Making small caps great again: An analysis of recent ASX 300 entries

George Soros’s first business partner, Jim Rogers, would love Aussie Small Caps. As the author of a book called ‘Hot Commodities’ Jim would have found a happy hunting ground in Aussie smalls over the last few years.

Having said this, if the recently announced S&P/ASX 300 entries are any indication, the tide may be turning back towards small cap industrials. For the first time in years, there were more small cap industrial stocks added to this key benchmark than resource companies.

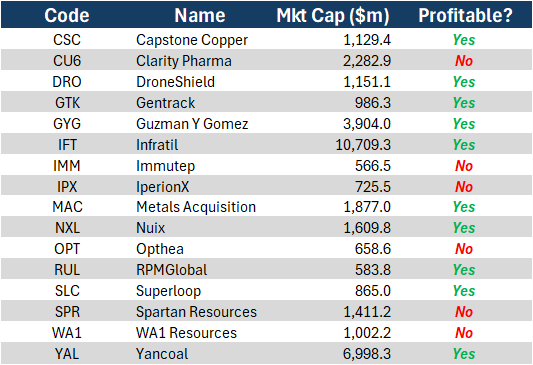

For the past few years, QVG Capital has been writing on Livewire about index changes, with a particular focus on the proportion of unprofitable companies entering the S&P/ASX 300. On 6 September it was announced a jumbo cohort of 16 companies will be added to the S&P/ASX 300. We have previously discussed the lack of quality of 300 entries but this batch is showing signs of improvement - 10 of the 16 are actually making a buck.

Why the ASX300 is a big deal

For those wondering about the significance of the S&P/ASX 300, it’s the benchmark that index funds such as the $16.1 billion Vanguard Australian Shares Index (ASX: VAS) seek to replicate. It’s also the pool that many fundamental portfolio managers use for their investable universe. With a new batch of additions entering the index in September, we felt it was worth reviewing the current crop.

Here goes:

Table: 16 stocks that have been added to the S&P/ASX300 (Source: QVG Capital)

The table above shows the 16 stocks that have recently been promoted into the index. It’s notable that there were more industrials – 7 – than resources – 6 – added, with 3 biotech’s rounding out the additions.

Clarity, Immutep and Opthea are the biotech’s being promoted into the 300. None make money yet but biotech investors have had big wins out of Telix (TLX, $6B market cap) and Neuren (NEU, $1.7B), so will be hoping these three can defy the odds and come in a winner. For the technical analysts, Clarity has a chart to die for, but the other two are a little more aimless and we note this is Opthea’s second crack at the 300.

Recently, the themes in resources have been clear. Last rebalance saw a bunch of uranium names added just in time to mark the top market, while the prior two years were all about Lithium (and we know how that has ended). Apart from a couple of Copper names, it’s a mixed bag of commodities with Coal, Gold and specialty metals all featuring.

Of more interest this time around is the fact there are several high-growth, high-quality small industrial names coming into the 300. Names like Gentrack, GyG, Nuix, RPMGlobal and Superloop all have identifiable competitive advantages, are profitable and are growing above market.

What to make of all this?

We suggest the following:

If you buy an index product, be aware you’re buying the good, the bad and the ugly.

Fundamentals such as profitability, durability of those profits, and efficiency (i.e. how much capital is required to generate those profits) drive share prices in the long run.

And finally, stocks with weak fundamentals that are over-valued for technical reasons can present great shorting opportunities; ones the QVG Long Short fund seeks to take advantage of.

How to take advantage of volatile share prices

The August reporting season saw significant fluctuations in stock prices, sometimes unrelated to the fundamental value of companies. Volatility creates opportunity for active investors to buy shares at attractive valuations and to exit overpriced stocks during these pronounced market swings.

If you're interested in learning about how to take advantage of these opportunities please register for the upcoming QVG Capital Investor Webinar to be held on Thursday 19 September.

3 topics

17 stocks mentioned

1 fund mentioned