Market bounce but no bottom in sight

Since mid-June there has been a powerful rally in global stock markets. The idea that the US Federal Reserve might have turned dovish combined with a US earnings season that contained few negative surprises has juiced share prices.

The question on investors’ minds is: is this a sign of the market turning, or just a countertrend move in a bear market? For holders of Australian shares, the current reporting season adds spice.

Whilst the noise is distracting, even enticing, there are three strategic factors that we want to focus on in answering the question. And we also want to concentrate on the US because it remains by far the most important influence on global financial markets.

1/ Fighting uncertainty on inflation and corporate profitability

With the tone set by politicians and central bankers, war in Ukraine and supply chain disruption have dominated the debate over the direction of inflation. Whilst these have been central to an understanding of ballooning headline prices, the driver to core inflation is services. And it is consumption that drives services, not war, not supply chains.

For the first time in a generation the labour market is tight. Participation rates and unemployment are low, there are many more job openings than workers available, and the risk of a wage spiral is live.

In this context, it is audacious to assume the Fed has or will imminently move to a stance more supportive of financial markets.

Inflation is not the only area of uncertainty. Whilst we are confident that the outlook for earnings is poor, it is challenging to say exactly how bad things might become and for how long. Nevertheless, certain recognised relationships between economic measures provide clues.

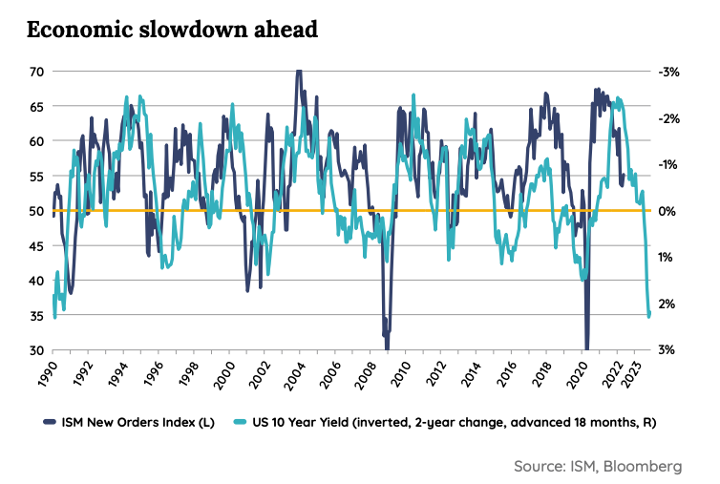

For example, the ISM manufacturing index, a leading economic indicator, tends to lag inverted 10-year bond yields by about 18 months. The ISM in turn, runs ahead of moves in corporate earnings by about three months.

If these relationships hold, US profitability may not trough until the second half of 2023 and at a level considerably below current forecasts – the ISM’s relationship with inverted bond yields is not just in terms of direction but also magnitude.

Given the uncertainty concerning inflation and corporate profitability, you might expect valuations to be low. After all, if it is hard to forecast future cashflows and difficult to work out what one should pay for them, the least valuation might do is provide a considerable buffer against loss.

However, US shares are costly. Recently the Shiller Price Earnings Ratio, a much-watched valuation measure that adjusts for earnings and smooths out cycles, was 31.5x for the S&P 500. In the more than 140 years for which data are available it has only been higher than this for a total of 5% of the time.

If thinking about financial markets was not intricate enough already, the instability in geopolitics is adding complexity.

The tragic war in Ukraine has had knock-on effects felt around the world, most obviously in terms of energy and food prices. And the recent visit to Taiwan by Speaker of The House of Representatives Nancy Pelosi has been, if nothing else, a reminder of the currently fragile relationship between the US and China.

Perhaps this has always been the case, but when it comes to weighing political against economic interests, politics is trumping economics.

We believe that we are seeing a rally in a bear market rather than something more sustainable. But we have also been around long enough to know that anything can happen, in which case we would encourage investors to build a portfolio that is robust in a range of outcomes – the founding principle of diversification.

4 topics