Long quality, short junk: The science-backed portfolio producing outsized returns

It's possible to find knowledgeable, well-read investors on opposite sides of any question in investing. While this is not a bug, but an important feature of efficient markets, the maths geek in me breathes a sigh of relief when it's possible to find strong empirical evidence for a particular strategy or idea.

In this wire, I'll be summarising one such strategy, the "Quality minus junk" portfolio suggested by Clifford Asness, Andrea Frazzini, and Lasse Heje Pederson which was published in the Review of Accounting Studies.

The core thesis:

The work done in the journal centres around answering three key questions:

- What is quality?

- How does quality affect the decisions made by investors?

- How does quality affect the performance of assets?

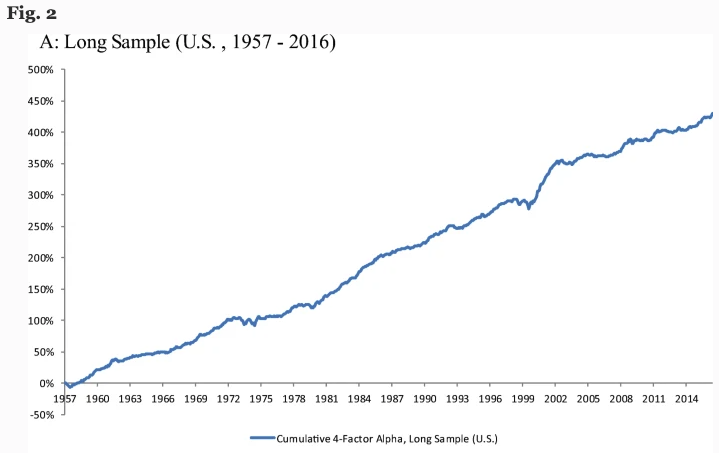

The authors aim to test a pretty basic premise: The highest-quality companies outperform over time, while the lowest-quality companies underperform. As a result, a portfolio that is long quality companies, and low "junk" companies will produce outsized risk-adjusted returns.

The methodology:

The authors began by breaking down "What is quality?" A formula was created, based on the factors:

1. Profitability

"Profitability is the profits per unit of book value. All else equal, more profitable companies should command a higher stock price. We measure profits in several ways, including gross profits, margins, earnings, accruals, and cash flows and focus on each stock’s average rank across these metrics."

2. Growth

"Investors should also pay a higher price for stocks with growing profits. We measure growth as the prior five-year growth in each of our profitability measures."

3. Safety

"Investors should also pay, all-else-equal, a higher price for a stock with a lower required return - that is, a safer stock. What should enter into required return is still a very contentious part of the literature. We do not attempt to resolve those issues here."

The exact formula used is beyond the scope of what I'll cover here, but check out the original journal article if you're interested.

The sample data used contained 54,616 different stocks, covering 24 different markets. A portfolio was constructed which was long the top 30% of stocks on the QMJ score, and short the bottom 30%.

The results

The impact on market efficiency was discussed, by contrasting the findings of the portfolio to analyst expectations. In general, it was found that the ratio of target price-to-book price was higher for high-quality companies. This demonstrates that analysts already believe that a premium should be paid for companies of a higher quality.

However, implied expected returns of analyst prices were still lower than the returns typical for "high-quality" companies. A potential inefficiency was thereby identified, in that market analysts generally under-predict the risk-adjusted returns that high-quality companies are likely to generate.

"Analysts’ implied return expectations could reflect that the required return of high-quality stocks is lower than that of junk stocks (because quality stocks are viewed as safer). If so, quality stocks should realize lower returns than junk stocks, or, said differently, quality stocks should have a larger price premium. However, since quality stocks actually realize high risk-adjusted returns, our findings reflect erroneous analyst expectations consistent with theory (c) for our finding that the price of quality is too limited."

Although the Quality minus Junk portfolio is clearly backed quite well by empirical evidence, the old warning of "Past performance is no guarantee of future results" holds here. Economic conditions have changed drastically since the data used for this paper was collected. As a result, rather than trying to replicate the exact algorithm utilised in this journal article, investors should aim to understand the thought process behind it.

2 topics