price again trading above the ribbon for the Lithium Carbonate Index and showing rising peaks and rising troughs for each, I can say the short term trend for each is neutral. Ergo: the bottom is in for now.

Clearly, one would have to be very brave (or be able to predict the future) to be able to say the official bear market low is in – for me it’s just too early to tell using my model. To do so, I’d need to see the charts above trading above their respective long term trend ribbons, and at least one instance where those ribbons are acting as dynamic demand (again, Primer for definitions!)

Notice on the way down, just how effective my long term trend ribbon was at acting as dynamic supply, that is, at impeding upward price action and beating down any rallies. In my experience, it is foolish to mess with that long term downtrend ribbon!

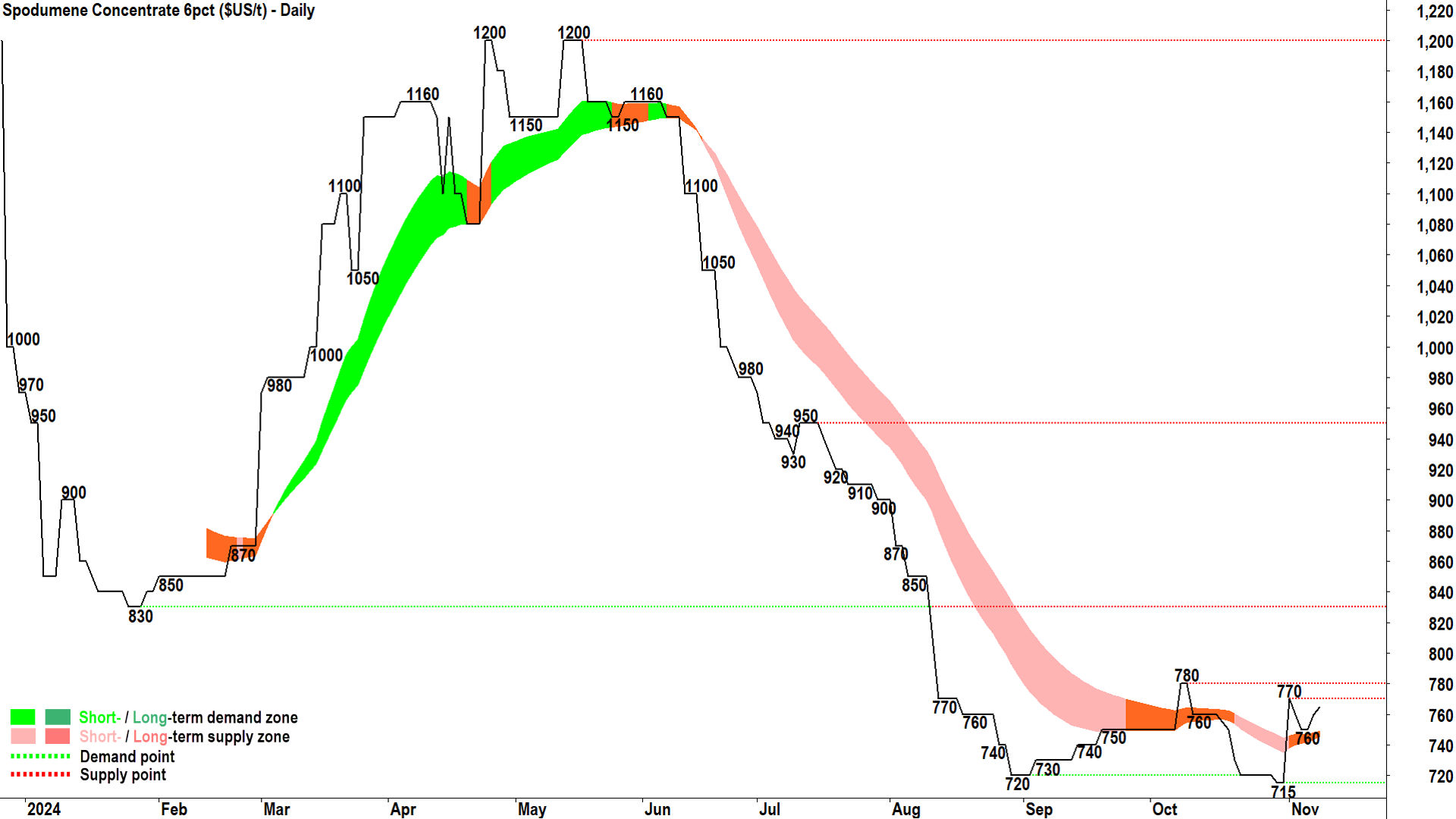

There are other signs at least a short term bottom is in for lithium minerals. Note that S&P Global Platts Australian Spodumene 6% is also trading above a neutralised short term trend ribbon, and it’s also showing rising troughs. (FYI, there isn’t a long term trend ribbon here yet because I only started collecting and charting the data for this one in late 2023.)

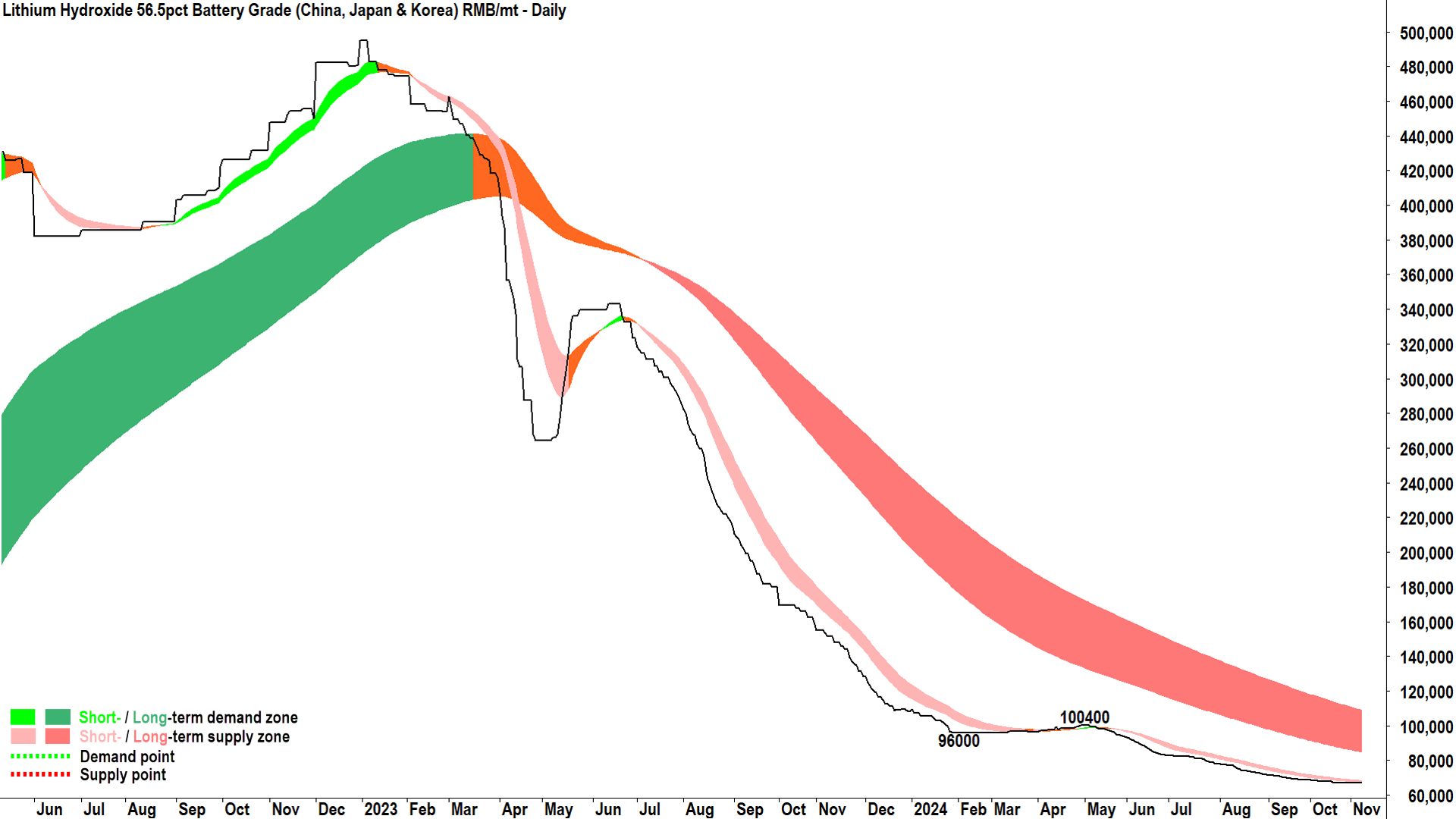

The final piece of the puzzle is perhaps the chart of the Lithium Hydroxide Index, it remains an absolute trainwreck – failing to notch even a single daily uptick in over 6 months now! I suggest at least some kind of turnaround here is required to call the end of the current bear market in lithium minerals.

As you can see, there are a few moving parts to the lithium minerals technical analysis puzzle. I prefer to ignore all market fundamentals – putting them down to mere noise. When the market fundamentals improve, so too will the balance between demand versus supply in the market – and prices will dutifully rise. Until then, as always, I continue to trust the trends (or lack thereof for now).

Note: I publish my updated technical analysis lithium minerals charts daily via Twitter/X.

September quarterlies are in…

Let’s change gears from lithium minerals to ASX lithium stocks. Each of the major ASX lithium producers, as well as those exploring for lithium and those currently developing a lithium project, have just released their September quarter results. The big brokers and research houses have had some time to review those results and have released detailed research reports containing relevant ratings and price targets tweaks.

If lithium prices are indeed bottoming out, and with newly updated broker data, I put to you this is the perfect time to answer the question: Which ASX lithium stock is most highly rated by the brokers?

So, let’s review the ratings and price target changes for each major ASX lithium stock in light of their September quarter results, and I’ll also provide a brief technical analysis overview for each in an attempt to bring the technicals and the fundamentals together ⚖️.

All chart analysis and upside/downside to consensus (average) price targets are based upon closing prices on Friday 8 November.

Pilbara Minerals (ASX: PLS)

%20chart%208%20November%202024.png)

The PLS chart shows a fledgling short term uptrend but a very well established long term downtrend. The short term uptrend ribbon is acting as a zone of short term dynamic demand and the long term trend ribbon is acting as a zone of long term dynamic supply.

The price action is rising peaks and rising troughs (i.e., an indication of short term demand-side control), but the candles are still too mixed for me to be able to call a convincing demand-side market is in place in the short term.

I can say that the overall technicals point to general equilibrium here, that is, the demand and supply sides of the market appear to be fairly evenly matched. The elephant in the room for PLS remains the long term trend ribbon. It has proven effective at killing promising rallies in the past – most recently to 3.41 following the announcement of CATL lepidolite production cuts and China stimulus measures.

A close below the major point of demand at 2.83 would likely realign the short term trend with the prevailing long term downtrend, and threatens a potentially a deeper price decline to probe demand towards the 2.31 major point of demand.

As with many of the charts we’re about to see, I really have no interest here until the price can close above the long term trend ribbon (preferably it is transitioned to at least neutral) and the long term trend ribbon has begun acting as a zone of dynamic demand.

I am happy to miss the first 20-30% or more of the next lithium bull market just to be sure that the long term trend has changed. My theory is that if that next bull is to deliver returns of 200% or 300%, then what’s the big deal of missing the first 20% or 30% if it saves me being stuck in a dud or losing trade for months or years?

%20Broker%20Consensus%20vs%20September%20Quarter%20Results.png)

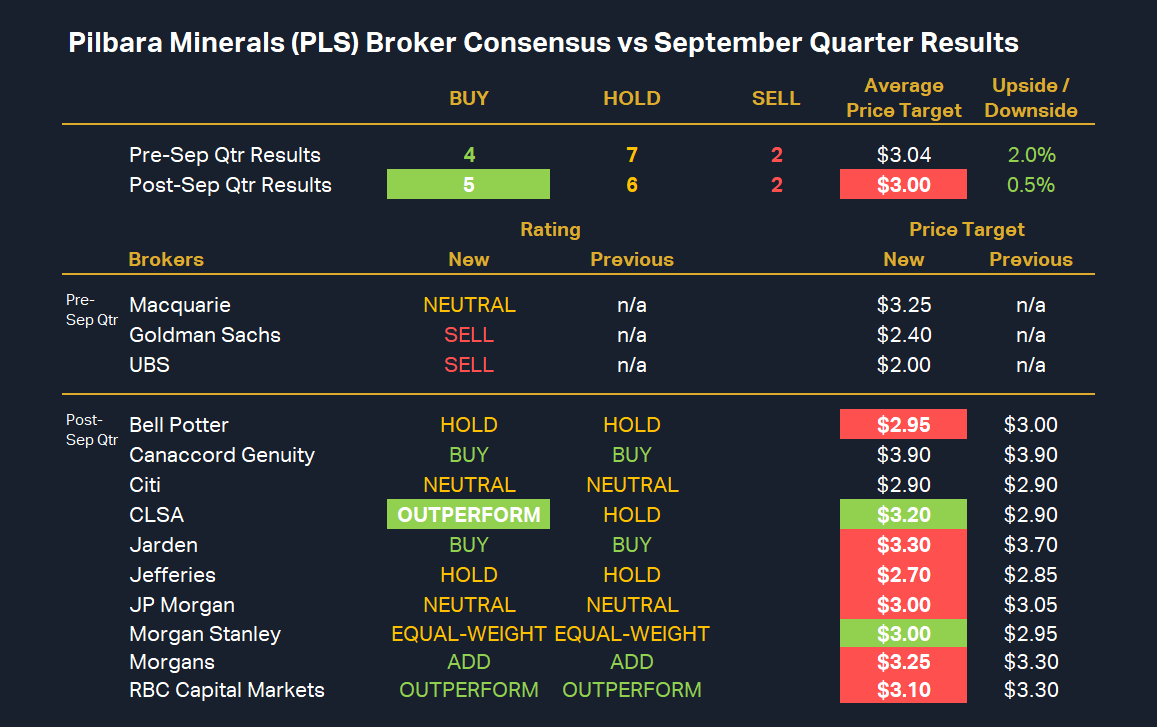

For each of the tables below, all ratings and targets are taken from broker research notes since July 1 (to keep them current). To obtain a stock’s Broker Consensus Rating, I assign a value of +1 to any rating better than HOLD/NEUTRAL/MARKETWEIGHT, a value of 0 for any rating equivalent to HOLD/NEUTRAL/MARKETWEIGHT, and a value of -1 to any rating worse than HOLD/NEUTRAL/MARKETWEIGHT.

I then take the average of all assigned rating values and assign a Broker Consensus Rating of BUY to values greater than +0.5, a rating of HOLD for values between -0.5 and +0.5, and a rating of SELL for values less than -0.5.

PLS’s broker consensus rating is +0.23 (up from +0.15 prior to September quarterly results) resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $3.00 (down from $3.04 prior to September quarterly results). This suggests brokers collectively believe the stock is around 0.5% undervalued based upon the closing price on Friday 8 November of $2.98.

Mineral Resources (ASX: MIN)

%20chart%208%20November%202024.png)

The MIN chart shows a short term downtrend and a very well established long term downtrend. Both short term and long term downtrend ribbons are acting as a zone of dynamic supply.

The price action is falling peaks and rising troughs (i.e., equilibrium market), but the candles are predominantly supply-side in nature.

Overall, the MIN technicals are consistent with both short and long term supply-side control.

A close above 42.70 accompanied by a return to rising peaks and rising troughs and a predominance of demand-side candles would recommence the short term uptrend and would likely set up a retest of the excess supply expected at the long term downtrend ribbon.

Alternatively, a close below 33.23 threatens a retest of the 29.51 major point of demand, and below that – potentially a far deeper price decline for the MIN share price.

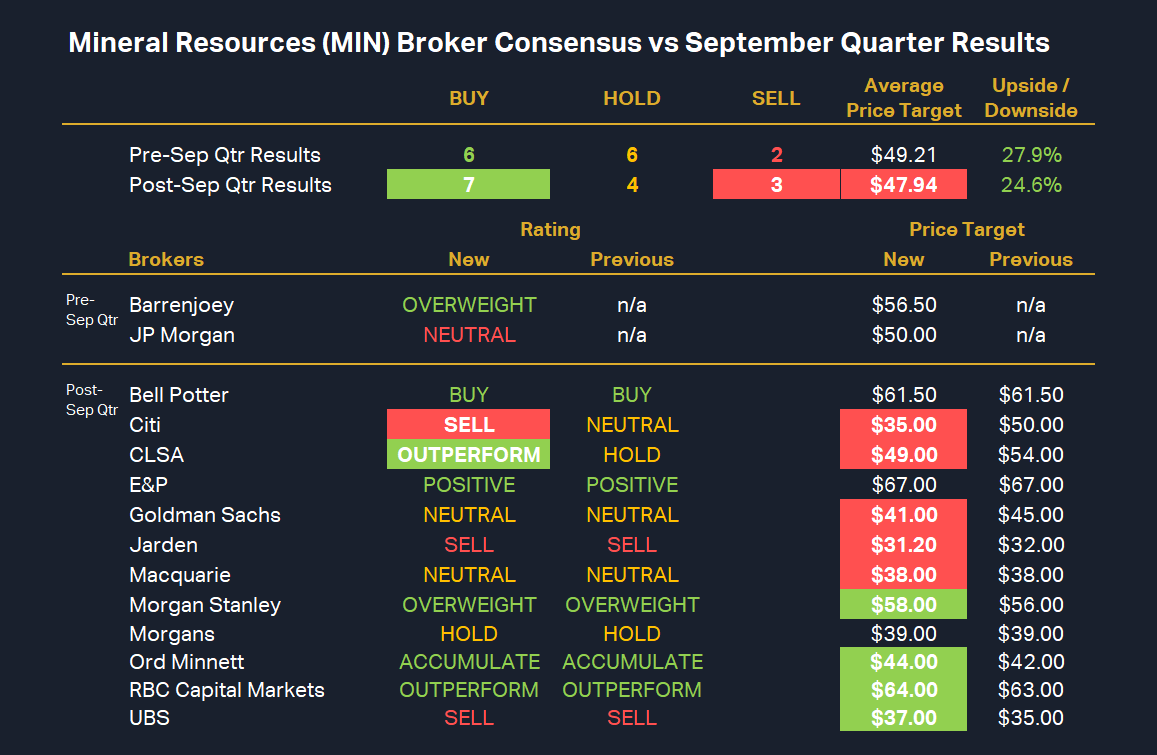

%20Broker%20Consensus%20vs%20September%20Quarter%20Results.png)

MIN’s broker consensus rating is +0.29 (steady versus prior to September quarterly results) resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $47.94 (down from $49.21 prior to September quarterly results). This suggests brokers collectively believe the stock is around 24.6% undervalued based upon the closing price on Friday 8 November of $38.47.

IGO (ASX: IGO)

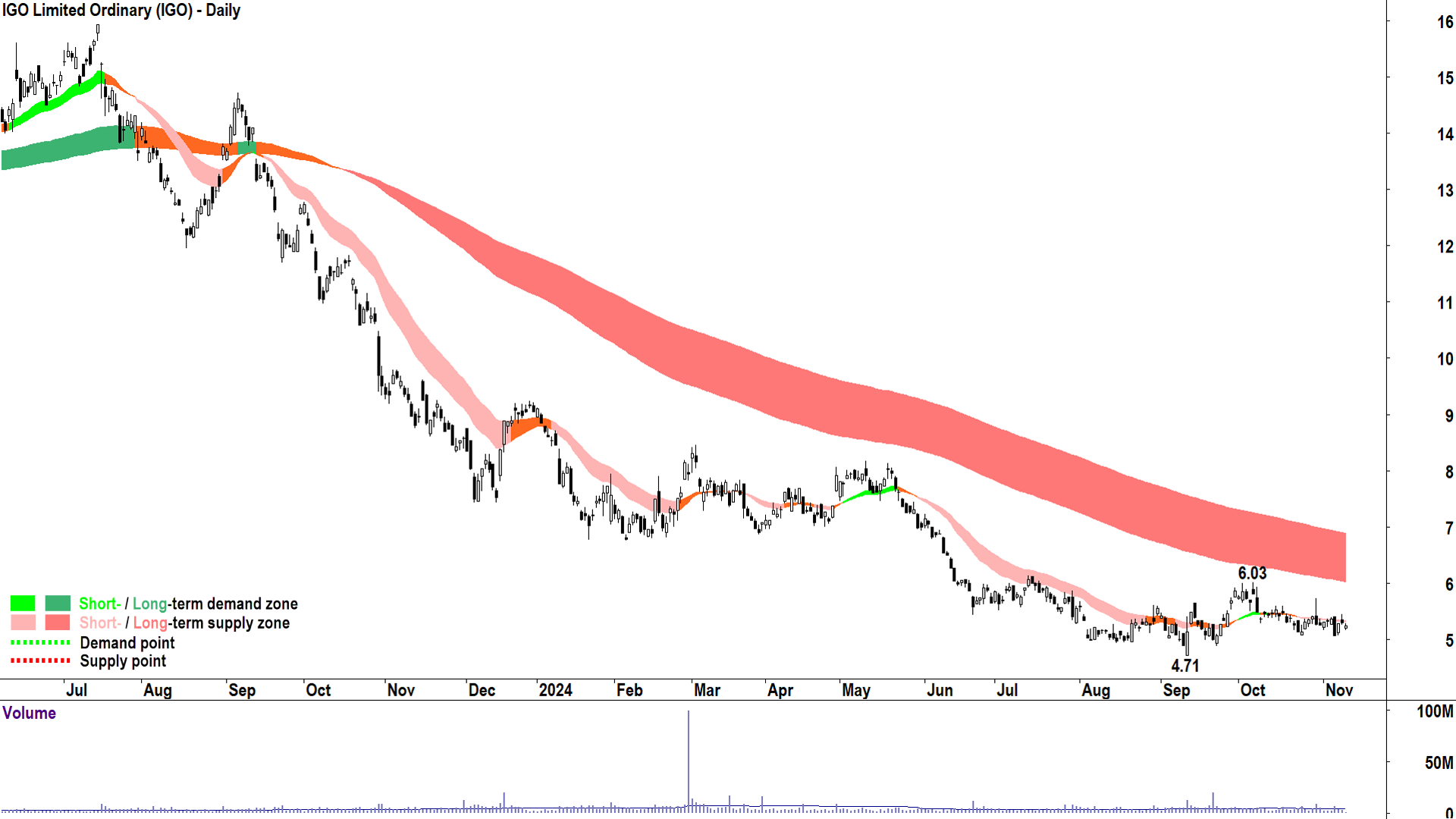

%20chart%208%20November%202024.png)

The IGO chart shows a short term downtrend and a very well established long term downtrend. Both short term and long term downtrend ribbons are acting as a zone of dynamic supply.

The price action is falling peaks and falling troughs (i.e., supply-side market), and the candles are predominantly supply-side in nature.

Overall, the IGO technicals are consistent with both short and long term supply-side control.

A close above 6.03 accompanied by a return to rising peaks and rising troughs and a predominance of demand-side candles would recommence the short term uptrend and would likely set up a retest of the excess supply expected at the long term downtrend ribbon.

Alternatively, a close below the major point of demand at 4.71 threatens a potentially a far deeper price decline for the IGO share price.

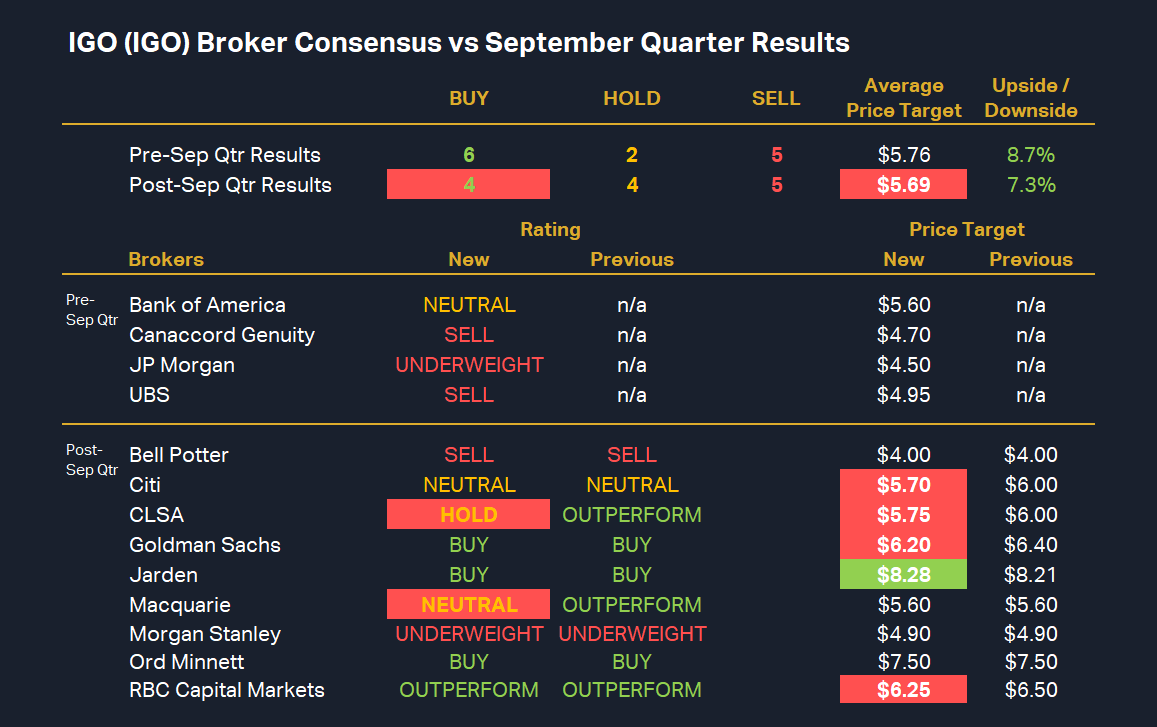

%20Broker%20Consensus%20vs%20September%20Quarter%20Results.png)

IGO’s broker consensus rating is -0.08 (down from +0.08 prior to September quarterly results) resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $5.69 (down from $5.76 prior to September quarterly results). This suggests brokers collectively believe the stock is around 7.3% undervalued based upon the closing price on Friday 8 November of $5.30.

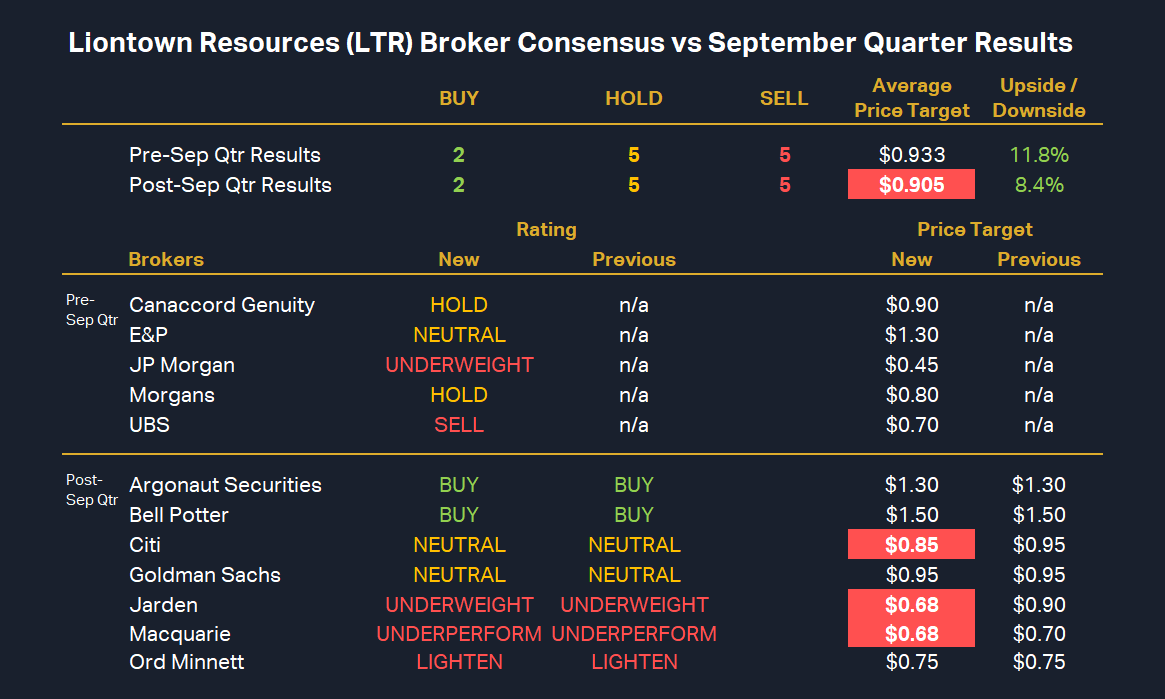

Liontown Resources (ASX: LTR)

%20chart%208%20November%202024.png)

(This is largely a copy and paste from above. If you think my analysis is disrespectful of the key attributes and nuances of each of these stocks – please remember that these are not unique companies with unique sets of circumstances and opportunities to me. They are just charts: Demand versus Supply. Nothing more. To be interested in buying one of them I require Demand > Supply – and if I cannot see it – then the stock in question might as well not exist!)

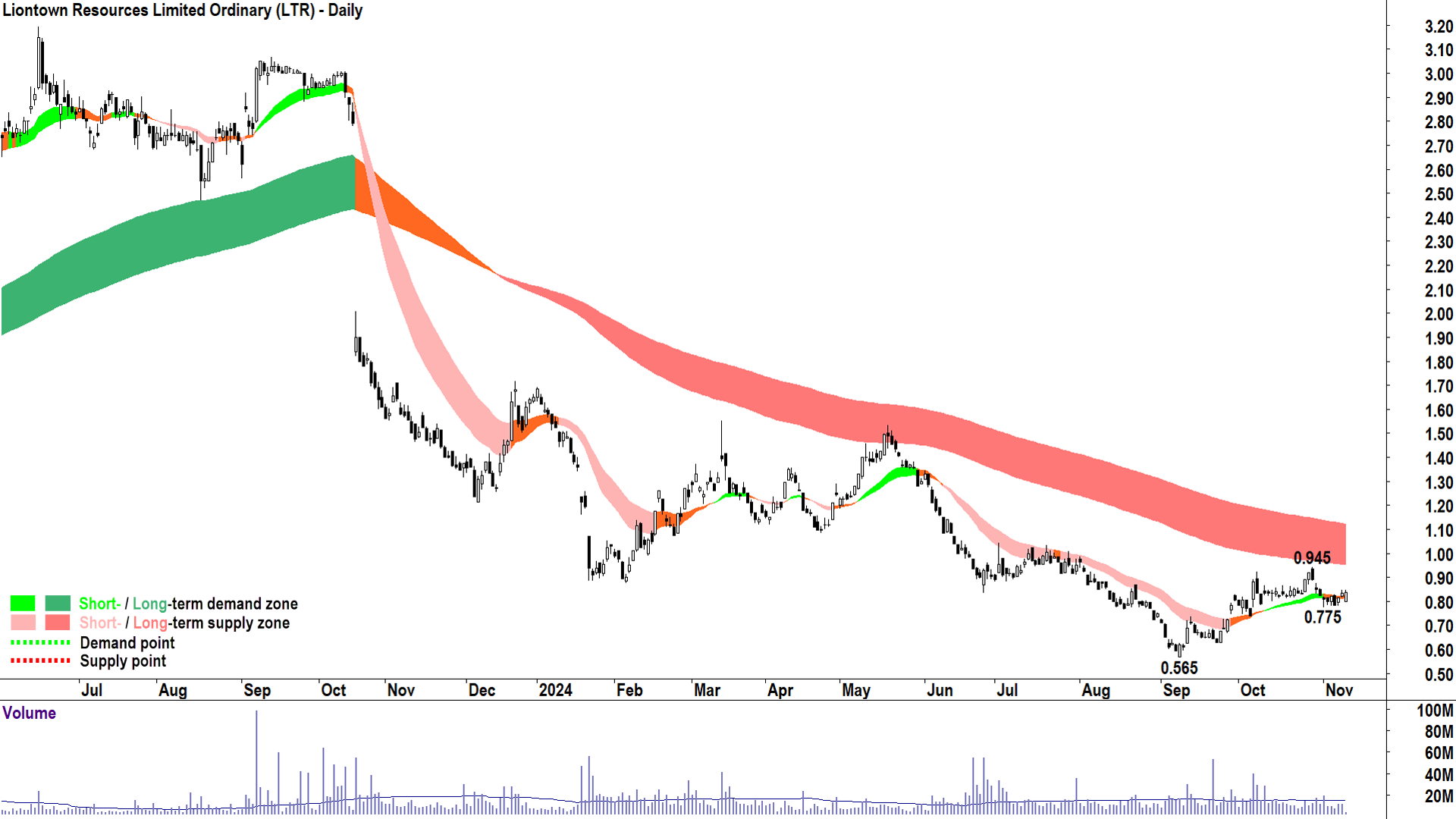

The LTR chart shows a neutral term downtrend and a very well established long term downtrend. The long term downtrend ribbon is acting as a zone of dynamic supply.

The price action is falling peaks and falling troughs (i.e., supply-side market), and the candles are predominantly supply-side in nature.

Overall, the LTR technicals are consistent with neutral short term control, but long term supply-side control.

A close above 0.945 accompanied by a return to rising peaks and rising troughs and a predominance of demand-side candles would recommence the short term uptrend and would likely set up a retest of the excess supply expected at the long term downtrend ribbon.

Alternatively, a close below 0.775 threatens a retest of the 0.565 major point of demand, and below that – potentially a far deeper price decline for the MIN share price.

%20Broker%20Consensus%20vs%20September%20Quarter%20Results.png)

LTR’s broker consensus rating is -0.25 (steady versus prior to September quarterly results) resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $0.905 (down from $0.933 prior to September quarterly results). This suggests brokers collectively believe the stock is around 8.4% undervalued based upon the closing price on Friday 8 November of $0.835.

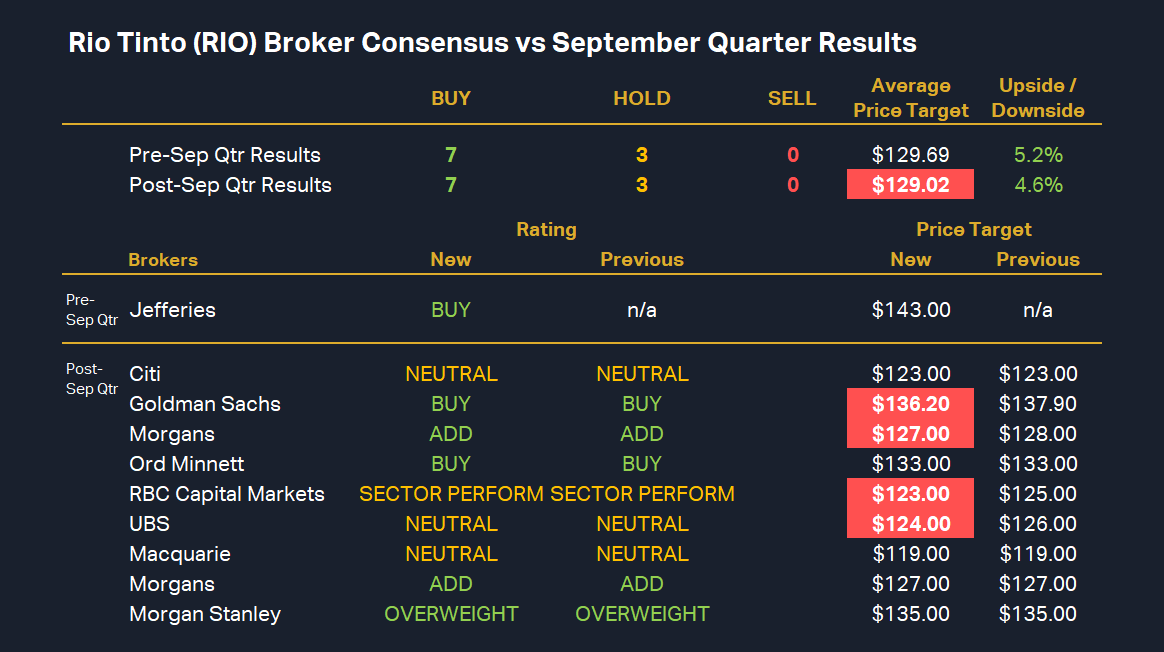

Rio Tinto (ASX: RIO)

%20chart%208%20November%202024.png)

Ok, ok… technically RIO is an iron ore, copper, aluminium, and some other stuff stock. But given it’s about to swallow a stock that would otherwise have appeared on this list in Arcadium Lithium (ASX: LTM), and given it has a couple of other long term lithium development projects in its mix – I suggest it now deserves a mention here.

The RIO chart shows a short term uptrend and neutral long term trend. Neither trend ribbon is acting as a zone of dynamic supply – but they are potentially acting as a zone of equilibrium (a balance point the price is drawn to).

The price action mixed as are the candles.

Overall, the RIO technicals are consistent with short term and long term equilibrium.

A close above 124.47 accompanied by a return to rising peaks and rising troughs and a predominance of demand-side candles would recommence the short term uptrend and would likely set up a test of the major point of demand at 130.99.

Alternatively, a close below 116.68 threatens a potentially a deeper price decline to probe demand towards the 105.11 major point of demand.

%20Broker%20Consensus%20vs%20September%20Quarter%20Results.png)

RIO’s broker consensus rating is +70 (steady versus prior to September quarterly results) resulting in a Broker Consensus Rating of BUY. Its consensus (average) target price is $129.02 (down from $129.69 prior to September quarterly results). This suggests brokers collectively believe the stock is around 4.6% undervalued based upon the closing price on Friday 8 November of $123.31.

Conclusions

There are several other smaller ASX lithium stocks that have very limited broker coverage that are not discussed here. Note that no other lithium stock had more than three brokers on file since July 1, and for the one that did, there wasn’t any coverage post September quarter results.

This lack of wider coverage/interest from the big brokers for smaller lithium stocks potentially indicates a diminished desire by them to continue to cover the sector in light of 80-90% price declines that are all too common over the last 18 months. I suggest these stocks hardly qualify for a most highly rated list.

Also, for what it’s worth, none of the following lithium stocks presently have charts that would see them make my ChartWatch Daily Scans Uptrends lists: Core Lithium (ASX: CXO), Sayona Mining (ASX: SYA), Piedmont Lithium (ASX: PLL), Ioneer (ASX: INR), Patriot Battery Metals (ASX: PMT), Wildcat Resources (ASX: WC8), Galan Lithium (ASX: GLN), and Global Lithium Resources (ASX: GL1).

Keep an eye on these daily updates because you can be sure that if and when the worm does finally turn for ASX lithium stocks – their charts are going to print the things I consider represent strong excess demand for their shares – and therefore they’ll be all over the Uptrends lists.

As for the brokers, their most highly rated “lithium” stock is Rio Tinto with a Broker Consensus Rating of +0.70. Hey, it’s probably as much a lithium stock as MinRes which comes in second with +0.29. As for consensus target price upside, MinRes is your best bet with 24.6% upside compared to Friday’s close. Liontown is a distant second with 8.4% upside.

The rest are fairly neutrally rated, and roughly also fairly valued according to consensus price targets. I do note though, that consensus price targets have been falling (in line with share prices) for over 12 months now. What will be interesting, is when we achieve that inflection point where both broker ratings and price targets begin to improve – i.e., the so-called “upgrade cycle”.

(Did Pilbara Minerals just start an upgrade cycle...i.e., with respect to its rating...that's the first notch up I've seen in a long time! 🤔)

I don't think we're there yet, but again – be sure to keep an eye on our Broker Consensus page for signs when this begins to occur. At Market Index we have you covered on both the technicals and the fundamentals!

This article first appeared on Market Index on Monday 11 November 2024.

5 topics

14 stocks mentioned