Livewire readers' most-tipped large caps: First-half 2021 results

The year is half over already and companies (and the ATO) have just closed the books for another financial year. That means it's time for another update on your most-tipped stocks!

The second quarter is often a quiet one on the ASX, with the vast majority of companies reporting results in Q1 (February) and Q3 (August). Q4 usually involves a swath of annual general meetings - perhaps not the highlight of the year for some, but it often brings updates to company guidance.

With that in mind, this will be a slightly scaled-back version of our usual updates, where we'll provide an update on performance, and some brief commentary on the companies that have reported results or significant news.

The data on the stocks below was sourced from Sharesight.

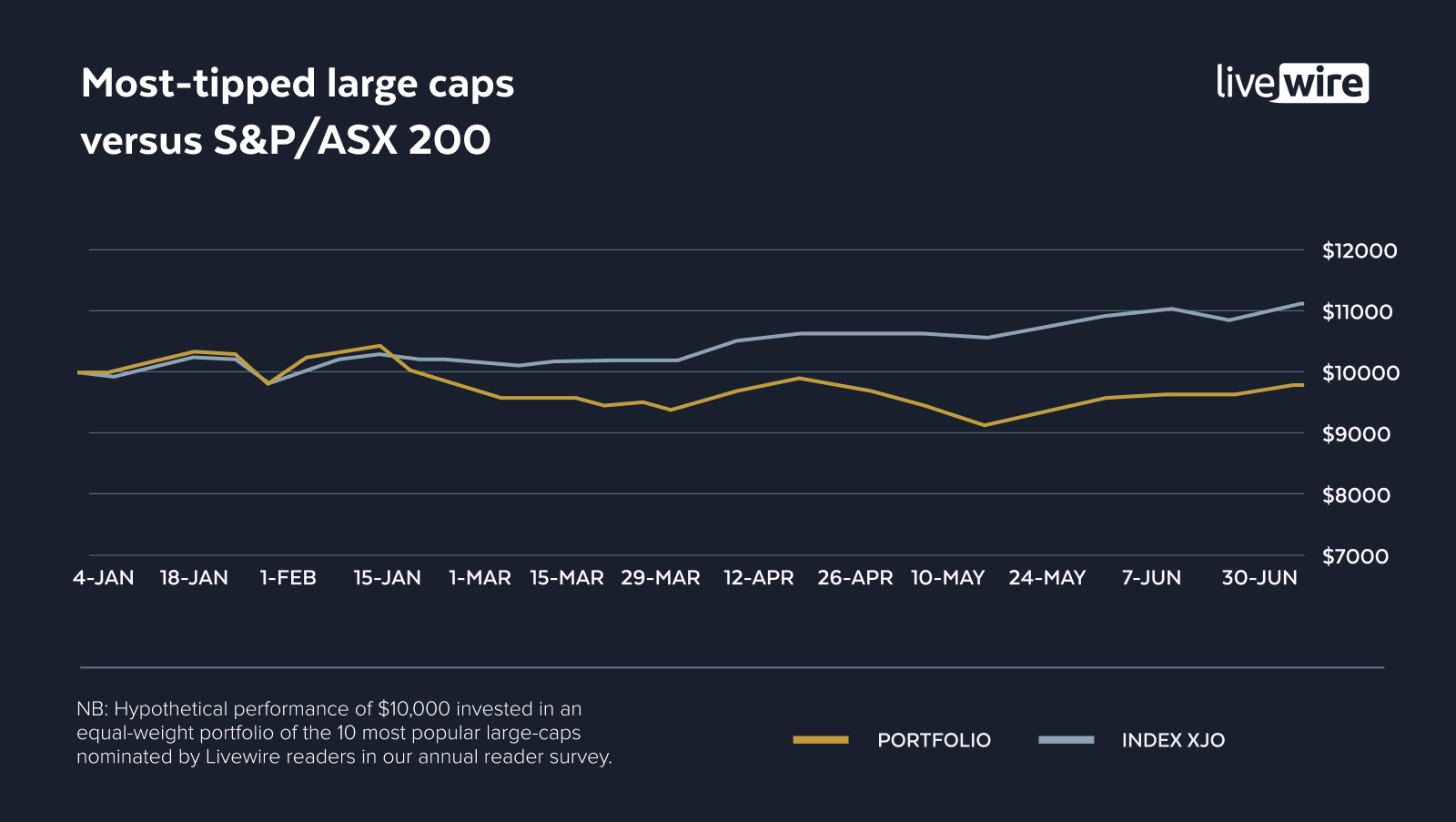

Half-year performance

The most-tipped large caps recovered somewhat in Q2, after a fall of nearly 8% in Q1, but the performance is still negative over the first half of the year. This looks even worse in light of the strong 11.6% return (including dividends) that the S&P/ASX 200 booked for the first half.

The two laggards from Q1 - The A2 Milk Company, and Appen - continued to drag on performance in the second quarter, though Xero and Afterpay both rebounded.

Commonwealth Bank and Fortescue were the stand outs of the quarter, though neither reported major news to explain the moves.

Here are the large-cap stocks that mattered for the quarter.

The A2 Milk Company (A2M)

- YTD return: -46.6%

- Q2 return: -13.1%

- Market cap: $4.5 billion

How the mighty have fallen. Once a favourite small-cap among Livewire readers, A2 Milk recently found itself among the realms of the large-caps after several years of strong returns. But since August last year, there's been a bad smell developing at A2 Milk.

Problems distributing the product into China have seen cuts to earnings and guidance, but probably more importantly, they've painted a dark cloud over the future of the company. As the old saying goes - there's a long gap between when growth investors start to sell, and value investors start to buy.

The company was dealt another blow in May after releasing a trading update and revised outlook. Excess inventories appear to be a major problem for the company, and "more aggressive actions" (read: heavy discounting) are being taken to reduce this overhang.

However, one of our guests on Buy Hold Sell this week thinks it's a "strong buy" at current prices, so don't miss that episode to find out why.

Commonwealth Bank of Australia (CBA)

-

YTD return: 24.5%

-

Q2 return: 19%

-

Market cap: $178 billion

Commbank had a big quarter, outperforming all other entries in the list, which brought it to the top of the pile for the first half. The rally seems to main driven by macro factors, with no significant positive news released during the quarter. Given the earnings beat in February though, this could be a case of 'post-reporting season drift' that Rudi Filapek-Vandyck has discussed before.

Of note however, was the recent announcement of the sale of their general insurance division for $625 million plus undisclosed deferred milestone payments. This was not well received by investors, with the stock falling heavily on the announcement.

Macquarie Group (MQG)

- YTD return: 14.7%

- Q2 return: 6%

- Market cap: $57.4 billion

Macquarie is one of the few companies on the ASX that does not report in February or August. With its financial year ending on 31 March, it instead reports in May and November. The share price barely budged on the day of reporting, falling just 0.7%.

The result saw a huge recovery from their first half result (which was based on a reporting period of 1 April 2020 to 30 September 2020), but more impressively, the full year result actually exceeded their FY20 result. Dividends also exceeded their FY20 mark, with a total of $8.43 paid out through the year (up from $7.91 in FY20). The big gains in the second half were primarily from their markets-facing activities, which saw a huge 39% jump in profit contribution.

Xero (XRO)

- YTD return: -5.9%

- Q2 return: 6%

- Market cap: $20.5 billion

Xero is the other stock on the list that reports in May and November. This year's result went down like a tonne of bricks though, with the stock falling nearly 13% on the day. Despite clearly missing investor's expectations, on the surface the result seemed a solid one, with EBITDA up 39% to $191 million, and free cash flow more than doubling to $57 million.

The poor result wasn't enough to hold Xero back though, with rallies both before and after reporting day more than offsetting the 13% loss. This left it up for the quarter, but still down nearly 6% for the year to date.

More updates

That's it for Livewire Readers' Most-Tipped large caps for the first half of the year, I'll be back following Q3 with another update. This time, we'll have FY20 results, which should give us a good indication how companies are performing.

In the meantime, my colleagues Glenn Freeman, Bella Kidman, and Mia Kwok will be providing updates on the Most-Tipped small caps, Most-Tipped global stocks, and Fundies' Top Picks in the days ahead. Follow their profiles to be notified when they post.

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors. And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics

20 stocks mentioned

3 contributors mentioned