Macquarie: The 16 highest quality small caps on the ASX

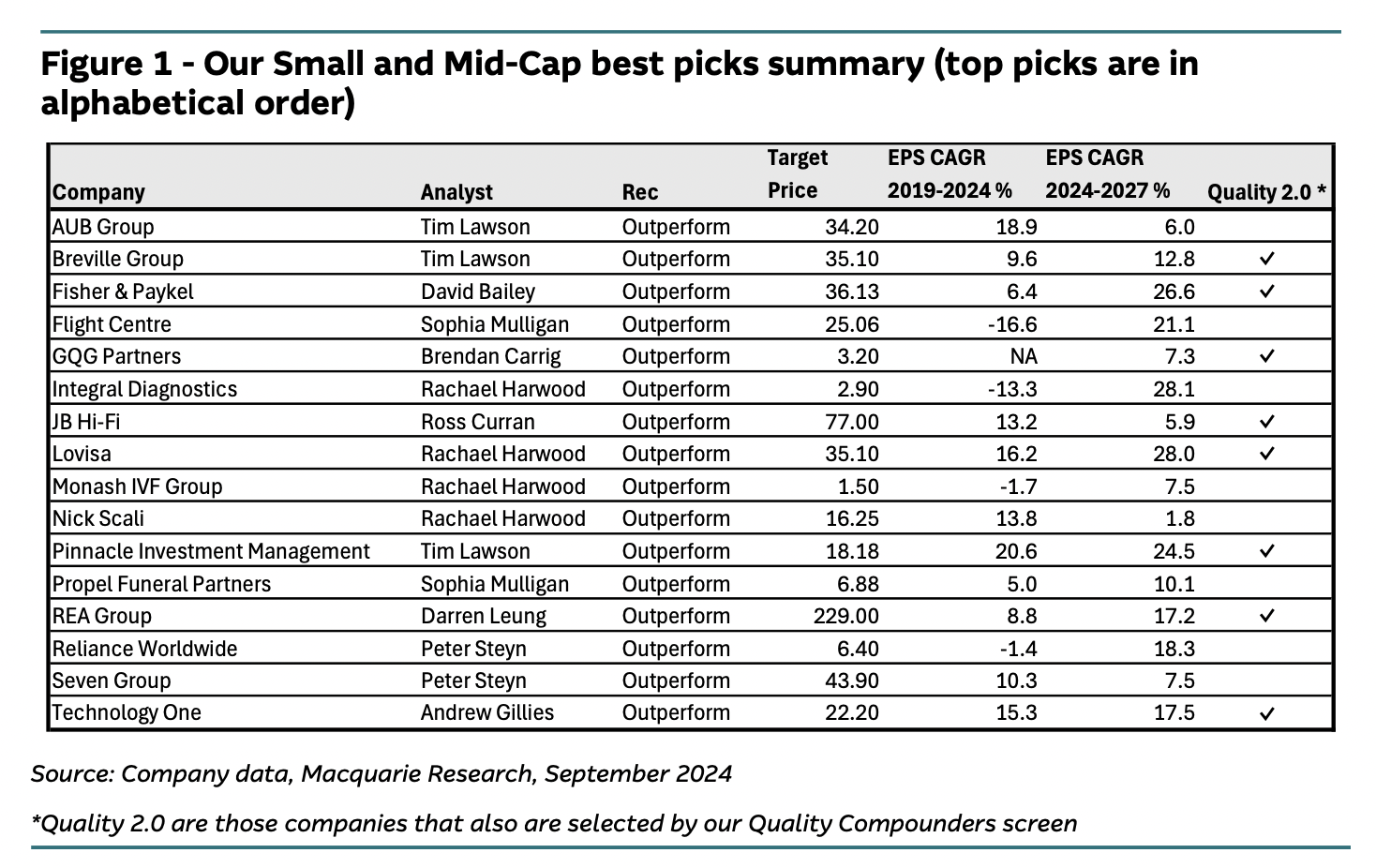

Macquarie has released its best small and mid-cap picks, based on its analysts' fundamental research. The list leverages Macquarie's systematic "Quality 2.0" screen, which includes factors like persistent profitability, competitive advantage, risk and growth outlook.

"Quality 2.0 had compelling outperformance historically, particularly in the Australian Mid and Small-cap universes," Macquarie said.

"This screen has proven more defensive and had a significantly greater propensity for upside earnings surprise than mainstream benchmark Quality definitions."

These factors are necessary to best emulate Quality investing, Macquarie wrote and increases the likelihood that a company can compound its earnings.

The factors are measured as below:

- Persistent profitability - The number of times that a stock has been in the top third of the universe over the last five years, measured through ROE, ROIC, and various free cashflow profitability factors.

- Risk - Macquarie uses both earnings variability over the last five years, as well as traditional risk measures such as 52-week volatility, beta, leverage, company size and earnings certainty to find the lowest risk and best third of stocks.

- Growth outlook - Stocks with a "good" growth outlook over the next 12 months and the longer term.

So, without further ado, here are the stocks that Macquarie's analysts believe are the highest-quality small and mid-caps picks on the ASX.

AUB Group (ASX: AUB)

- Target price: $34.20

- Potential upside: 14.30%

Macquarie believes that EBIT margins are on track for all segments of AUB's business. If these targets are achieved, this would imply an 8% upside to the investment bank's FY27 EBIT forecasts. It also notes that margins increased across all divisions in FY24.

Macquarie believes earnings per share will increase to 166 cents per share (cps) in 2025, 176 cps in 2026 and 185 cps in 2027 - up from 156 cps in 2024.

Breville Group (ASX: BRG)

- Target price: $35.10

- Potential upside: 2.15%

Macquarie believes Breville has entered FY25 with momentum on the top line, with its new product development pipeline continuing to be released and new markets outperforming. The company will continue to plan inventory for accelerated growth, Macquarie said, while at the same time managing costs to limit downside risk.

Macquarie estimates that earnings per share will increase from 82 cps in 2024 to 93 cents per share in 2025, 105 cps in 2026 and 117 cps in 2027.

Fisher & Paykel (ASX: FPH)

- Target price: NZ$39.20

- Potential upside: 13.29%

Macquarie believes Fisher & Paykel has demonstrated positive momentum for its home care products, and its new app growth looks sustainable. It also believes that the group has a solid EPS growth outlook - forecasting revenue growth of around 13% per annum over FY24-27, thanks to a gross margin recovery and operating expenses leverage. New apps are forecast to be a key growth driver of earnings/valuation.

The investment bank believes that earnings will compound at an annual growth rate of 27% between now and FY27.

Flight Centre (ASX: FLT)

- Target price: $25.06

- Potential upside: 29.30%

Flight Centre is Macquarie's preferred travel exposure given its market share, expected earnings growth, upside risk to earnings expectations, and valuation.

The bank forecasts around 6% total transaction value (TTV) growth in FY25 and FY26, noting that corporate has grown to be about 50% of Flight Centre's TTV. Macquarie believes that EPS will grow at a compound annual growth rate of 21% between FY24 and FY27.

Macquarie also believes there is potential for earnings upgrades, arguing that Flight Centre achieving its 2% underlying profit before tax TTV margin target represents a 12%/16% upside. It expects further margin improvements in FY25 will be driven by reducing corporate cost margins, improvements in leisure revenue margins, reducing the drag of corporate overheads and the closure or turnaround of loss-making businesses.

GQG Partners (ASX: GQG)

- Target price: $3.20

- Potential upside: 24.51%

Macquarie notes that the 1H24 result was around 2% ahead of consensus. However, it notes that the revenue beat was primarily driven by performance fees. The investment bank also argues that investment performance has been exceptional over a consistent period of time.

Analysts say they would have liked to see more operating leverage delivered at the 1H24 result. They note that the costs are the result of either strong performance or in advance of revenue generation. However, they argue that the valuation remains very attractive.

Integral Diagnostics (ASX: IDX)

- Target price: $2.90

- Potential upside: 12.40%

Macquarie believes that Integral Diagnostics' growth outlook looks attractive, with analysts forecasting a 28% EPS CAGR between FY24-27, excluding the potential of a merger with Capital Health (ASX: CAJ).

The investment bank also believes that investors can expect further margin expansion in FY25, with EBITDA margins growing by 20bps to 19.5% in FY24. Analysts predict margin expansion will lift 80bps to 20.3% with ongoing employee cost savings expected.

Macquarie believes that the potential merger with Capitol Health could provide a significant opportunity from both a revenue and cost perspective, and could drive double-digit EPS accretion both in the first and second year post the merger.

JB Hi-Fi (ASX: JBH)

- Target price: $77.00

- Potential upside: -4.68%

Macquarie's analysts believe JB Hi-Fi can grow its earnings per share at a CAGR of 6% over the next three years. They believe this will be supported by three drivers - AI-driven growth, the upcoming replacement cycle and an improved discretionary spending outlook for FY25.

In terms of AI-driven growth, Macquarie believes that consumers and corporates upgrading their computers with AI-enabled upgrades will be a windfall for JB Hi-Fi given its market share and strong relationships with suppliers.

It also believes that stage three tax cuts and the potential for interest rate cuts to boost household disposable income over FY25 and FY26.

Lovisa (ASX: LOV)

- Target price: $35.10

- Potential upside: 13.59%

Analysts predict significant growth over the next three years for Lovisa (EBIT CAGR of 26% from FY24-27), thanks to the company's store rollout and EBIT margin expansion.

Macquarie also believes investors can expect a ramp-up in store openings in FY25, particularly in the US. The investment bank expects 132 new stores will open in FY25, despite only 8 net new stores opening in the first eight weeks of FY25.

These store openings inform Macquarie's revenue growth forecasts of 15.2% in FY25, accelerating in FY26 with increased store openings and a new CEO - which analysts believe will lead to significant cost savings (and EBIT margin expansion as a result).

Monash IVF (ASX: MVF)

- Target price: $1.50

- Potential upside: 25%

Macquarie argues that the growth outlook for Monash IVF remains attractive, predicting an EPS CAGR of 7.5% from FY24 to FY27. Analysts forecast FY25E revenue/uNPAT growth of 6.4%/7.6%.

Analysts note that Monash IVF experienced a net increase of 15 specialists in FY24, and predicts continued strength in specialist recruitment will support market share in FY25 (45bps of market share gains).

The investment bank also believes the international outlook is improving, with 2H24 cycles up 38.9% versus the previous period. Analysts believe international fresh cycle growth will lift 13% in FY25 while frozen growth will lift 10%.

Nick Scali (ASX: NCK)

- Target price: $16.25

- Potential upside: 8.55%

Macquarie's analysts believe Nick Scali will deliver 2% EPS growth between FY24 and FY27, however, they note that the real opportunity exists in the firm's acquisition of UK-based Fabb Furniture. The investment bank believes there is potential for gross margin expansion in the UK, which is currently at 42%. With Nick Scali's products set to arrive in UK showrooms in September, analysts believe gross margins could lift to 45% in FY25 and 48% in FY26.

Analysts also see significant store rollout opportunities, noting the ANZ region is only 67% through its long-term target of 176-186 stores. They also note that Nick Scali continues to optimise the Plush store network, closing some of its less profitable stores. This will help to drive better conversion, analysts said.

Pinnacle Investment Management (ASX: PNI)

- Target price: $18.18

- Potential upside: 9.78%

Analysts believe that the growth outlook for Pinnacle remains attractive, estimating a 25% EPS CAGR in FY24-27 (compared to 31% in FY16-24).

They also believe that Pinnacle's diverse set of affiliates (across multiple strategies and asset classes), combined with distribution, will continue to support net inflows and operating leverage.

Macquarie also notes that Pinnacle's NPBT (net profit before tax) margins have historically averaged around 50% - however, investments have caused margins to contract to as low as 35%. Analysts believe as Horizon 2 investments become profitable, margins can return to 50%. Analysts also argue that the outlook for organic performance is backed by net flows, performance fees and operating leverage.

Propel Funeral Partners (ASX: PFP)

- Target price: $6.88

- Potential upside: 18.42%

The only certainties in life are death and taxes, right? Macquarie analysts believe Propel Funeral's industry fundamentals remain attractive, noting that organic earnings are expected to rebase in FY25.

They note that M&A continues to represent material upside risk to earnings, arguing that Propel Funerals has sufficient funding capacity ($153 million) to take advantage of strategic acquisitions as they arise.

Macquarie forecasts a 10% EPS CAGR between FY24 and FY27.

REA Group (ASX: REA)

- Target price: $229.00

- Potential upside: 15.38%

Similarly, the outlook for REA remains attractive, with analysts predicting a 17% EPS CAGR between FY24 and FY27 (compared to 8% between FY18-FY24). However, this does not include any impact from the potential acquisition of Rightmove (Rightmove has since rejected REA's first $11 billion bid.)

It also believes REA's FY25 outlook seems conservative given the group expects flat listings and some headwinds in NSW and VIC.

From a macro standpoint, analysts believe that both demand and supply look strong, underpinned by high levels of employment and immigration. If the current pace of listings remains at this level for the remainder of the calendar year, analysts believe that FY25 listings could be up 2% year on year.

That said, analysts believe that valuation support remains limited given the stock's current share price, but relative valuation compared to other marketplaces is starting to look supportive.

Reliance Worldwide (ASX: RWC)

- Target price: $6.40

- Potential upside: 16.57%

Macquarie argues that Reliance Worldwide has an attractive exposure to the acceleration of US housing activity - noting that management has done a good job preparing for the recovery. It also notes that the company's valuation remains attractive in that context.

Analysts believe that group revenue will remain flat compared to the previous period, with 1H FY25 EBITDA margins also remaining stable thanks to cost reduction.

They also note that cash conversion has remained strong at 114%, with net working capital declining US$16.4 million year on year. The company has pointed to a cash conversion of around 90% in FY25.

Seven Group (ASX: SVW)

Analysts believe that Seven Group's valuation looks attractive with this in mind, with the stock trading in line with historic averages.

Seven Group has guided to EBIT growth of mid to high single digits in FY25. However, Macquarie's analysts note that the group has historically been conservative early in the year.

In addition, Macquarie believes that Boral's strong performance, delivering 10.5% EBIT margins in FY24, continues to demonstrate its potential as a turnaround opportunity.

Technology One (ASX: TNE)

- Target price: $22.20

- Potential upside: -0.89%

Macquarie's analysts argue that Technology One is in an upgrade cycle, with positive EPS revisions, an attractive relative valuation, high returns and an improving competitive position. They note that the current share price implies a free cashflow CAGR of 18.5%, the lowest of all Macquarie's ASX technology coverage.

Analysts also note that Technology One is continuing to take share in the UK market - with recent deal wins in the UK signalling a step change in growth.

R&D investment (target of 20% of sales) also signals product-led growth, which will help Technology One increase customer spend.

4 topics

17 stocks mentioned