Managing a bubble

You may have seen an article recently about the head of the Dutch central bank, Klaas Knot, who is also a governor on the ECB, saying that “the picture resembles that of the period before the financial crisis”, that we are “about to witness a brutal collapse in asset prices”. He talked about overvaluation (the S&P 500 is hitting all-time highs), a low level of volatility (the VIX just hit a record low), and the risk that investor sentiment could turn very quickly if the US raises interest rates more aggressively than the market expects. He said the “risk of sharp market corrections is real”.

Meanwhile Wolfgang Schauble, the German finance minister, also talks about a risk of “new bubbles” as a result of a decade of quantitative easing and the trillions of dollars central banks have pumped into the financial markets through the bond markets.

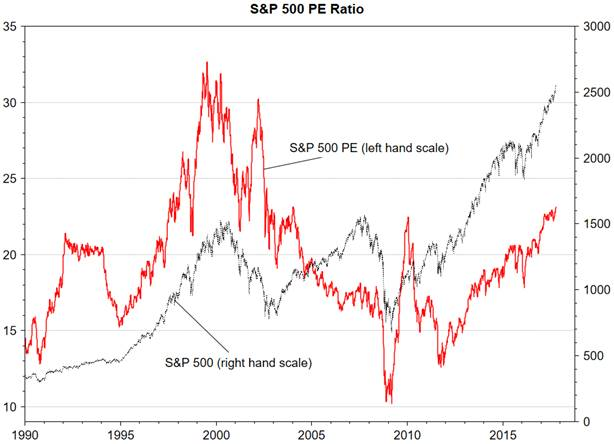

On top of this an award-winning Nobel prize winner (in economics) Richard Thaler says markets don’t always price assets efficiently because investors are not always rational, can be overcome by emotive human psychology and that they lack perfect information. He highlights the herd mentality driving everybody to buy mortgage-backed collateralised debt obligations causing the global financial crisis. He now talks about Wall Street being perched on a record high with market volatility being abnormally low with geopolitical risks and huge increases in Global public and private debt being ignored. He says, “the unbelievably low volatility in a time of massive global uncertainty seems mysterious to me”. He also talks about the Australian property market running with a record 189% household debt to income ratio and mentions the Robert Schiller cyclically adjusted P/E ratio (CASE PE) shown in the chart below which is showing the S&P 500 to be more expensive than it has ever been apart from two moments in time. Before the 1929 crash and during the tech boom.

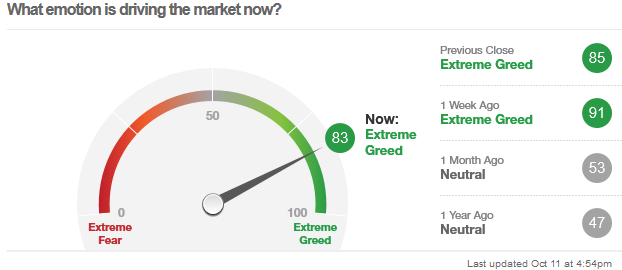

Then there is the CNN Money Fear & Greed Index, which shows that "extreme greed" is driving the market.

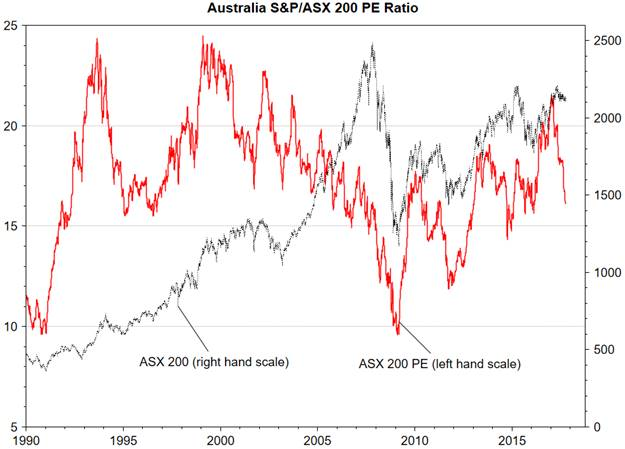

The ASX 200 has hardly risen this year and is trading on a price-earnings ratio of just below 16x which is only marginally above the long-term average of around 15x. No bubble here.

The US, on the other hand, has seen the S&P 500 up 12.5% this year, the NASDAQ up 20.5% and the S&P 500 has moved from a price-earnings ratio of 18x to 23x in the last couple of years. Think about that. It means that share prices have risen 27% more than earnings since early 2015.

Now I own a couple of businesses and I have to tell you if someone wanted to come and pay me 23x post-tax earnings for either of them I would retire a squillionaire. Yet this is the average, repeat, average, valuation of US$22.97 trillion worth of US stocks in the S&P 500.

But before you rush to the doors on the back of Klaas Knot’s comments you should understand that central bankers are perhaps the most conservative market commentators in existence. Prudence is their job, and all we are seeing is the first level of many markets chicken little commentators, who are paid to do so, turning chicken. That is their role. On top of that let me make a few unconventional observations about stock-market bubbles.

The best market performance comes before a bubble. We should never fear a bubble, we should welcome them, Encourage them even. They are rare, fantastic, twice in a lifetime opportunities. If you spend those moments sitting on the sidelines wagging your finger at everyone else’s stupidity you are missing the point.

You have to take advantage of bubbles. What you can achieve in a few months or years ahead of a bubble bursting is what makes the stock market worthwhile in the long-term. All that time spent managing small returns over many years is marking time, waiting for this moment. And please understand, that long-term average return everybody is quoting includes bubbles. You will never achieve the long-term average unless you participate. Those long-term averages include the whole bubble, not a chickening out when things are a bit overvalued. To sit it out at the first sign of a bubble is lunacy.

When it comes to bubbles the obvious concern is the risk of a crash. Let me give you a few pointers on managing that possibility. The first is that you should never try to predict the top of a bubble. You are not that smart. You have to let it run. You only call the top of a bubble after it starts, after the market starts to dump, not before.

When the end comes it will come fast so you have to be ready, watching, finger on the trigger. Vigilance is King. By the time you read about the end of a bubble in the research, in the media, or on CNBC, it will be too late. You have to spot it earlier. I had a Member once whose golden rule of trading was that if the US market ever fell 3% in a day, sell half of everything, and if it did it again, sell the rest.

Also, understand that no one will ever tell you to sell. The finance industry works very hard to get you into financial products, so they will never tell you to get out. That decision must be yours and yours alone.

Not sure when to sell? Of course, you’re not. At some points in the market, there is no science, no fundamental basis for anything, there is just your guts. Go with them, they are a distillation of your state of mind which is a distillation of everything happening around you. If you are worried, sell. And if you are awake at night thinking you should have sold yesterday, sell tomorrow.

Above all be willing to do the one thing that most puritanical value-based investors never do, which is to sell. The first day you see the market down 3% you must react not debate. An ability to sell is the most important element of risk management.

We are not in bubble territory yet, so relax. But when you see the market up 50% in less than a year, get this article of the fridge.

Marcus Padley is the author of the Marcus Today stock market newsletter. To sign up for a 14-day free trial please click here.

1 topic