Macquarie's ASX August reporting season guide: A must-read for investors

There is an old adage which suggests that earnings and fundamentals dictate share price moves. And while prices lead fundamentals in the short-term, it's earnings that separate the great from the good and the good from the bad. Or put another way, earnings drive share prices above all.

In less than two weeks, Australian corporates will start handing down (mostly) full-year reports and it's there that we will find out who's weathering this incredibly challenging macro landscape the best (and the worst).

Ahead of August reporting season, Macquarie is out with its sector-by-sector analysis of the crunch period. In this wire, I'll take you through the highlights of that report.

The macro highlights

As is tradition with a Macquarie research note, the team starts off with a thorough read of the macro landscape. Here is what they are expecting at the big picture.

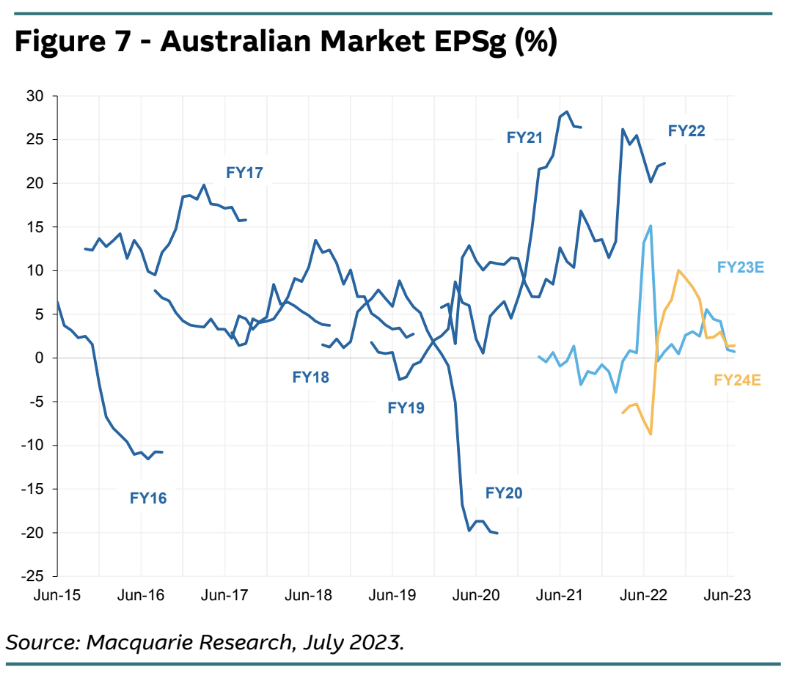

- Last financial year, EPS was +15%. This year, we'll be lucky to see flat.

- FY23 results may beat low benchmarks, but FY24 could see a 10% EPS decline by that year's end.

- Expectations by some companies were already reset before this coming August. Some, like CSL (ASX: CSL) have already lowered the bar even further.

- Last August, twice as many companies guided below Street expectations, driving negative price reactions. You can't rule out this happening again this time.

"With negative forward orders signalling weak demand and cost pressures persistent (albeit easing), we think outlook comments will again err on the side of caution. This is important, as positive/negative guidance surprise was a key driver of relative returns in the 2H22 reporting season," analysts wrote.

From a general strategy perspective, analysts added:

"We still favour defensives given the risk of EPS downgrades due to the impact of past rate hikes. Stocks have rallied since the US CPI print, but before that share prices were falling with EPS. Given the market P/E is not low, we see only a small risk P/Es keep rising to offset falling EPS."

The low bar may be set even lower

Macquarie's equity market view is dominated by their own expectation that the consensus estimate for earnings is both too high and that margins may not rise next year like many expect. Rising interest rates and a resilient labour market may gift Australia an enviable soft landing but it does mean that the RBA may keep rates higher for longer as a result.

The consensus is also crowded in defensives, which is Macquarie's preferred trade. They see utilities, infrastructure, and insurers providing most of the gains over the next 6 weeks.

And while some cyclical sectors (consumer-facing stocks) could still grow earnings by double digits, that's a view which Macquarie argues is optimistic.

But above all, earnings are all about margins. And for Macquarie, they say the split between falling margins and flat EPS growth hasn't been since 2008 - and that's a red flag.

"The net profit margin for the All Industrials has been falling in 2023, but the impact on EPS has been muted by rising sales as companies continue to pass on inflationary cost increases. This dynamic was last seen around the GFC, when margins peaked and started to fall before the US recession started," analysts wrote.

"We could see a similar sequence play out again over FY24 as inflation slows, especially if central banks continue to hike," they added.

On a P/E basis, Macquarie analysts noted that although sentiment and volatility may be depressed, valuations are certainly not.

Macquarie's favourite reporting season screens

To find their favourite stocks for the upcoming earnings period, Macquarie use a series of screens and thematics.

- Revisions can lead earnings surprises (needless to say, it's better to buy a company in an upgrading cycle rather than a downgrading cycle)

- Some earnings surprises are already in the share price - and this works both ways with overbought or oversold companies

- High short interest can be a good contrarian indicator if its outlook statements are viewed more positively than expected (Pilbara Minerals (ASX: PLS) and Seek (ASX: SEK) are the examples provided)

Top picks by sector

And now, you've waited long enough, here are the sector-by-sector picks for August reporting season.

- Insurers (OVERWEIGHT) over the Big Banks (UNDERWEIGHT)

Although FY24 EPS is forecast to fall across the sector, the team look to Bank of Queensland (ASX: BOQ) for a contrarian opportunity. In the insurers, their top picks are split between QBE Insurance (ASX: QBE), IAG (ASX: IAG), and Suncorp (ASX: SUN)

- Be picky in consumer discretionary (UNDERWEIGHT) names

Given the post-COVID travel boom is still in full flight (pardon the pun), Flight Centre (ASX: FLT) and Webjet (ASX: WEB) are considered two key names to watch. They are also keeping a close eye on the gambling names The Lottery Corporation (ASX: TLC) and Aristocrat Leisure (ASX: ALL) as well as Domino's Pizza (ASX: DMP) for a contrarian trade.

- OVERWEIGHT on telecom, more nuanced in the other two of the TMT trinity (media and technology)

Telstra (ASX: TLS) and TPG Telecom (ASX: TPG) are both favoured for their defensive qualities. Analysts are also bullish on Seek (ASX: SEK), NextDC (ASX: NXT) and Altium (ASX: ALU).

They are below consensus or less bullish on WiseTech (ASX: WTC) and the major real estate platforms of REA Group (ASX: REA) and Domain (ASX: DHG).

- Look to oversold healthcare and staples names

CSL (ASX: CSL) and ResMed (ASX: RMD) are two of the most oversold companies on the index while Treasury Wine Estates (ASX: TWE) has been oversold significantly as investors expect a disappointing outlook to come for grape prices. The analysts' above-consensus calls come in the staples space as well - Coles (ASX: COL) and Woolworths (ASX: WOW).

- A slight UNDERWEIGHT in metals and a clear preference in the energy space

The Macquarie team have a preference for gold and lithium over the base metals names. The team generally have above-consensus estimates for industrial metals, and below for precious metals. Having said this, they argue that Alumina (ASX: AWC) is the most "unloved" mining stock of them all.

In energy, the team prefer Ampol (ASX: ALD) and Santos (ASX: STO). The latter is rated a BUY by every single energy analyst in the market. We'll know soon enough if it's the most crowded trade of all time or a collectively genius call.

2 topics

26 stocks mentioned