Looking to 2024

Key Points:

• Global growth softened in 2023, with many economies suffering technical recessions. Mega-cap technology companies dominated equity market returns, with the rest of the asset class relatively benign.

• The outlook for 2024 is highly uncertain. We still think there is still a high chance of a recession in the US, but don’t dismiss the probability of a rebalancing without a recession or a continuation of the current cycle.

• Markets seem to be pricing a low chance of either a recession, or a continuation of the current cycle, suggesting there is opportunity to take the other side of that expectation from a tactical perspective.

Every December for the past few years, our Market Insight has focused on how we fared in our predictions the year before and what is the general outlook for the year ahead. 2023 has been a confounding year. The consensus expectation (also held by us) at the end of 2022 would be that major global economies would suffer a minor recession in 2023 because of monetary policy tightening. Because of this, investor positioning was tilted strongly away from equities. We were also underweight equities, which seemed like a logical position to be in if a recession is expected.

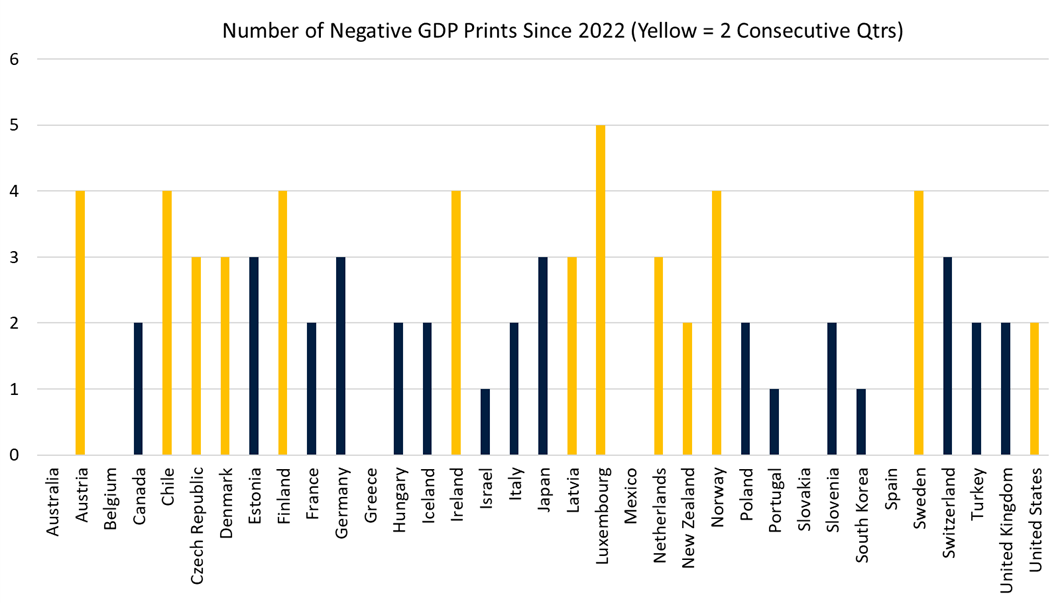

In practice, while global economic growth weakened, and many countries suffered “technical” recessions, the United States economy remained resilient and technology companies rallied strongly on AI positivity, supporting global equity markets through the year. The nuance here is demonstrated in the charts below.

Of the 35 largest countries in the OECD, nearly 40% have experienced two consecutive quarters of decline in economic activity since 2022. Only a handful of countries, including Australia, which is in a per-capita recession, have experienced consistent growth in the past two years.

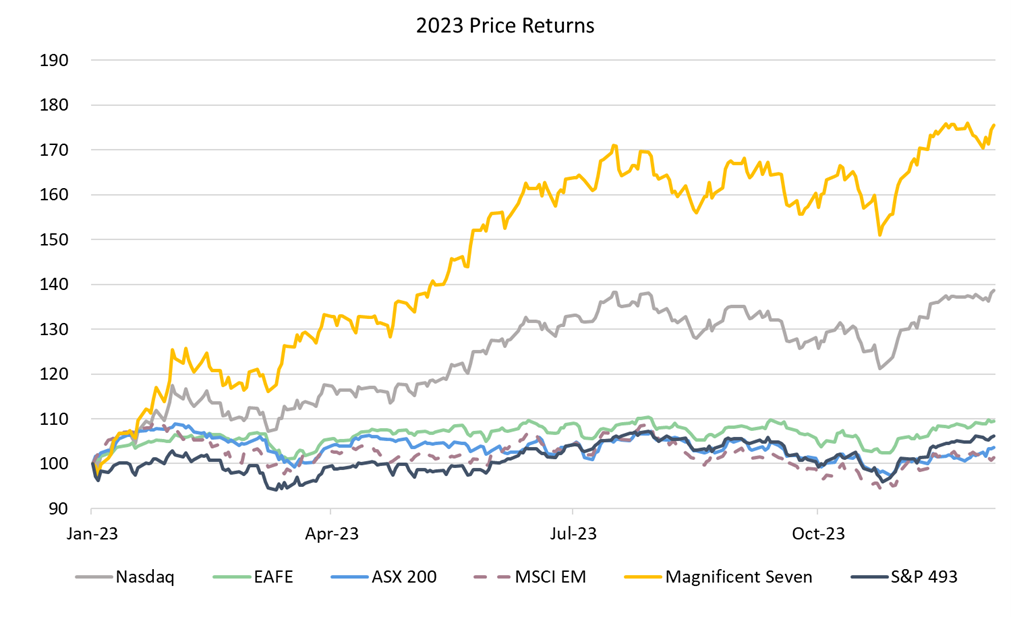

This soggy economic backdrop goes a long way in explaining the relative performance across different equity markets in 2023. Performance has been absolutely dominated by seven mega-cap technology companies – the Magnificent Seven. In price terms these companies are up around 75% from a market cap weighted perspective. Excluding these, the S&P500 is only up 6%, in line with Australia and Europe and beating emerging markets, which were basically flat for the year. In addition, outside the Magnificent Seven, equities are well below all time highs given poor returns in 2022.

So how do we think the next year plays out? Uncomfortably, the outlook is about as uncertain as it can be. We can think of a few reasonably likely scenarios in 2024.

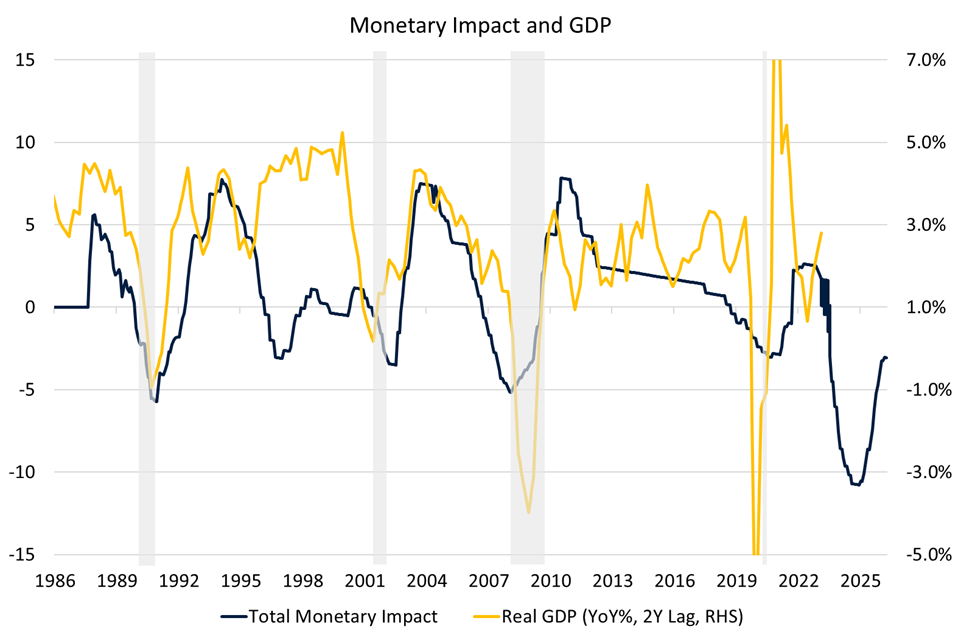

Recession in the US

Other than the fact that there hasn’t been a formal recession in the US yet, there hasn’t been a whole lot of evidence to suggest that it is no longer at least probable. Monetary policy works with lags, and the brunt of its impact should be felt in the US in the first half of next year (see chart below). Put another way, the fact that there hasn’t been a recession yet doesn’t mean there won’t be one in six months’ time.

Bank lending standards in the US are still tightening, suggesting the credit cycle won’t be supportive of growth in the year ahead either. Should a recession eventuate, we expect equity markets to perform poorly and central banks to cut rates. Though, importantly, there is a good chance any market reaction is more muted than the historic norm if the recession turns out to be relatively minor. Soggy markets in inflation adjusted terms over the past two years, as well as reasonable earnings growth, have delivered a better starting point in terms of market valuations. The Federal Reserve will also likely step in at any major sign of weakness, delivering some support to markets.

Rebalancing without Recession

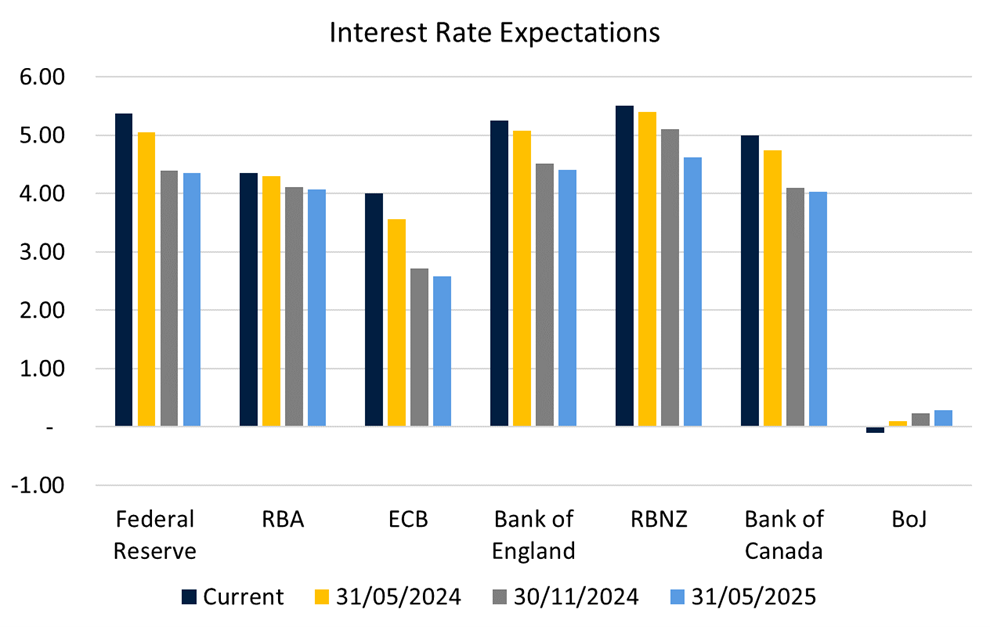

In this scenario, inflation moderates back towards target, economic growth slows, but economies don’t go backwards, and central banks cut rates next year as they no longer feel they have to restrict growth. This seems like the scenario the market is currently pricing. Major equity markets are a long way from the lows (notwithstanding the point about intra-market rotation made at the beginning of this Insight) and interest rate markets are pricing rate cuts from most major central banks (see below).

Although markets seem to be placing the highest probability on this scenario, we think there is still room for equities to rally further (but not boom) should it occur. Lower bond yields will flatten the valuations of the mega-cap tech companies and a likely reacceleration in economic growth (driven by rate cuts) should support the parts of the market which have underperformed (value, SMID, EAFE).

While this scenario would be unprecedented, it is not impossible. As we demonstrated in our Australia’s Rate Surprise Insight, the impact of monetary tightening in this cycle is being muted by demographics. Ageing households with high savings are benefiting from higher interest rates and are a larger part of the population than ever before. This isn’t reducing the pain of highly indebted, younger households, but seems to be keeping the overall economy afloat. This theme is common across major developed market economies. Growth in the US in particular has also been supported by fiscal stimulus. The Inflation Reduction and Chips Acts have supported economic growth by encouraging significant private sector manufacturing capex. The US Government has also been running a much larger fiscal deficit than previously expected, supporting the economy. Finally, the Federal Reserve has become so adept at crisis management that markets no longer price any chance of systemic shock. A case in point is the banking crisis in March 2023, where substantial bank failures were resolved almost immediately with no real market reaction.

The Cycle Continues

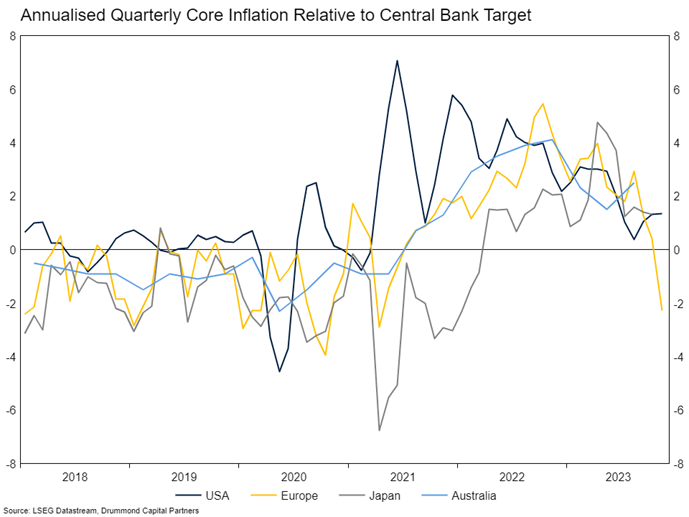

Inflation is still too high in most major economies (see below). There has been a substantial improvement in outcomes over the past year, particularly as core goods inflation has moderated in line with supply chain normalisation and inventory rebuilding. However, services inflation is still not consistent with central bank targets in many places.

There is a reasonable chance that the “last mile” in inflation is quite hard to achieve, and we see a stabilisation just above target at current policy settings. In this scenario, there is no recession, but growth doesn’t accelerate either because central banks won’t be able to cut rates. We expect equity markets to perform poorly in this scenario, as it would involve higher long term bond yields and renewed worry about a recession, though probably not until 2025. This seems like the least likely of the three scenarios, but we would still assign a meaningful probability to it happening.

Balancing the Probabilities

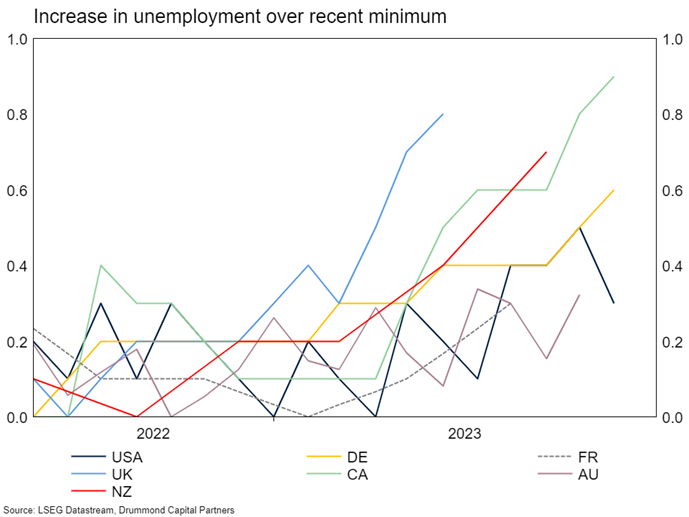

On the balance of historic probabilities, the first scenario is still the most likely, but it is not a lock. There has never been a monetary policy tightening cycle of this magnitude, with inflation starting so far away from target, that hasn’t led to a recession. We are also seeing some gradual steps towards a more material slowing in growth. A key trigger from a market psychology perspective will be movements in labour markets. The chart below shows that unemployment rates have begun to grind up in many economies. Often, unemployment begins to rise slowly, then once consumers and businesses become worried and pull back spending it rises much more quickly, cementing a recession.

While many leading indicators continue to point to a recession, it is hard to ignore the empirical evidence pointing to continued strength in household balance sheets, particularly in the US. If households remain strong (noting that most mortgage holders in the US remain on very low 30-year fixed rates) and the Government keeps running large deficits, it will be hard for the economy to shrink. However, in this eventuality we would argue that it would be hard for inflation to continue moderating as well, leading to the third scenario.

Portfolio Positioning

With a reasonable chance of any of the above scenarios occurring in 2024, portfolio positioning needs to consider the market pricing of each. We think markets expect the second scenario (Rebalancing without Recession). In practice, this means if we get either of the other two eventualities, markets will swing away from where they are now. From a tactical perspective, this means the missed performance from being underweight equities in a Rebalancing without Recession scenario is much less than the capital loss should we be overweight equities and there is a recession.

That said, the outlook and markets are at a point of flux, and we think we will be able to dismiss or confirm which of these scenarios is most likely in the near term. In line this this, we expect portfolio positioning to shift over this period to take advantage of this.

1 topic