Macquarie’s massive ASX metals and energy stocks review: Deluge of downgrades!

Commodity prices are always on the move, and so are the fortunes of ASX metals and energy stocks. Often, it’s a case of swings and roundabouts. The commodity price cycle can be very kind, just as it can be very cruel. If you’re an investor in resource stocks, this means getting the timing of the cycle right can have a major impact on your returns.

The Economics and Commodities Strategy team at Macquarie has just rejigged its commodity price forecasts. As a result, its Equities team has conducted a complete review of its coverage of metals and energy universes. The upshot is a deluge of ratings and price target changes.

Let’s review the key changes to Macquarie’s commodity price forecasts and the knock-on effects on their coverage of the ASX metals and energy sectors.

Iron ore down, base metals and gold up

After its recent review, Macquarie’s posture on metals can be summarised as (includes changes in price forecasts for each commodity):

“OVERWEIGHT”

Aluminium: No change

Copper: +11% 2024, +4% 2025 “driven by supply shortages against a relatively robust demand backdrop”

Lithium (Spodumene): -5% 2024, -10% 2026, -29% 2027 (to US$1,346/t, US$1,850/t, and $US2,080/t respectively) “on short-term weakness versus our last update… downward revisions reflect more balanced market”

Metallurgical (coking) coal: +9% 2024

Nickel: +7% 2024, +5% 2025

“UNDERWEIGHT”

Iron ore: -14% 2026, -27% 2027, -19% 2028 “driven by the West African supply response…to push marginal tonnes out of the market, bringing forwards large market surplus from 2025 onwards”

Thermal coal: No change

“NEUTRAL”

Gold: +4% 2024, +6% 2025 “impressive performance even as rate cut expectations have been downgraded”

Higher oil, lower LNG

(Oil and Liquified Natural Gas (LNG) changes via Macquarie’s Houston team)

Crude Oil: +4% 2024, +5% 2025 (to US$80.34/bbl and US$68.75/bbl respectively)

LNG: “We also incorporate lower spot LNG futures in 2024/25, down on elevated inventories after heating season & recent high LNG utilization”

Uranium: “the supply/demand outlook continues to provide tailwinds for the thematic”

ASX metals and energy stocks commentary

Iron ore

Change in preference between BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO), RIO now preferred due to “improving costs” and “potential downside” to BHP

BHP: “has had an exemplary track record of eking out productivity gains in its iron ore business…looking forward those gains become harder to replicate”

RIO: “has room to improve, which offers operational upside on a relative basis”

Fortescue (ASX: FMG): “more than fully valued with its iron ore business to come under pressure from a falling price environment”

Base Metals

South 32 (ASX: S32): “Improvements in the base metals price performance, particularly aluminium, which is now S32's prime commodity exposure”

Sandfire Resources (ASX: SFR): “our key copper producer pick with Motheo ramping up on time and on budget”

Nickel Industries (ASX: NIC): “our key nickel producer pick…continuing to generate positive profits and is well positioned if nickel prices stabilise or improve”

Lithium

On near-term lithium prices, “Inventory data points to destocking at refineries and restocking downstream…a very strong restocking cycle could see prices rise higher than current forecasts, particularly given the recent supply cuts”. Broker notes that this could result in volatility among ASX lithium stocks

Prefers Arcadium Lithium (ASX: LTM) and Mineral Resources (ASX: MIN), “with LTM's growth and MIN's services and energy valuation providing upside”

Pilbara Minerals (ASX: PLS): “has performed well”, but “existing premium becomes a barrier to further upside”. Still, broker believes PLS “offers the greatest leverage to spodumene prices”

Gold

Northern Star Resources (ASX: NST): “We continue to prefer NST from the larger-cap gold names driven by our expectation of a more meaningful production growth outlook”

Westgold Resources (ASX: WGX): “From the smaller-cap producers, our top pick remains WGX” due to lower costs guidance

Energy

Santos (ASX: STO): “Superior FCF growth is now getting closer, and growth portfolio appears back on track”

Woodside Energy (ASX: WDS): “Value has emerged at these levels”

Beach Energy (ASX: BPT): “we still see superior near-term earnings growth - led by Waitsia start & Otway production growth”

Ratings and price target changes aplenty

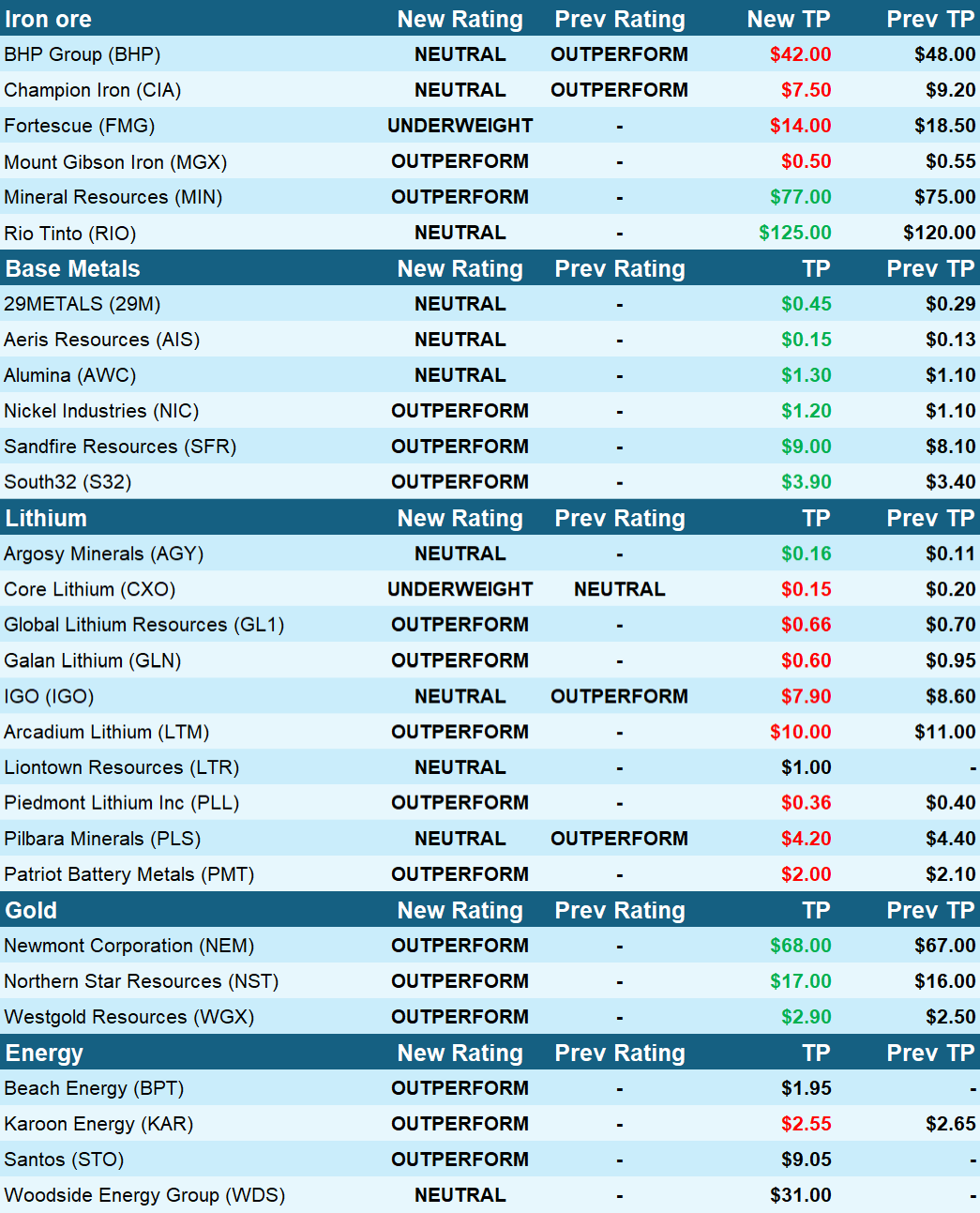

This table summarises the extensive changes made to Macquarie’s metals and energy universes coverage:

This article first appeared on Market Index on Monday 18 March 2024.

5 topics

29 stocks mentioned