Market dynamics – the case for value remains

In the world of haute couture, a famous designer once quipped – “In a world full of trends, I want to remain a classic”. At Investors Mutual we would rephrase it as: “In a world full of trends, we want to remain a true-to-label value investor”.

The past 18 months has been a challenging and at times a frustrating environment for value investors. At IML we pride ourselves on our strict adherence to the IML investment mantra which has defined our approach to investing for the past 20 years – through all market cycles. That is to buy and own companies with a competitive advantage, with recurring earnings, run by capable management, that can grow, at a reasonable price.

This can be neatly described as an investment style of Value with a strong focus on Quality. However, over the past 18 months this proven approach has significantly lagged the styles of Growth and Momentum based investing.

Value investors are diametrically different to Momentum based strategies. Whilst Value and Growth investors often rely on bottom-up, fundamental research, Value investors prefer not to pay more for a company than it is worth, nor make bets on the unknown or pay for excessive growth in the future.

However, history has shown that when uncertainty increases, portfolios managed by Value investors have proven more resilient than other styles. Companies trading on excessive valuations struggle to justify their lofty valuations and are often punished when markets go through one of their inevitable correction phases. Conversely, companies trading on realistic valuations have been more resilient in times of increased uncertainty.

So where are we today and why has it been a challenging 18 months for a Value investor?

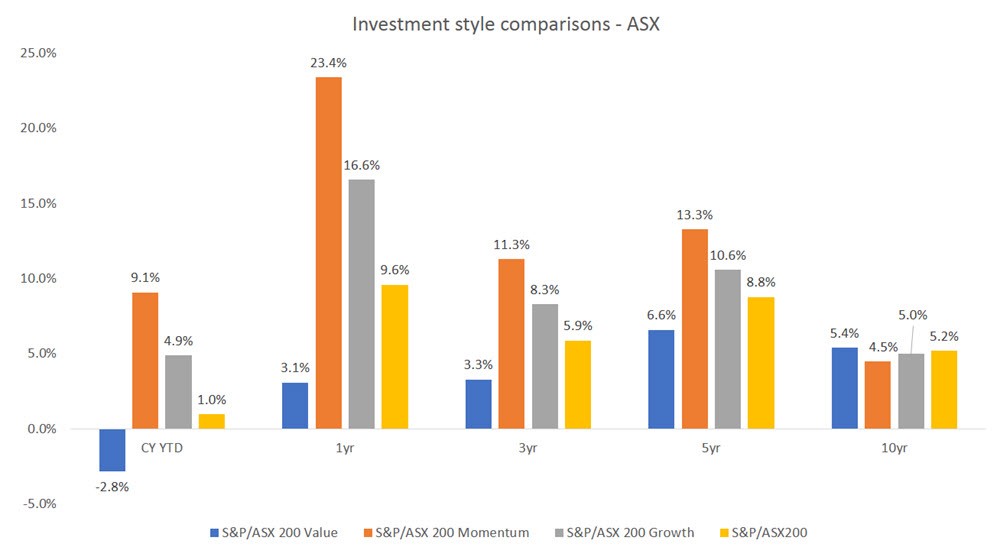

As can be seen from figure 1: Momentum and Growth have outperformed Value and the ASX300 by a significant margin over the last 12 months. The scale of the outperformance of the last 12-18 months has been so significant that it is now impacting the 3- to 5-year comparisons.

Figure 1: Annualised returns of ASX investment styles

Past performance is not a reliable indicator of future performance. Source: Dow Jones S&P Indices, 31 May 2018

There are a number of dynamics at play in the current market:

We are now nine years into the current market phase which has been driven by a record breaking US market and by continued record low interest rates in many parts of the world – including Australia. Since Donald Trump was elected 18 months ago the US market has risen strongly and until recently volatility was at all-time lows. This renewed and unflinching sense of confidence in the sharemarket has made it difficult for Value investors such as IML to keep pace with the sharemarket, while the environment has favoured both Growth and Momentum strategies.

The majority of companies we visit continue to indicate that conditions remain very competitive in many industries and it remains a challenging environment to grow profits.

As an experienced Value manager, it makes little sense in this environment to take on additional risk and pay excessive multiples for stocks which are attractive because they are growing faster than the average company.

However, over this same period many Growth and Momentum managers have shown a willingness to pay high multiples for companies such as; Treasury Wines, Bluescope Steel, Qantas, A2 Milk, NextDC, Cochlear, Macquarie Bank, Resmed and Aristocrat. While many of these are decent companies we challenge the thesis of buying these companies on such high valuations simply because of their short-term earnings outlook. It seems to us that some of the buying is being fuelled by hopes that current macro conditions will last forever.

As an example, a major theme has been the stellar performance of companies rising on exposure to the ‘daigou’ market into China, share prices continue to be based on the expectation that they can sell ever larger amounts of their products into China without any hitches.

We continue to ask ourselves when looking at many of these companies: is too much faith being baked into the future earnings projections of these companies? It seems to us that many companies are priced to perfection and any small slip or earnings downgrade will lead to a very rapid derating in many of these companies.

As demand for these Growth companies continue, we are now seeing Momentum strategies joining in and bidding these stocks up to vastly excessive valuations. The past 12 months has resulted in a very narrow universe of growth and momentum type stocks driving the market higher, whilst good quality industrial companies with modest yet sustainable earnings have lagged.

As Value managers, it is not our style to participate in this exuberance, we have a clear valuation framework around every company in our universe and one which we have always stuck to successfully since our inception.

The last 18 months has been a difficult market to perform in for value investors such as IML. Companies caught up in the latest theme, fad or concept are being rewarded despite, at times, questionable fundamentals and often a distinct lack of sustainable earnings.

We continue to remain disciplined in continuing to focus on the fundamentals of all the companies we invest in and we seek to not over pay for companies that are often over promising and on companies where the outcome is often far from certain. With many companies’ valuations stretched, we continue to believe that portfolios underpinned by value and quality stocks remain the best place to be.

Interested in reading more from IML?

For further Insights from IML's investment team, please visit our website

2 topics