Macquarie: These 3 retailers could see a major earnings boost thanks to AI

This week is a big one for traders given NVIDIA (NASDAQ: NVDA) will hand down its latest earnings result this evening Sydney time. The company has consistently exceeded its ultra-high consensus earnings estimates. And even on the day before its results, three sell-side analysts have upgraded the stock (UBS, HSBC, and Bank of America all have a price target of over $1,000/share for the company!)

So with this theme in mind, Macquarie has been looking for secondary AI beneficiaries in the Australian equity market. And while there are no pure-play applications listed on the stock exchange, analysts have identified one place where AI may have an impact - laptops and personal technology.

We’ll explain the connection in this piece.

The “generational upgrade cycle” coming for PCs

Analysts say the first major catalyst for AI in this part of the market is how it will affect personal technology devices - one that could mirror the move from MS-DOS to Windows 95.

“Apple (NASDAQ: AAPL), Dell (NASDAQ: DELL), HP (NASDAQ: HPE), Lenovo and Acer have all recently announced new premium consumer and business products. If the productivity gains predicted by industry watchers trigger a corporate upgrade cycle, we could see an accelerated replacement cycle of home computers,” analysts said.

But the good news for the ASX-listed retailers that carry these products is the change in the new purchase/upgrade cycle.

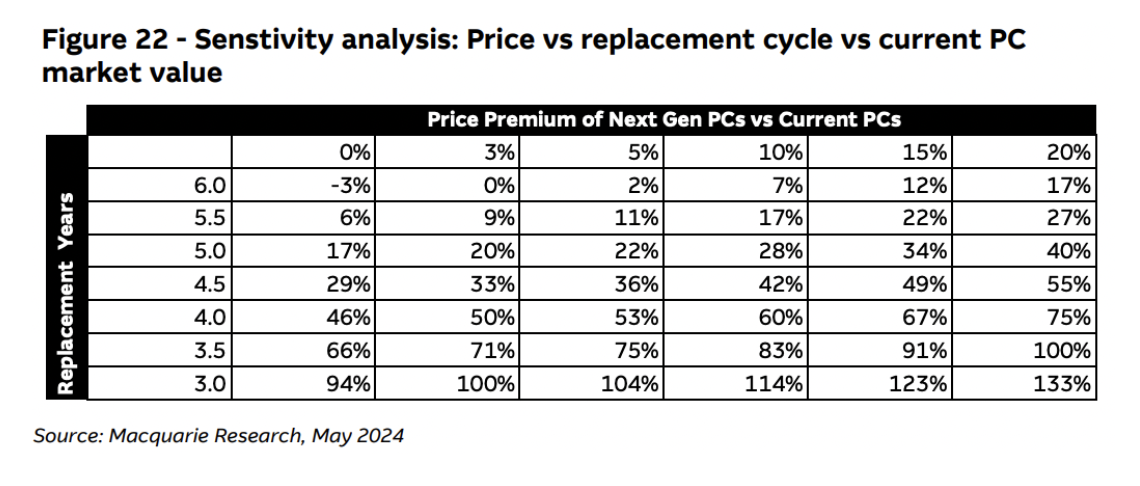

“If the current 6-year replacement cycle contracts to 5 years, coupled with a 15% price increase for the new tech, this could result in the PC market being 34% larger in FY25 than current estimates,” they add.

After all, retailers will want to use AI-embedded PCs to spark and speed up the upgrade cycle by encouraging people to replace their devices more often. More devices replaced, more devices sold, more revenue! Or as the analysts put it - moving from the top left of the following table to the bottom right.

So how does this affect the retailers?

If this base case were to eventuate, Macquarie analysts say that FY25 earnings estimates for each of JB Hi-Fi (ASX: JBH), Harvey Norman (ASX: HVN), and Wesfarmers (ASX: WES) could rise by 4.5%, 3.7%, and 0.5% respectively. The latter will receive the smallest share of the pie because it has only one major business which carries PCs (Officeworks).

As a result, JB Hi-Fi and Harvey Norman have each been upgraded to OUTPERFORM from neutral while Wesfarmers remains a NEUTRAL (albeit on valuation grounds).

JB Hi-Fi’s price target has risen to $63 per share (from $61) while Harvey Norman’s price target is up to $5.30 (from $5.10). Both are, in the analysts’ words, “based on a more favourable outlook for consumer spending over the next three years, supported by what in our opinion are unchallenging valuations for the stocks.”

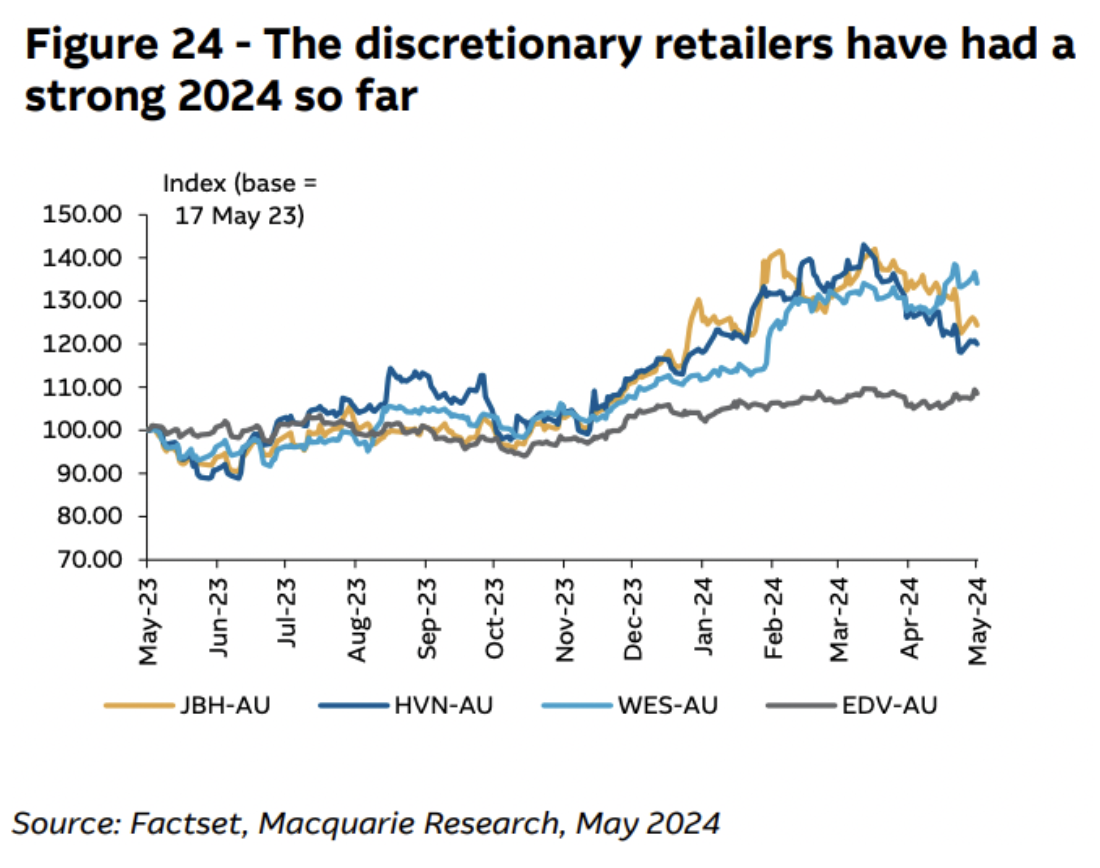

The last thing to note is that these price targets and rating changes come amid a strong 2024 so far for retail stocks. Investors considering these stocks should be aware they're buying into a lot of momentum (even if they think that valuations are still unchallenging).

3 topics

7 stocks mentioned