Market outlook - Q2 2022 update

May 2022

Since the start of the year, global financial markets have been in a tailspin. The year began with global markets rotating aggressively from growth to value companies, as investors attempted to adjust to a higher interest rate environment. Selling pressure in the interest rate and fixed income markets has been unrelenting. We have also dealt with the Russian Ukraine war, food shortages, China lockdowns, and supply chain disruptions, among other issues.

Global markets and the news flow associated with them seem to be running at an ever-increasing rate. In fast-moving environments like these, we find it effective to expand the assessment timeframe, review new information and data at hand, and then ascertain how this new information may impact our market outlook.

First, let’s start with an assessment of the notable events which have occurred since the start of the year.

1. Russian war

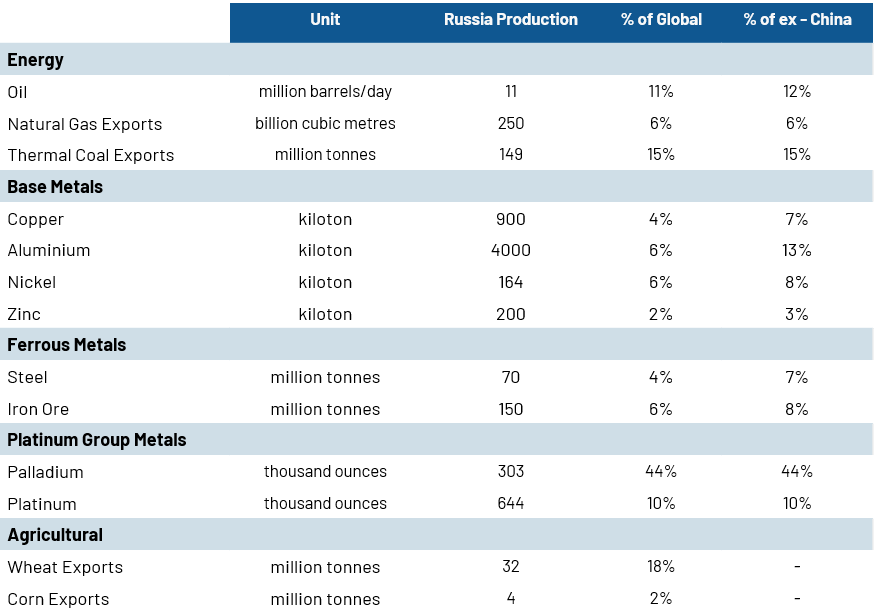

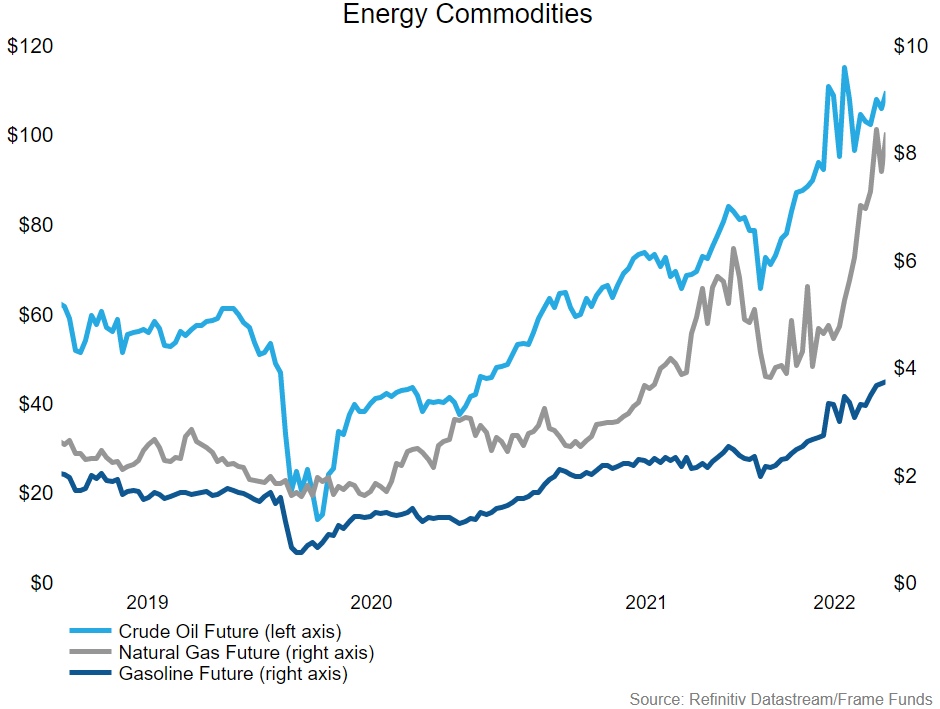

Aside from the tragic loss of human life, the war in Ukraine has numerous and far-reaching consequences for financial markets. The major focus for us has been on grain, gas, and oil markets. Due to the severe sanctions placed on Russian resource exports, the already tight global supply of these commodities has accelerated since the start of the year.

This acceleration has driven the price of these commodities higher, which will result in increased input costs for producers over the upcoming months. In this situation, the producer can then either absorb these costs (which reduces profit margins and their ability to grow) or pass the additional cost onto the consumer which would increase inflation and reduce affordability.

2. The US Fed pivot

Communication from the Fed earlier this year continued with the narrative that inflation was transitory and that they expect it to pass as supply chains eased. Since then, supply chains have tightened further, and US inflation has accelerated. This has forced the Fed to pivot. It now thinks inflation is a problem and has recognised the need to do whatever it takes to get it under control.

The Fed has often mentioned it needs to level out the supply/demand equation. Since the Fed has limited influence over the supply side of the economy, it must target demand destruction to achieve its goals. This ultimately means a reduction in asset prices (property, equities, venture capital etc.) is inevitable.

3. China lockdown

As a result of their zero COVID policy, cities across China continue to be plunged into strict lockdowns as new COVID cases emerge. This has weakened Chinese demand for metals, energy, agriculture, and consumer products. These lockdowns will continue unless China pivots away from its zero COVID policy. This is difficult as the COVID-19 vaccine presently in use across China has low efficacy and wears off relatively quickly.

4. Bond sell-off

Bonds have been selling off consistently since the start of the year. So far, the Bloomberg Global-Aggregate Total Return Index is down -12.44%*. The previous worst year was 1999, when the index declined by -5.17%. This sell-off has meant coupon rates on these bonds have appreciated swiftly. Not only are there implications for companies and their profit levels, but investor positioning is also having to unwind years of bond allocations due to this new environment. Although the move seen so far is statistically significant, the lack of capitulation or acceleration tells us it is far from over.

This event impacts the growth outlook negatively, as of 9 May 2022.

Our outlook, as illustrated by charts

Historically a very challenging time

Both stocks and bonds have underperformed this year. Numerous factors such as the Russia Ukraine War, the Fed pivot, out-of-control inflation, and supply chain issues have all contributed to this poor start.

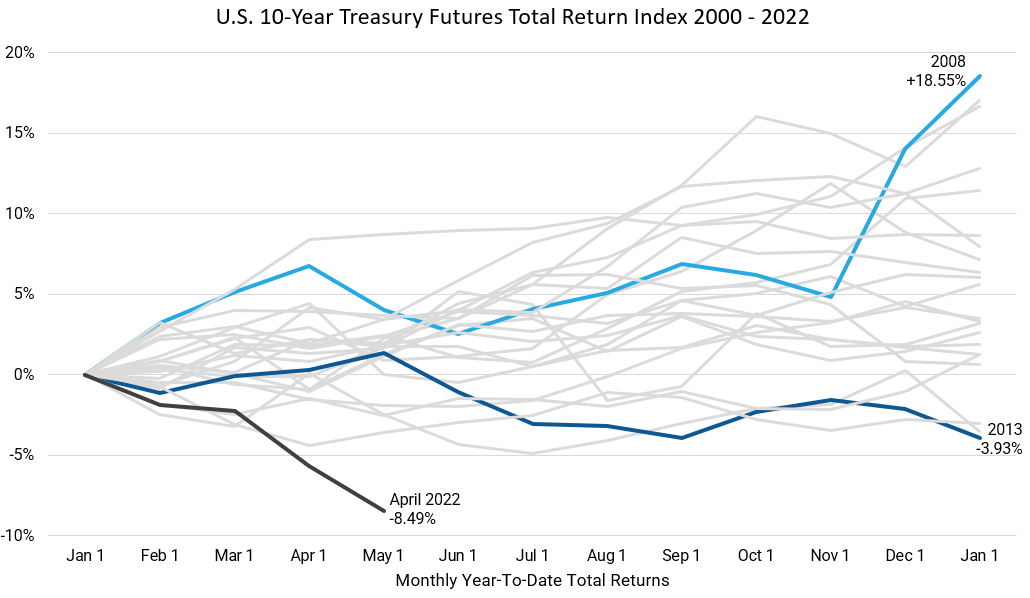

Bond markets have had the worst start in over 20 years

The Fed pivot has meant bond markets have gone through a period of poor performance as the US Federal Reserve attempts to tackle inflation head-on. Raising interest rates has been their first port of call.

Russia Ukraine war

The War in Ukraine has added pressure to an already tight supply chain for global commodities. Russia produces a significant amount of commodities consumed by the global market.

Russia Ukraine war (continued)

The War has had a significant impact on the global energy complex. Europe was one of the largest buyers of Russian oil and gas, and have now had to find supply elsewhere.

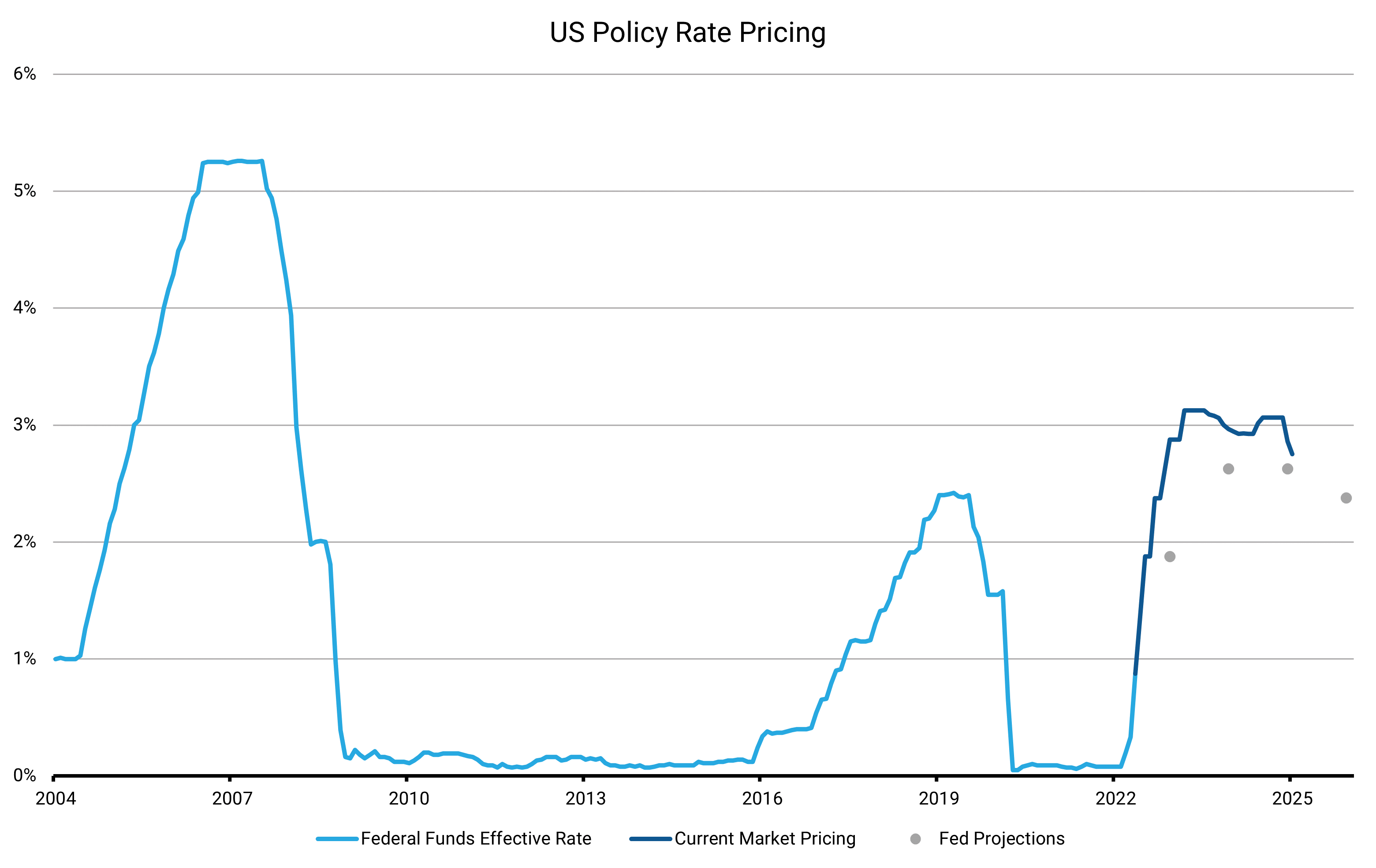

US interest rates have a long way to go

The Fed has only just started increasing interest rates. Considering the current rate of inflation, they still have a long way to go. Currently, the market is pricing in interest rates at around 3% by the end of 2023.

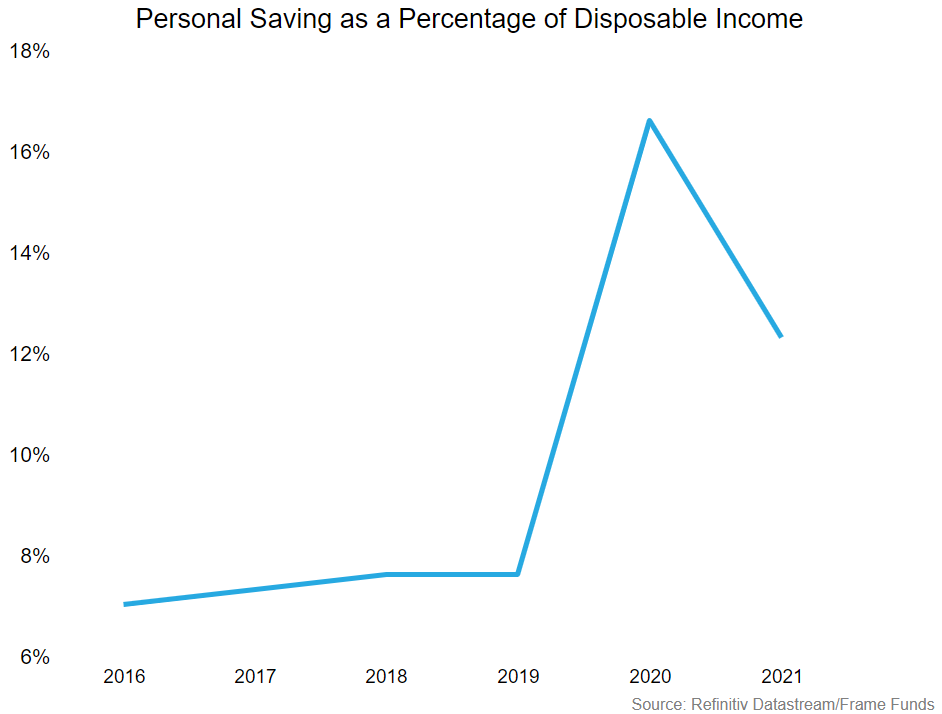

US personal savings reverting

The US personal savings rate has started to revert to the mean, as the significant stimulus packages launched during the COVID-induced lockdowns wash out.

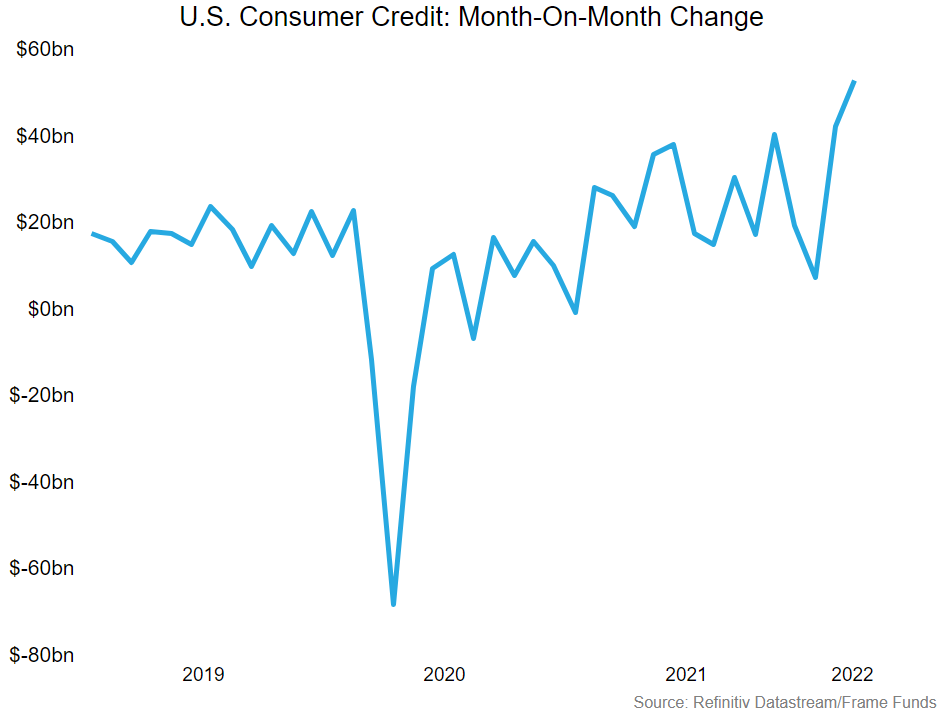

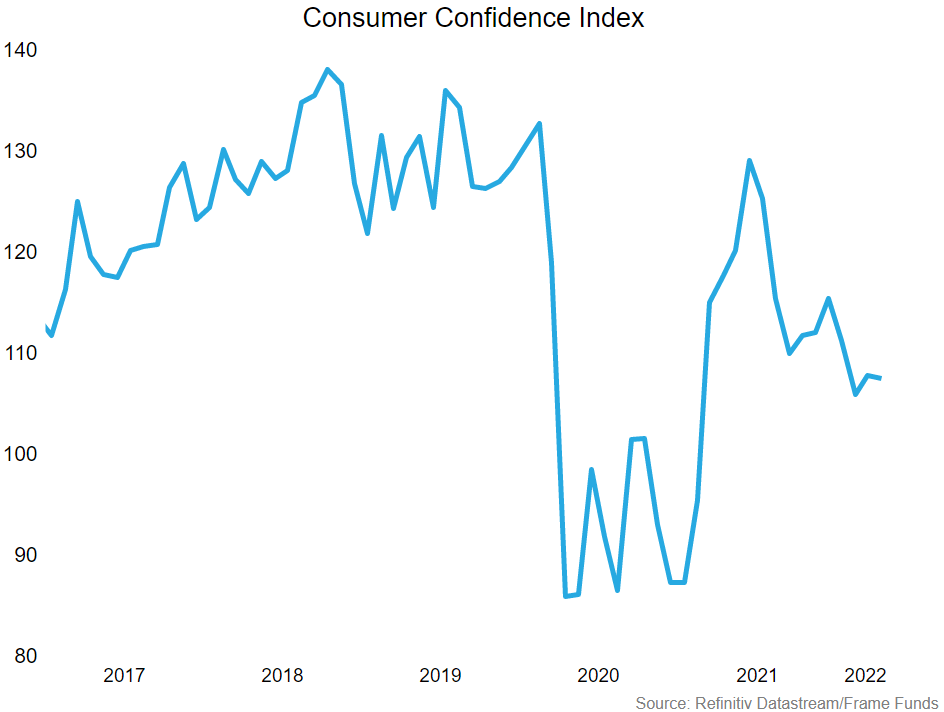

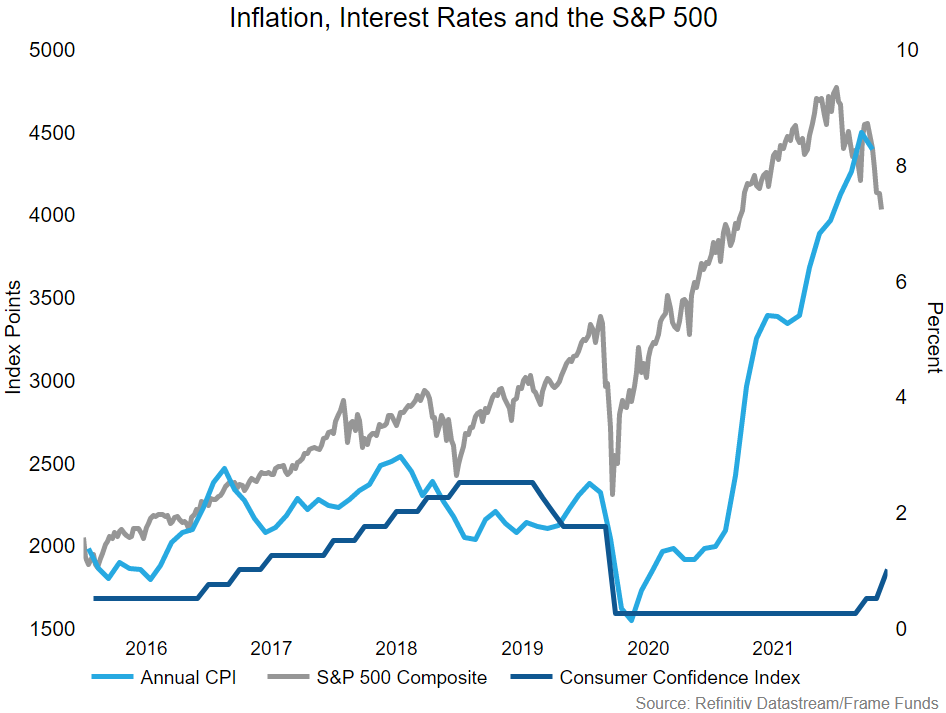

Consumer credit increasing, and consumer confidence declining

As US personal household savings decline, consumer credit has begun to increase. Expanding credit and household debt has meant consumer confidence has started to roll over.

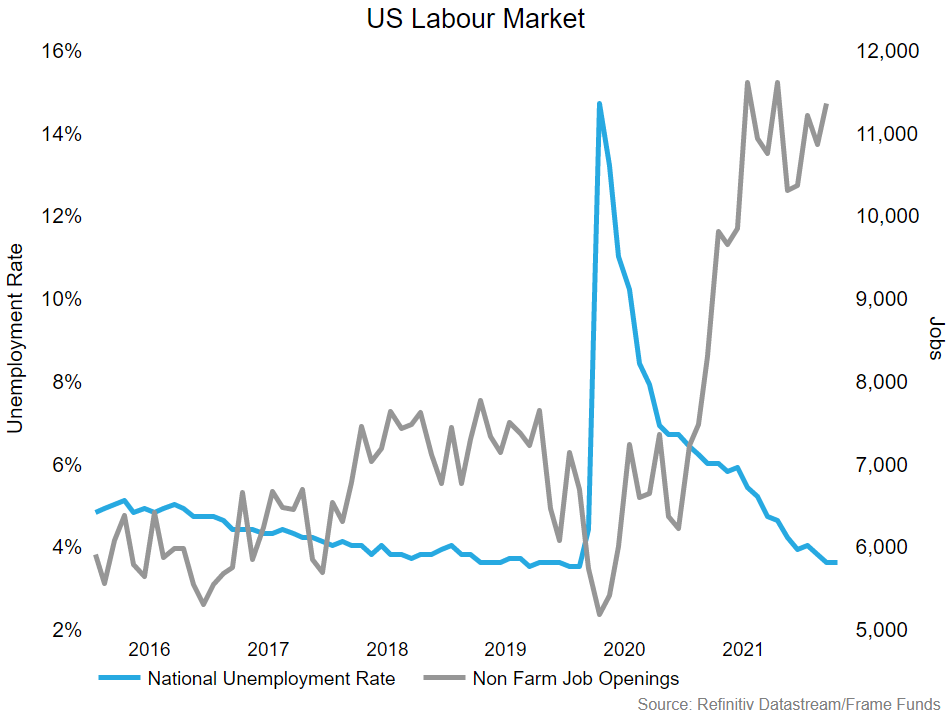

Numerous job openings, but not enough people to fill them

The current level of job openings has rarely been seen in history. With the national unemployment rate at record lows, the US Federal Reserve needs to try and cool the corporate demand side of growth.

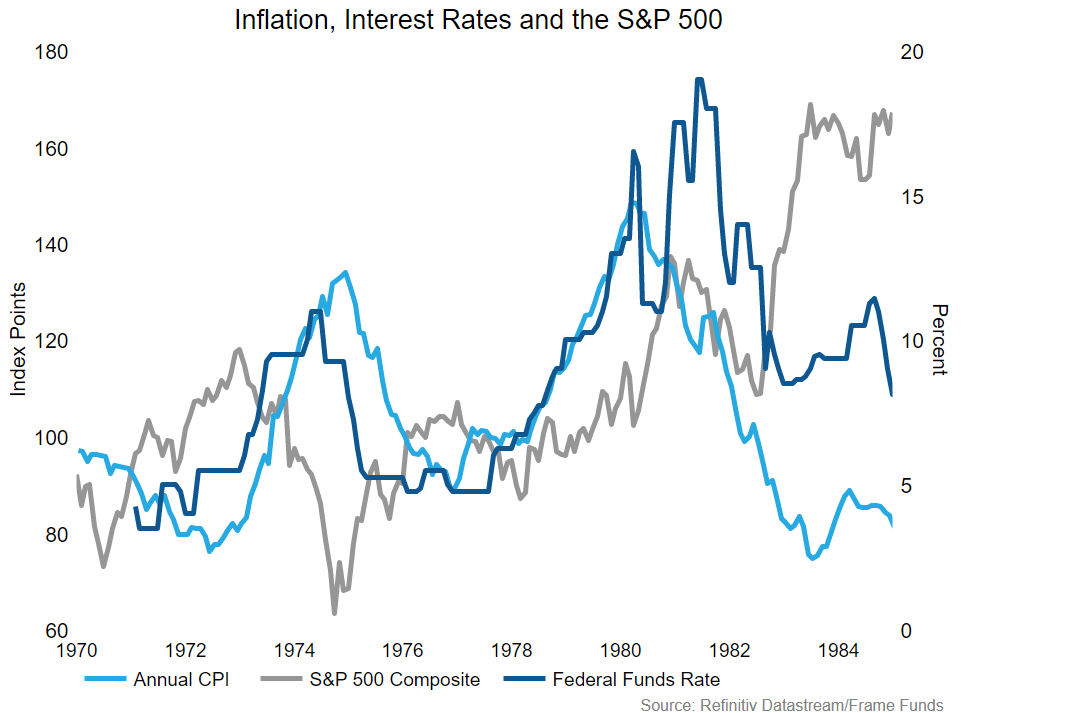

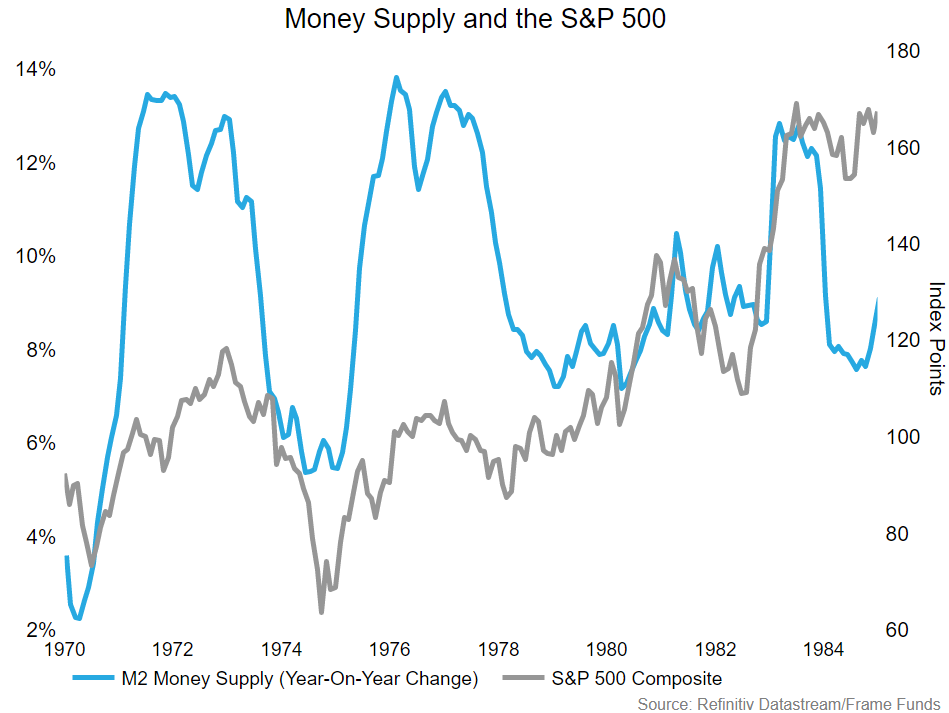

The 1970s provides a good insight

Although no two periods in financial markets are the same, the 1970s period of high inflation does provide an insight into how long it took for the US Federal Reserve to control inflation. From start to finish, it took approximately 10 years for inflation to drop back below 6%.

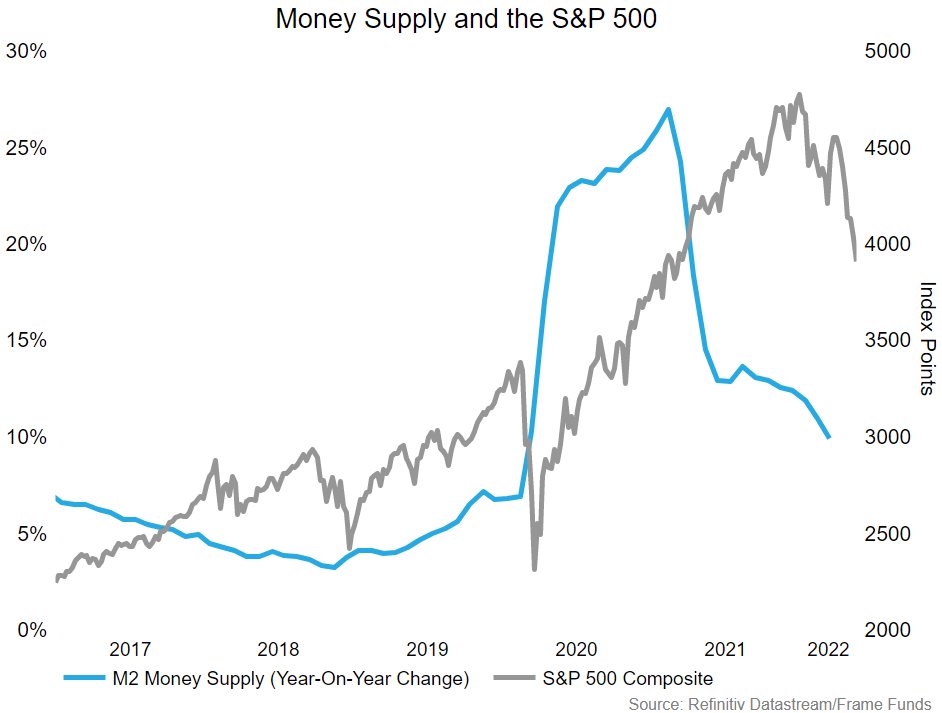

The current cycle may be only just beginning

As we saw in the 1970s, interest rate increases struggle to contain inflation in the short term. Only when demand destruction occurs (reverse wealth effect) does inflation begin to subside.

Follow the money

The rule for the last decade has been to not fight the Fed. As the central bank embarks upon a tightening cycle that promises to reduce liquidity and dampen financial conditions, it seems appropriate to remember - "Don't fight the Fed".

Outlook

In our view, the Fed has started to increase rates far too slowly. It has meant that inflation has run out of control, and they are now in a pickle. In the US, affordability is one of the largest political sticking points, and (1970’s), raising interest rates is not a solution that has a short-term impact on inflation.

It took the Fed two attempts to control inflation in the 1970s. The first time between 1973 and 1975, CPI rose from 4% to 12%, while the Federal Funds rate rose from ~3% to ~13.5%. The second occasion was between 1977 and 1980 when inflation rose from 6% to 14%. This time the Fed was forced to raise rates from ~4% to ~20%.

Inflation only returned to below 6% approximately 10 years after they first started to increase rates. On both occasions, policy responses caused recessions and significant volatility in financial markets, as investors rapidly repriced growth outlooks.

Through the above assessment process, we can see that many of these events have impacted both growth and inflation negatively. One of our core themes for 2022 was ‘inflation’. We have now experienced numerous extraneous events this year that will make inflation even more difficult to control. Because of this, we have adjusted our market outlook for the next 12 months.

Previously, we were overweight equities, underweight fixed income, overweight commodities, and neutral weight to currencies.

After these events, we have now pivoted to be underweight equities, underweight fixed income, overweight commodities, and have a neutral weight to currencies.

The original version of this document can be found here.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics