March Commentary: Markets Take a Breather After “Yuge” Gains

The Trump rally took a breather in March with risk assets mixed. Equities were flat in the US and China, rose in Europe (5.5%) and Australia (2.7%) and fell in Japan (-1.1%). US investment grade and high yield credit gave up a small portion of the recent gains. Commodities mostly fell including iron ore (-12%), US oil (-6.2%) and copper (-2.3%) with gold flat and US natural gas (15.2%) up.

Market Sentiment

Markets have that euphoric feeling to them, with Americans most upbeat about stocks since 2000. Buffet’s favourite measure says stock are getting close to 2000 level of stupidity, having surpassed 2007. Jesse Felder has a range of indicators showing that US stocks are at unprecedented highs. The post-election rally is being pinned on retail buyers, institutional investors have been net sellers. The ratio of buying to selling by corporate insiders is at a 29 year low, CEOs and directors aren’t nearly as bullish as investors. Fund managers agree – 81% think US equities are overvalued.

The low levels of volatility in equities measured by the VIX index isn’t the whole story, there’s also high demand for protection against large downward moves as seen in skew index. The bear fund index is at multi-year lows and the most bearish hedge fund has thrown in the towel on betting on a correction. Compared to the last 19 years, investors are long equities and short cash. Japanese and Korean investors are ploughing money into equity linked notes, a play which can be attributed to both low interest rates and positive sentiment.

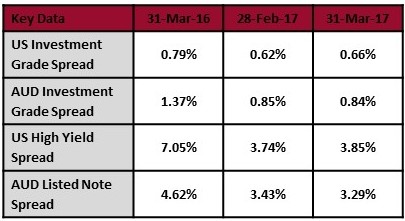

Depending on who you ask credit markets could be “frothy but not irrational”, “the most generous in a lifetime” or are like “a truckload of nitroglycerin on a bumpy road”. There’s plenty of evidence of yield chasing, including Asian high yield seeing record issuance and tight spreads and a boom in frontier market debt in US dollars. In Europe, the standout was a Macquarie coco (preference share/hybrid) which received bids for 16 times the amount available. Both the US and Europe have seen near record issuance of leveraged loans in the first quarter. Leveraged loans to smaller US issuers are coming with record amounts of leverage. US retail is the standout underperformer with one-sixth of all loans trading below the 80 benchmark that usually denotes a distressed company.

The US drug company Valeant is a good example of where credit sentiment is at. Valeant has been making slow progress in deleveraging by selling off its business units with its sales falling faster than its debt. A good portion of the drugs it owns are coming off patent and will be exposed to generic competition in coming years. There’s also the regulatory angle, if Trump takes action to push down drug prices Valeant will be one of the worst hit as its strategy has been buying up old drugs and ramping up prices. Notwithstanding that grim outlook, it was able to issue $6.25 billion of new debt using the proceeds to repay its 2018 to 2020 maturities. It also managed to get its covenants weakened. A Bloomberg columnist compared the refinancing to rearranging deck chairs on the Titanic.

A recent Canadian property conference aimed at retail investors has some calling the peak of Canada’s property market. Celebrity speakers and a “if you believe it you can make it happen attitude” abounded. Second lien debt funds, where investors take a one-year loan to leverage up their limited equity contribution, were being spruiked as an alternative way to participate in the boom. Another celebrity spruiking financial products is Mike Tyson, for a trading company that offers retail investors up to 400 times leverage.

Luxury goods can sometimes be a good indicator of market sentiment, but at the moment they are mixed. Imports of champagne to the US are back at 2007 levels but art sales fell 11% in 2016 with trophy works worst impacted. High end property prices in London and New York are both falling, with rents in New York and San Francisco coming off elevated levels.

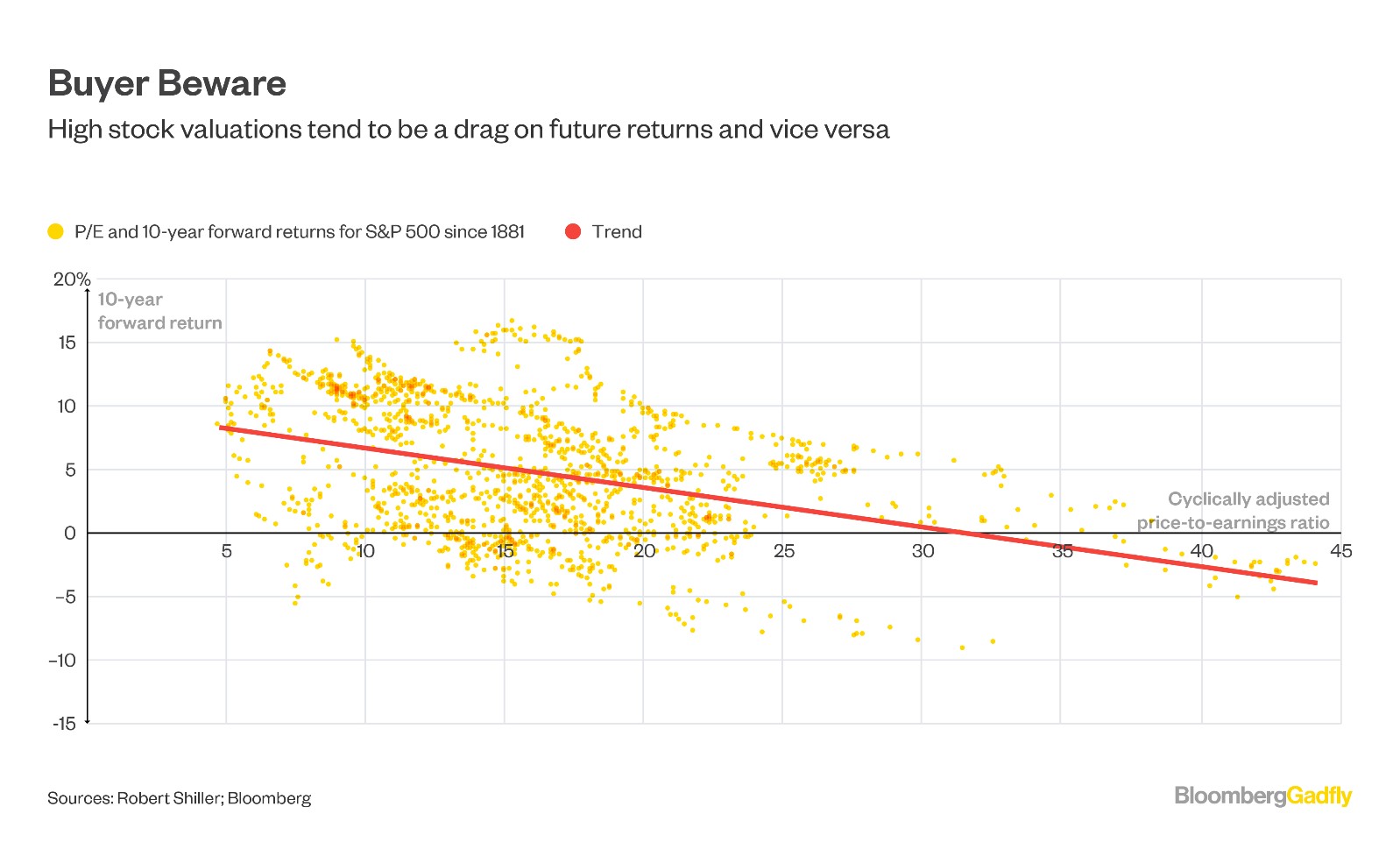

There’s been plenty of discussion on the merits of the CAPE ratio (cyclically adjusted price to earnings ratio). CAPE is criticised for not being a very good timing tool, but that misses the key point, it has been a very good return prediction tool. The graph below shows what can be expected over the following ten years based on various starting points. Note that we are currently just under 30. As always, if you pay high prices you get low returns.

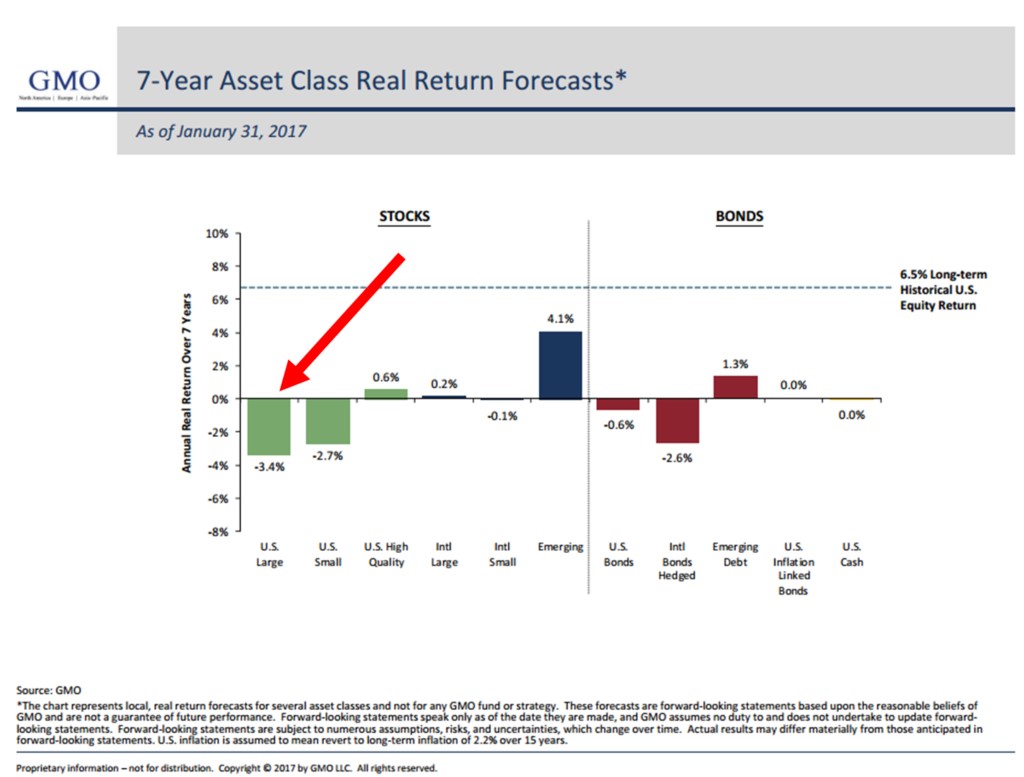

GMO developed something of a cult following for its forecasting abilities after it was sacked by some clients in 1999 and 2000 for providing forecasts seen as too bearish. Clients who took their advice had much better outcomes in the crash that followed. Their recent update has everything except emerging market stocks delivering well below historical returns to investors over the next seven years.

Pension Funds

The poor outlook for asset returns highlighted above is particularly troublesome for pension funds. If the forecasts are anywhere near accurate, the underfunding issue will get much worse and many more pension funds will default or reduce their payments to retirees. This has been a slow burning issue with some tracking its development for a decade, but the bad outcomes are now starting to hit home.

Examples this month were Calpers cutting pensions by 63% to former employees of a defunct government agency. Beneficiaries of a New York fund that went broke saw their payments cut to a maximum of $12,000 per year, some dropping from $48,000 per year. There are reported to be another 1 million beneficiaries of funds facing imminent insolvency. The backstop for busted US pension funds is the Pension Benefit Guaranty Corp, which itself is forecast to run out of funds in the next 8-10 years.

In the UK, the government is looking at pension changes that will impact benefits in 20 years’ time. Some companies are handing over responsibility for their pensions to insurers. Others are going down the road of defined contribution schemes. Most pensions are hoping for the best, often increasing their allocations to riskier assets in order to offset the low returns on their debt allocation. Even this isn’t enough, 2016 was a good year for asset returns but global pensions fell further behind their funding requirements. The catalyst for change is likely to be the next substantial sell-off in risk assets which will draw attention to the underfunding situation and see many funds hit the wall.

Funds Management

I often get comments that what I write is pretty negative, highlighting all the bad stuff that’s out there. That’s a reflection of the way that credit investing works; if you avoid the losses then the profits will take care of themselves. Having said that Blackstone made a very positive move for itself and its investors in closing an open-ended distressed debt fund. Closing a distressed fund when assets prices are high is a great call, as is moving investors out of an inappropriate vehicle for distressed investing. Blackstone’s investors have been offered the opportunity to switch across to close-ended distressed vehicles as part of the wind down process.

The experience of investors in the fund hadn’t been that great, it underperformed other Blackstone distressed funds. Blackstone has a good track record with distressed investing but liquidity requirements that come with running an open-ended fund meant that it couldn’t target the highest return assets. Had Blackstone kept the fund open it would have been at risk of a redemption run during the next crisis, when it could be forced to sell assets at exactly the wrong time. That’s why distressed and other illiquid asset classes should be run in close-ended funds or individual mandates. If you’re interested in the opaque world of distressed debt trading, Matt Levine wrote an excellent commentary on a real life example of trading a distressed security and the impact on fund valuations.

One hedge fund is offering no management fee and a 5% loss guarantee, but it comes with a 50% performance fee for returns above 10%. Forbes had an interesting article on AQR, describing it as a mix of Vanguard and a hedge fund. AQR is primarily a smart beta firm, a sector some are questioning as there is the potential for data mining and crowding to impact future returns. Arlington Value has closed its fund to new investors after posting another great year in 2016.

It’s one thing for private equity funds to sell assets to each other, it’s another thing altogether for a manager to raise a new fund to buy out the assets of its old fund. Investors could be buying assets at an inflated valuation and shouldn’t be paying big management and performance fees for businesses the manager already owns. Private equity has the same problem as listed equity, current high valuations mean lower future returns. For those in index funds and ETFs the fees are getting so low that they are almost irrelevant compared to the asset class and sector picks.

Banks and Shadow Banks

Non-bank lending is growing quickly due to the combination of higher regulation for banks and advances in technology. Both of those factors are a tailwind for market place lenders. Peer to peer lenders are increasingly turning to institutional funding, via securitisation or partnerships with banks. Fintech companies are figuring out that banks have a huge cost of funding advantage over them, so a partnership model or a full buyout is their best outcome. Several fintech lenders are having teething issues; a Sofi securitisation has hit triggers for early amortisation and Prosper has recorded big losses and falling loan volumes. In perhaps a 2017 equivalent of the infamous 2000 IPO of pets.com, there is now a lender for people wanting to lease a purebred dog.

Deutsche Bank is in the process of issuing €8 billion of equity at €11.65 per share, a steep discount to the €19.55 shares were trading at in early March. This is a positive development, but it’s a long way short of the €40.1 billion needed to hit a 5% leverage ratio. This will buy the bank and the German Government some breathing room, but it’s no guarantee that Deutsche Bank will be strong enough to survive the next crisis without a government bailout. The bank still has limited prospects for a decent return on capital with the “global laundromat” foreign exchange scandal likely to cost it billions more in fines. If nothing else, the capital raising should serve as a reminder to investors who are complacent about other banks needing to raise capital.

Economics

The debate about the usefulness of economics continues, with an interesting piece arguing that economics needs to incorporate sociology to provide better answers. Whilst this might seem revolutionary today, it would just be a return to the roots of economics where people used a wide view range of tools to understand and solve society’s problems. That’s what true economics is. Building models based on ridiculous assumptions or throwing darts at board to guess what the GDP number will be are fake economics.

An example of useful economic analysis is the debate over the impact of technology on employment. It is true that technology will automate some jobs, but it also creates other jobs and reduces costs. The simple view that many will never work again when their jobs disappear fails to recognise that people will spend the money they saved somewhere else and use the time they saved in other ways. The last 50 years has many examples of people predicting mass employment and reductions in hours worked as technology improves. If we want to worry about technology, it will be things like the impact on democracy as large corporations control what we see and know what we do.

The 2015 Nobel prize winner Angus Deaton recently gave a speech slamming American banks and healthcare companies for engaging in rent seeking behaviours. Rent seeking is defined as “the fact or practice of manipulating public policy or economic conditions as a strategy for increasing profits”. Deaton argued that these actions are the biggest cause of capitalism’s problems, not income inequality. The outsized influence of banks is in part due to political donations, with the sector throwing over $2 billion at lobbying in the last US election cycle.

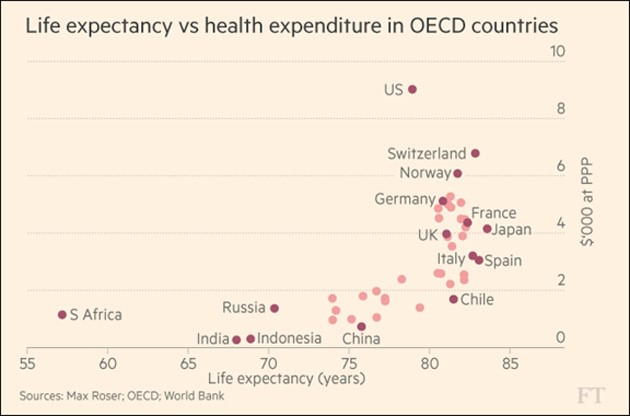

In US healthcare drug makers, hospitals and doctors treat insurers, government and consumers as a piggy bank to be raided at will. The chart below shows that the US is spending far more than any other country on healthcare but getting worse outcomes than other developed nations. The cost of healthcare grew 818% in 50 years, compared to 168% for GDP. In most sectors, such rich pickings would attract new competitors but the high regulatory barriers for healthcare stop this from happening.

The Obamacare and Trumpcare plans do nothing to address the underlying problem. Both plans focus on getting insurance coverage at an affordable cost, but both fail basic economics. They encourage healthy people to remain uninsured and expect people with no savings to cover thousands of dollars in expenses before their coverage kicks in. Without attacking the vested interests, Americans will continue to pay more and receive worse outcomes than citizens of Canada and Australia. The failure to legislate Trumpcare could turn out to be a huge win for Republicans and Americans as the eventual collapse of Obamacare will open up the opportunity to address the real issues.

China

The precarious position of China’s economy was sharply summed up by Ed Hyman from Evercore. “China’s a mess and at some stage it will blow up” as “debt is growing faster than GDP”. When asked about when it will happen he noted that there’s no fuse determining how long things stay together. In the short term, there’s a broad range of positive economic data.

The trouble with predicting the timing of credit problems for China is that the government and the central bank can take action that would be unacceptable in a democratic, market driven economy. The PBOC is experimenting by withdrawing liquidity but that caused some smaller banks to default on interbank payments. Large banks are generally thought to better positioned than the smaller ones, as they have longer term funding and are not growing their loan books as rapidly. The problem with that argument is that larger banks are big lenders to smaller banks and wealth management products, making for substantial contagion risk.

Iron ore has pulled back from recent highs as port stockpiles continue to build. The preferred avenue of speculators, iron ore futures, fell 19% in a week. It’s also believed that steel producers have been stockpiling finished product. Copper inventories are at four year highs and that’s after a series of strikes and shutdowns.

The 85% collapse in the share price and suspension of trading of China Huishan Dairy Holdings is another interesting case study for Chinese capital markets. In December 2016 the infamous short seller, Muddy Waters, released a report that concluded the company was “worth close to zero”. Shares traded sideways for three months before collapsing in March. It appears that someone was mopping up all of the selling but has now run out of funds. As is often the case with Chinese companies in financial trouble, the company treasurer has disappeared. The Chinese banks have double exposure to the company through company debt and margin loans on the shares.

In private markets, China’s bicycle unicorn Ofo is being called worse than Uber. Unlike Uber, there’s substantial capital required to purchase the bikes and ongoing maintenance required on them. Unlike cars, bikes have a very low cost of entry so anyone needing a bike regularly is going to be better off buying one outright. None of that has stopped the mass expansion of bike hiring facilities in cities and investors from throwing money at bike hire businesses. It’s indicative of the rapidly growing venture capital scene in China where signs of speculative activity are rife.

There’s yet more crazy debt issuance, including soon to be CCC rated Evergrande issuing ever more debt at the same time as it looks to loosen covenants on existing debt. The sale of preference shares by a sub-investment grade bank at a margin of +2.14% over 10 year government debt is tighter than US high yield ever was in 2007. Banks and bond buyers should be concerned as local governments are helping busted companies avoid paying back banks.

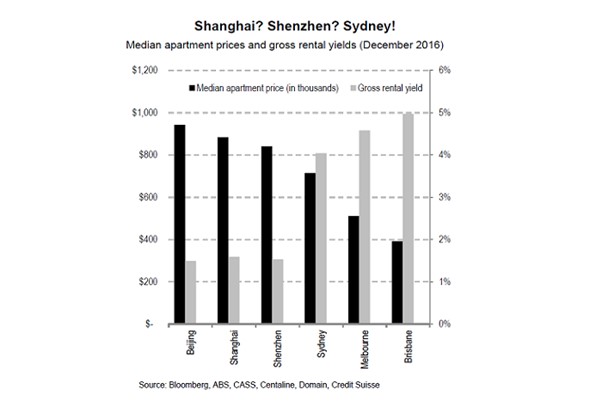

Those wondering why property prices in Australia and Canada have been rising so quickly might find the table below helpful. Whilst property prices in Australia might seem high on a historical basis, they are cheap compared to China on both an outright and gross yield basis. If you think Australia and Canada have housing bubbles, the numbers point to China having the mother of all housing bubbles.

4 topics