Major lithium bull: End-user EV demand, not restocking, key to sustainable rally in prices

Arguably the biggest lithium bull among Australia’s broking community, Macquarie, has released a new research report suggesting the problems facing the lithium market are far more deep-seated than whether or not restocking has begun.

The concept of restocking has captured the market’s attention since the start of the year, as many lithium bulls on social media have pegged it as the key factor in sparking a much-anticipated rally in lithium minerals prices. The background to the restocking theory lies in two major driving forces in the lithium minerals market through the backend of 2023.

Firstly, as prices of major lithium minerals such as lithium carbonate fell quickly during the year, battery manufacturers began to expect even lower prices. Naturally, this incentivised them to run down inventories to the thinnest sustainable margins so they could replenish at more attractive prices.

Secondly, there was a seasonal element at play concerning the Chinese New Year holiday period where battery manufacturers typically run down inventories ahead of the extended break.

The upshot is, as battery manufacturers withdrew en masse from the lithium minerals market, it further exacerbated the plunge in prices. But, with inventories now down to just four weeks supply, the theory is plenty of pent-up demand must return post-CNY holiday, and this will help boost prices.

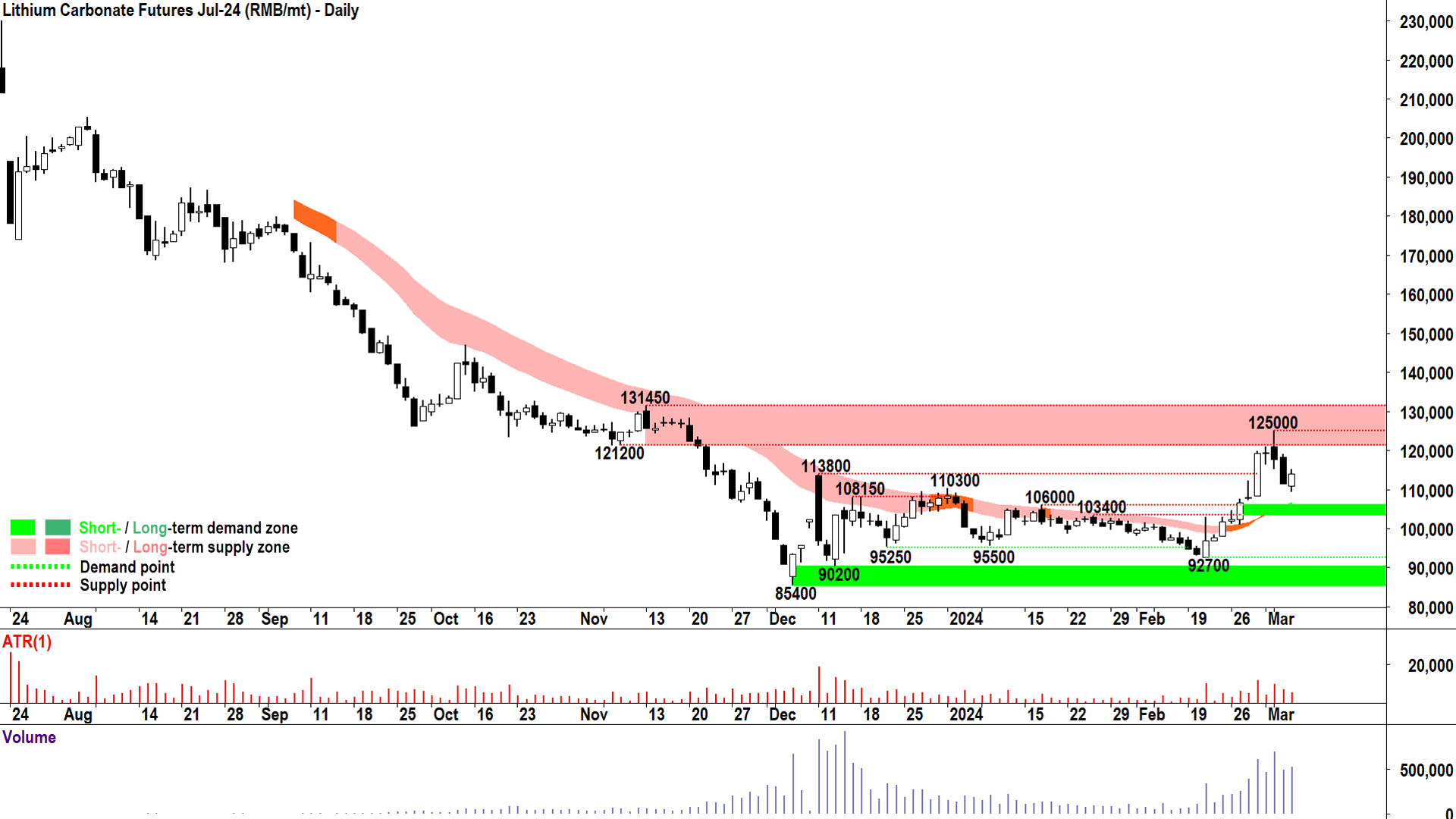

This certainly appears to be the case so far if we look at lithium carbonate futures on the Guangzhou Futures Exchange (GFEX). The benchmark July contract enjoyed a 46% rally between December 13 and March 4.

It’s too early to tell, watch Feb data (Macquarie)

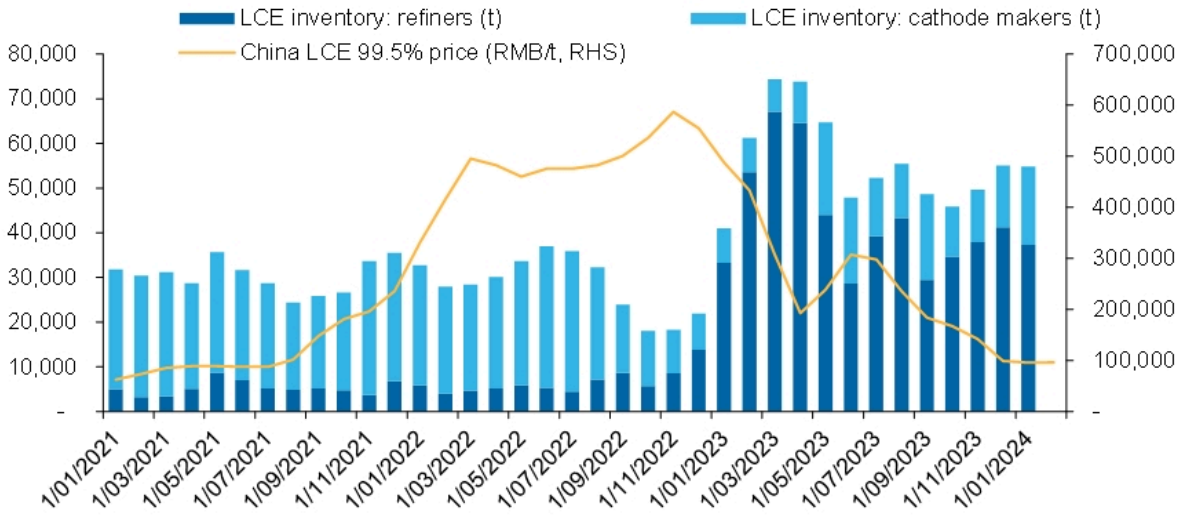

Whilst early indications suggest at least some restocking has begun, Macquarie warns it’s still too early to quantify the extent of the phenomenon. The broker notes lithium’s “long value chain”, suggesting that “February inventory levels at refiners and cathode makers would be key to watch”.

On the current rally in lithium carbonate futures, Macquarie suggests it’s also dangerous to mistake the size of the recent rally as a signal the lithium minerals market is out of the woods in terms of pricing. Any present inventory build “could have a disproportional impact on apparent demand and prices in the near term”, they note.

Macquarie also makes some interesting points on the increasing focus on GFEX’s relatively new futures contracts. The contracts that commenced in July last year are increasingly being viewed as a leading indicator of market sentiment, but their novelty has earned them many detractors.

There’s some justification for the market’s attention to GFEX futures pricing, suggests Macquarie. Many lithium producers have recently chosen to shift their pricing mechanisms from backward-looking previous-month pricing (M-1) to forward-looking next-month pricing (M+1). “As such, the equity market may place more emphasis on future lithium prices to estimate near-term earnings performance”, notes Macquarie.

Supply risks emerging despite production pullbacks

Whilst February inventory data is going to be important in providing the next piece of the lithium demand puzzle, Macquarie is optimistic that the supply side may inevitably deliver more enduring support to lithium prices.

The first reason isn’t good news if you own ASX lithium stocks, though. According to Macquarie, the slump in lithium prices has triggered several “output cuts and delays to green-field and brownfield projects” by Aussie lithium producers. The resulting impact on the lithium market could be the loss of as much as 150kt of spodumene supply during 2024.

Next, Macquarie cites ongoing environmental inspections in the “lithium hub” of Jiangxi in China. The broker notes Jiangxi is the epicentre of “marginal volumes for lithium supply”. The inspections have triggered a lull in production which was largely to blame for lower lithium prices in 2023. “The supply uncertainty caused by environmental inspections could limit operating rates and shift cost curve support in the near term”, says Macquarie.

The final piece of the supply puzzle that could support lithium prices this year relates to African production. Macquarie believes the market “could be over-optimistic on supply growth in Africa”. The broker points out that “mineralisation issues” at the Arcadia lithium project in Zimbabwe may impact its planned ramp-up, whilst a “severe” drought in the country may impact the commissioning of new projects.

In the end…it’s about end-use

Longer term, Macquarie suggests restocking alone probably isn’t going to cut it in terms of helping stamp a meaningful recovery on lithium prices. The broker notes “A sustained demand improvement requires a lift in end-user EV purchasing activity instead of just value chain restocking”.

That’s just not happening yet, notes Macquarie. “Our channel checks with major batteries manufacturers and companies on the lithium supply chain indicated no substantial changes in end-use demand”.

Mac’s ASX lithium preferences

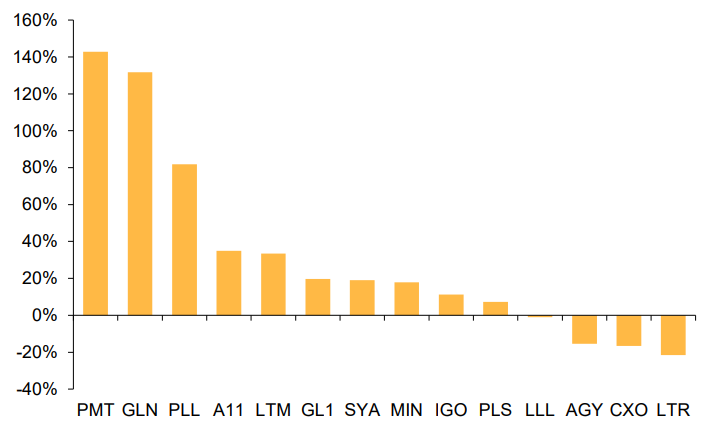

Given their substantial research into what’s happening right now on the ground across the Chinese battery supply chain, Macquarie has reiterated its top picks in ASX lithium stocks.

Pilbara Minerals (ASX: PLS)

Rating: OUTPERFORM Price Target: $4.40

“PLS is our preferred producer with the most un-leveraged balance sheet in our AU lithium coverage universe”

Arcadium Lithium (ASX: LTM)

Rating: OUTPERFORM Price Target: $11.00

“We see value in LTM given its recent share-price underperformance”

Patriot Battery Metals (ASX: PMT)

Rating: OUTPERFORM Price Target: $2.10

“PMT remains our exploration pick”

For a full list of Macquarie’s ASX lithium sector ratings and price targets, make sure you check out the Broker Notes section of today’s Evening Wrap. In the meantime, here’s a graphic that depicts the implied return of each stock in Macquarie’s ASX lithium universe concerning its current price and the broker’s price target.

This article first appeared on Market Index on Thursday 7 March 2024.

5 topics

9 stocks mentioned